Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 30 day boosted yields this week!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $5M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $5M TVL

Here’s the top yielding BTC vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

3Jane is a new credit primitive that has been tried before, but not quite in this way. The necessary infrastructure is now ready to make a project like 3Jane possible.

Here’s what we wrote about it in our “Tokens on our Radar” piece:

I haven’t been able to use it yet (coming to Canada 🔜 I hope), but so far DeFi Dad has managed to pull a $100k line of credit at sub 8% interest. Click on his post below and read the whole thing, I really think this can materially change DeFi if they can scale it:

This is one that could make sense to use early in order to build up a good onchain credit score (not financial advice of course).

If you really want to do your homework, we peppered the founder Jacob with every question we could think of on our podcast - all links posted here:

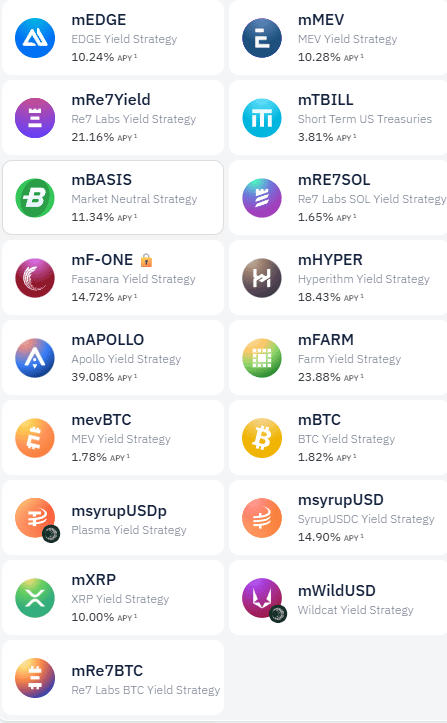

We talked about Midas a few months back when onchain hedge funds were becoming popular. I was surprised to see how much they had grown, reaching $1.12 billion in TVL, and how many impressive markets they had created since then.

Check out all these different opportunities (with some incredible partners):

One really cool thing is that if you click on any of these markets there is a great “Factsheet” on how the vault operates as well as lots of transparency documentation.

We mention Avant a lot in YOTW and have introduced each of their new products here over the past many months.

Recently, they expanded their suite of offerings to support a yield bearing ETH position:

Avant has had some of the highest no leverage yield in DeFi for the past ~6 months

As always, I find this chart can be really helpful to discern the different risk profiles of each of these offerings:

Yield Trading

The big news of the day in Pendle world is Kinetiq’s surprise announcement that kPoints are ending October 16th. See full announcement here:

Analysis

I bought a little bit more kHYPE YTs at around 6.8% IY, but missed the really good dip early morning on September 29th. I like Bitcoineo’s breakdown posted below:

Hyperliquid Eco made some assumptions here on what final $/pt might end up at:

Again, this is total speculation, but I’m starting to think $20 - $25 per point is possible here

With 2 more distributions left before October 16th, I have a strong hunch that Kinetiq team will juice these final distributions a bit, but nothing is certain (and definitely not financial advice).

Here’s what the top yield markets on Pendle look like across Stables, BTC, ETH and HYPE (keep an eye on the maturity dates, pools with only a few days left typically show elevated yields):

Stables

26.76% - 36.16% - The top 4 positions are both AI DeFi tokens

BTC

1.47% - 3.25%

ETH

HYPE

11.68% - 22.89%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Gearbox has some nice loops with incredibly low borrow rates at the moment. These particular strategies are centered around Midas products and generating between 96.89% - 99.25% APR:

OK and one other thing, TIL that Tezos is powering an L2 called Etherlink and that’s where these markets are:

Proof that it’s impossible to stay fully on top of everything happening in crypto - I had no idea this existed.

Finally, here’s a helpful looping tutorial from DeFi Dad where he uses GAIB Pendle PT as an example:

That’s all for now, thanks for checking it out!

.jpg)