Here’s a list of upcoming or live protocols we’re closely tracking. As investors who also produce content, we aim to be transparent about the teams we’ve invested in or the tokens we hold. While we’d like to believe we’re unbiased, some bias is inevitable. That said, as investors, we often get a behind-the-scenes look at these teams and their innovative ideas, which naturally fuels our enthusiasm for the projects we back or know well. Still, we didn’t want to exclude them from this list simply because of our investments.

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Update

We’ve grown our subscriber base by almost ~50% since we first published this piece on April 25, 2025 so we wanted to republish it with a few updates and a look back on how we did.

Only the tokens marked with “UPDATED” have new content, but wanted to leave what we had before due to readership growth 📈

We also added a couple “NEW” entries to the liquid token side.

Summary

Unlaunched Tokens

Liquid Tokens (The bulk of the updates are on the Liquid Tokens side)

Unlaunched Tokens

3Jane is the only new addition here, and we’ve done a few quick updates to this list (still none of these teams have launched tokens yet)

NEW 3Jane (invested)

3Jane is the best attempt I’ve seen at solving credit onchain.

Why We’re Bullish:

This has been tried and failed many times before in crypto. I can’t guarantee they will be successful, but their team and technical implementation are positioning them very well to pull this off. If they do, the market is absolutely massive. Furthermore, the creation of these onchain credit scores actually could be a bit of a moat (IMO) and I say this as someone who tries not to throw around the term “moat” flippantly in crypto (due to the nature of open source code).

The 3Jane team do a great job on their comms so I’ll let them explain it themselves:

Helpful Resources:

The Real Ethereum Hasn’t Been Tried Yet (this piece took me down the rabbit whole initially)

Podcast coming 🔜

UPDATED InfiniFi (invested)

InfniFi is now live since we posted this last time on April 25th. They launched a few months back and have already accrued ~$100 in TVL.

Their senior tranche is yielding ~9% and their junior tranche is yielding ~15% - 17% on various durations of iUSD.

Something we outlined before the protocol went live was how positive sum InfiniFi would be. We’re now seeing it in action:

Here’s what we wrote back in April:

InfiniFi are calling themselves the first onchain fractional reserve system. That is a bit of a mouthful, but basically they will be able to take any asset, add a duration to it and achieve a higher yield. This can work with any onchain asset. Essentially, any asset that can be tokenized can work with InfiniFi.

Why We’re Bullish:

InfiniFi is highly composable with other protocols. They will be able to take any yield and make it higher by adding duration. DeFi operates as a meritocracy, where the highest risk-adjusted yields typically prevail. If InfiniFi executes its vision effectively, it could become a powerful magnet for assets.

InfiniFi's positive-sum integration with other protocols is a key strength. For instance, Ethena would likely welcome users locking sUSDe for 10–12 weeks with InfiniFi. They’re fostering lots of strong behind-the-scenes partnerships like this Ethena example above (maybe even with Ethena 👀). Also, I’ve seen the looping assumptions spreadsheet and they are some of the highest I’ve ever seen in DeFi (a fixed rate collateral with high yield is a looping dream).

Helpful Resources:

Referral code: https://infinifi.xyz?ref=DEFIDAD

UPDATED Cap Labs (invested)

Cap has just recently gone live and has already accrued ~$75M in TVL in little over a week of being live.

Here’s what we wrote back in April:

Cap is introducing a novel mechanism to attract yield coordination that ultimately benefits their cUSD yield bearing stablecoin. They are calling it a stablecoin protocol with credible financial guarantees. The protocol leverages shared security protocols like Eigenlayer and others like Symbiotic.

With this setup they can attract a near limitless number of offchain or onchain yield strategies. There’s a great writeup in their docs on where the yield sources come from.

Why We’re Bullish:

We love to see experimentation in DeFi and to see ambitious founders push the space forward. While that of course comes with risks, its needed to find PMF and to further adoption. Their mechanism expands the pool of contributors to yield sourcing, effectively crowdsourcing from top-tier operators in both DeFi and TradFi. This creates one of the most dynamic and versatile platforms for yield generation in DeFi.

Lastly, the team is stacked with DeFi OG builders. On paper, Cap checks almost every box for me, but time will tell.

Helpful Resources:

UPDATED Kinetiq (invested)

Kinetiq has been one of the fastest growing protocols I’ve ever seen since it’s launch a little over a month ago. It’s currently sitting at ~$1.8B in TVL (fluctuating with HYPE price swings) and growing almost by the day.

There’s actually a lot we didn’t account for in our initial writeup especially around HIP - 3. If you haven’t seen the Kinetiq article on “Launch” and Exchange as a Service (EaaS) you should give it a read right here.

TLDR, there’s a lot more here than just an LST play and I expect the future $KNTQ token should be priced on a similar FDV/TVL ratio as Jito rather than something like Lido.

Here’s what we wrote back in April:

Kinetiq will be powering liquid staking on Hyperliquid (kHYPE).

Why We’re Bullish:

Kinetiq is positioning itself as the native LST for Hyperliquid. They aren’t venturing into other ecosystems like some of their competitors, they’re just hyper focused on winning the Hyperliquid market.

The founding team is made up of many HYPE whales who had high conviction in Hyperliquid from very early on. They’re also connected to the entire Hyperliquid whale community and it seems obvious to me this will be the LST of choice for this ecosystem. They’ve taken their time with audits instead of rushing to launch on day 1 of HyperEVM. They’re now almost through their fourth audit and should be going live soon (Some of the best in class auditors).

Their roadmap and strategy are very reminiscent to what Jito did with Solana. They have a lot on the roadmap to come with how they’re positioning for MEV in the Hyperliquid ecosystem. We have a podcast coming out soon as well.

Helpful Resources:

Updated GAIB (invested)

Since our writeup, GAIB has gone on to secure $60M in early deposits into their “Spice Harvest” with the cap on their “Final Spice” campaign just being hit as well. Pretty soon their AID synthetic dollar will go live. Once AID goes live, GPU yields will start being streamed to staked AID holders (sAID).

Here’s what we wrote back in April:

At the center of GAIB is AID, which is a synthetic dollar. Under the hood, GAIB is providing financial infrastructure for AI, starting with a new financial primitive for AI compute. GAIB tokenizes GPUs and their cash flows to create a new type of asset, and builds a DeFi ecosystem on top. This approach accelerates the expansion of cloud and data centers by facilitating funding, but also offers investors direct exposure to compute assets and their products, democratizing access to the AI space. By staking AID (sAID) holders will be exposed to these tokenized revenue streams from GPUs.

Why We’re Bullish:

I’m bullish on bringing new yields to DeFi, whether that be through a breakthrough in mechanism design or finding external yields and bringing them onchain. With GAIB, it’s a bit of both.

Below is an excerpt from the docs on the three main models for where the yield comes from:

Hybrid = Debt + Equity

GAIB could have some incredible yields 👀

Some of the yields they are projecting are pretty incredible and if they can execute, I see it garnering a lot of mindshare in DeFi.

Like anything new and ambitious, its worth it to think through all the scenarios where this can break down. We had a lot of calls with the team and talked through a lot of “what if” scenarios, but again, with anything new and novel, there’s always added risk.

Helpful Resources:

UPDATED Yield Basis (not invested)

YB is still not live, but we’re starting to see more activity. It looks like they’ve caught the eye of Coinbase:

Here’s what we wrote back in April:

Curve founder Michael Egorov has found a way to isolate incredible single sided Bitcoin yield with no IL.

We were lucky enough to have the Yield Basis pitch presented to us by Michael himself and if it works as designed on paper (and via simulations), its groundbreaking for DeFi yields.

Why We’re Bullish:

Michael is a proven builder and to us its obvious that the market would greatly value real yield on Bitcoin. Some of the simulations they’ve ran show that upwards of ~20% APY is very attainable with more in bull conditions and less in other bear conditions.

There’s another component with the tokenomics design that I really like that I might not be able to share yet, but I think its really compelling. Without giving it away, there’s lots of optionality on how you can receive your yield.

Helpful Resources:

UPDATED GTE (not invested)

I think one of the biggest updates on GTE since we mentioned them back in April is this obscure message about leaving the Mega Mafia:

Here’s what we wrote back in April:

GTE stands for Global Token Exchange. GTE is going after CEX level performance but with the security, transparence and compossibility of being fully onchain. They’re touting themselves as fully vertically integrated with the ability to handle asset creation, spot and leverage.

Why We’re Bullish:

GTE wasn’t really on my radar (or even MegaETH) until our podcast and Enzo sort of blew me away with their vision. I ended up getting red pilled on MegaETH and GTE all in the same ~ hour long podcast (quick aside - this is sometimes how we diligence teams ourselves, we learn a lot by doing a podcast).

With the success of Hyperliquid, the space is starting to get crowded by new entrants, but I think the GTE team/vision has all the ingredients to carve out their own niche in the space.

Helpful Resources:

UPDATED Felix (not invested)

Felix is now up to $415M in TVL and is solidifying itself as a core component of the HyperEVM DeFi ecosystem. I personally have almost all of my kHYPE on Felix and it has become my base of operations on the HyperEVM 🫡

Here’s what we wrote back in April:

Felix is a Liquity V2 CDP fork and one of the first money markets on HyperEVM.

Why We’re Bullish:

Like Kinetiq, Felix also shares a lot of the same roots in the Hyperliquid genesis story. Both projects have been incubated from early Hyperliquid community members and are positioned to be native winners of the ecosystem. Also, I’ve had a lot of interactions with their founding team and they are very strong.

There’s other money markets live on HyperEVM, but my hunch has been that Felix will attract a lot of the early whale TVL. It has already attracted ~$170M in TVL and its only been live for a few weeks. I think this ramps up even more once Kinetiq goes live as both protocols are extremely synergistic to one another. Many whales are waiting to unstake from Hyperliquid validators once kHYPE is live. Once live, users will be able to use kHYPE on Felix and borrow feUSD to perform all sorts of other DeFi activities.

Helpful Resources:

Liquid Tokens

We originally published this list on April 25, 2025 and will be using that date as a reference point.

I added 3 new assets to this list. I think ENA is fairly obvious and I could have (and maybe should have) added some even more obvious ones like AAVE or AERO. However, I wanted to put MNT and TOKE on here, because both have some major upcoming catalysts that could be going a bit under the radar and I’d rather try to pick a couple names that maybe not everyone is looking at.

Another name I didn’t put on this list that I wrote up recently is RED. Check out our full writeup on RED below:

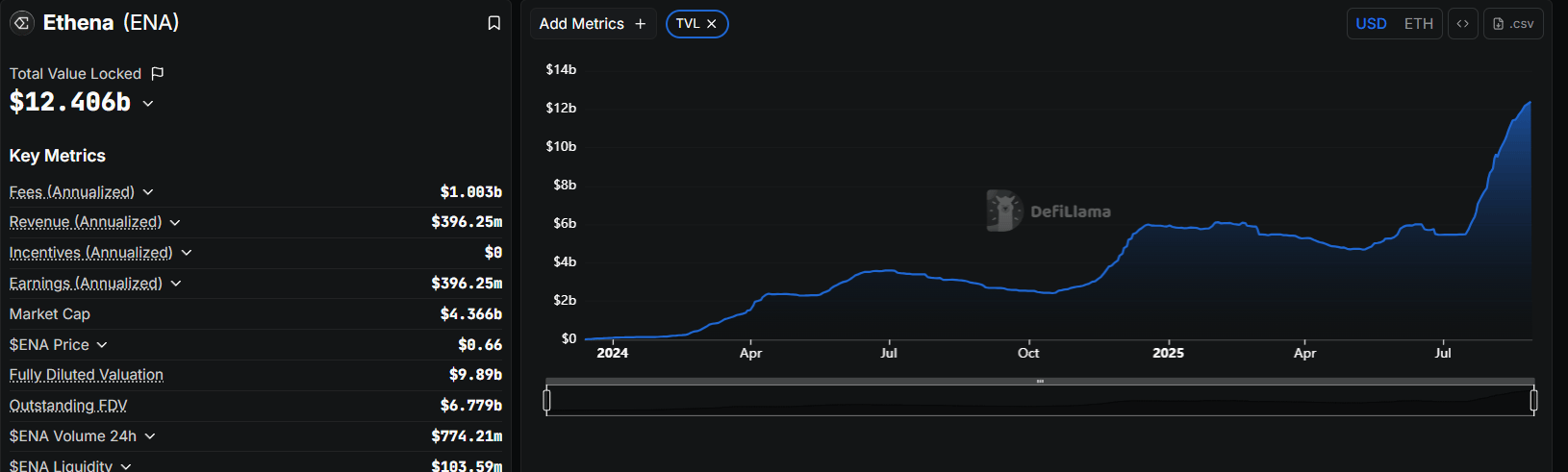

NEW Ethena (holding)

Why We’re Bullish:

This team has proven themselves time and time again. The way they managed the ByBit hack (case study here) really helped solidify what a “worst case scenario” situation would look like in practice.

On top of this, they’ve shown a nimbleness and adaptability to all market conditions. When funding rates were bad they formed new partnerships to continue to fuel yield. You want to bet on teams where no matter what is thrown at them you believe that they will figure it out. That’s Ethena to me.

Now to the really bullish items.

There’s so many things happening within the Ethena ecosystem, but here’s a few that come to mind:

hyENAtrade (early rumors 👀)

Fee Switch (good article in general here)

Also, they’ve managed to double their TVL growth in July and August and are now over $12B:

I think the combination of the fee switch going live and StablecoinX beginning to trade publicly will be a really interesting time.

Right now, Circle represents the clearest path for public access to the stablecoin market. But once a broader capital base gets exposure to Ethena, they’ll see a fast-emerging competitor with massive revenue potential. The comparisons between Circle and Ethena will be impossible to ignore (and I think Ethena is going to come out looking really good in that comparison).

Helpful Resources:

NEW Mantle (not holding)

Why We’re Bullish:

Mantle has been growing into something much bigger than just a network. The full umbrella of the Mantle Group looks something like this:

Mantle Network

mETH Protocol

Function (fBTC)

Mantle Index Four

UR (banking protocol)

As you can see, Mantle is far more than just a Layer 2. Across these initiatives, they’re consistently tying the successes back to the MNT token.

Also, Mantle has a massive treasury at $3B + :

Thanks to Castle Labs - link to this full report down below

I think one of the biggest catalysts though is the recent realignment that was announced with ByBit. This renewed partnership is one of the key drivers why I’m starting to get bullish on the MNT token going forward.

TLDR

MNT will be rolled into almost every facet of ByBit’s business.

This to me will resemble something like Binance to BNB Chain relationship.

There are two posts that I think really showcase the MNT opportunity (give them both a read):

Both of these have different assumptions and breakdowns for what this could do for the token. However, both net out extremely bullish.

I personally think many are fading this still or somewhat unaware of what’s going to play out here. That said, I do think this will take time and this is more of a medium to long term bullish catalyst.

Helpful Resources:

NEW Tokemak (not holding)

There’s a theme recently where a small handful of DeFi founders/teams continued building their protocols through adversity and eventually found product market fit.

It’s nice to see when it happens (a few of those stories below).

I think Tokemak is on the verge of becoming another one of these names.

It’s commendable that they totally reinvented themselves without launching a new token or abandoning the project. That may seem like a low bar, but it’s sort of par for the course in our industry.

Why We’re Bullish:

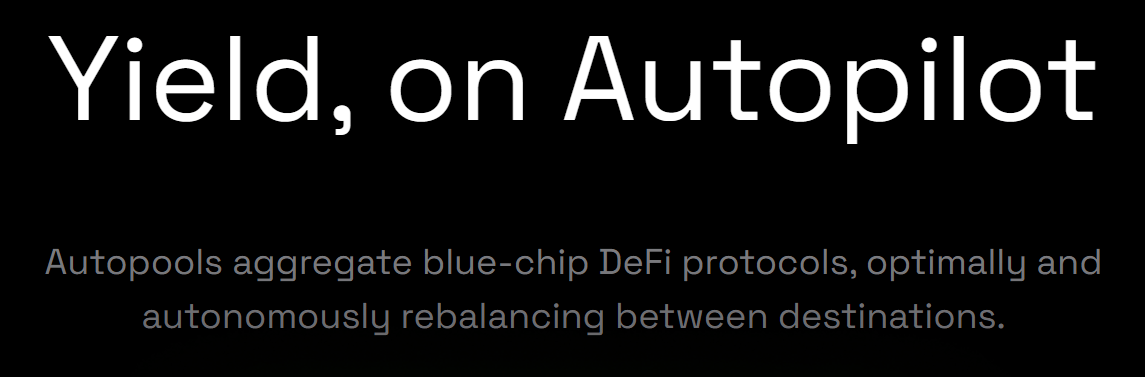

Tokemak came back to market with a product called Autopools.

What are Autopools:

Taken straight from their homepage

If you read Yields of the Week, you’ll notice I’ve been writing about Autopools since they launched. I’ve probably written them up 10 or 15 times in the past ~6 months. I just think its a great form factor for yield as its competitive and has built-in intelligent rebalancing and guardrails. I also see it getting better over time.

A few things I like :

I like the product

They’ve built all the core infra in-house

They’re done with the proof of concept phase and now ready to scale

At $15M FDV I like the price

They have ~$120M in TVL so the TVL to FDV ratio is solid

Their treasury has $24M meaning they hold more assets than the public is valuing them ($15M FDV)

🚨 Alpha 🚨

I’ve been close with a few members of the Tokemak team for the last couple years years and have been pretty plugged into some of the upcoming expansion plans now that they are comfortable with how the Autopools function.

Essentially, there’s some major new roadmap goals coming at then end of September/beginning of October.

OK that’s all sort of vague. What’s the significance of this timing?

There’s been a massive early Tokemak investor dumping huge quantities of TOKE daily for many months. I won’t name this entity but they had a very material portion of the supply (almost fully depleted now, also no shade to that entity selling btw, it’s a free market).

Everyday they systematically dump the same amount of tokens.

Why does this matter? Well obviously it’s bad for price. But also, the team has been trying to use their token (TOKE) as a small incentive for the Autopools. The daily selling pressure from this entity has wreaked havoc for them as they’ve tried to be methodical about token incentives.

However, this massive whale should be done selling by the end of September(ish) and that is when the team will step on the gas with more of their marketing/expansion plans.

Again, I really like the product and direction here, but they’ve been fighting with two hands tied behind their backs against these headwinds.

Basically, when I look at this from an investor lens, if I was approached to invest in a good team with a good product at $15M val that already had $123M in TVL and all investors were fully unlocked and almost fully out of tokens - would I like that deal?

Yes I would and I do.

Also, I think Archer on their team is one of the most underappreciated builders in DeFi. He’s extremely thoughtful/hardworking and has helped will this back into existence (and shoutout to the rest of team as well).

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

UPDATED Fluid (holding)

April 25th Price: $4.25

Most Recent High: ~$7.92 (Aug 14) = 1.86x

Quick Thoughts:

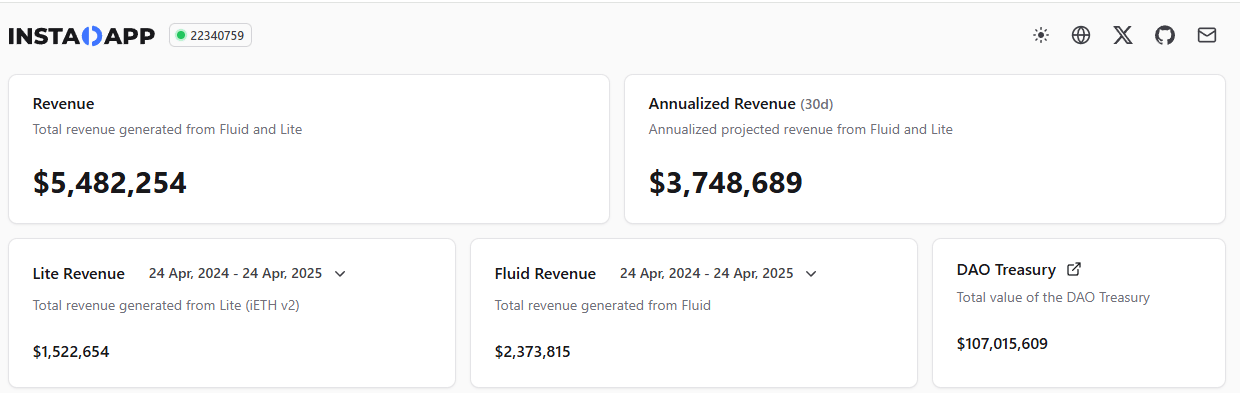

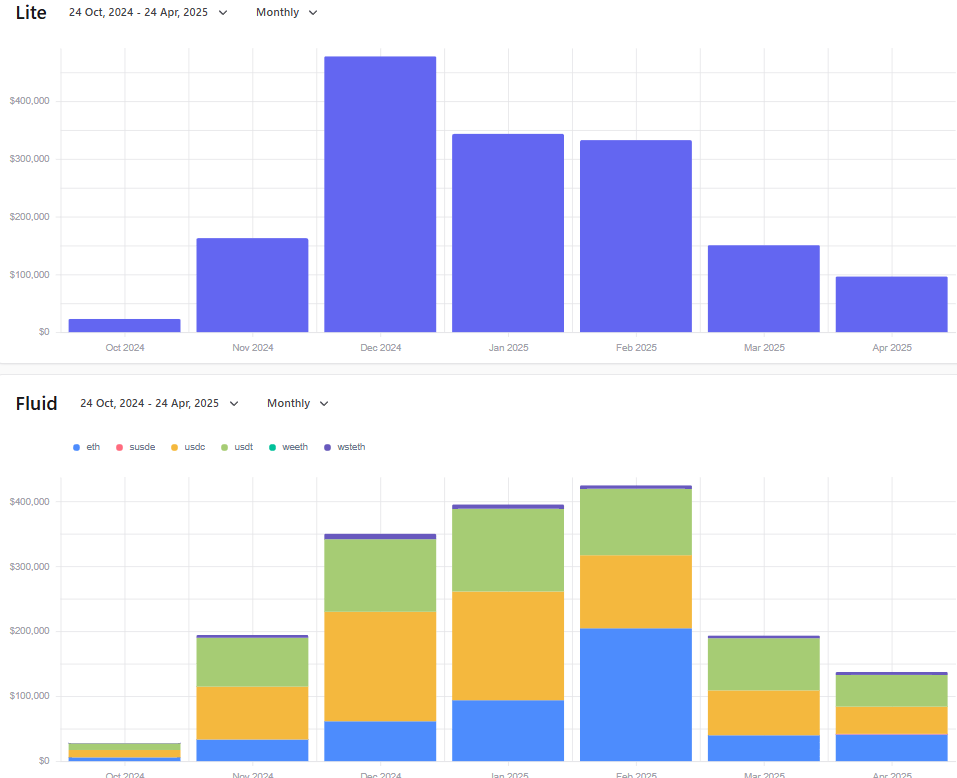

ARR was at $3.7M when I wrote up FLUID last in April

The ARR goal of $10M (we talked about below) has been hit and the team is now exploring a fee switch via governance

One huge catalyst that we didn’t know as much about before was Jupiter Lend - it’s live and amassed over $500M in TVL in it’s first 24 hours (huge)

Jupiter Lend will become another interesting revenue generation business line (50/50 profit share with Jupiter)

We did a full podcast on Jupiter Lend

DEX v2 still isn’t live yet and will be a major catalyst (this is what we were originally excited about) - v2 will do what v1 did for stable pairs but for volatile pairs

Our Interpretation:

Revenue is trending up just as we expected/forecasted in our original piece. Our full thesis is still yet to play out and this one is still a long term hold for me.

Here’s what we wrote back in April:

We’ve been close with the Fluid team (formerly Instadapp) for years. I had the honor of looking at the early designs of Fluid’s smart debt and smart collateral innovations a long time ago and even though I didn’t fully grasp every nuance at the time, it was obvious this was a net new design for the lending/DEX space.

Why We’re Bullish:

As I type this, Fluid’s DEX v2 announcement is about to go live (I’ve had an early look at it). This new version builds on smart debt and smart collateral and makes the whole arrangement even more modular. It’s the final piece of the puzzle to make Fluid a one-stop onchain hub for all your DeFi needs.

On top of this, the brother founding team of Samyak and Sowmay Jain are some of the best builders in all of crypto. They are in it for all the right reasons and playing the long game. Another great hire was bringing on DMH as their COO, who’s absolutely crushed it.

Lastly, I think the profile of a money market + DEX has the ability to generate a lot of revenue as users/volume scale up. In talking to the team, the plan was to enable buybacks once the revenue reached >$10m annualized. They touched this in January but its since gone a bit lower. That said, with DEX v2 coming online, they think they hit $50M in annualized revenue before the end of the year.

Here’s what their numbers look like right now (this is straight from the team):

Fluid is in a strong position on the verge of DEX v2 and a treasury of $107M to utilize if needed.

After DEX V2, Lite will make up a smaller % of revenue and Fluid will take more

They’ve used almost no incentives to grow their TVL and all of the activity is generated by having a sticky product with incredible mechanism design and PMF. These are the types of team/product combinations I’m willing to bet on (and I have).

Helpful Resources:

Fluid in action (below)

UPDATED Hyperliquid (holding)

April 25th Price: $18.50

Most Recent High: ~$51.16 (Aug 27) = 2.76x

Quick Thoughts:

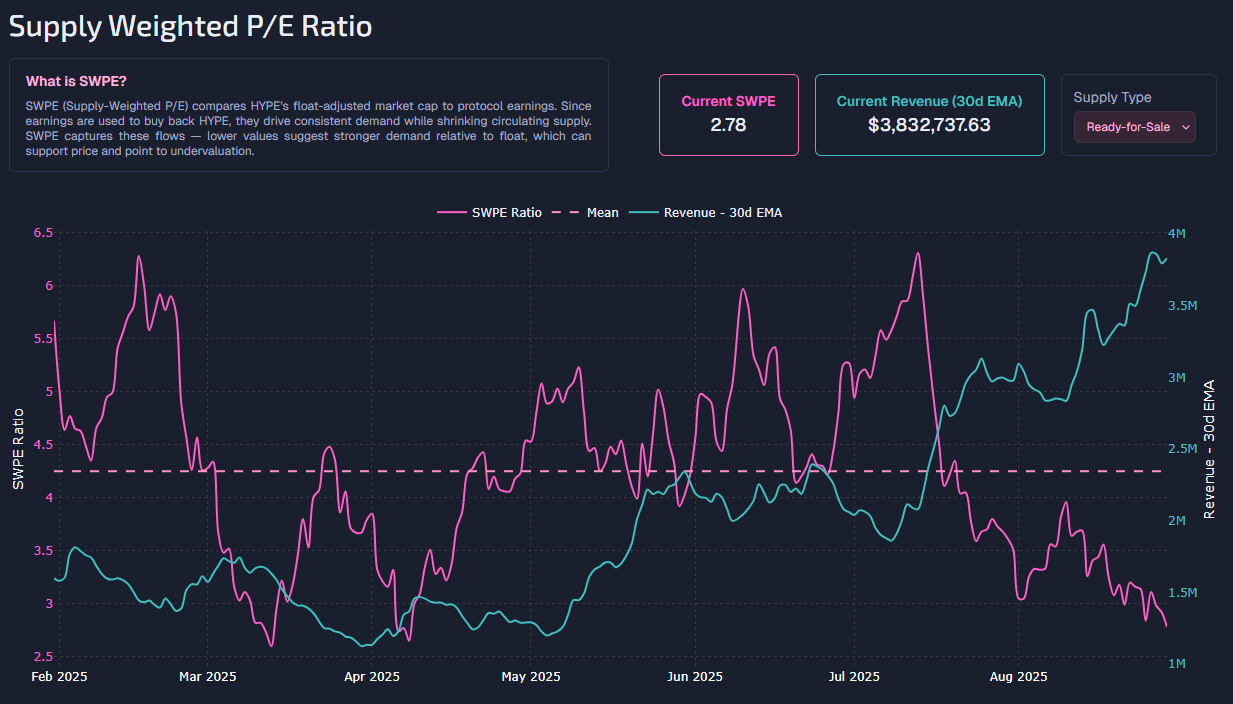

NFA but this is my favorite chart to reference to see when HYPE might be undervalued:

The builder codes vision starting to be more widely understood and appreciated

Phantom, Rainbow, Rabby, Rainbow and possibly MetaMask (rumors) all becoming Hyperliquid frontends via builder codes (this trend won’t slow down IMO)

HIP-3 still not fully understood by the broader market IMO

Time will tell how successful these new HIP-3 markets are, but there’s strong incentives for them to work and they will be backed by best in class Hyperliquid backend infrastructure.

Hyperliquid market share continues to grow and eat into CEX volumes

It will be interesting how the November unlocks for team allocations are handled

Bob Diamond (former Barclays CEO) planning to acquire $888M HYPE position - Video link

Our Interpretation:

Revenue keeps climbing as Hyperliquid takes more CEX market share. Builder codes are only just starting to show impact, and HIP-3 hasn’t even launched yet. Plenty of reasons to stay long HYPE - I’m holding.

Here’s what we wrote back in April:

I don’t think I need to spend too much time on this one. Hyperliquid has been as close to an immaculate conception in crypto I’ve seen since Bitcoin.

Why We’re Bullish:

The team is on another level and seem motivated to build for all the best reasons. They’ve nailed every single major milestone to date.

They’ve created a rabid community, much like the Link Marines and I only see this growing. Since the HYPE token went live, the Hyperliquid Assistance Fund has bought back ~$392.56M of its own token with fees generated by the protocol. Hyperliquid is in its own stratosphere of revenue generating protocols (on pace for ~$500M annualized). Even without the HyperEVM fully online it sits just behind Ethereum and Solana for highest revenue generating chains in crypto. When pre-compiles go live and more of the mature DeFi apps launch, I think HyperEVM starts to garner a lot of mindshare as well (It’s already closing on $400M TVL).

Lastly, I think the Hyperliquid Exchange + EVM opens new synergies and DeFi primitives that haven’t been able to exist or at least executed with this level of capital efficiency. I think we’re going to see some clever new designs developed with this arrangement.

Helpful Resources:

This thread + writeup by Syncracy is one of my favorites to highlight the opportunity for Hyperliquid:

UPDATED GammaSwap (not holding)

April 25th Price: $0.07

Most Recent High: ~$0.089 (Jun 10) = 1.27x

Quick Thoughts:

My main catalyst for GS was the launch of yield tokens

They finally launched and demand was very high

Here’s a quote from founder Devin “We actually paused deposits because of overwhelming demand”

They’re currently working out a different fee structure and will be opening up many more token options

Overall the market reacted exactly how many thought - there’s massive PMF for this type of offering

Price is down considerably from where we initially wrote this up, but if you look at my notes below, I thought a lot of the value of yield tokens was priced in - it’s actually beginning to come into value range now for me and something I’ll watch closely as they rollout their full launch of yield tokens

Our Interpretation:

As you can see from our previous piece, I was not a proponent of holding GS at the time, but its starting to fall closer into my value range and the major catalyst of yield tokens is still in its infancy.

I’m more bullish on yield tokens now than I was before, because I’ve seen proof that they work. Now it’s just finding ways to scale them. Still keeping an eye on GS for now, but not holding.

Here’s what we wrote back in April:

GammaSwap has built the tooling for users to get leverage on any token and trade perpetual options.

Why We’re Bullish:

I’ve followed the GammaSwap team for a long time even before they were live and just writing some research papers/threads. Their current positioning reminds me a bit of the spot Pendle was in before they broke through with major PMF. I say this as they are on the verge of a major release that I think the DeFi market will really enjoy. In a nutshell, they are tokenizing concentrated liquidity positions:

I mention Ethena in the post above as they really showcased the appetite for simplifying complex strategies into one-click solutions. I think the yields that these tokenized positions will provide could be very attractive. There’s probably some crossover here with Yield Basis with what they’re doing for BTC yields.

This has been in the works for a long time and I feel like the GS token has priced a lot of this in as the token currently sits at ~$112M FDV while only $9.6M of TVL and $3.2M of Open Interest.

This is a case of where I’m quite bullish on the protocol going forward, but more of a wait and see on the token. If they can pull in some serious TVL with this new innovation and generate nice revenue it would start to look appealing. The best way for me to assess this will simply be to try out the product when it goes live. If the yield is good and frictions of holding and getting into position are minimal, than I think it can do well.

Helpful Resources:

Really good article that breaks this all down:

UPDATED Maple (not holding)

April 25th Price: $0.16

Most Recent High: ~$0.67 (Jul 25) = 4.19x

Quick Thoughts:

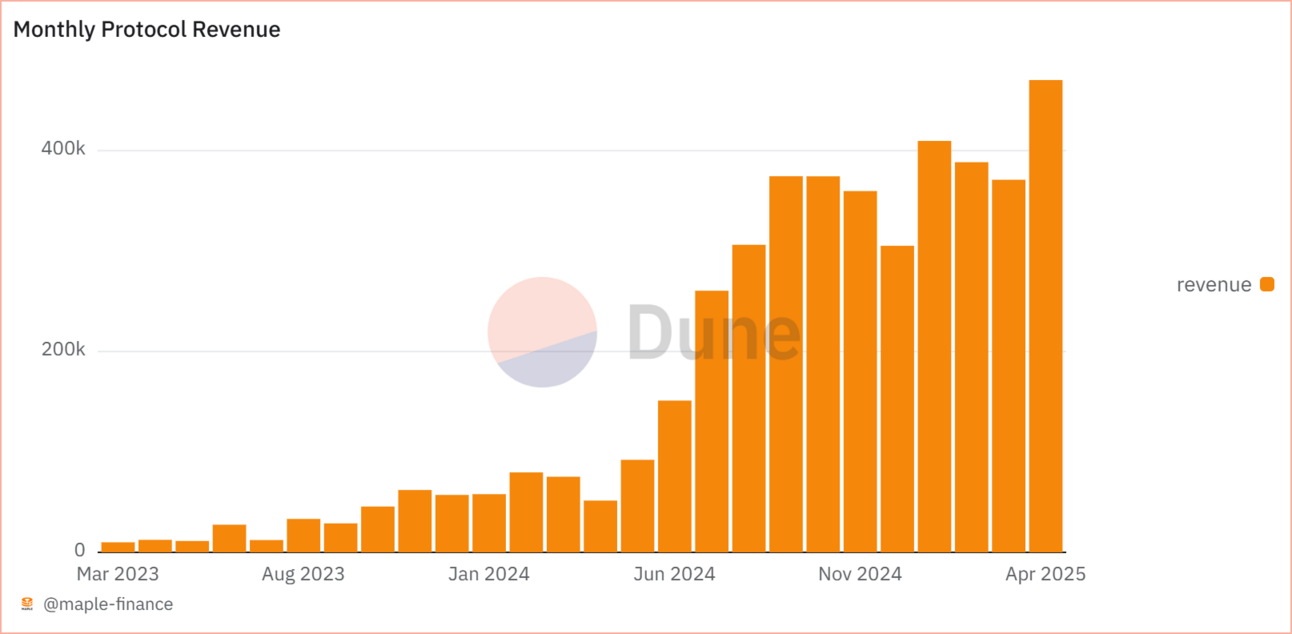

The red arrow is pointing to April. April looked like a huge month when we originally posted this article back then, but look how much it has been dwarfed by May, June, July and August.

Revenue growth was an important catalyst to us when we wrote about Maple back in April - the trajectory isn’t stopping

I wrote extensively about the possible upcoming Aave integration which has major implications (massive revenue driver if approved - read here)

Another catalyst that I really didn’t see coming at the time was how well syrupUSDC has handled the expansion to the Solana ecosystem

syrupUSDC on Kamino was a huge success, but now syrupUSDC on Jupiter Lend looks like it will be an even bigger win for Maple and its just getting started

Our Interpretation:

I never secured a bag of SYRUP when I wrote it up in April and am still underexposed. I definitely fumbled this one, but you can’t own everything.

Personally, I think it’s almost as attractive now as it was at $0.16 when I originally wrote it up. Revenue isn’t slowing down and there’s a bunch of near term catalysts that could propel these numbers way higher (Jupiter Lend, Aave).

Here’s what we wrote back in April:

Maple offers secured/curated lending opportunities for KYC’d institutional lenders while also hosting a robust DeFi suite. They have a bit of something for all user types.

Why We’re Bullish:

Grit.

This team is extremely intelligent/competent - they’ve been through DeFi hell and have come out stronger on the other side.

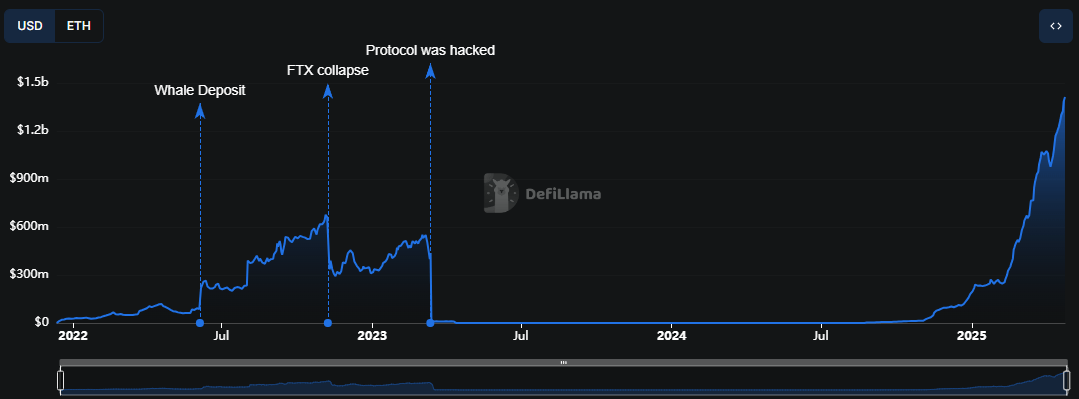

There’s almost nothing that tells the story better than this chart. Incredible comeback arc here. They’ve just crossed $1.15B in TVL.

Their products are able to serve two key segments of the crypto market of: institutional investors and onchain DeFi users. They’ve shown an ability to repeatably source industry competitive and scalable yields.

This is a team I’m paying close attention to going forward. I don’t own the token yet, but if their growth keeps up and they can generate meaningful revenue, I think it begins to get very interesting. On the revenue side, you can see that things have been trending up and to the right:

You really couldn’t ask for a better looking revenue chart than this

Helpful Resources:

UPDATED Ether.Fi (holding)

April 25th Price: $0.60

Most Recent High: ~$1.65 (May 15) = 2.75x

Quick Thoughts:

Here’s a key passage from what we wrote down below in April:

One thing to consider is, there are a lot of investor unlocks starting very soon. However, I’m personally of the belief that ETH the asset is in the midst of a turnaround and we could be on the verge of an upswing. If that plays out it will be a boon for ETHFI as it is sensitive to ETH price (positive and negative), which could negate a lot of that sell pressure.

We got the turnaround in ETH price that we were forecasting

Another thing we talked about below was the importance of their Neobank/credit card vertical - their rollout couldn’t really be any better so far IMO (check out this post)

Etherfi will be expanding to Plasma and already integrating with Hyperliquid via Hyperbeat

They’re also bringing perps directly to the Etherfi app via builder codes + swaps are coming too.

The term Superapp gets thrown around a lot, but Etherfi is well on its way to realizing this vision

They also have [REDACTED] coming 👀

Our Interpretation:

With ETH back near ATHs, Etherfi’s revenue is climbing and they’ve rolled out new business lines on the path to becoming a Superapp. Hard not to stay bullish on this team and their execution - I’m holding.

Here’s what we wrote back in April:

EtherFi has vertically integrated itself into a staking protocol, a yield app and a cash app.

Why We’re Bullish:

This team, helmed by Mike Sialagadze and Rok Kopp, is exceptional. They’re never satisfied and always grinding and improving.

Their very recent news brings the entire vision together. If you have the time, you should read their longform announcement here (link below too).

If you put all of this together, its clear to see that EtherFi is positioning itself as a new type of onchain Neobank. Their new credit card is one of the first attempts (of many) I’ve seen in crypto that actually looks like its going to be a major upgrade.

I think my friend and colleague Keegan Selby summed it up best:

Lastly, on the token side, EtherFi has amassed ~$5B in TVL and has been profitable from day one. Check this excerpt out from Blockworks:

Looking to do $40M to $90M in revenue

Right now, the ETHFI token trades at ~$600M FDV. When you start to comp it to other things in the industry, many have less traction, TVL, revenue and expansion plans. If these credit cards take off, it could really become a value. One thing to consider is, there are a lot of investor unlocks starting very soon. However, I’m personally of the belief that ETH the asset is in the midst of a turnaround and we could be on the verge of an upswing. If that plays out it will be a boon for ETHFI as it is sensitive to ETH price (positive and negative), which could negate a lot of that sell pressure.

Helpful Resources:

UPDATED Pendle (not holding)

April 25th Price: $3.43

Most Recent High: ~$6.28 (Aug 23) = 1.83x

Quick Thoughts:

Flawless execution and dominance by the Pendle team since our last post in April

Boros has launched

TVL has gone parabolic from $3B - ~$11B since our April post

Pendle becoming more and more of a staple for fixed rate yields and PTs being integrated everywhere

Even more major catalysts on the horizon with further tradfi adoption of the PT standard

As you can see from Linn’s post below, the revenue is starting to tick up nicely

Our Interpretation:

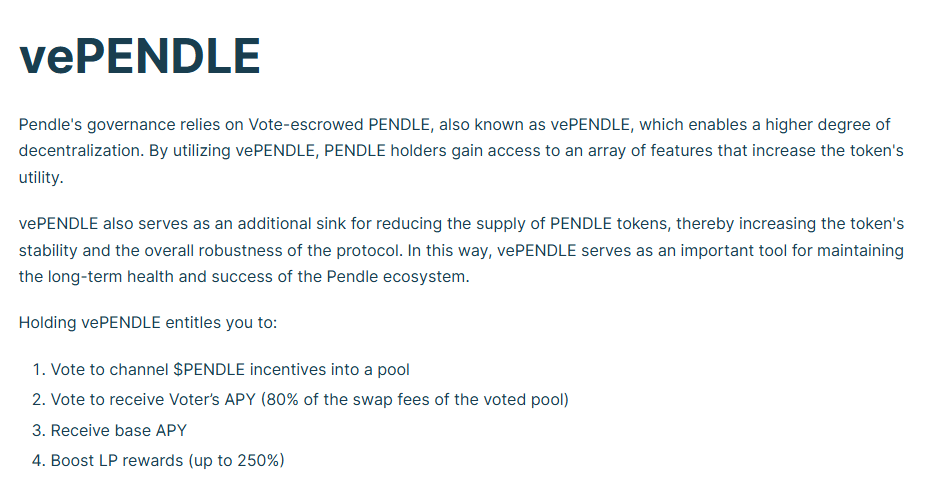

I feel underexposed not holding PENDLE, even though I use the app almost daily. I’ve been close to buying a long-term bag and max locking for vePENDLE more than once. The utility vePENDLE unlocks for LPs is powerful and is almost worth it independent of price appreciation (though both together is ideal). Still underexposed - even though I love the product.

Here’s what we wrote back in April:

Pendle is a permissionless yield-trading protocol where users can execute various yield-management strategies. The rise of the “points” meta in crypto really kicked-off a lot of demand for the platform and was highly synergistic to their fixed yield side (PTs).

Why We’re Bullish:

The Pendle team are on a very shortlist for being one of the best teams in DeFi (if not the best). Myself and DeFi Dad feel lucky that we get to chat with them almost daily in telegram and showcase their platform via our podcast + this newsletter. I open Pendle more than almost any other app in DeFi and I notice changes and optimizations weekly. It’s just always getting better.

The fixed-term market in tradFi is massive, but it hasn’t converted to DeFi just yet. However, Pendle is one of the first teams to really find PMF here and they are expanding their reach into the institutional arena with “Citadels” (article below). I think the timing here is perfect and the yields of 10% - 20% on yield bearing stablecoin PTs are highly enticing. Especially with TradFi becoming more and more comfortable with DeFi by the day (great deep dive on this here)

Lastly, I’m personally quite bullish on Boros. We wrote about it a bit here, but its also linked below. With Boros, users will be able to trade all sorts of different offchain and onchain yields. One early usecase will be the ability to hedge and leverage funding rates. This will be highly beneficial for teams like Ethena who are heavily reliant on funding rates.

One the best decisions Pendle made was not launching another token for all of this. Many teams have or would have in their position, but the value flows from Citadels and Boros will flow back to vePENDLE holders. The way things should be 🤝

Speaking of vePENDLE, from April 2024 through April 2025, Pendle distributed around ~$25M in vePENDLE + Airdrops

vePENDLE has some incredible utility if you actually use the protocol. I personally didn’t realize the extent of boost LPs get for holding vePENDLE. From the Pendle docs:

Helpful Resources:

Really hard to fade this tweet below:

UPDATED Euler (not holding)

April 25th Price: $8.37

Most Recent High: ~$17.29 (Jul 15) = 2.07x

Quick Thoughts:

Euler has doubled in TVL since our last post

It’s continued to be an incredible source for yields and attracting the best curators

Euler Swap went live recently and there’s lots of depth and ways to use it - see here

Euler Earn just launched - see here

Euler is another team that just continues to quietly execute and innovate

Not sure if these revenue numbers are accurate, but if they are they will need to heavily scale to make these number more meaningful to token holders

Our Interpretation:

I love the Euler story and the product speaks for itself (although I can find the UI a little bit confusing). That said, I still don’t currently own any myself and would want to see the revenue numbers come up a bit to justify the price (or maybe Defillama is not correct?).

Here’s what we wrote back in April:

A lot of my thinking on Euler mirrors my thoughts with Maple. They’ve lived through somewhat similar DeFi life cycles.

They’ve built a very modular/flexible substrate and we’re starting to see all the expressivity of their design come to life. Not only have they executed with their mechanism design, but their clever use of incentives rEUL have really helped them grow their TVL. It will be key to see how they grow without incentives going forward and if they can sustain this growth.

Another incredible DeFi comeback arc that’s playing out before our eyes. Love to see it!

Another story in a chart

That’s all for now, thanks for checking it out!

.jpg)