Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

(We suggest reading this on our website vs email as the email version gets cut short every week!!!)

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

Here’s the top yielding stablecoin vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding stablecoin vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, boosted yield)

The link to this filtered table above is here

Bonus: Before we jump into ETH & BTC yields I need to cover something called Peapods Finance. I’ve actually been getting DM’d by this one guy on X relentlessly every week for probably 5 - 6 weeks to include it in YOTW (btw its this guy). On top of that a bunch more of the peas army has shown up in comments every week to show me all the yields I’m missing on Peapods 🤣. It’s actually pretty bullish that they have this vibrant of a community. It’s a good thing!

I admit, I’ve actually been having a tough time figuring out what’s totally going on here despite the immense help their community is giving me and even their core team hopping in my DMs to help. That said, there is something interesting here and I need to continue to look into it.

Peapods introduces a way to earn yield through something called “volatility farming” and even advanced strategies that allow for “leveraged volatility farming”. You can find the full docs here.

The part that’s immediately interesting is the yields. There is some really nice opportunities here to lend USDC and get a good return. I also like that it appears to be all real yield.

One minor gripe is I do find the UI a bit confusing to navigate, but its new and a new primitive so fine to give that a pass for now. Also, another concern I voiced is there’s nothing in the docs that outlines the risks or where all this goes wrong. The good thing is their team were really receptive to my feedback and sounds like they are working on getting more of that information into the official docs.

This is what the main UI looks like on their new beta

One of their higher TVL Pods is boasting a 60.9% APY on USDC:

I wanted to put this on peoples radars for now because I do think its really interesting, but I still need to do more homework and due diligence before I deposit my own funds. Again, curious what other people think, would love anyone to weigh in with comments below.

ETH & BTC Yields

Here’s the top yielding ETH vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding ETH vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, boosted yield)

The link to this filtered table above is here

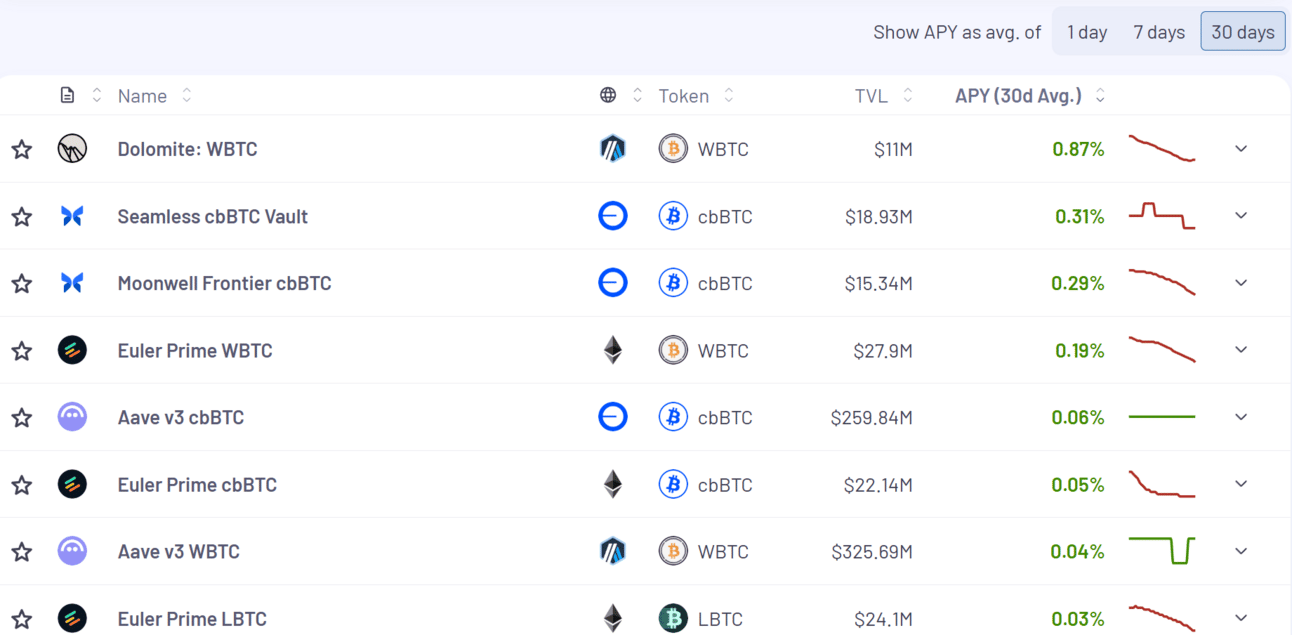

Here’s the top yielding BTC vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding BTC vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (30 day avg, boosted yield)

The link to this filtered table above is here

Yield Trading

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

12.24% - 15.16%

We are investors in GAIB the two tokens at the top of the yield list this week (AIDaUSDC + AIDaUSDT). If anyone wants to learn more about this novel protocol and where the yield comes from, we wrote all about it here:

BTC

2.11% - 2.89%

ETH

5.03% - 5.67%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Maple comes to Solana!

It’s pretty cool to see the Maple team continue to relentlessly ship with their expansion into the Solana ecosystem. Solana needs more mature DeFi teams and Maple making this move is a big signal.

See posts below for more details:

This opportunity above is on Kamino Finance and utilizes their Multiply feature that currently has a max APY of 19.68%:

Here’s one more gem from DeFi Dad himself that involves Morpho and Coinshift’s csUSDL:

That’s all for now, thanks for checking it out!