Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

Here’s the top yielding stablecoin vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Bonus: Gold has found its way to blockchain in a big way with Pax Gold (PAXG) issued by Paxos and Tether Gold (XAUT) issued by Tether.

It’s pretty cool to see the world’s oldest store of value come onchain, but what’s even cooler is that you can sit in that collateral and borrow against it or take on leverage:

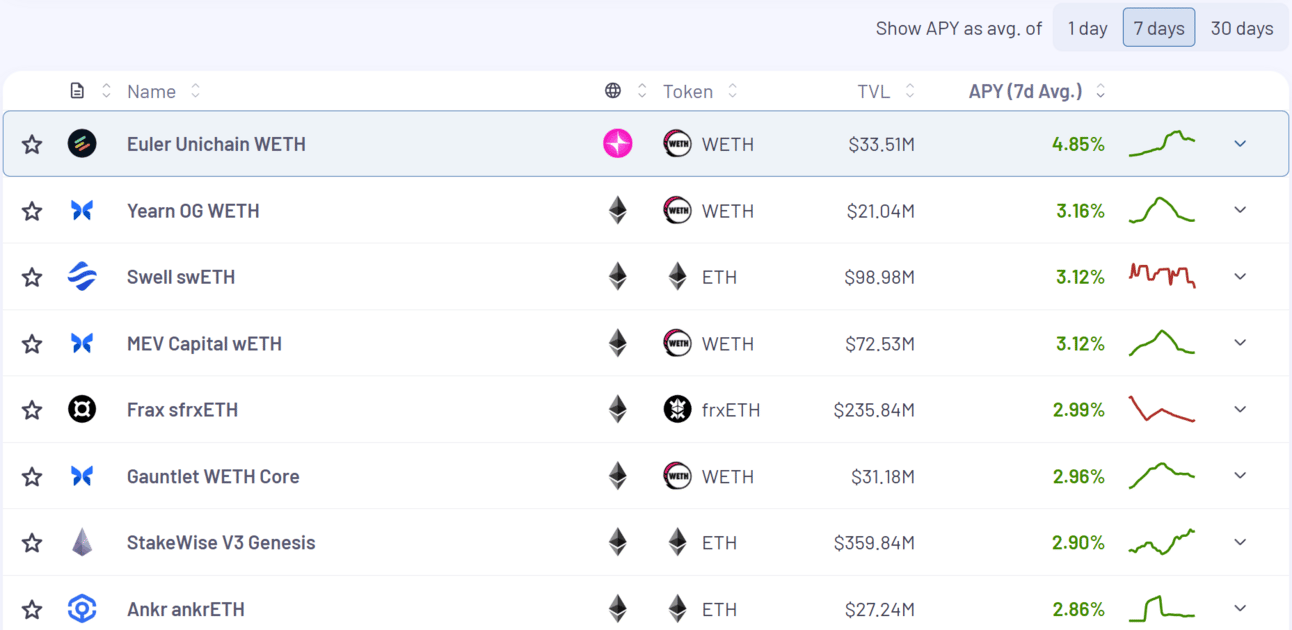

ETH & BTC Yields

Here’s the top yielding ETH vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding BTC vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Bonus: I’m always looking for more opportunities on HyperEVM (very bullish long term) and the Felix team are one of the best new operators in DeFi IMO.

They just launched USDhl to be a native yield bearing stablecoin on Hyperliquid. In typical Hyperliquid fashion they’ve committed to using revenue from this to buyback HYPE.

While yields have compressed a bit since launch on USDhl, I think interacting with Felix in some way could be highly beneficial. It appears like it could be positioned to have one of the bigger airdrops in the HyperEVM ecosystem when they eventually launch a token:

These are their vanilla vaults powered by Morpho. This is separate from their CDP suite.

Another way to maximize your opportunity for future airdrops is to interact with Unit assets that are on Felix. Unit and Felix are probably my most bullish teams building in the Hyperliquid ecosystem (I’d add in Kinetiq too but not live yet) and I believe you will be able to get exposure to both airdrops by utilizing Felix (no guarantees, this is just my speculation).

For example uBTC (from Unit) is offering 13.28% APY:

Bonus: Another player doing really well in the BTC yield space is Maple.

They’ve managed to generate between 4% - 6% on BTC:

Yield Trading

Something standing out to me right now is opportunities for Liquity V2's Bold on Pendle right now:

The YTs are looking especially interesting as not only do you get exposure to yield but also “~14x leveraged exposure to 20 + fork airdrops” (Felix is one of these forks 👀)

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

11.63% - 12.31%

We are investors in GAIB that has two tokens in the top 5 this week (AIDaUSDC + AIDaUSDT). If anyone wants to learn more about this novel protocol and where the yield comes from, we wrote all about it here:

BTC

2.28% - 4.32%

ETH

5.78% - 10.06%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

This one is very fresh and involves InfiniFi, a team we’re very bullish on (and invested in).

Interested in ~61% APY on stablecoin looping yield?

DeFi Dad has the breakdown:

That’s all for now, thanks for checking it out!