Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

BTC Yields

Here’s the top yielding BTC vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

Once again, BTC yields have really compressed (there’s no easy way to get yield on BTC)

What does this mean?

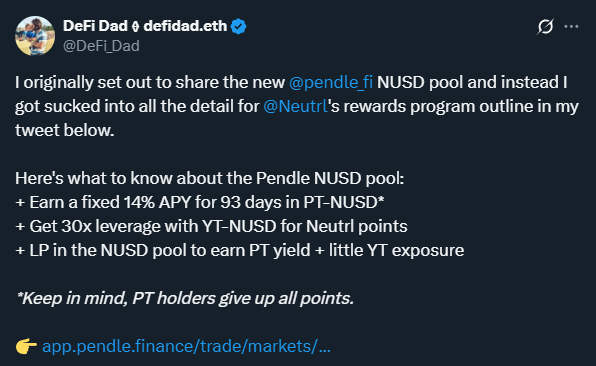

If you scroll down to our “Yield Trading” section of this report, you will see that NUSD is now on Pendle and you can lock in 14.45% fixed-yield for the next 92 days.

If you want to learn more about Neutrl, we chatted with them on our podcast and DeFi Dad has been writing a bit about them this week:

Here’s info on Neutrl points:

This fusion vault release caught my eye the other day and I bookmarked it to come back to for YOTW:

Why did this catch my eye?

I’ve talked at length with the TAU Labs team and Ipor Fusion team. I had the opportunity to get an in-depth product demo on the Fusion vaults from their team and came away extremely impressed. I’ve also heard very good things from builders I trust that are working directly with the Fusion product.

On top of all this, I’m an investor in InfiniFi and routinely chat with the team about their roadmap and product (sidebar, InfiniFi just dropped a major points update as I was writing this)

All this to say, I’m fairly comfortable with the people behind these products and the tech stack here strikes me as fairly robust.

The actual design of these vaults is pretty interesting and seems to have a lot of automations - here’s a look at exactly what is happening:

There’s very little liquidity in these at the moment and both have fairly tight caps as they look like they’re just rolling these out.

This isn’t something I would jump into right away, but I will monitor them and see how they perform.

With limited time/data here’s their reported performance as of now:

BTC carry trade - 2.19% APY (7 day)

ETH carry trade - 4.81% APY (7 day)

Levr has been on my radar for a few years now and is such a cool concept. As DeFi Dad mentions below, we’ve met these guys many times and we’ve always been fans of what they’re building:

I’m highlighting this because I find it really innovative and interesting. I’m not sure what the ROI/risk will end up being on something like this just yet, but the general idea of “backing a sportsbook” and getting 50% of the revenue via staking is cool.

This is another thing I’ll be keeping my eye on to see how it performs in the wild.

Thanks to our sponsors for making it possible to share this content for FREE!

Yield Trading

Here’s what the front page of yield on Pendle looks like this week:

Stables

6.45% - 17.22%

BTC

1.15% - 2.92%

ETH

2.91% - 7.01%

HYPE

2.91% - 7.26%

Air Drop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

Here’s a cleaner version with the same tone:

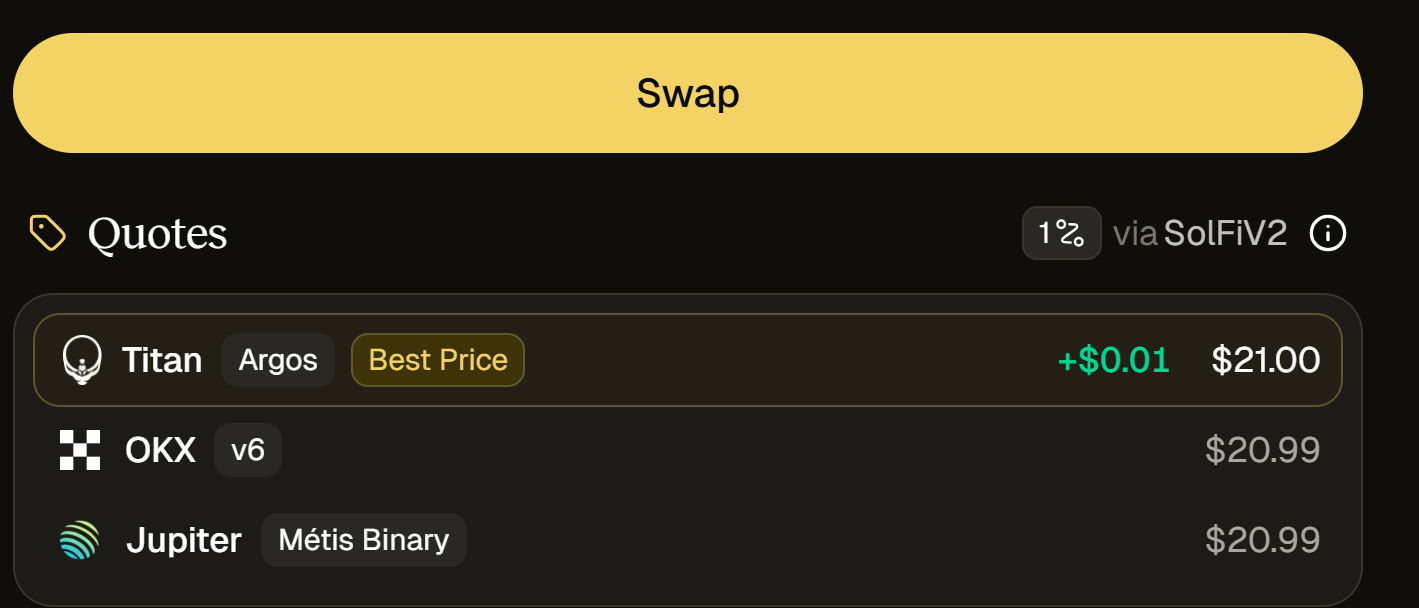

Titan is our farm of the week.

It’s a really strong Meta DEX Aggregator on Solana, and they just announced a $7m raise led by Galaxy.

Most Solana traders know Jupiter, and many received an airdrop from them. Jupiter aggregates across venues to get you the best swap price.

Titan takes that a step further by finding the best rate across the aggregators themselves. They also have leaderboards showing your volume and edge (the dollars saved by routing through Titan).

I’d bet they eventually offer some form of airdrop down the line.

The best ways to farm it:

• Organic usage. Swap volume will almost certainly be the biggest factor.

• Referrals.

• Collecting badges. Complete the current tasks to earn them.

Bonus: Once you’re signed up on Titan, also push some volume on Ranger Finance (spot). You’ll earn the Ranger badge on Titan while also farming volume and points on Ranger itself.

What I like most about this farm is how straightforward it is. You can farm just by using it organically. Trade the tokens you already trade on Solana. No weird hoops. No obscure, unreliable assets.

More volume today likely means a larger airdrop in the future.

Good luck farmers.

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!