Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

(We suggest reading this on our website vs email as the email version gets cut short every week!!!)

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

Here’s links to the top 5 yielding stablecoin pools (non-boosted) for the past 30 days according to Vaults.fyi:

15.35% - Resolv RLP (not a stablecoin - RLP comes as added risk as first loss junior tranche if Resolv has issues)

8.97% - Staked lvlUSD

8.76% - Resolv stUSR

7.06% - Euler Yield USDT

6.99% - Dolomite: USDC

Full list below:

Min $10M in TVL

Bonus: Fluid Smart Lending is pretty interesting providing you’re OK with holding either token in the pair. As these are relatively pegged assets there should be little to no IL. This tweet is what made me investigate:

Under the “Smart Lending” tab on Fluid you can see all the opportunities. Check out the RLP/USDC one which is offering 30.26% APR:

Holding vanilla RLP is yielding 15.35% whereas this pool gives you double the yield and more points as every $1 in this pool is delivering 30x points.

As mentioned above, be aware of the risks of holding RLP as it comes with added risk as first loss junior tranche if Resolv has issues.

Bonus: Liquity v2 is live again and has some really nice yields on BOLD:

ETH & BTC Yields

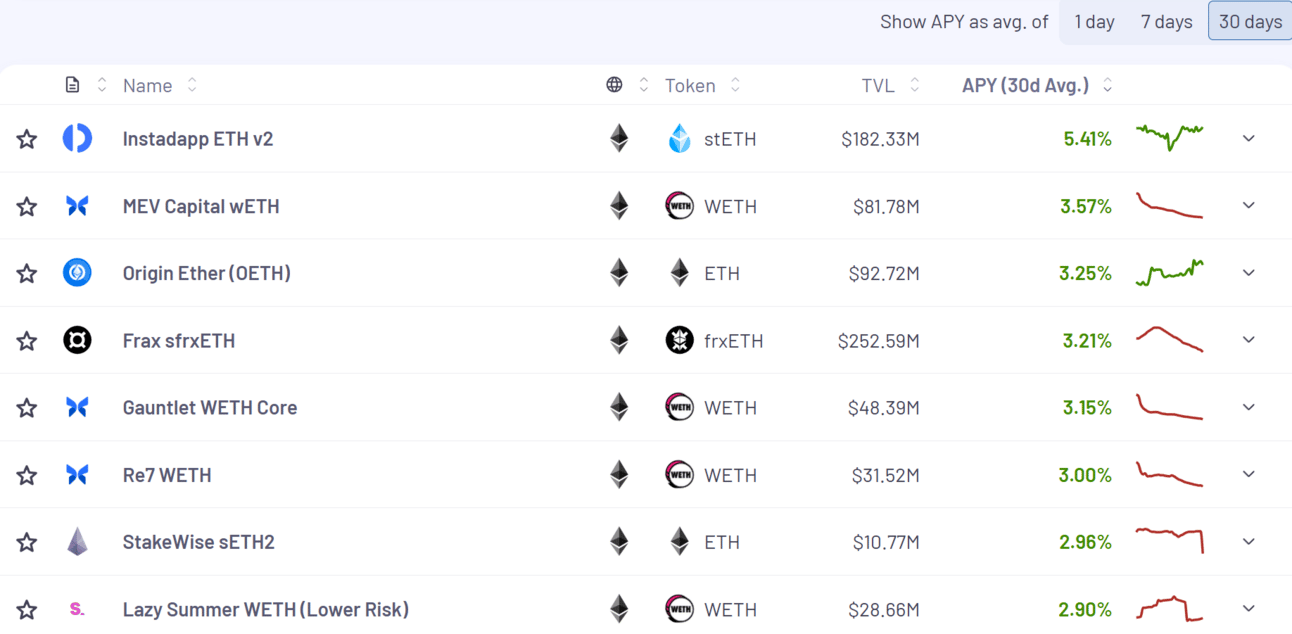

Here’s links to the top 5 yielding ETH and BTC pools (non-boosted) for the past 30 days according to Vaults.fyi:

5.41% - Instadapp ETH v2

3.57% - MEV Capital wETH

3.25% - Origin Ether (OETH)

3.21% - Frax sfrxETH

3.15% - Gauntlet WETH Core

Full list below:

Min $10M in TVL

Bonus: Stephen from DeFi Dojo dropped some absolute gems in this BTC thread this week:

Yield Trading

I want to cover a few specific YT moves that have my interest this week (and I am doing them myself).

Last week Spark started their points campaign on Pendle and the only way to get these points is currently through Pendle.

Spark is as OG as it gets and are becoming a DeFi hub with $7.55B in TVL. Meaning, this airdrop could be massive. However, there’s been people farming it for almost 2 years so the question is, how meaningful will the Pendle points be?

The good thing is, I think we’re still early on this one as this just went live last week and this pool has an August maturity.

(if you do want to join this you can use my referral here to get started)

There’s a lot of unknowns here, but here’s a thread of threads to help navigate the opportunity:

Another YT I’m quite keen on is Resolv. I like it because its sort of gone under the radar on Pendle with the flood of the flashy new stablecoins on the market. I was a moderately large contributor to Resolv Season 1 via YTs (we’ll see how that turns out). However, I think Season 2 is even more compelling.

I’ve been slowly accumulating more of these May maturity YTs and will continue on with a future maturity pool (haven’t decided which one yet):

As of writing this, Resolv TVL is up to $439M. It’s highly sensitive to funding rate changes which I think are starting to work in Resolv’s favor again. Why does this matter? TVL is still somewhat tethered to token FDV and with Resolv still pre-TGE, the higher this TVL climbs the higher the FDV of the RESOLV token could be at launch. All these factors influence the YT/PT balances too.

Resolv understands how to do a proper referral. If you use mine I get 10% of your points, BUT you the user will get a 20% boost on ALL your points. It’s pretty much a must to use someone’s if doing this campaign: here’s mine.

Stables

11.95% - 19.03%

BTC

2.84% - 4.18%

ETH

6.32% - 10.83%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

We have more Fluid financial wizardry this week. This one was actually called out in Stephen’s yield thread from above. This involves Smart Debt + Smart Collateral looping with WBTC/cbBTC - WBTC/cbBTC and right now you could obtain 24% - 25% APR on this (which is pretty wild for BTC yield!):

That’s all for now, thanks for checking it out!