Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Before we begin…

We’re going to do something a bit different for this special 4th of July edition. A few readers have mentioned lately about highlighting some lower TVL pools with higher yields. We’re going to do just that!

We’re going to showcase yields from minimum TVL of $100k this week 👀 (while still curated from more blue chip/ trusted teams).

Stablecoin Yields

Here’s the top yielding stablecoin vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $100k TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Bonus: We’ve been having a number of discussions with the Falcon team lately as we’ve seen their TVL growing tremendously ($540M TVL). These talks and the implementation of their transparency dashboard, has made us a lot more comfortable with their product.

A new vault from Silo caught our eye that utilizes yields from USDf, sUSDf and PT-sUSDf and is generating a very respectable 15.4% APR:

If you want to learn more about this opportunity there is a great thread you can read up on here.

Bonus: The Term Labs team have a new USDT Meta Vault on Avalanche that is generating some nice yields at 15.48% APY:

ETH & BTC Yields

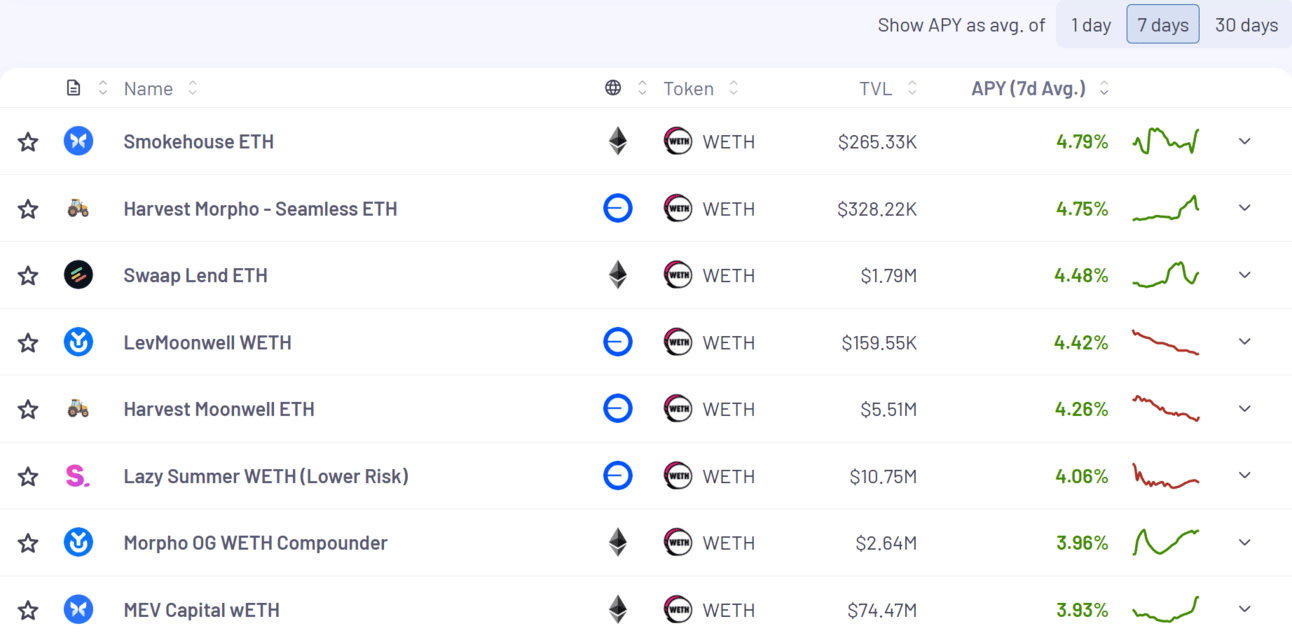

Here’s the top yielding ETH vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $100k TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding BTC vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $100k TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

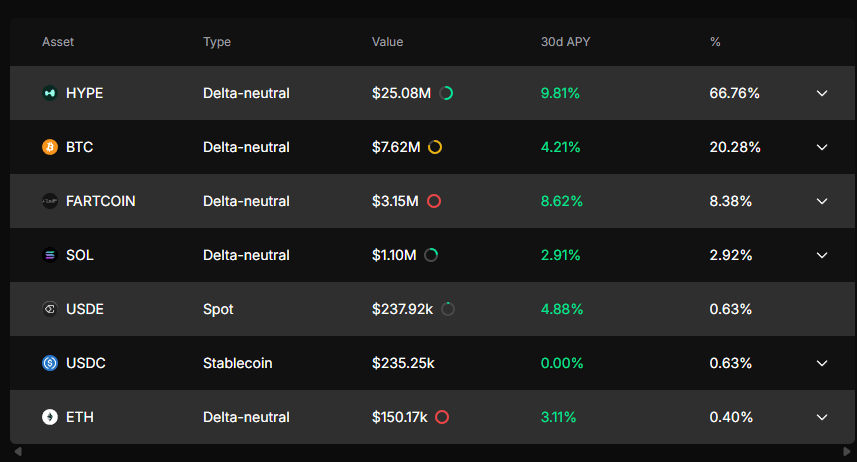

Bonus: I think one of the coolest DeFi product ideas I’ve read about recently is Liminal. It allows you to get delta neutral yield on a number of blue chip assets with ease.

Here’s an idea of assets and yields:

Again, this is real yield, no incentives.

The ones that obviously standout are the HYPE and BTC yields.

This is the excellent thread that finally got me up to speed on Liminal. It’s very much worth your time:

OK, want to take it one step further?

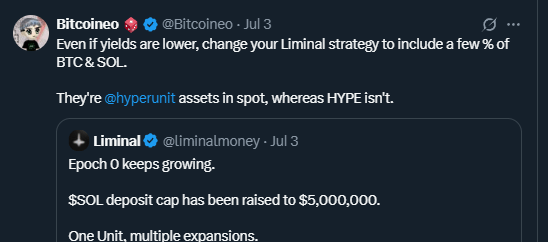

I’ve been looking for ways to get creative exposure to Hyperunit airdrop. This strategy makes a lot of sense to me:

Pretty sharp idea here by Bitcoineo

OK and lastly check this out:

Yield Trading

Before we look at the top yields on Pendle this week, I will share that I’m part of a group of testers playing around with Boros. For those of you that aren’t familiar with Boros, it’s a totally new product being brought to market by the incredible Pendle team. Check out their blog if you want to learn more here.

I don’t know what I’m allowed to share here, but I will say that so far what they’ve built is totally net new and incredibly designed. There’s nothing on the market like this. I need to play around more with it as it’s a familiar trading UI, but it’s a completely new primitive.

Very encouraging what I’m seeing so far!

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

11.47% - 16.38%

BTC

1.55% - 4.24%

ETH

3.89% - 5.32%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

It sort of amazes me that Maple’s SyrupUSDC ports over to Solana only recently and instantly is the best DeFi yield on Solana (risk adjusted IMO).

It’s not just me though, I think Stephen from DeFi Dojo had an incredible rant on this recently that everyone should give a read.

Here’s the Syrup opportunity - currently sitting at 27.05% Max APY!

That’s all for now, thanks for checking it out!

.jpg)