Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

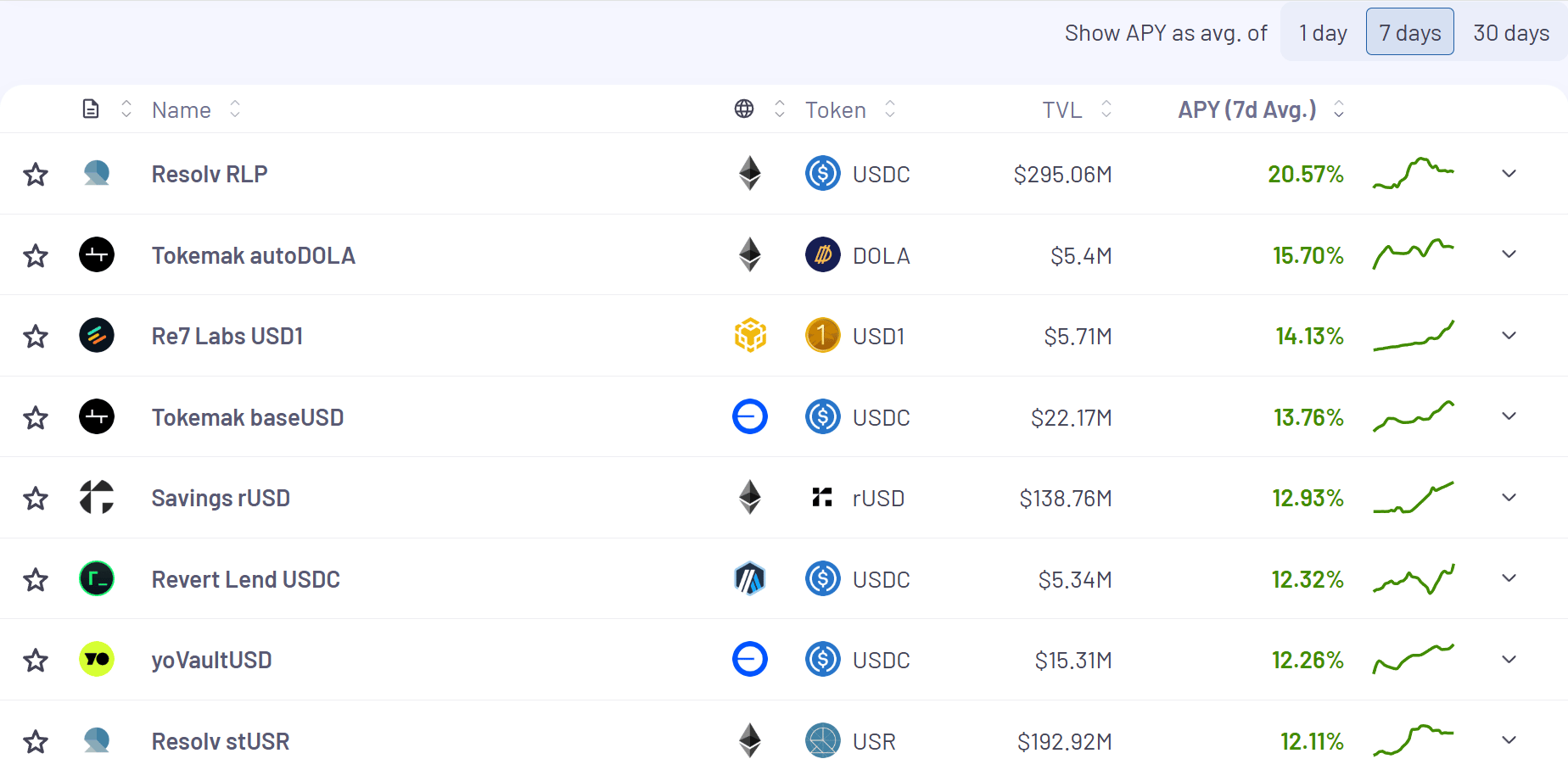

Here’s the top yielding stablecoin vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $5M in TVL

The link to this filtered table above is here

Bonus: I’ve written up Avant Protocol lots now, but they just launched a new product and the yields are wild!

This new product is a junior tranche called avUSDx which is basically savUSD's yield boosted Junior Tranche. It’s currently yielding 50% APY.

(*Junior Tranche experiences first loss in event of exploit, hack or other loss events. Always be mindful of the added risk/reward here.)

OK all that was confusing, here’s their products mapped out:

If you want to read up on more of this it’s all here in their docs.

It’s a pretty impressive suite they are building here (including the avBTC side at 7.11% APY)

Bonus: I wrote about this Hyperbeat yield last week, but their USDT vault is still very solid. It’s currently yielding ~17.23% APY:

It’s come down slightly since last week (19.83%), but still very high with over $90M in TVL.

ETH & BTC Yields

Here’s the top yielding ETH vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $5M in TVL

The link to this filtered table above is here

Here’s the top yielding BTC vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $5M in TVL

The link to this filtered table above is here

Bonus: Maple continues its ascension as one of the juggernauts of DeFi. They’ve been offering some of the most consistently high yields on BTC since February 2025. They’ve been able to generate a 5.13% APY on $180M worth of BTC. It’s pretty impressive to see those kinds of yields at scale.

They’re now opening this product up to accredited investors and institutional investors. If you want to read up more on this you can at the link below:

Also, for anyone who is earning Maple “Drips”, Edge readers get an extra multiplier that can be fairly material:

If you want a to earn this multiplier click the button below:

What I’m Doing On HyperEVM

So far I’ve:

Staked all my HYPE on Kinetiq and converted to kHYPE (usable in DeFi) which yields 2.2%.

Moved all of my kHYPE to Felix where I’ve deposited into the vanilla vault and am borrowing HYPE against my kHYPE collateral (paying a hefty 12% borrow rate).

Taking my borrowed HYPE and staking it again for kHYPE and depositing into the Kinetiq Veda vault that’s farming 6% APY + airdrop rewards from other protocols.

I’ve since deposited into Hyperbeats beHYPE as I’m quite bullish on them and this vault has a ton of points. If you’re not up to speed on this opportunity, this is a great thread from last week.

More continued in “Yield Trading” just below

Yield Trading

It’s here!

I kid you not, Kinetiq and Hyperbeat going live on Pendle this past Wednesday felt like Christmas morning to me (I really need to get out more - I’m aware).

The ones I’m looking at are Kinetiq’s kHYPE YT and Hyperbeat liquidHYPE YT:

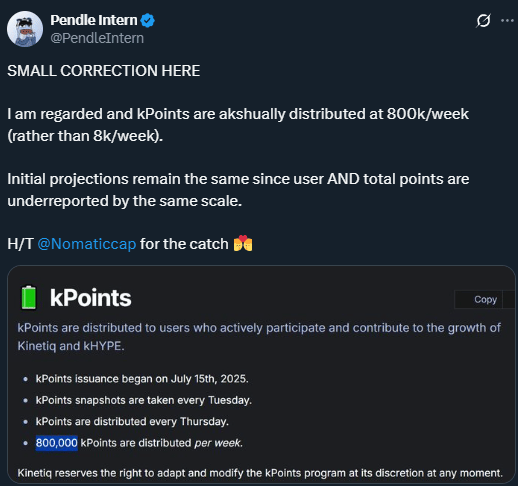

The intern himself wrote up some great analysis on kHYPE to try to figure out the upside here. There was one small error though as kHYPE releases 800k points per week and I had to correct the master himself:

Here’s Intern’s full writeup - Click Here

(note - Implied Yield was actually quite high when he wrote this up so numbers could look a bit better now)

ALPHA 🚨

Kinetiq, like Hyperliquid, is only releasing a set amount of points per week (800k), meaning, rewards are front loaded to early participants. Therefore, if you are going to do YTs it makes sense to be positioned early.

I’m currently in the Hyperbeat early deposit vault but I feel like I missed the best entry on the liquidHYPE YTs. I’m keeping an eye on them for an entry, but again, these made a lot of sense to be early on. Why you ask? Your rewards are proportionate to your share of the vault based on your own TVL in the vault. The vault was only a little over ½ full when YTs launched so there have been days when you were getting close to double the hearts (points).

Still only ¾ full which means extra points for people currently in

Stephen from DeFi Dojo did an incredible writeup on this YT opportunity - Click Here

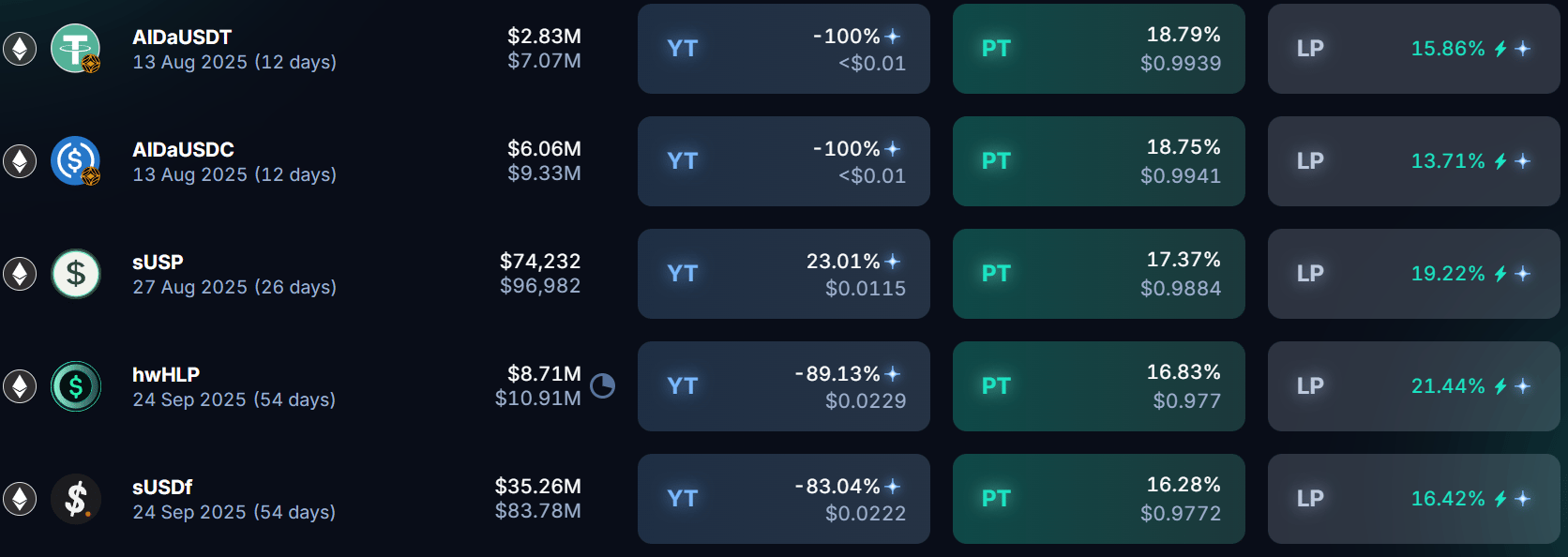

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

16.28% - 18.79%

BTC

2.13% - 4.16%

ETH

4.38% - 6.44%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Check out these yields.

73% - 163% APRs 👀

The Edge actually has the highest possible referral for Falcon where you earn an extra 15% in their “Miles” rewards campaign:

The Aavethena team have joined forces once again to create a product they are calling Liquid Leverage.

One of the problems they are trying to solve for is:

Partners enabling Liquid Leverage provides a solution to a key issue that sUSDe users faced in the past: the 7-day unstaking cooldown for sUSDe.

While at least half of a user's position will be still in sUSDe, the USDe component allows for the risk of the position to be managed more effectively.

More on this in their full announcement:

The Post-Loop APR from their image below shows 49.89% APR.

That’s all for now, thanks for checking it out!

.jpg)