Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Before we begin…

This week we’ll be looking at the best 30 day avg yields with no incentives.

We love using vaults.fyi and they just released reputation scores, check it out:

Stablecoin Yields

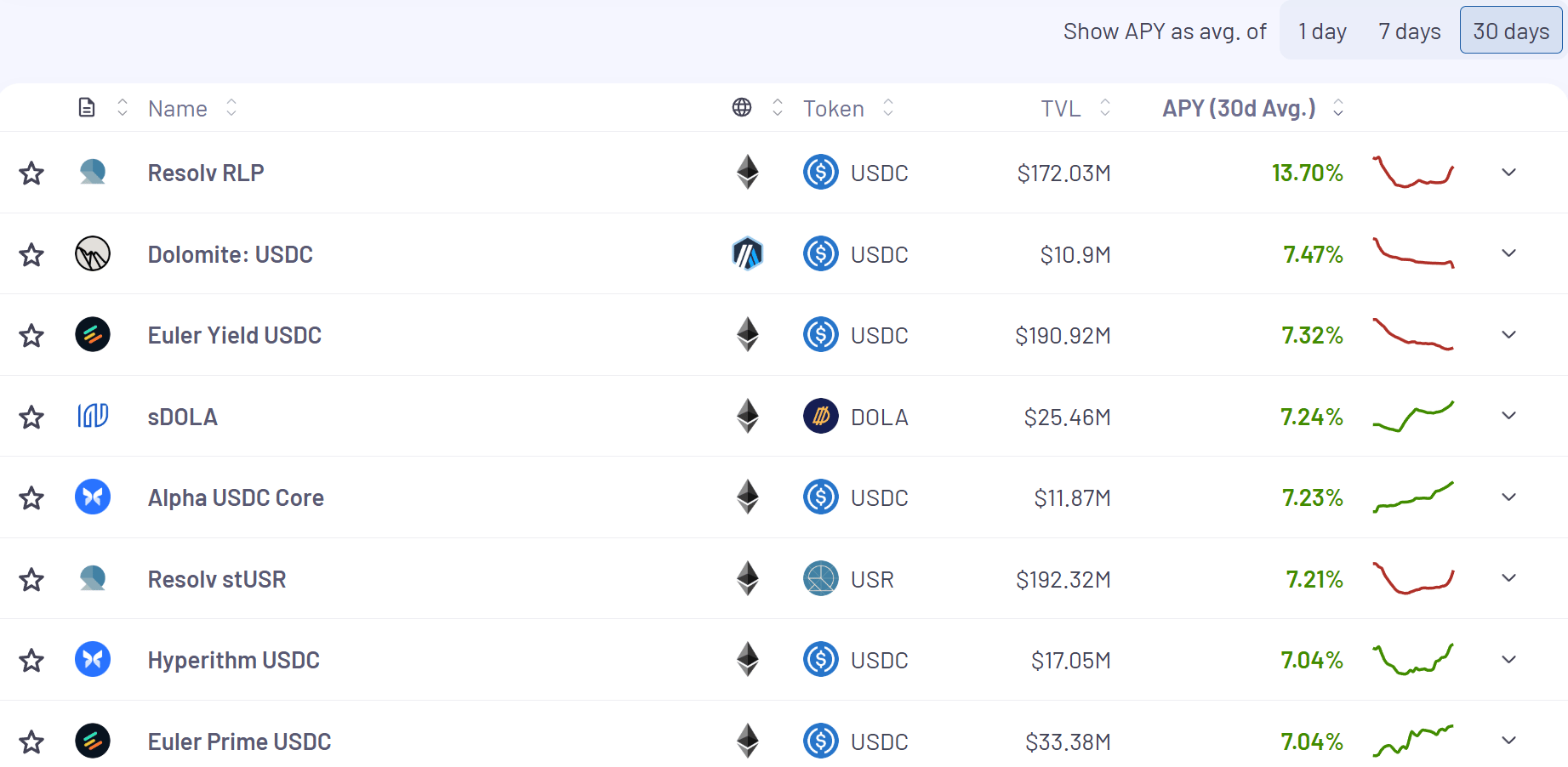

Here’s the top yielding stablecoin vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

Bonus: Term now has ~$26M in their vault products and is cooking with stablecoin yields up to 15% APY:

Bonus: How about ~27% APY yield on your stablecoin position with no leverage? As long as you’re cool with holding either of RLP or USDC you can do that with “Smart Lending” on Fluid.

Now that animal spirits are flowing again, it makes sense to look to the funding rate coins like Resolv/Ethena:

Check out this full yield breakdown. Essentially, you will always beat the vanilla yield rate for RLP in this pool.

ETH & BTC Yields

Here’s the top yielding ETH vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

Here’s the top yielding BTC vaults (non-boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

Bonus: The HYPE yield on Felix is very nice right now and is currently fluctuating between 6% - 10% APY. Charlie is absolutely on point with this breakdown (no leverage, no incentives and all real yield):

Yield Trading

I’m very bullish HyperEVM and Rumpel (one of our amazing partners) will be supporting one of my favorite teams building in the HyperEVM ecosystem - Kinetiq.

So not only will you be able to take profits on your Kinetiq points immediately (if you so choose), you will also be able to speculate and buy Kinetiq points if you think they are undervalued 👀

There’s a team we’ve covered previously in this newsletter called Pareto who have some nice fixed yields on their PTs via Napier Finance. Check this out, 38.62% APY:

If you want to learn a bit more, they wrote a great article on these yields right here.

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

14% - 15.11%

BTC

2.08% - 3.45%

ETH

4.2% - 7.09%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Here’s two looping ideas this week. This first one is coming 🔜 and its from Gearbox. They estimate a 30% APY on ETH loops and it’s highly scalable 👀 (should be live in the next few days):

This other opportunity is one I sniped from Stephen at DeFi Dojo and showcases an ETH loop opportunity netting up to ~37%:

That’s all for now, thanks for checking it out!

.jpg)