Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Huge thanks to our Yields of the Week lead sponsor: Summer.fi

Earn high-quality DeFi yield on assets like ETH, USDC and USDT automatically - with Summer.fi

Now, stake $SUMR ahead of the January 21 TGE to access protocol fee yield before the market prices it in. Check out more at Summer.fi

Learn more about Toros Finance and their novel leverage tokens

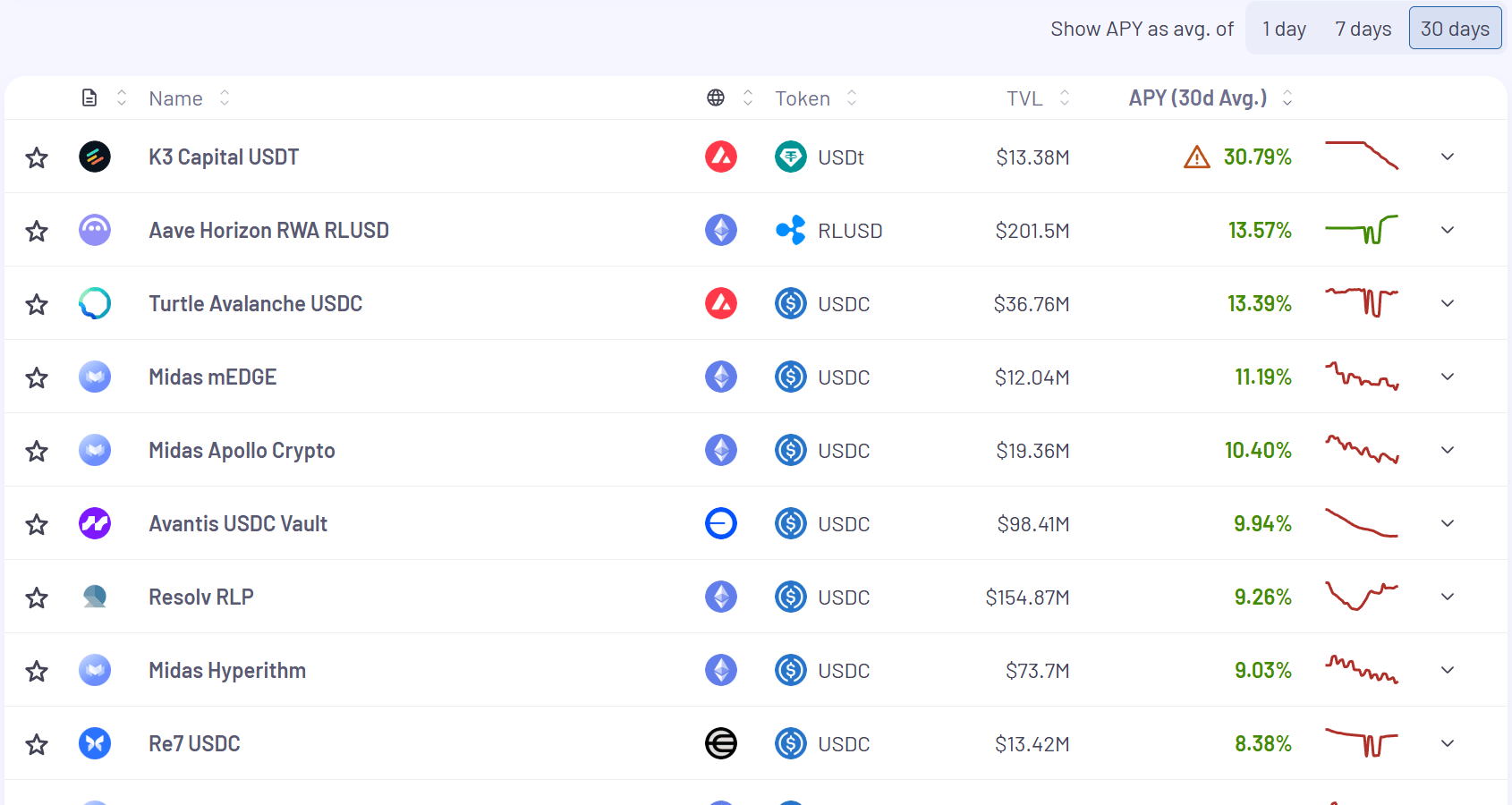

We’re looking at 30 day real yields this week with minimum of $10M in TVL (powered by vaults.fyi)

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $10M TVL

I keep checking Stablewatch lately.

Not really for headline yields, but to see the 7-day TVL changes. It’s one of the cleaner signals for where people are actually allocating, not just what’s being promoted.

This week the top movers were Midas +20.3%, Neutrl +17.8%, and Noon +15%. Different strategies, but clearly attracting capital at the same time.

What also stood out was Sky +12.9% and Maple +9.9%. Seeing sUSDS, syrupUSDT and syrupUSDC put up solid weekly inflows while already sitting on large TVL bases is notable. It’s easier to grow from small numbers. Growing at scale is a different thing.

Nothing conclusive here, just something I’m watching:

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $10M TVL

Looping RWAs feels like one of the bigger DeFi trends heading into 2026. You can already see teams spending real time and resources on it.

A couple that stand out are 3F Labs, Kamino and the Gearbox team, and there are likely plenty more working quietly in the background.

I actually came across a new article from Gearbox today while scrolling X, where they lay out how they’re thinking about solving the RWA looping problem. It’s a solid window into how this category might start to mature beyond our current sandbox of experiments.

Definitely worth a read if RWAs are on your radar.

The issue with looping isn't flashloans or DEX liquidity, but the design of lending protocols that forces them to rely on external tools and middlemen…

Their architecture cannot enforce issuer mandates, redeem assets, or scale to RWAs. That's why, Gearbox is eliminating looping. And replacing it with RWA native Credit Lines.

The first of these new credit lines is live and already pulling in a decent amount of TVL, with a headline 37.01% APY.

The most interesting part isn’t even the yield. It’s the structure. There’s zero slippage and no interaction with DEX liquidity. All the wrapping and unwrapping happens directly through smart contracts, which removes a whole layer of execution risk and market impact you normally have to think about.

Early days, but the mechanics here are worth paying attention to.

Check out their full article on their plans for the future of RWA Native Credit Lines right here

We actually wrote this vault up late last year just before it went live and I wanted to check in on it again.

This vault is the sUSN Delta Neutral Yield Vault by Noon Capital.

It’s currently yielding 19.87% APY:

Here’s what the yield looks like below. There’s a strong underlying native apy of 11.62% + WMON and ACC (minus the performance fee):

How to Evaluate Crypto with DeFi Metrics

I think anyone investing their time and money in this space should give this piece a read by Patrick Scott:

I've spent the last four years immersed in DeFi metrics, first as a researcher, then working at DefiLlama. This article is a summary of the most useful frameworks I’ve learned in that time to help you start using them.

Here is a link to the full article

Thanks to our lead sponsors for making it possible to share this content for FREE!

Yield Trading

Taking a look at the front page of DeFi yields on Pendle:

Stablecoins

13.72% - 18.19%

BTC

0.96% - 4.59%

ETH

4.76% - 6.99%

HYPE

4.93% - 5.82%

In other Pendle related news, Neutrl’s PT-sNUSD is now available as collateral on Morpho and curated by Hyperithm:

Airdrop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

RateX is the Pendle of Solana, offering PTs and YTs as options to farm up-and-coming protocols.

This essentially allows you to either LP and forgo points in exchange for increased yield, or choose the leveraged option, where your position will slowly deteriorate over time but you earn leveraged points.

There are tradeoffs with both, and calculations to be made for each individual farm. That said, RateX brings a strong opportunity to Solana, as it now allows users to speculate on up-and-coming protocols and gain points at a much faster rate if that option is chosen.

The available farms also show which Solana projects are actively seeking usage of their platforms or vaults. They are incentivizing these farms heavily, so check them out and see which ones look interesting to you.

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!