Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Huge thanks to our Yields of the Week lead sponsor: Summer.fi

Built by the team behind the Sky Ecosystem (aka MakerDAO) and Oasis, Summer.fi provides automated access to high-quality DeFi yield through curated vaults for assets like ETH, USDT, and USDC.

Earn above benchmark yields + SUMR tokens on top!

We’re looking at 30 day real yields this week with minimum of $10M in TVL (powered by vaults.fyi)

Stablecoin Yields

USDC 30 day benchmark rate on Aave: 3.55% (down from 3.73% last week)

A wild spike on January 29th

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $10M TVL

Checking in on Stablewatch to see the 7-day TVL changes.

The BUIDL is notable to see adding + 5.6% at $1.80B in TVL.

msY makes an appearance for the first time at +6.9% (more on them below).

Nothing conclusive here, just things I’m watching:

ETH Yields

ETH 30 day benchmark rate on Aave: 1.70% (up from 1.41% last week)

Huge spike on February 6th and overall average moved significantly since last week

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $10M TVL

Rapid Fire Yields

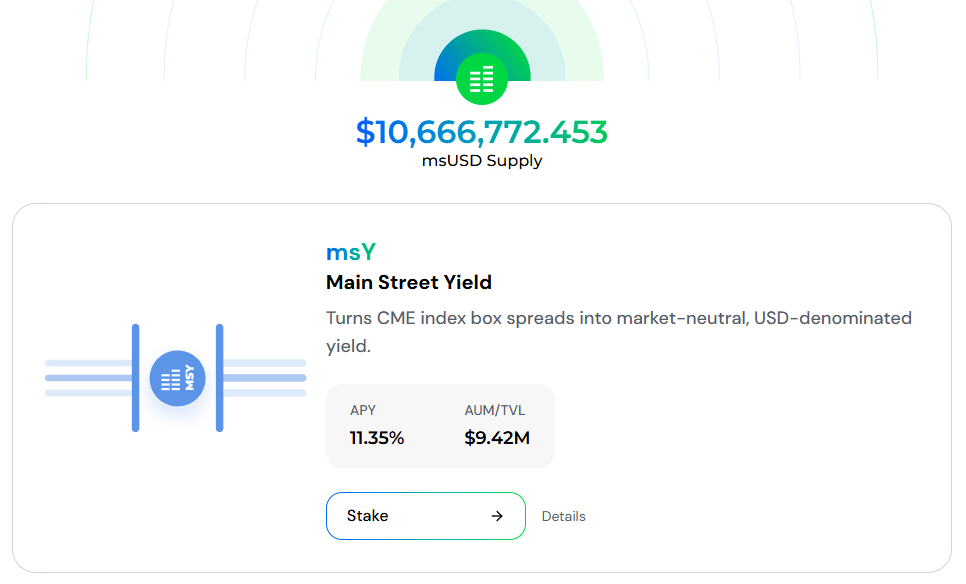

Mainstreet came on our radar a few weeks ago after a chat with someone from their team. Then they popped up again in the Stablewatch TVL changes this week, which caught our attention.

They’re doing something fairly unique by turning CME index box spreads into market-neutral, USD-denominated yield. At the moment, they’re offering 11.35% APY on roughly $10M AUM.

One other thing that stood out is that they’re also using Accountable for their transparency dashboard, which we really liked.

This is an interesting product offering from Seamless. They’re taking InfiniFi’s siUSD, the staked but fully liquid version that is not locked, and auto looping it.

The target is roughly 15% APY, made up entirely of real yield, with incentives layered on top.

Junior and Senior tranche mechanics are clearly making a comeback in DeFi. You could argue that Resolv helped kick off the renewed interest, but protocols like InfiniFi and Strata are starting to see real traction as well.

I’d heard of Strata before, but somehow hadn’t taken a proper look. They’re now expanding beyond just Ethena with the addition of Neutrl, which is an interesting next step.

Based on what they’ve been able to achieve with Ethena yields, I wouldn’t be surprised to see Junior tranche yields on Neutrl land quite high. My guess would be somewhere in the 18% to 20% APY range.

If you want to learn more about how the tranche mechanism works on Strata, you can check out their docs here

To keep the tranche theme going, here’s one more. Royco just announced Royco Dawn, their take on bringing tranche mechanics to DeFi:

Thanks to our lead sponsors for making it possible to share this content for FREE!

Yield Trading

Taking a look at the front page of DeFi yields on Pendle:

Stablecoins

12.44% - 18.57%

BTC

0.99% - 5.88%

ETH

5.24% - 6.98%

HYPE

4.87% - 8.45%

Last But Not Least

We shared Part I of this piece last week, so we wanted to follow up with Part II.

Part I landed at a perfect time for me. I was looking at the 30% to 40% returns on Ostium’s OLP vault and, on the surface, it looked very compelling.

This article digs deeper into the tradeoffs and potential pitfalls users should be aware of when evaluating vaults like these:

Hyperliquid’s HLP

Lighter’s LLP

Paradex’s Gigavault

Ostium’s oLP

That’s all for now, thanks for checking it out!

DISCLAIMER: Nothing written in The Edge Newsletter or said on The Edge Podcast is a recommendation to buy or sell tokens or securities. This content is for educational and entertainment purposes only. Nothing shared here is financial advice. Any views expressed in our content are solely the opinion of that writer, host, or guest. Always do your own research. DeFi Dad, Nomatic, and guests may have positions in the assets or other matters discussed in this content.