Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL

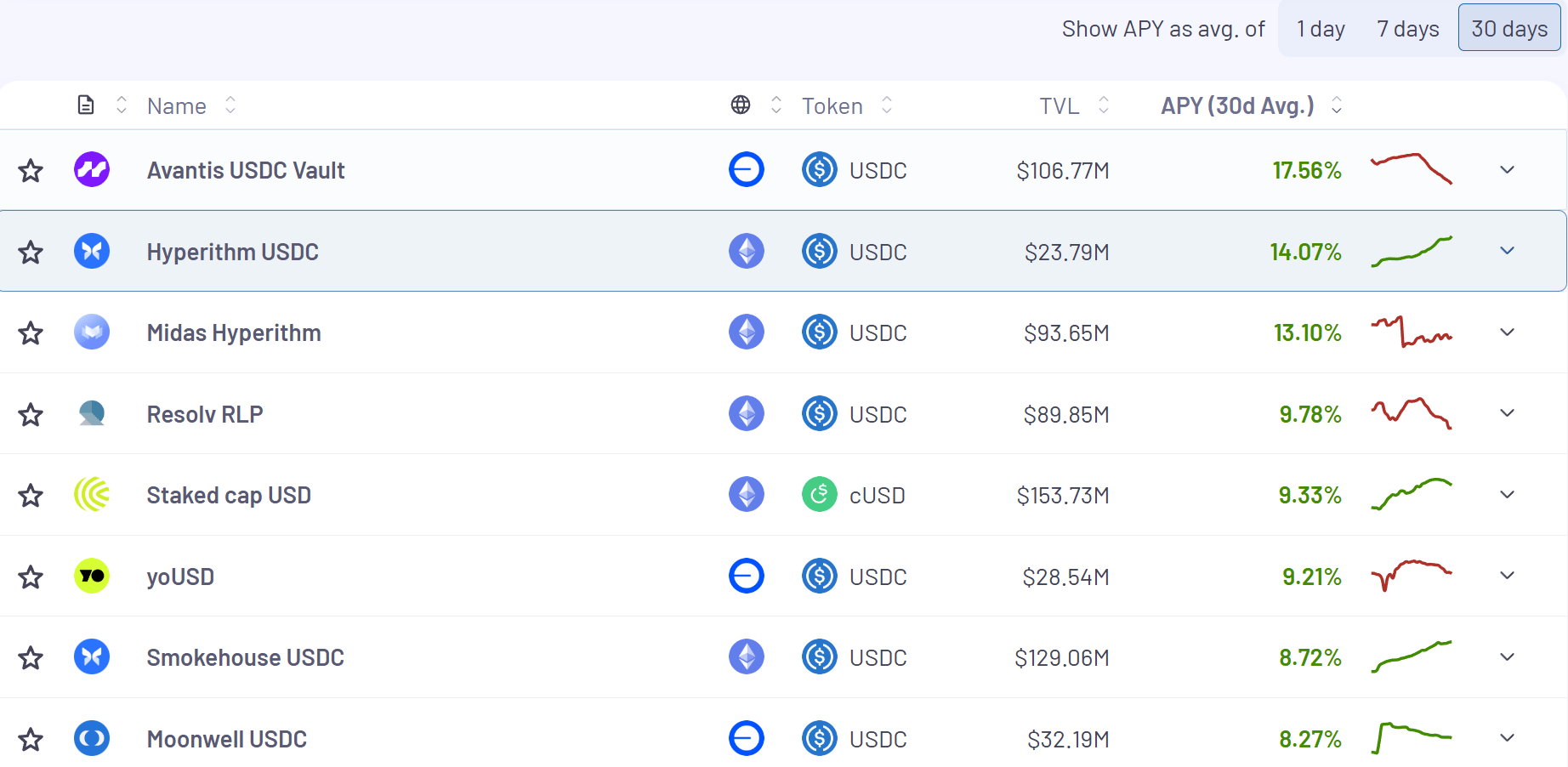

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

BTC Yields

Here’s the top yielding BTC vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

(Once again, a trend we’ve continued to notice is the total evaporation of BTC yields)

With the rise of all these yield bearing stablecoins (that aren’t really stablecoins) the underlying yield sources have become increasingly opaque.

With protocols running delta neutral trades partly onchain and partly on CEXs it became almost impossible to understand where yields were coming from, whether the backing was sufficient, or if the protocol was even solvent.

As tokenization and RWA continue to collide with DeFi this problem will only get bigger.

We risk ending up with another trust me bro version of TradFi.

After the Stream Finance fallout the need for full transparency in DeFi is stronger than ever.

Accountable is probably the best end to end solution I have seen to actually address this issue.

But what is it?

The interesting thing about Accountable is they are building B2B transparency tech for the entire industry (including TradFi), while also vertically integrating their stack to offer vaults powered directly by their own technology.

This is a great explainer video for their very own Yield App:

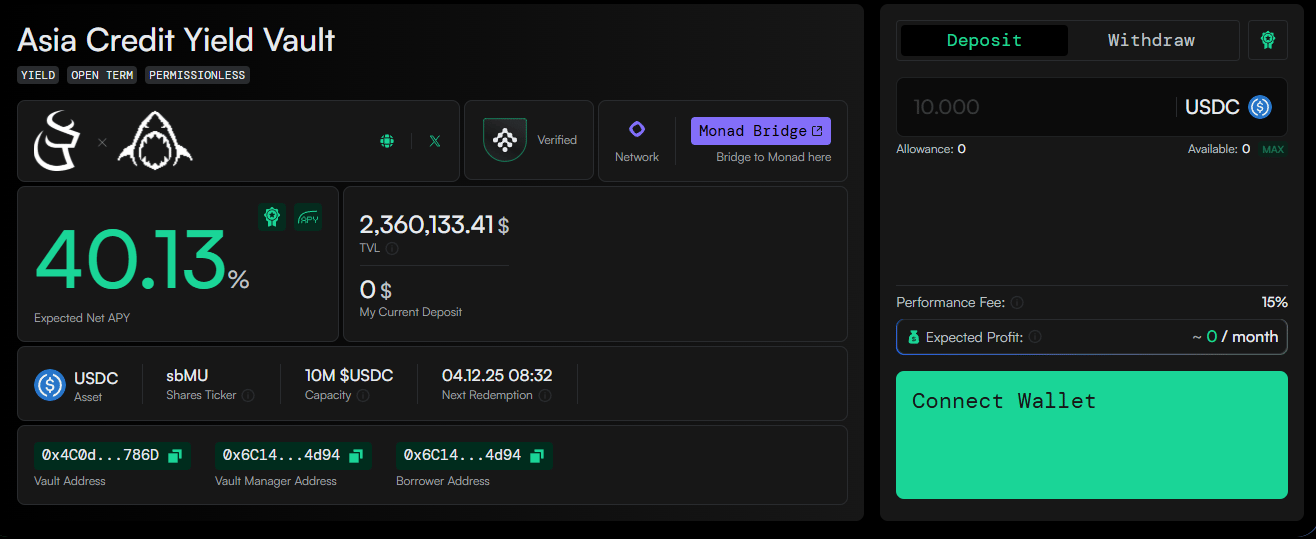

What Do The Yields Look Like?

There’s one vault currently live called the Asia Credit Yield Vault yielding 40.13% APY:

Here’s a break down of the yield:

Some points here from Accountable and Mu Digital + a heavy amount coming from MON incentives (bullish if you think MON has bottomed out or close to a bottom)

Noon has been on my radar for a while but I somehow had not written it up in YOTW until now.

I think teams that lean into transparency will be heavily rewarded in DeFi going forward and Noon fits that bill.

Noon was one of the early teams to showcase Accountable tech under the hood.

I am genuinely surprised they have only $25.27M in TVL while posting 7 day yields of 16.36% APY.

We have gone through another necessary cull in the industry and we are seeing who is naked as the tide rolls out.

Protocols like Noon are positioned well to capitalize on this.

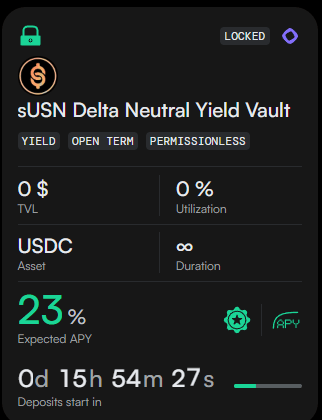

sUSN Delta Neutral Yield Vault

I’m writing about this new product from Noon + Accountable the day before its live, but by the time you are reading this, it should be out:

Here’s a break down of the yield:

Pretty solid real yield here with some upside potential on ACC + MON

If you’re curious where the yield is coming from for this vault, check this out below:

One thin I didn’t realize is this line:

“All Noon DeFi strategies are stablecoin based, fully insured for smart-contract vulnerabilities, and stablecoin depegs”

I need to look into this a bit further as it seems almost too good to be true.

Noon has been quietly very strong recently:

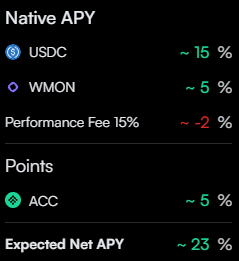

I don’t know a lot about Synnax or the methodologies they use for their ratings, but Noon appears to be the highest rated on their site:

Overall, Noon seems very worthy of more attention going forward.

Thanks to our sponsors for making it possible to share this content for FREE!

Yield Trading

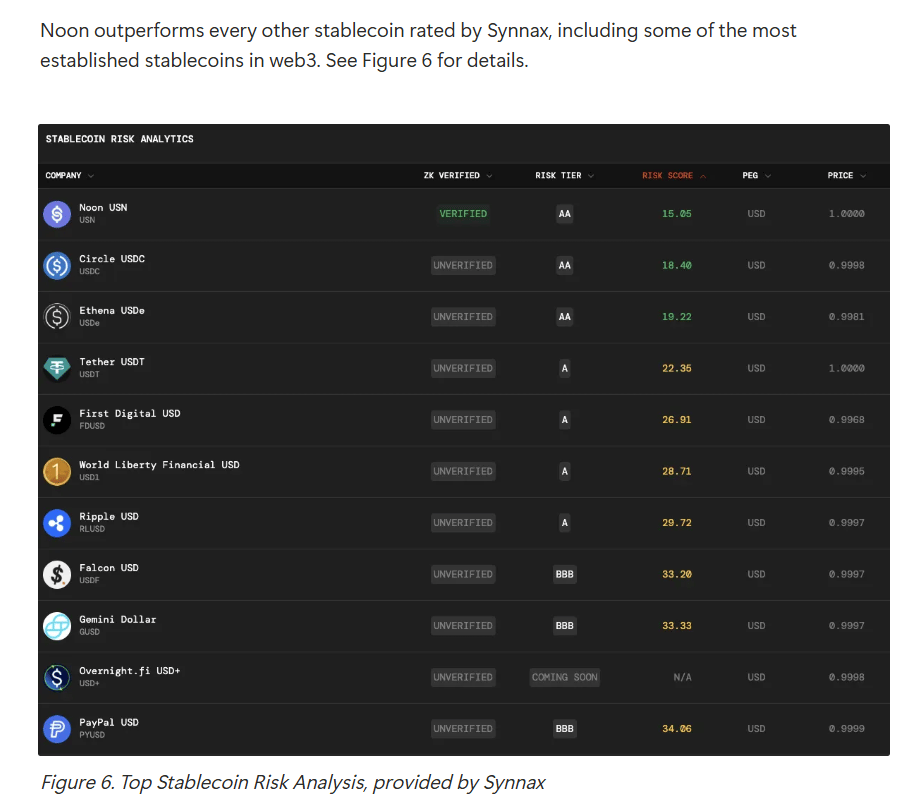

Here’s what the front page of yield on Pendle looks like this week:

Stables

5.72% - 19.86%

BTC

1.15% - 4.11%

ETH

2.94% - 5.8%

HYPE

2.79% - 4.5%

Air Drop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

Tydro + Ink for Farm of the Week

Tydro (AAVE) on InkChain (Kraken’s L2).

Tydro’s points program has just started, and it looks like it will count toward both Tydro (the leading money market on Ink) and the Ink airdrop. It seems to be a combined approach that makes sense since the chain needs deep liquidity early on to succeed.

How to farm it

>Bridge to Ink (stables earn higher points per dollar) Swap to USDG or GHO on >Velodrome to earn the most points per dollar (compare on the Merkl rewards page) >Lend on Tydro (don’t borrow since points are calculated off total deposits)

Your points (TydroInk) are claimable on Merkl.

I’d use Superbridge to bridge over to Ink for a potential bonus airdrop.

Tydro: https://app.tydro.com/

Merkl: https://app.merkl.xyz/

Superbridge: https://superbridge.app/

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!