Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL (powered by vaults.fyi)

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $20M TVL

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $20M TVL

A lot of the grift has been cleansed from DeFi and seeing a lot of the OG DeFi builders back on this list.

BTC Yields

Here’s the top yielding BTC vaults (real yields) for the past 30 days:

Min $20M TVL

I just read this article from Nick, the founder of Derive, and it’s excellent. I may not agree with every point, but the argument feels directionally right.

As someone who writes about crypto yields every week, the title immediately caught my attention.

I’m still getting comfortable with options, but I’m increasingly convinced they represent one of the purest and most scalable forms of yield. It’s a trend I’ve been watching quietly take shape.

Options haven’t had their true onchain moment yet, but I think it’s coming. That’s a big reason I remain bullish on what teams like ETH Strategy are trying to do by harvesting yield from ETH volatility.

I’d encourage you to give the piece a read.

Btw, I still don’t own the DRV token, but it is definitely on my radar. It’s sitting around $79M FDV which is interesting when you realize Coinbase acquired Derebit for $2.9B.

Most crypto teams are making an effort to vertically integrate and get closer to the customer.

Katana, just dropped their new all-in-one DeFi app and DeFi Dad shared some of his thoughts:

I will say, I don’t do a lot of crypto on mobile, but this UI looked extremely intuitive and clean on mobile as well as desktop.

If you want to learn more about this release they wrote up a full article on X.

In line with our ongoing effort to highlight teams pushing for greater transparency in DeFi, I wanted to call out something I saw from the Aragon team last week.

I’m a strong believer in tokens as long term vehicles for value. That said, the regulatory overhang of the Gensler era has pushed many projects into overly complex structures, where multiple foundations, operating companies, and tokens are tightly intertwined. The end result is often confusion. Tokenholders are left unsure of what they actually own or have a claim on.

I’ve seen solid work in this area from Blockworks, MetaDAO, and now Aragon. The more efforts like this that emerge, the clearer the divide will become. Teams that prioritize transparency and support their tokenholders will stand out, while those that do not will become increasingly exposed.

Full post on X here:

Thanks to our sponsors for making it possible to share this content for FREE!

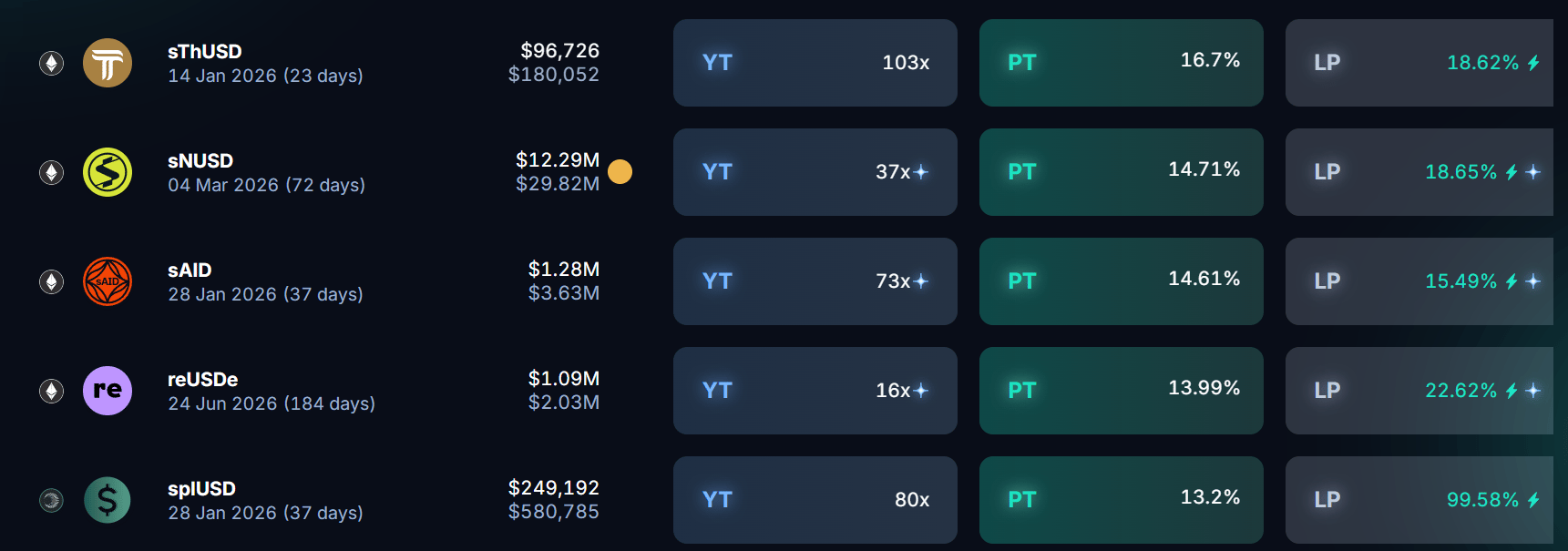

Yield Trading

Taking a look at the front page of DeFi yields on Pendle:

Stablecoins

13.2% - 16.7%

BTC

0.85% - 9.03%

ETH

5.2% - 6.96%

HYPE

4.16% - 6.6%

Airdrop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

Onre (click for referral)

Onre is a solid stablecoin yield opportunity on Solana. You can simply hold their yield bearing stablecoin, which is backed by real world assets and generates passive yield.

What makes Onre especially interesting is that they are one of the early pioneers of reinsurance in DeFi, bringing a real world, underexplored yield source onchain.

It still feels very early. TVL is only around $50m so far, but backing from some of the biggest names in the Solana ecosystem makes it look promising.

I’m also starting to see leveraged looping strategies emerge. Personally, I’ve been farming this via RateX, which is effectively the Pendle of Solana.

Click this link for RateX referral

More on this next week when I break down some of the best farms on RateX.

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!