Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

Euler just announced their “Earn” feature and it’s already generated $12.55M in TVL on day one of launch as I write this.

Here’s the full launch post:

The supply APY is currently 13.26% APY:

Here’s a look at the breakdown of yield:

* 4.74% of this yield is currently coming from rEUL which is good if you’re bullish EUL over the medium term (I am)

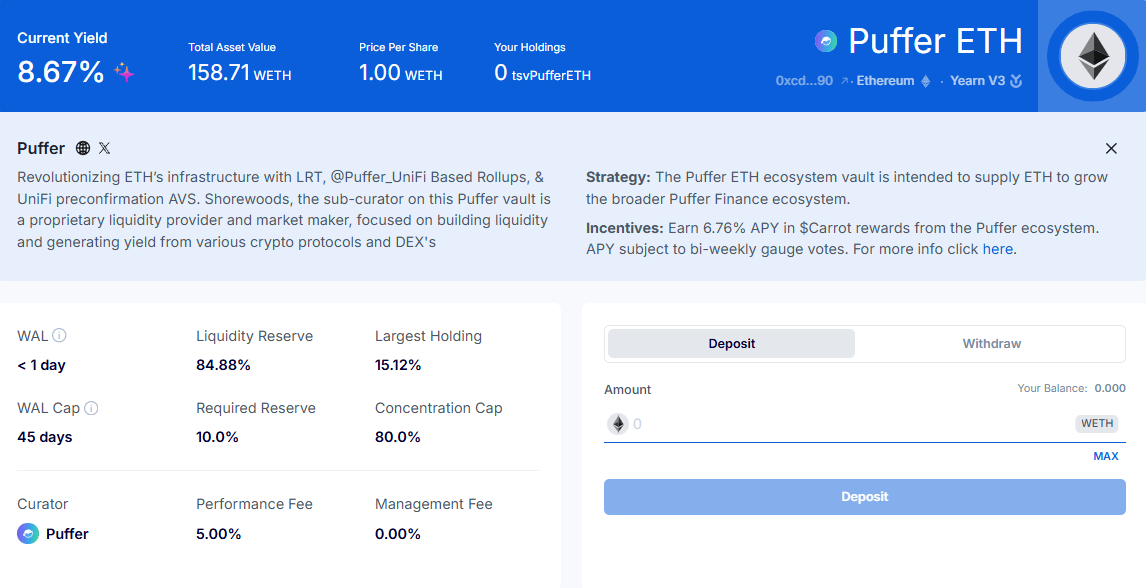

Term and Puffer have teamed up to provide a competitive 8.67% yield on ETH.

(Be aware there is a base yield of 1.90% + a 6.76% yield in Carrots from Puffer)

I posted this a while back about the impending Solana DeFi revival I see coming:

As I write this #1 Jupiter Lend is about to go live today August 27th (pending no more delays).

The [REDACTED] #3 here was actually Solstice (also, I just so happened to write up onRe #2 a little further down in our looping section not even on purpose)

I’ve known some of the core team behind Solstice for almost 2 years now and I think they have a chance to make a real splash on Solana when they go live.

See what Stephen says below:

Also, I sniped this from their X profile, but it appears they are going to come to market in a big way with a lot of TVL, much like Ethena did:

Yield Trading

If you read this column weekly, you know I’ve been very into the kHYPE YTs on Pendle. I haven’t vetted all the math here, but I thought this was an incredible breakdown of what you’re actually paying per point right now:

The thread above makes some assumptions, but many of them seem sound. It comes to the conclusion that 1 kpoint can be acquired on Pendle for about $3.52. However, it should be noted that this calculation was done at 11.2% IY and right now it’s 9.47% IY meaning, entries for YTs are even better right now and thus price per point is probably quite a bit lower (low entries are key for YTs).

I was doing my civic duty out in the trenches getting Lito red-pilled as well (there’s a bit more alpha in that thread where I share my base case ROI for these YTs if you click on that post below 👀 )

Here’s what the top yield markets on Pendle look like across Stables, BTC, ETH and HYPE:

Stables

18.05% - 21.14%

BTC

2.39% - 3.77%

ETH

5.29% - 6.22%

HYPE

10.87% - 14.69%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

I’ve written this up before, but Rumpel gives you the ability to cash out your points to USDC in real time rather than waiting months for the end of a season/epoch.

Basically, it makes the “points APR” a bit more real, because you can realize them almost immediately.

Check out the yields on these smart vaults below - the top vault has a looping yield of 94.60% right now (note this is all through the Rumpel UI):

Rumpel

Here’s what it looks like under the hood for yield:

But wait there’s more!

It seems like we’ve been highlighting Maple here a lot in YOTW, but there’s another very interesting looping opportunity live on Kamino.

This one is from onRe and they are bringing reinsurance yields to DeFi. We’ve actually chatted with their team quite a bit and are really impressed with what they are doing. For a bit more information, give this a read:

The yields are very competitive right now while only offering 2x leverage - The ONyc strategy with USDG is currently sitting at 28.01% APY:

OK last one.

The Resolv looping yields on Gearbox are nutty. The RLP one especially stands out at 93.79% APR if you can get comfortable holding the junior tranche asset (if unsure what I mean by “junior tranche asset” give this a read):

That’s all for now, thanks for checking it out!

.jpg)