Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🥞 SYRUP.FI | EARN INSTITUTIONAL DEFI YIELD

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

(We suggest reading this on our website vs email as the email version sometimes gets cut off)

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

(Note: we’re now showing non-boosted yields and boosted yields that include rewards)

Here’s links to the top 5 yielding stablecoin pools (non-boosted) for the past 7 days according to Vaults.fyi:

8.06% - Euler Yield USDT

7.66% - Fluid GHO

7.21% - sDOLA

6.99% - Syrup USDT

6.95% - Syrup USDC

Full list below:

Min $10M TVL (non-boosted)

Here’s links to the top 5 yielding stablecoin pools (boosted) for the past 7 days according to Vaults.fyi:

9.08% - Euler Yield USDT

8.68%% - Compound Blue USDT

8.06% - Gauntlet eUSD Core

7.76% - Compound Blue USDC

7.66% - Fluid GHO

Full list below:

Min $10M TVL (boosted)

Bonus: Maple has extended the Edge community a boost on Drips.

TLDR

Our community earns a higher APY if you use this code: https://syrup.fi/lend?referral=STAaNBFJwIc8

Here’s what the UI looks like with our boost:

We wrote it all up below which includes details on their May prize pool where they have $500k USDC in prizes:

Bonus: I’m including this pool on Upshift again as I’ve been keeping my eye on it for a few weeks and it’s still yielding 27% APY and $1.4M in TVL:

ETH & BTC Yields

(Note: we’re now showing non-boosted yields and boosted yields that include rewards)

Here’s links to the top 5 yielding ETH and BTC pools (non-boosted) for the past 7 days according to Vaults.fyi:

4.97% - Instadapp ETH v2

4.37% - MEV Capital wETH

3.82% - Re7 WETH

3.60% - Gauntlet WETH Core

3.40% - Frax sfrxETH

Full list below:

Min $10M in TVL (non-boosted)

Here’s links to the top 5 yielding ETH and BTC pools (boosted) for the past 7 days according to Vaults.fyi:

6.54% - Compound Blue WETH

5.03% - Euler Prime WETH

4.97% - Instadapp ETH v2

4.73% - MEV Capital wETH

4.49% - Seamless WETH Vault

Full list below:

Min $10M in TVL (boosted)

Bonus: Harvest has their own Autopilot feature now that rebalances to the best yields, more details right here:

This is what the UI/yields look like right now (2.71% on BTC is solid):

Pretty good industry competitive yields across all majors here

Yield Trading

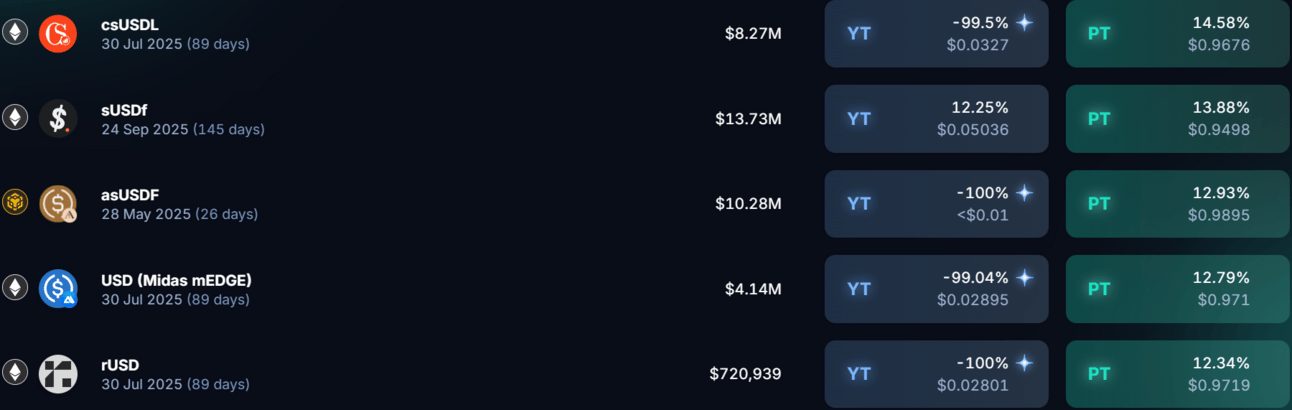

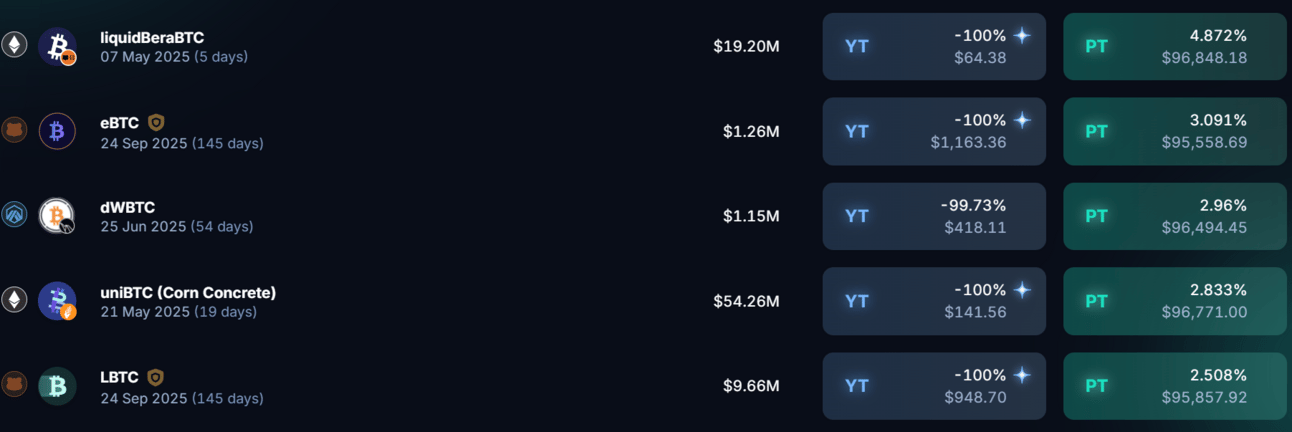

Checking in on what Pendle is cooking this week with their PT fixed-term yields (btw, if you hold vePENDLE their LPs are very attractive too)

Stables

Special shoutout to the Coinshift team. It’s incredible to see them at the top of the PT list this week. We’ve been working with them and have gotten to know them well behind the scenes. Their team are all hardworking high caliber people 🫡

12.34% - 14.58%

BTC

2.5% - 4.87%

ETH

6.45% - 8.59%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Euler has made a big splash on Avalanche and both parties have leaned in with incentives. Another big winner is Avant who appear to be becoming one of the centerpieces of DeFi in the Avalanche ecosystem. There’s a lot of savUSD strategies on the Euler UI now, but this one in particular looks interesting:

Some of this underlying ROE is WAVAX incentives, but you can toggle this off to see real yield in the Euler UI if you like

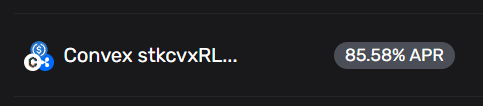

Here’s another opportunity that caught my eye from Gearbox that has a max APR of 85.58%. If you want to check this one out yourself, you can click here:

That’s all for now, thanks for checking it out!