The following is a writeup by inPlanB on what he’s seeing recently with 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

You can get 10% off a Subscription to Nansen with our referral link: https://nsn.ai/EDGE

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

How Is Smart Money Defined?

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Nansen’s definition of Smart Money

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base and BNBchain

24H Smart Money Flows

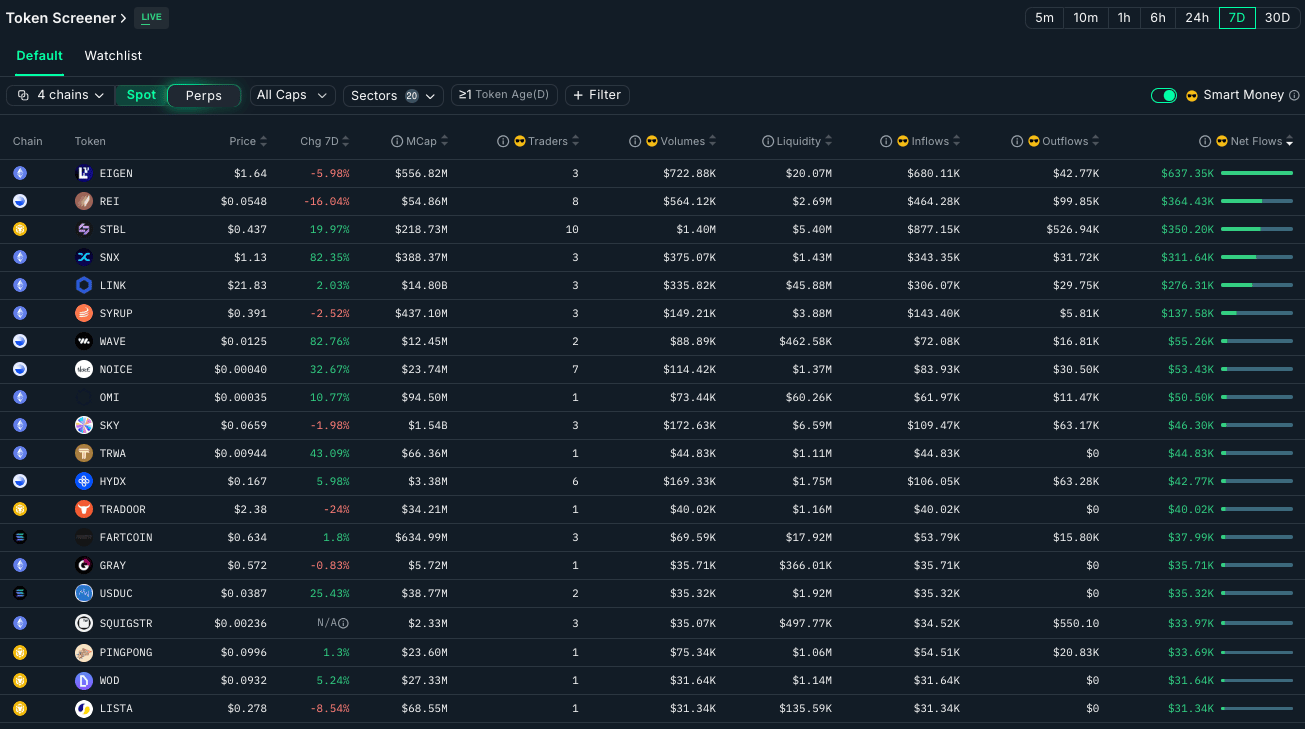

7D Smart Money Flows

30D Smart Money Flows

Smart Money's New Playbook: 6 Under-the-Radar Tokens That Just Got Interesting

Market Recovery Update: BTC has climbed back to $114.3k and ETH is sitting at $4220, signaling a broader recovery that's creating selective opportunities as investors prepare for Uptober (we hope).

Last week, we highlighted STBL's paradox play on BNB Chain, where whales accumulated while top traders took profits. That divergence played out exactly as the smart money predicted, with STBL surging 20.5% despite the initial skepticism. This week, we're seeing similar patterns emerge in six new tokens that deserve some attention.

This Week’s Focus

*Previously covered - included for update

The Biggest Discovery: Smart Money Is Playing The Infrastructure Game

After digging through Nansen's highest net flows by smart money, we noticed that they are systematically accumulating infrastructure plays. The most compelling signal? On September 27th, smart addresses collected 495,100 $EIGEN tokens, which is almost $900,000 in just one day.

Quick Update: STBL's Prophecy Fulfilled

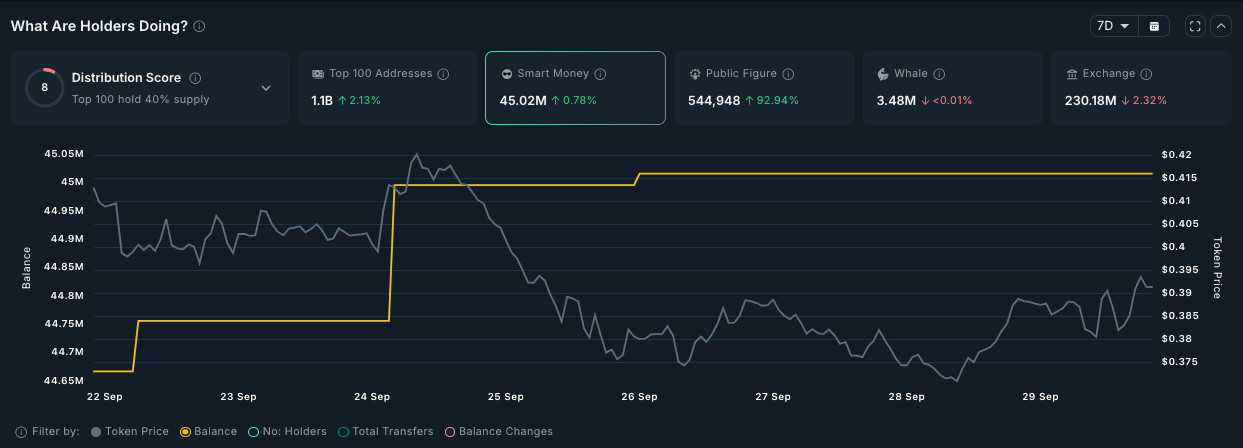

Remember last week when we called out $STBL's "paradox play" that had whales accumulating while top traders sold? The whales appear to be right in the short term. $STBL pumped 20.5% this week, validating the divergence pattern we identified. Smart trader count increased from 27 to 35, and that whale we mentioned who accumulated $1.4M is now sitting on substantial profits. The token hit $0.44 (up from $0.35 last week), with market cap climbing to $219M.

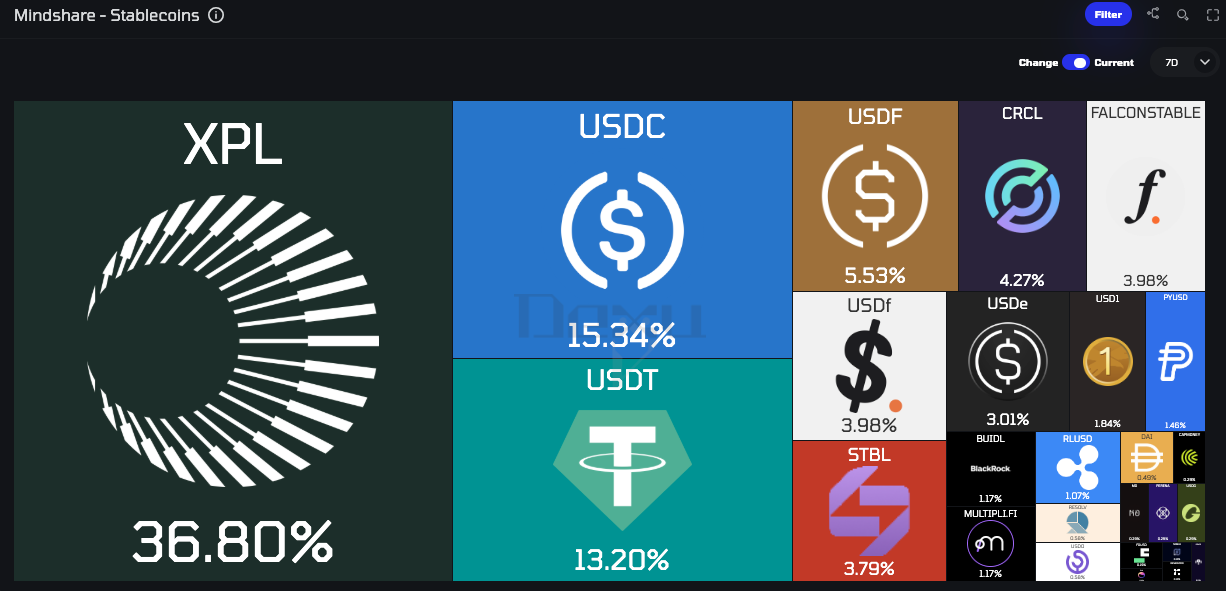

Over 7D, $STBL has gained significant mindshare in the stablecoin category, as some major KOLs keep promoting catalysts (token buyback & burn, announcements).

1. Eigenlayer ($EIGEN, Ethereum) - Restaking to Come Back?

What Is It?: While everyone obsessed over Reeve Collins' STBL last week, the real infrastructure play was happening quietly on Ethereum. EigenLayer is building the security layer for the entire crypto ecosystem, think "Ethereum security as a service."

Core Innovation:

Universal restaking that lets ETH stakers earn multiple revenue streams

Intersubjective fault resolution (consensus for things that can't be proven onchain)

Already securing $17.7B in TVL (dwarfing most DeFi protocols)

Market Position & Backing: Backed by a16z, Polychain, and raised $220M total. Currently, the largest restaking protocol by a massive margin, Symbiotic, their closest competitor, has just $1.16B TVL.

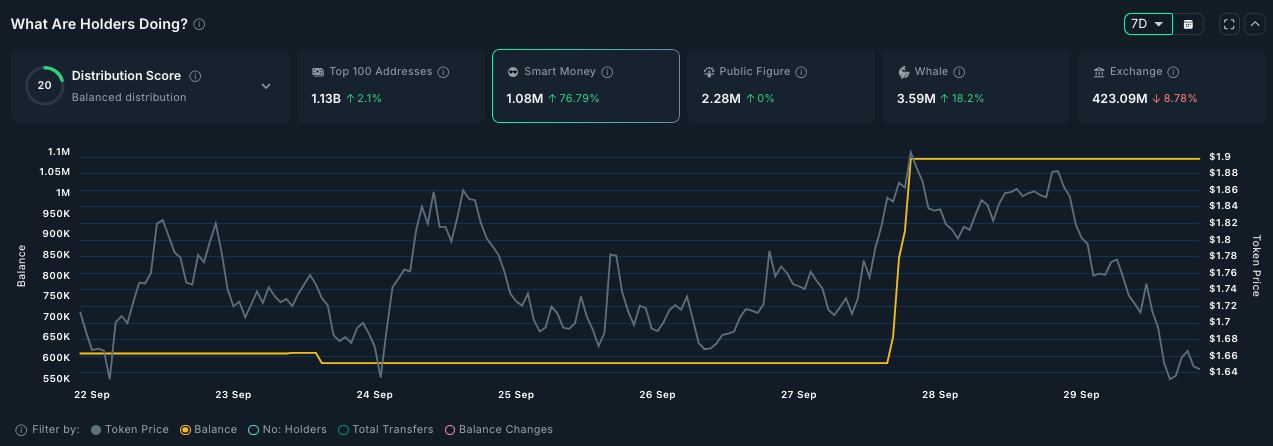

Smart Money Spotlight

The pattern here is even more pronounced than STBL's last week:

24H: Minimal activity - smart money waiting

7D: $637K net flows, 6 active smart traders (concentrated bets)

30D: $740K net flows, sustained conviction

What's fascinating is the September 27th surge, 495K tokens in a single day. This mirrors the pattern we saw with $STBL, but at a much larger scale.

Market Data:

TVL: $17.7B | Fees (Annualized): $85.16M | Revenue: $0 (all goes to stakers).

Current Price: $1.78 | Market Cap: $564M | FDV: $2.9B | 24h Volume: $132M

Exchange Flows: -$65.9M (massive withdrawal, similar to $PCULE's pattern last week).

Despite the decline in price, all the metrics show bullish sentiment.

2. Synthetix ($SNX, Ethereum) - The Phoenix Rising From DeFi's Ashes

What It Is: Remember when we highlighted how smart money maintains positions while reducing risk? $SNX is the extreme version that. A protocol left for dead that smart money just front-ran with an 83.8% surge in the last 7D.

Core Innovation:

Infinite liquidity for synthetic assets (V3 finally works)

Cross-chain perps infrastructure

Powers Kwenta, Lyra, and Polynomial

Smart Money Spotlight

Unlike the accumulation patterns we saw with $BLOCK last week (where smart traders took profits but didn't exit), $SNX shows aggressive re-accumulation:

7D: $311.6K net flows, but only 3 smart traders

Top PnL traders: $590K inflows

Pattern: Concentrated bets from the smartest money

Market Data

TVL: $147M (stabilizing after massive decline)

Current Price: $1.14 | Market Cap: $393M | 24h Volume: $209M

As per the image below, Apollo Capital is confident. They added a position over the last 7D.

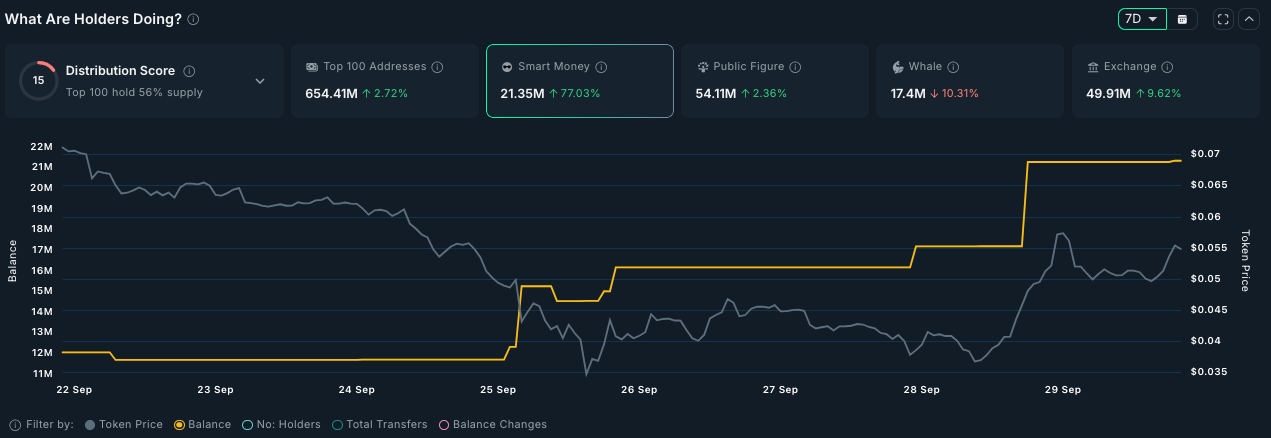

3. Reisearch ($REI, Base) - The Anti-Pattern Play

We won't say much because we talked about this project last week. However, $REI is an AI infrastructure protocol on Base, and it's behaving very differently from last week's $STBL pattern.

Smart Money Spotlight

This is fascinating… smart money buying while top traders dump.

7D: $364.5K smart money inflows vs -$472K top PnL outflows

13 active smart wallets (highest concentration after STBL)

Fresh wallets: $631K inflows

Market Data

Current Price: $0.06 | Market Cap: $55.6M | 24h Volume: $2.2M

This reverse-divergence often signals early-stage accumulation, and smart money seems to catch the bottom (image below).

4. Maple Finance ($SYRUP, Ethereum) - Maple Finance's Quiet Comeback

Following the "silent accumulation" playbook we identified with $PCULE last week, $SYRUP shows institutional lending making a comeback with zero fanfare.

Despite the recent market pullback, Maple's TVL is still looking strong and might reach another month ATH in revenue (Dune dashboard).

Maple TVL going parabolic while price has stagnated - If this keeps up, price will likely follow again at some point.

Smart Money Spotlight

Public figures and smart traders accumulating ($137.6K)

Top PnL selling (classic profit rotation)

Exchange outflows: -$1.5M (bullish)

Market Data

TVL: $4.14B | Current Price: $0.39 | Market Cap: $437M | 24h Volume: $20.6M

5. Waveform Finance ($WAVE, Base) - The 11-Day Wonder

At 11 days old, $WAVE is even younger than $STBL was when we covered it. But the pattern is unmistakable, concentrated smart money bets on Base's AI narrative.

Smart Money Spotlight

$55.3K flows (for $11.7M mcap)

71.9% surge with only 3 smart wallets

Pattern: Ultra-concentrated, high-conviction bets

Market Data

Current Price: $0.01 | Market Cap: $11.7M | 24h Volume: $416K

Patterns From Last Week Playing Out

Looking back at our September 23rd analysis:

$STBL: Whale accumulation thesis validated (+20.5%)

$BLOCK: "Profit-taking not abandonment" – still consolidating as expected

$PCULE: Whale magnet thesis continues (smart money doubled down)

The consistent pattern? When we see divergence between whale accumulation and top trader distribution, the whales usually have the right read on longer timeframes.

Risk Reality Check

Token Unlocks (Learning from STBL's FDV concerns):

$EIGEN: Sept 30 unlock (minimal impact at 0.06%)

$STBL: Still massive FDV risk despite gains

The "Too Early" Risk:

$WAVE at 11 days old is pure speculation

$REI's reverse-divergence could mean smart money is wrong

Bottom Line

Smart money is running the same playbook we identified last week, just with different tokens. The infrastructure thesis ($EIGEN, $SNX) is replacing the RWA thesis (STBL) as the primary focus. Most interesting? The concentration of bets – fewer wallets making larger positions, suggests higher conviction than the scattered accumulation we saw in early September.

If last week taught us anything, it's that divergence patterns matter more than price action. STBL's 20.5% surge after whale/trader divergence validates this approach. Now we're seeing similar setups in $EIGEN (massive single-day accumulation) and $REI (smart money/top trader divergence).

Not financial advice. The patterns we identify are probabilities, not certainties. Even smart money gets it wrong sometimes.

All of the Smart Money information in this article can be obtained via Nansen’s “Pioneer Plan” - If you’d like to use this yourself you can get 10% off a Subscription with our referral link: https://nsn.ai/EDGE

.jpg)