The following is a writeup by inPlanB on what he’s seeing recently with 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

You can get 10% off a Subscription to Nansen with our referral link: https://nsn.ai/EDGE

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

How Is Smart Money Defined?

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Nansen’s definition of Smart Money

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana and BNBchain

24H Flows

7D Flows

30D Flows

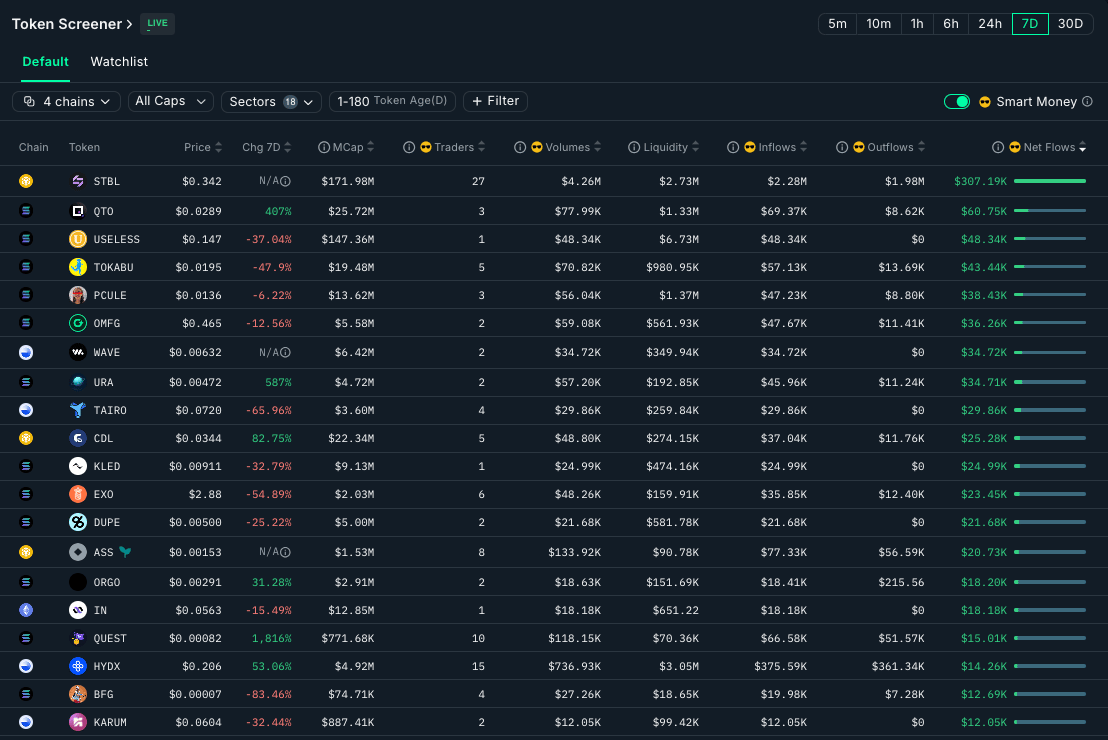

While retail traders chase weekend pumps in the perp wars, smart money has been quietly accumulating positions in three under-the-radar tokens showing divergence patterns across different timeframes. The most intriguing? A token on BNB Chain created by Reeve Collins, who co-founded Tether, that's seeing simultaneous whale accumulation and top trader profit-taking, a pattern that usually precedes major moves.

The Smart Money Spotlight on Ethereum, Solana and BNB

1. STBL ($STBL, BNB Chain) - The Paradox Play

The Pattern

24H: -11.5% balance change, $734K net flows, 4 smart traders (initial profit-taking)

7D: Strong accumulation, $307K net flows, 27 smart traders (heavy positioning)

30D: Sustained conviction with 27 smart traders maintaining positions

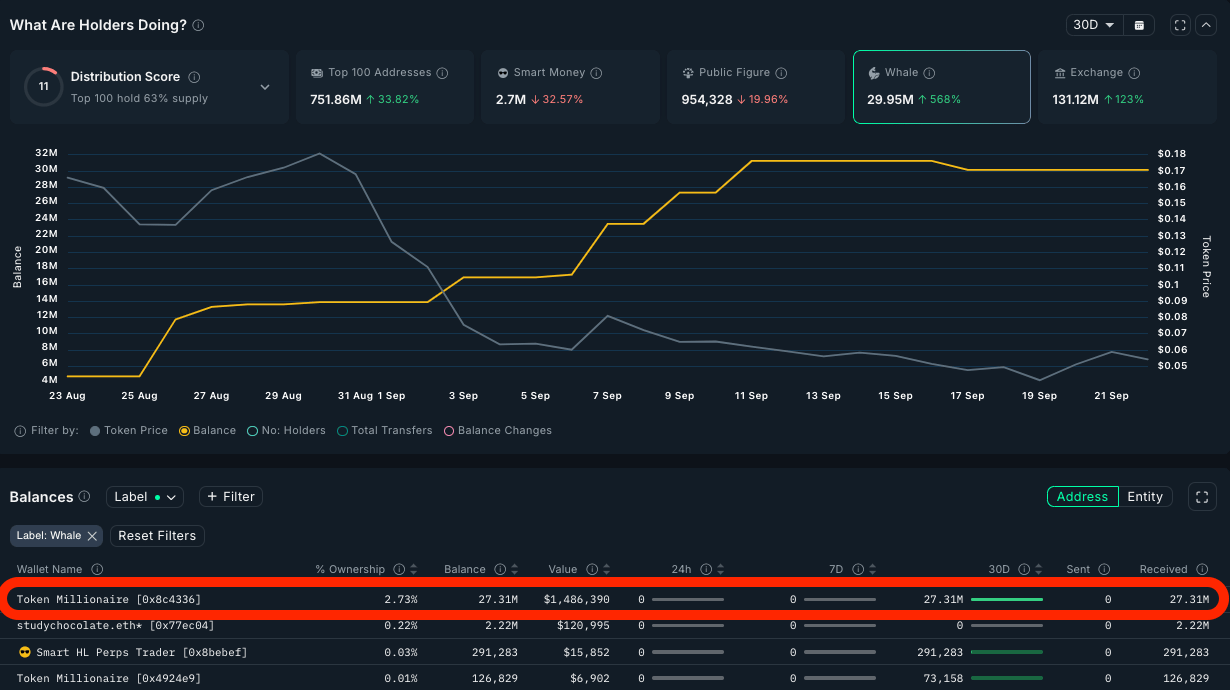

What makes $STBL fascinating isn't just the $307K in smart money inflows over the past week, it's who is doing what. While top PnL traders took $1.8M off the table, whales added $1.9M and fresh wallets poured in $18.3M. The realized PnL Leaderboard below shows that most traders are holding a moon bag after partial profit-taking.

The Fundamental Data

Current Price: $0.35

Market Cap: $171M

24h Volume: $157M (that's 92% of market cap – extremely liquid)

Smart Trader Count: 27 actively monitoring/trading, but only

The volume-to-market-cap ratio here is exceptional, it could be signaling a bet on a Tether's co-founder, Reeve Collins. With tokenized treasuries and RWA products reaching over $15.5 billion in TVL, STBL positions itself at the intersection of traditional finance and DeFi.

STBL in Nutshell

When users deposit real-world assets (like tokenized U.S. Treasury bonds) into the protocol, they receive two separate tokens rather than just one. First, they get $USST, which is the actual stablecoin pegged to the US dollar that can be used for trading and DeFi activities. Second, they receive $YLD tokens, which represent their right to the yield being generated by those underlying Treasury bonds. This "yield splitting" mechanism means you can actively trade or use your stablecoins while still earning passive income from the backing assets - something that's impossible with traditional stablecoins like $USDT or $USDC.

STBL Launch

STBL launched in Sep 16th with significant support, including a pre-seed round led by Wave Digital Assets (which manages over $1 billion). The token went live on major exchanges (Binance Alpha, Kraken, and MEXC), generating over $250 million in trading volume and big price action within hours of launch (see chart below). Currently, only 500 million tokens (5% of the total 10 billion supply) are circulating, giving it a market cap around $170 million but a FDV over $3 billion.

Despite the big FDV, investors appear to be positioning themselves early in what could become a major player in the stablecoin market, especially after seeing a $100M $USST mint by Franklin Templeton. The divergence between whale accumulation and top trader profit-taking suggests different investment horizons: whales may be betting on the long-term disruption of the stablecoin market on BNB Chain, while shorter-term traders are capitalizing on the initial launch volatility.

2. Blockstreet ($BLOCK, Ethereum) - The Silent Giant

The Pattern

24H: -9.35% balance change, $10K net flows, 1 smart trader (consolidation)

7D: Limited activity

30D: -59.92% balance change BUT $785K net flows, 12 smart traders (distribution into strength)

$BLOCK presents an unusual pattern: 30D smart money involvement ($785K net flows) despite a 60% reduction in smart money balance. This suggests smart traders have been distributing tokens and that's why the token might not be performing well lately. With 12 smart traders still active, this looks more like profit-taking than abandonment. What's interesting though, over 30D a whale has accumulated $1.4M (Maybe they know something).

The Fundamental Data

Current Price: $0.055

Market Cap: $25.8M

24h Volume: $3.2M

Price Change 24h: -7.9%

30D Net Flows: $785K with 12 active smart traders

The key here: smart money took profits but didn't exit completely. They're maintaining positions while reducing risk – classic "letting profits run" behavior. As shown in the chart below, the token peaked at a $124M market cap in early August and has since fallen to around $25M, where it appears to be making a bottom.

3. Polycule ($PCULE, Solana) - The Whale Magnet

The Pattern

24H: Limited data in top movers

7D: -6.22% balance change, $56K net flows, 3 smart traders

30D: +125% balance change, $107K net flows, 6 smart traders (doubling down)

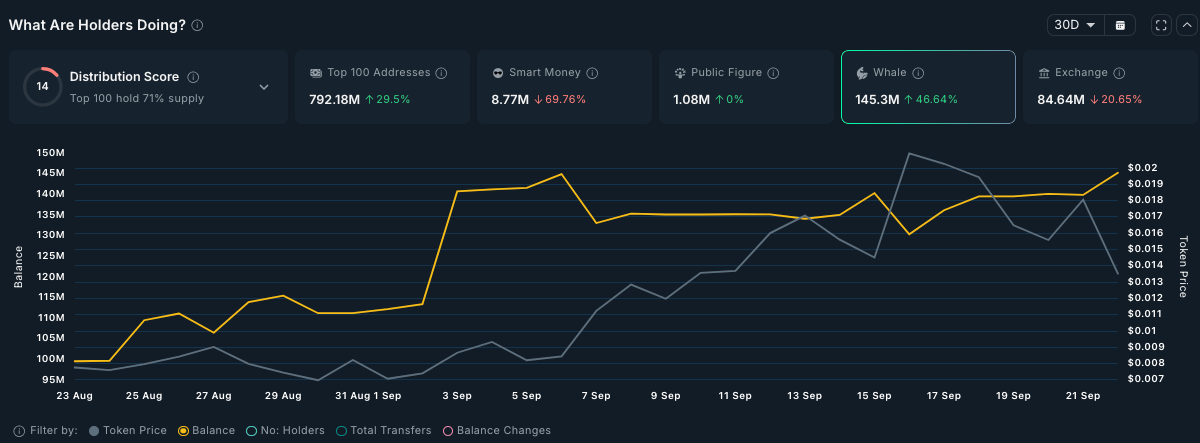

$PCULE is showing clear signs of accumulation: smart money more than doubled their holdings over 30D. The 7D slight decrease appears to be minor profit-taking after gains, but the 30D trend is unmistakably bullish, which is also telling by the chart below.

The Fundamental Data

Current Price: $0.0136

Market Cap: $13.6M

24h Volume: $1.7M

Whale Flow (7D): +$345K

Exchange Flow: -$180K (bullish withdrawals?)

Whales added $345K in the past week alone, while exchanges saw $180K in outlfows. When whales accumulate (chart below) while retail sells, it can precede significant moves.

Polycule is a bot that allows users to trade on Polymarket anywhere. The daily volume has started to increase in the past weeks (chart below, more here).

Polycule trade volume starting to tick up again

The Sentiment Reality Check

Current market sentiment across these tokens shows divergence between smart money actions and retail perception. While social volumes remain relatively muted for most of these tokens (they're not trending on Crypto Twitter, except $STBL), the onchain data tells a different story. Smart money typically accumulates during periods of low social interest (they buy the silence, not the noise).

The Bottom Line

Smart money appears to be rotating into specific smaller-cap tokens while taking profits in others. The standout patterns:

STBL shows the most interesting divergence, worth deeper research into why a big whale has accumulated while top traders sell.

PCULE is quietly attracting whale money despite minimal social attention.

BLOCK smart money is taking profits but not exiting fully, suggesting more upside potential.

Remember: Smart money flows can be leading indicators, but not guarantees. These patterns suggest where smart money attention is focusing at the moment, but always conduct your own research, especially on token fundamentals, team backgrounds, and upcoming catalysts.

This analysis is based on onchain data as of the publication date. Smart money flows can change rapidly. None of this is financial advice and all content is for informational purposes only.

All of the Smart Money information in this article can be obtained via Nansen’s “Pioneer Plan” - If you’d like to use this yourself you can get 10% off a Subscription with our referral link: https://nsn.ai/EDGE

.jpg)