We're reaching out with a brief update on BTC and ETH ETF flows.

The BTC ETF has been performing strongly across nearly all timeframes, while the ETH ETF faced some challenges along the way - until recently.

We've noticed a definite change in activity with the ETH ETF, and we're excited to share the details below!

Thanks to our sponsors for making it possible to share this content for FREE!

| CONTINUE BELOW FOR PODCAST LINKS |

June 6th Update

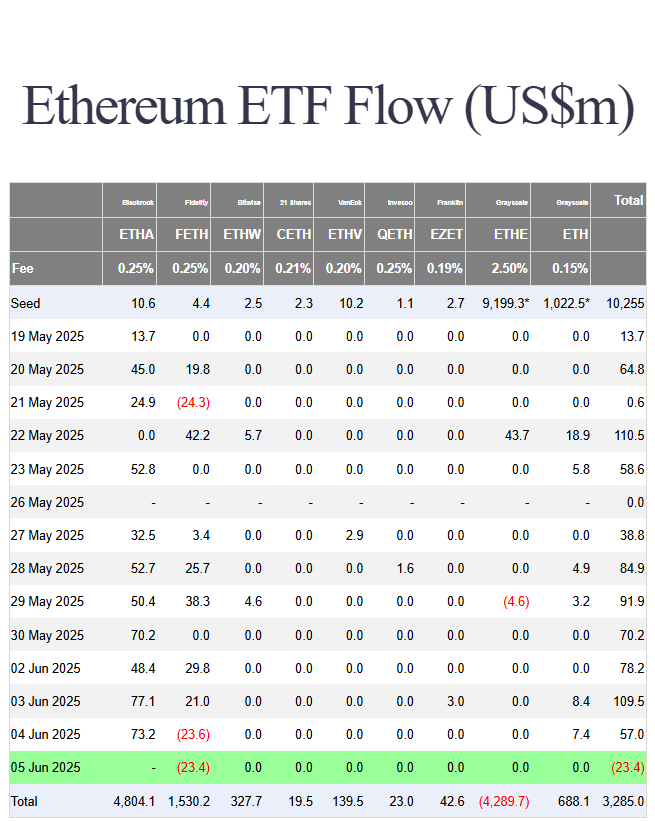

Recent Ethereum ETF Flows

See the data below from Farside:

*IBIT numbers for June 5 had not come in as of publishing this

Looking back over the past ~2 weeks ETH flows have been a model of consistency bringing in a net positive of $755.3 million over this period.

As you can see from this chart below, ETH is having one of its more consistent runs of net positive flows so far.

Full time series chart from Coinglass tracking flows

Recent Bitcoin ETF Flows

See the data below from Farside:

*IBIT numbers for June 5 had not come in as of publishing this

Bitcoin flows have been up and down, but stilly mostly positive net flows with $2.52 billion in the last ~2 weeks.

You can view the full life cycle of the BTC ETF below and as you can see it has been mostly green of late:

Full time series chart from Coinglass tracking flows

Some Relevant News

It feels like every company is running a Saylor playbook and turning into a Bitcoin treasury company with Twenty One Capital, Nakamoto, Metaplanet and many more coming online. This is significant because it seems like the beginning of a major trend.

For example, the current stable of crypto treasury companies that have been announced from April 7th - May 27th will account for up to $7.9 billion of purchases. The bulk of these are BTC, but also SOL and ETH treasury companies are emerging:

Someone in a telegram group I’m in is actually tracking them all

Many are pointing to these treasury companies as crypto’s next major contagion. On this front, Alex Thorn seems to think there’s not a ton of risk for at least 2+ years:

We’re now seeing ETH treasury companies with Joe Lubin’s SharpLink play

Seeing more and more positive momentum for ETH staking ETFs as SEC just ruled staking activities are not securities transactions

Conclusion

The markets were looking to be a in pretty good place as I was writing this and then one of the biggest grenade tosses of all time happened on X:

The market is absorbing the Trump/Musk breakup in real time right now. I’ll leave it at that for now, but it feels like this has started a butterfly effect that will definitely have impacts on markets and much more.

As far as the ETFs go, they’ve really been humming along. With ETH pulling in $755.3 million in net positive flows the past 2 weeks and BTC doing $2.52 billion.

If you’ve read this far I’d love to hear your thoughts on what you think the markets do over the second half of this year? Will summer be rocky with a better Q3/Q4? As in, will the “sell and may and go away” crowd be right for the 100th time 🤣 (honestly, I always think it can’t be that easy and its always the right call)

Or could summer still surprise to the upside? Or are we just in for more pain in general now?

Share your thoughts below!