Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

(We suggest reading this on our website vs email as the email version gets cut short every week!!!)

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

Here’s links to the top 5 yielding stablecoin pools (non-boosted) for the past 30 days according to Vaults.fyi:

18.97% - Resolv RLP (not a stablecoin - RLP comes as added risk as first loss junior tranche if Resolv has issues)

10.31% - Resolv stUSR

9.70% - Staked lvlUSD

7.82% Savings rUSD

7.53% - Falcon USDC Core

Full list below:

Min $10M TVL (30 day avg, non-boosted yield)

ETH & BTC Yields

Here’s links to the top 5 yielding ETH and BTC (non-boosted) for the past 30 days according to Vaults.fyi:

5.01% - Instadapp ETH v2

3.39% - MEV Capital wETH

3.35% - Origin Ether (OETH)

3.07% - Frax sfrxETH

3.03% - Gauntlet WETH Core

Full list below:

Bonus: mETH is a great way to get exposure to ETH and fully composable in DeFi while boasting ~2.8% APY. I bring it up because I also wanted to share something pretty cool I saw this week regarding mETH.

mETH became the first liquid staking token to be held by a public company:

Agents and Smart Vaults

I’ve been writing Yields of the Week for almost a year now and one thing is clear:

Agents/Intelligent Vaults are coming for my writing job 🤣

Meaning, my role as a curator of yields is on the verge of disruption by agents or complex yield vaults that somewhat resemble agents.

I’ve written about a few of these vaults in the past, but I haven’t really included agents here yet. It still may be a bit early, but I’m finally starting to see some agents that can do some useful things.

Agents

The three I want to highlight from this list above are Giza, Newton and Mamo.

Giza - I was on a pitch call with these guys ~two years ago and saw the early vision for what they wanted to build. The space and their idea have come a long way since then. They’ve now deployed their first agent called ARMA.

ARMA is currently boasting 15% APY and has $46M in TVL. This is one I want to pay close attention to. As of writing this I haven’t tested it out yet but that is on my to-do list.

Newton - Newton is built by Magic Labs, who have been developing wallet infrastructure in crypto since 2018. They just came out of stealth recently with their Newton product and we had a chance to interview their founder Sean Li on our podcast. Sean was one of the first people at Docker and helped scale it to what it is today. Newton is also a sponsor of The Edge Podcast which is why we’ve had some behind-the-scenes access to what they’ve been working on.

Essentially Newton is a next generation crypto wallet/interface powered by agents. The first agent is a DCA recurring buy agent you can setup to acquire crypto in a fully customizable way.

Newton has their own SDK that allows anyone to build agents on top of their framework and I expect to see a lot more agents with different abilities coming to market soon.

MAMO - Mamo is an agent that just went live last week and is built by Lunar Labs which is the team behind Moonwell.

I would describe MAMO as an intelligent AI savings account. MAMO is starting out by providing exposure to the highest yields on Moonwell and then compounding those yields constantly to obtain a higher APY.

MAMO will eventually open up to other DeFi ecosystems to find even better sources of yield. Right now, it can connect to your telegram and give up updates throughout the day if you want and notify you whenever its switched to a higher yielding vault. It’s also very mobile friendly and even a crypto novice should be able to get setup in under a minute on their phone without touching private keys.

Here’s why MAMO is interesting to me:

Smart Vaults

Smart Vaults aren’t agents, but they operate on some of the same principles. I like to think of them as very complicated “if/then” statements with a ton of built in guardrails and parameters.

Essentially these vaults auto rebalance to the highest risk adjusted yields in DeFi on the fly. Instead of active human management you get active automated management that sticks to preset rules. They can rebalance at any time of the day or night if its deemed optimal.

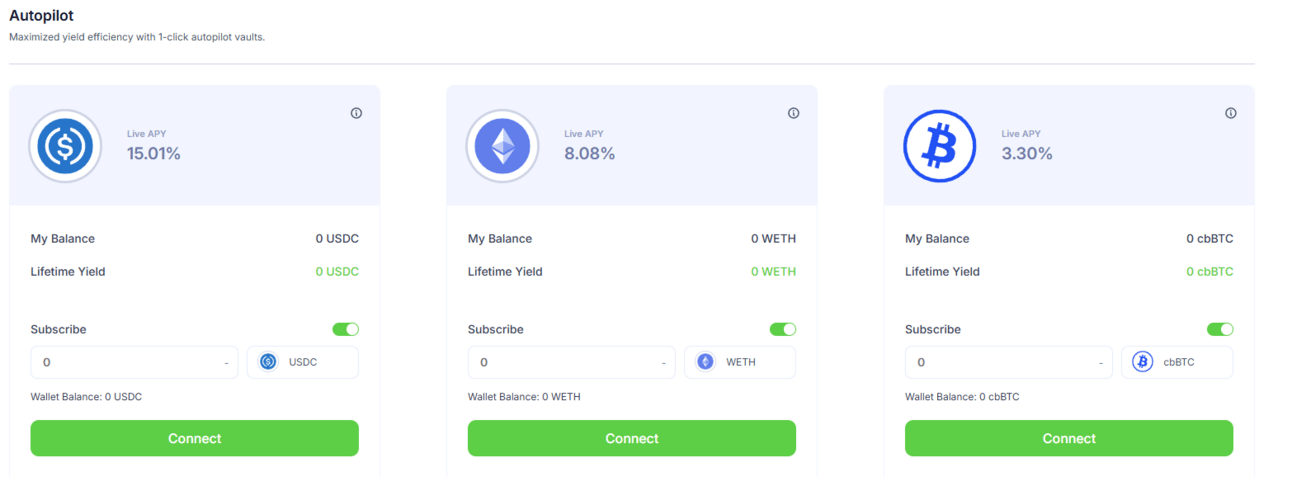

My two favorite ones that I’ve been writing up a lot are Autopools from Tokemak and more recently Autopilot by Harvest.

Tokemak’s AutoETH is their longest running autopool and its extremely transparent. You can actually see it did rebalance #459 and #460 today. It’s pretty cool you can see all that in the open.

Tokemak

Harvest

These yields seem a bit outlier, if you click into the 7 day averages they are not this high

Yield Trading

I still think Spark YTs represent a potential asymmetric opportunity. I wrote about this in detail last week if you want to check it out here. This and Resolv season 2 are the main things I’m doing on Pendle right now.

While I was typing this up, Stephen from DeFi Dojo also dropped a nice update on Spark YTs you can read here.

Speaking of points…

Rumpel just introduced a major update called Auto Seller that streamlines points into immediate yield. For those unfamiliar with Rumpel, it essentially gives immediate utility to point programs, immediate liquidity to point farmers, and maximizes everyone’s yield. By using Rumpel, point sellers can realize their gains immediately, point buyers can get exposure to their favorite protocols without risking capital/time, and point issuers can maximize the value of their incentives and get discovered through Rumpel's curation.

I never look too closely at yield in “points”, but with Rumpel it makes those points easier to realize. For example, if Ethena is netting 10% APY base + 10% points yield, I typically don’t really weight the points as highly as its really hard to count on when you will get them and at what price. Rumpel streamlines that and allows you to convert the points in real time into USDC vs holding IOUs.

Here’s their full announcement:

Here’s what the Pendle Markets look like this week!

Stables

10.23% - 13.36%

BTC

2.11% - 2.92%

ETH

5.06% - 6.41%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Gearbox makes it into our looping section once again. They’ve been all over my X feed this week and therefore on my mind, in part because the token jumped about 50%, but also just due to pure staying power. They’ve been around forever in DeFi years and have never had a major hack or exploit. On top of that they’re always tweaking and iterating:

TLDR opening positions have always been 1:1 on this vault, but closing positions 1:1 is coming sometime in July I’m told. Which would be a nice QOL upgrade and ease user frictions.

The vault in question is below and still very strong yields on ETH at a max APR of 18.01%:

That’s all for now, thanks for checking it out!