The following is a writeup by inPlanB on what he’s seeing recently with 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

Quick note from Nomatic:

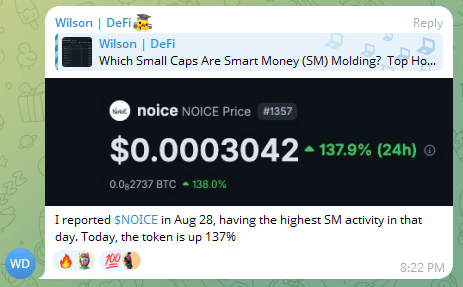

I just wanted to share another example of how inPlanB has been early to some alpha in our private telegram chat. He was all over NOICE on August 28th and even called it out:

August 28th from inPlanB

Then on September 5th, NOICE jumps 137.9% and up 2.3x since his initial call only 7 days earlier:

There’s more examples I could share from just this past week, but I’m starting to see leading indicator patterns emerge since we’ve started looking closer at Nansen these past few weeks.

OK onto this week’s writeup 🚀

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

How Is Smart Money Defined?

Nansen’s definition of Smart Money

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Consistent trading success:

Superior win rates

Substantial realized profits

Performance across market cycles

Skill indicators:

Token diversity

Strategic timing

Risk management

Leading indicators:

Early position taking

Trend anticipation

Market signal generation

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base, Arbitrum and BNBchain

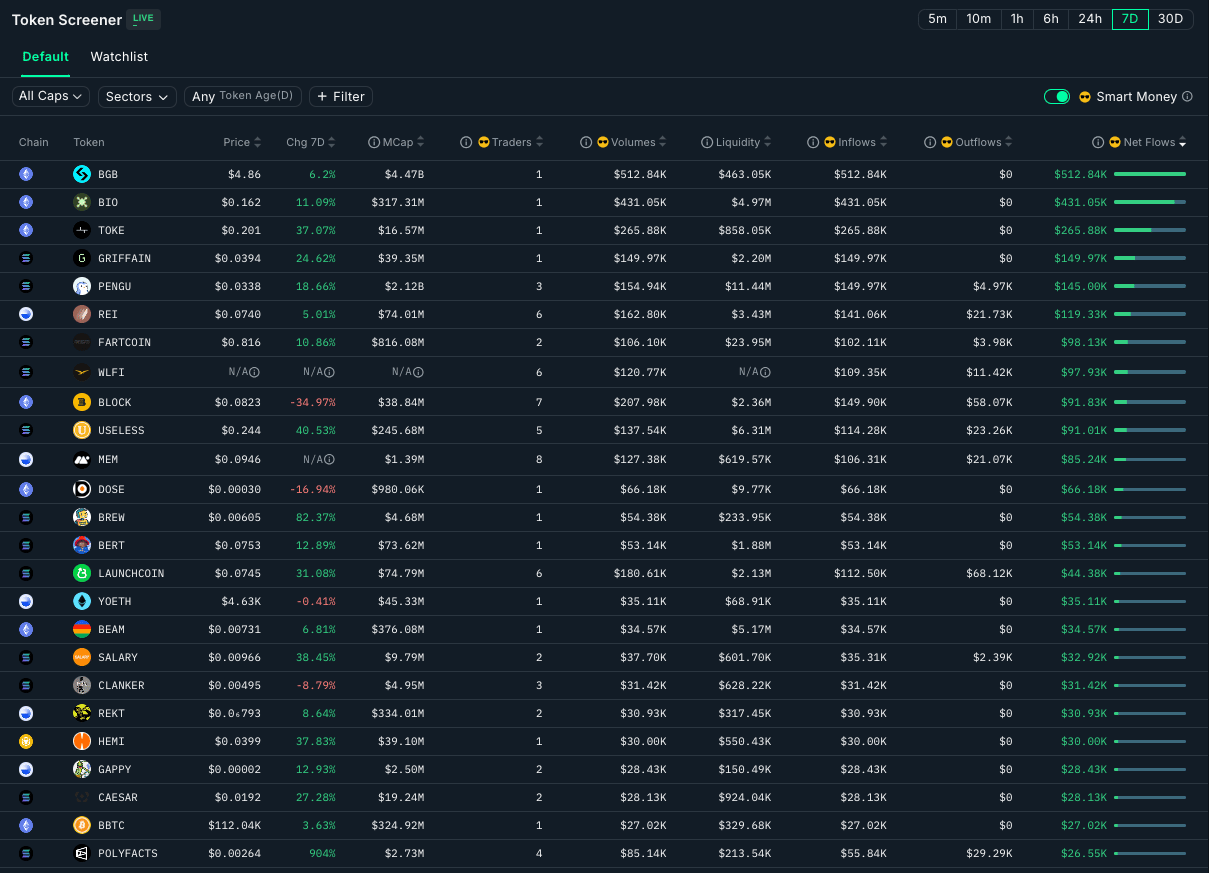

24H Flows

7D Flows

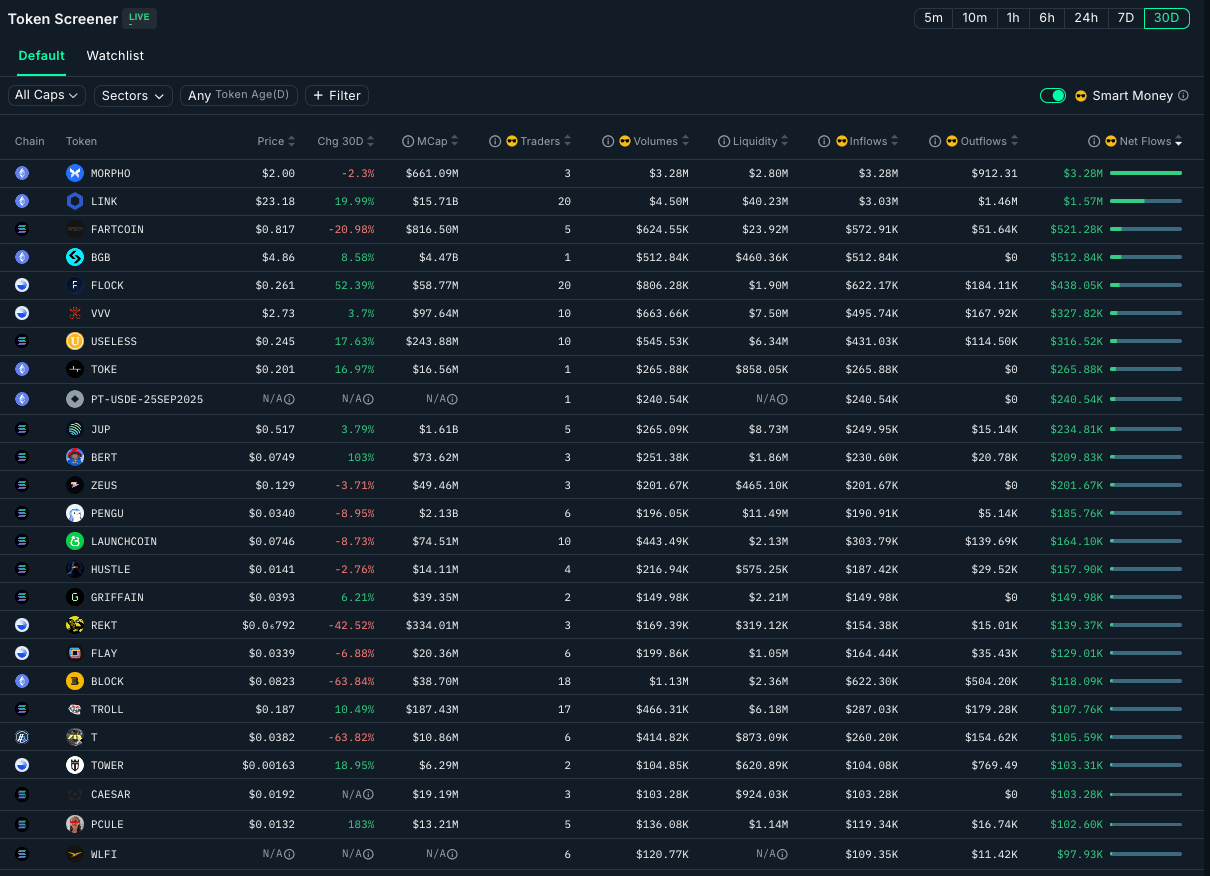

30D Flows

Smart Money Update: Understanding Concentrated vs. Distributed Institutional Interest

Last week I showed you how SM was rotating back into fundamental utility tokens. This week's data reveals something fascinating about how different types of institutional capital deploy - and why understanding the difference between concentrated and distributed SM interest can dramatically improve your decision-making.

Let me walk you through a more nuanced way to read these signals, because the distinction between one large institutional player and many smaller ones tells completely different stories about risk, conviction, and opportunity.

Understanding Smart Money Concentration: Two Valid Investment Approaches

When analyzing SM flows, it’s important to recognize that both concentrated and distributed institutional activity serve as valid, though distinct, forms of investment thesis validation. Think of it like venture capital: sometimes you want to see twenty different VCs each writing small checks (distributed consensus), and sometimes you want to see Sequoia writing one massive check (concentrated conviction).

Both patterns can be bullish, but they indicate different things about the opportunity and suggest different risk profiles for followers.

Concentrated Institutional Conviction: The High-Conviction Plays

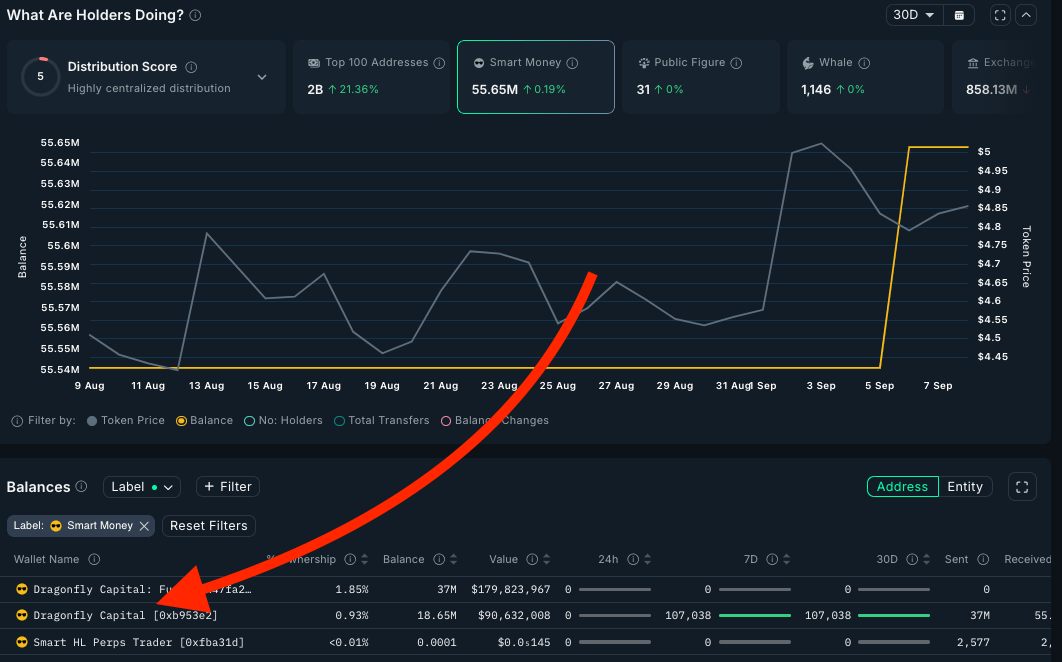

Bitget Token (BGB) - Institutional Fund Deployment Pattern

Pattern Analysis: $512.84K net flows from one SM address in the last 7D.

Current Price: $4.85 | Market Cap: $3.37B | FDV: $9.7B

What this pattern tells us: When a single SM address deploys over half a million dollars in a concentrated timeframe, we're likely looking at an institutional fund. In this case, Dragonfly Capital. This isn't random speculation - they did serious due diligence and decided this deserved a meaningful position size. As you can in the image below, they actually added more to their previous position.

The investment thesis becomes clear when you examine BGB's fundamentals. Bitget executed a $5+ billion token burn (40% of total supply) in December 2024 and is implementing quarterly buyback mechanisms. For an institutional player, this represents a clear value creation mechanism: exchange revenue directly flowing to token holders through systematic supply reduction. What's happening with BGB, is the same playbook that happened to BNB, and it's also being setting up with the MNT/ByBit relationship.

Why concentrated interest matters here: Large institutional players often move decisively when they identify clear value catalysts. The fact that Dragonfly Capital chose to deploy significant capital could mean they've modeled the deflationary mechanics and believe the current valuation doesn't reflect the value accretion from reduced supply.

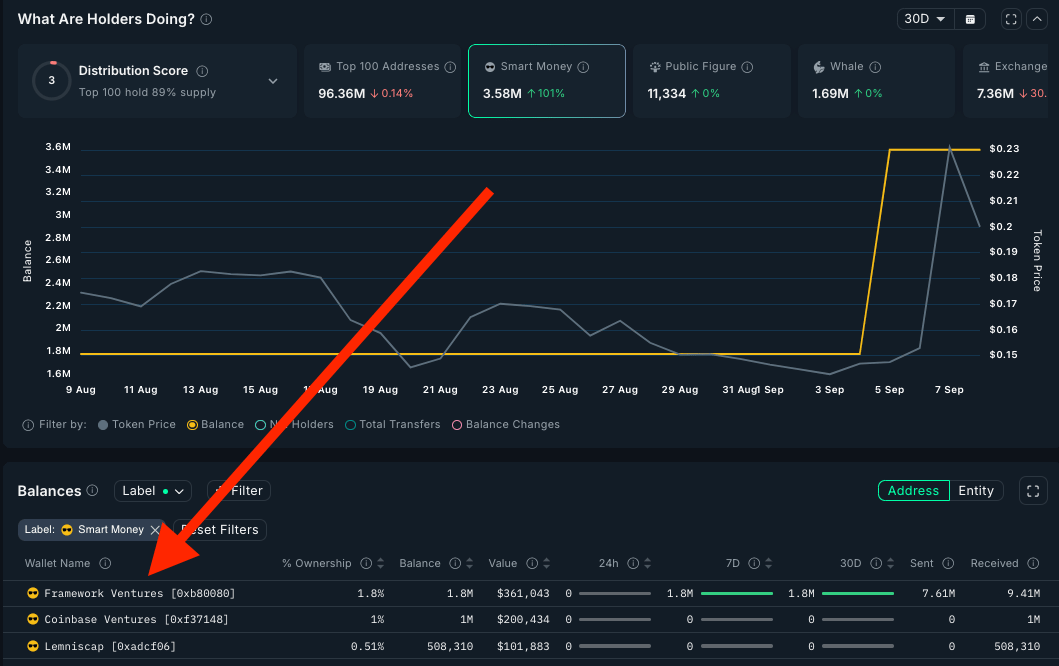

Tokemak (TOKE) - Early Stage Institutional Discovery Or Something Different?

Pattern Analysis: $265.88K net flows from one SM address with explosive 37.07% balance change over 24H.

Current Price: $0.20 | Market Cap: $16.58M | TVL: $148.49M

On the surface, this still looks like classic early-stage institutional discovery. When you see a smart money address rapidly accumulating a meaningful position in a smaller market cap protocol, it often signals they’ve identified fundamental value the broader market hasn’t yet priced in.

Consider the setup: $148.49M in TVL supporting only a $16.58M market cap, which implies a 9x TVL-to-market-cap ratio. For context, most established DeFi protocols trade closer to 0.1x–0.5x. An institutional player stepping in with $265K here likely sees Tokemak’s autonomous autopool rebalancing tech as an undervalued piece of infrastructure with significant upside as DeFi expands.

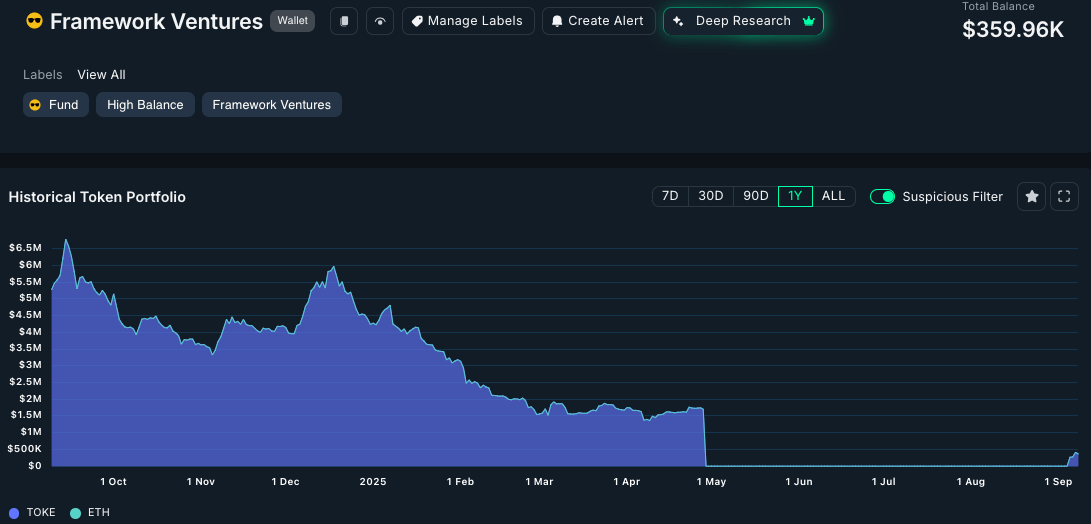

The concentrated nature of this activity suggests early-mover conviction. Institutional players who specialize in spotting underpriced DeFi infrastructure tend to move quickly when the risk-adjusted setup is compelling. In this case, the player is Framework Ventures. What’s important to understand is that Framework once held a very large position in TOKE, but back in May they transferred all of it to FalconX to be sold systematically (we wrote about this happening under “Tokemak” section in Tokens on our Radar piece). What looks like them “coming back” is actually more nuanced: some of that inventory now appears to have been returned to their address.

That distinction matters. It may not necessarily represent fresh bullish accumulation. They could be repositioning, preparing for an OTC deal, or indeed re-entering with renewed conviction. The key point is that their reappearance in the token flow is noteworthy and worth tracking.

This shows the TOKE drop off in May and then the possible return of tokens recently this month

Distributed Institutional Consensus: The Validation Plays

Chainlink (LINK) - Broad Institutional Validation

Pattern Analysis: $1.01M net flows from 24 different SM addresses over 30 days with +34.52% balance change.

Current Price: $22.33 | Market Cap: $15.1B | 24h Volume: $496M

This pattern represents something entirely different but equally compelling: distributed institutional consensus. When nearly two dozen different sophisticated investors independently reach the same conclusion about an asset, you're witnessing genuine institutional validation of an investment thesis.

As mentioned last week, the breadth of interest in LINK likely stems from multiple catalysts converging: Bitwise's pending LINK ETF filing, SBI Group's partnership for tokenized assets, commitment to their reserve/token buybacks and Chainlink's continued dominance in the oracle space. Institutional players may be approaching this thesis from different angles. Some drawn by ETF approval potential, others by enterprise adoption, and still others by the strength of the technical moat.

Distributed consensus provides different risk characteristics than concentrated interest. You're not dependent on one institution's judgment or timeline, but rather participating in a broad recognition of value that spans multiple institutional approaches and strategies.

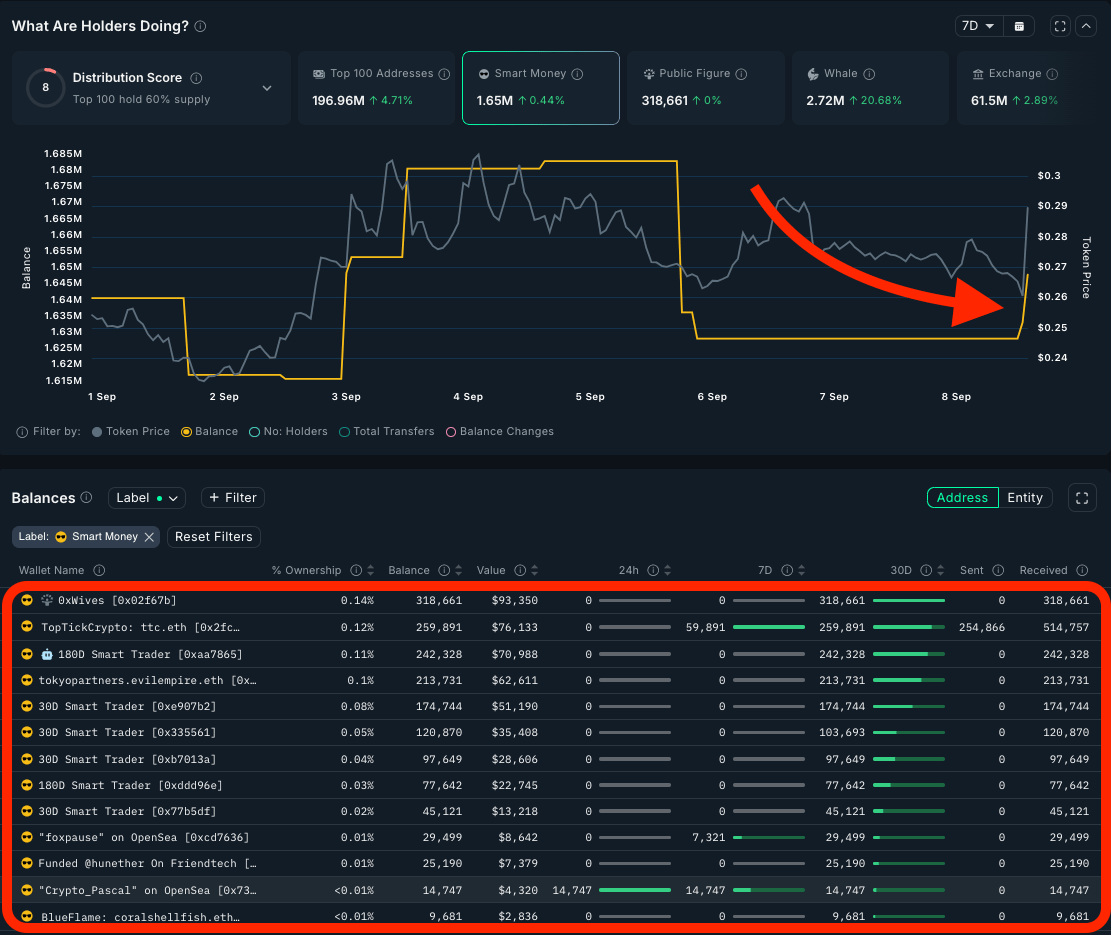

FLock.io (FLOCK) - Emerging SM Consensus

Pattern Analysis: $460.78K net flows from 24 different SM addresses over 30D with +41.69% balance change

Current Price: $0.23 | Market Cap: $52M | FDV: $235M

Showing up again in this week’s newsletter, FLOCK is in an early-stage opportunity. The SM balance started to increase, with several addresses holding the small-cap AI infrastructure token could suggest genuine alpha discovery (see image below). When sophisticated players independently identify the same small-cap opportunity, it often precedes broader market recognition.

The AI infrastructure thesis appears compelling, as the training model represents genuine utility. FLock.io's backing by DCG, Lightspeed, and OKX Ventures provides institutional credibility, while the distributed accumulation pattern suggests multiple SM have validated the investment thesis independently. Thus, you might want to keep a closer eye.

***Update***

Just as we were going to publish this, we realized that FLOCK was just listed on both Upbit and Coinbase:

While we don’t know for sure, it’s possible that some of the SM accumulation we were seeing was insider knowledge of these major exchange listings 👀

Bottom Line: Match Your Strategy to the Signal Type

Both concentrated and distributed SM interest can be extremely valuable investment signals, but they require different approaches and risk management.

If you're following concentrated institutional interest like BGB and TOKE, you're essentially co-investing with sophisticated early-stage thinking. This can be highly profitable but requires understanding that you're betting on one entity's judgment and timeline. Make sure you understand their potential thesis and have conviction in their track record.

If you're following distributed institutional consensus like LINK and FLOCK, you're participating in broader institutional validation. This typically offers better risk-adjusted returns but may provide less explosive upside since you're not capturing pure early-mover advantage.

The key insight from this week's data is that SM operates differently across different opportunity types and market caps. Understanding these patterns helps you make more informed decisions about when to follow concentrated conviction versus distributed consensus.

Whether you choose to follow the concentrated high-conviction plays or the distributed validation plays, you're following institutional capital that has presumably done some form of due diligence. The choice comes down to your risk tolerance and whether you prefer early-stage alpha capture or validated consensus participation.

Please comment below if this is something you’d like us to include in The Edge Newsletter more often 👇

.jpg)