The following is a writeup by inPlanB on what he’s seeing recently with 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

You can get 10% off a Subscription to Nansen with our referral link: https://nsn.ai/EDGE

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

How Is Smart Money Defined?

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Nansen’s definition of Smart Money

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base and BNBchain

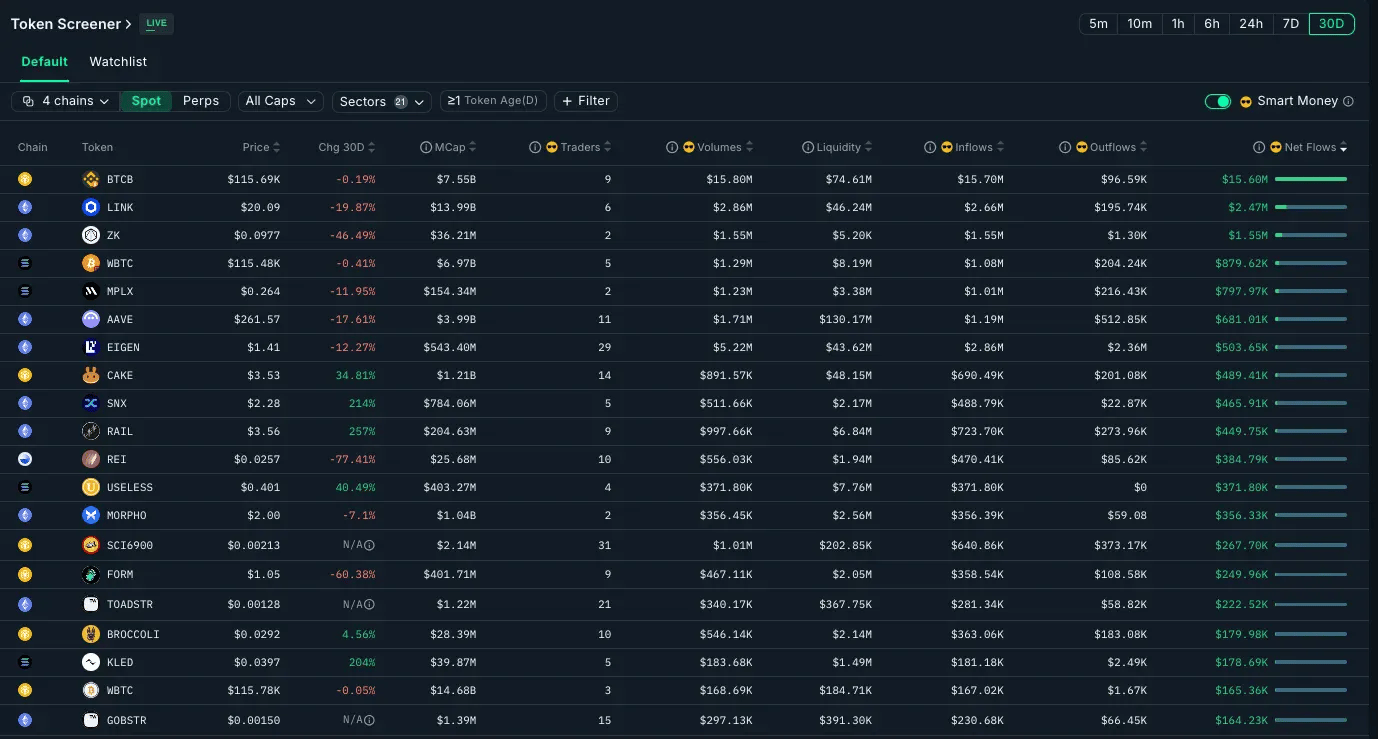

24H Smart Money Flows

7D Smart Money Flows

30D Smart Money Flows

Tracking The Smart Money Using Nansen - October 14

The crypto markets just went through their largest liquidation event on record, with sharp volatility across the board. Yet beneath the surface, Nansen’s smart money data tells a different story. Over the past week, 11 smart money wallets have accumulated more than $449K in RAIL, and 76% are still holding their full positions despite the turbulence.

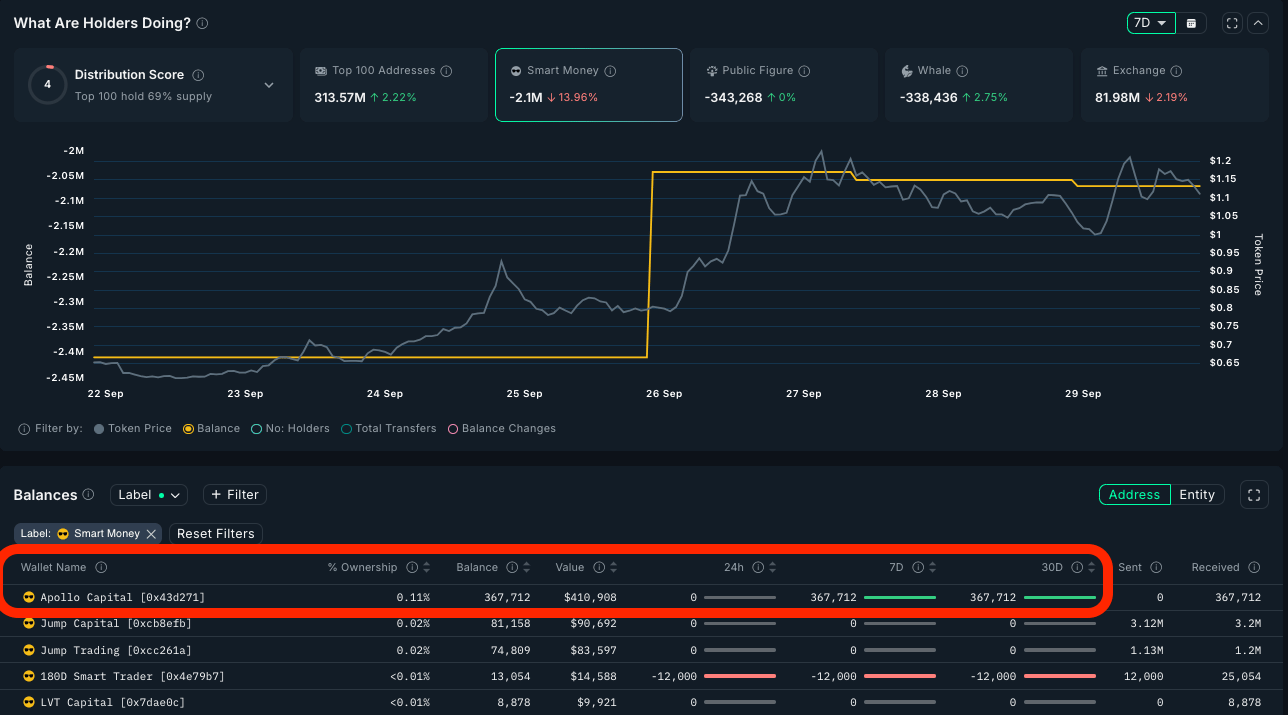

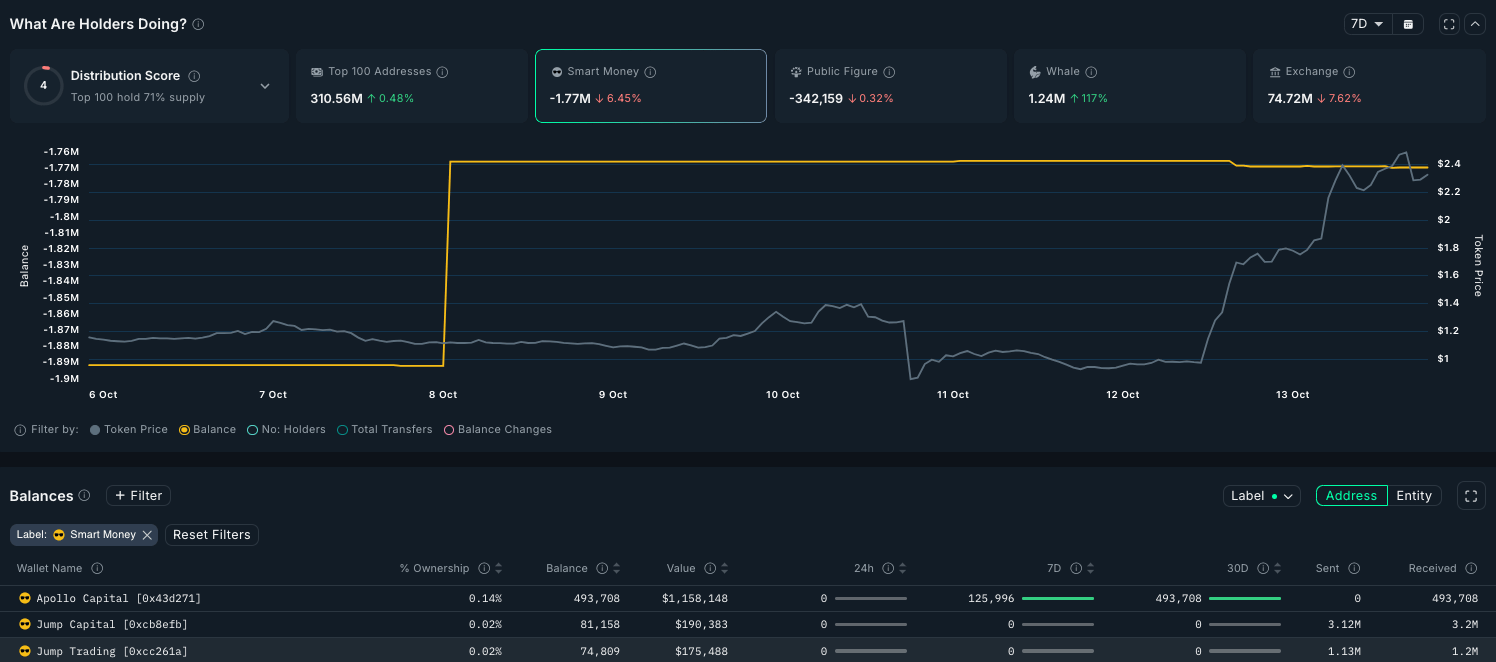

As I’m writing this, SNX hit $2.47. In our September 30th Smart Money report, we highlighted Apollo Capital’s accumulation of SNX when it was trading at $1.14.

As a reminder, here’s what we wrote back then:

From our September 30th Smart Money article.

And here’s the image where we showed Apollo Capital accumulating at the end of September:

It still boggles my mind how much information is available onchain if you have the time to look and the correct tools.

The following analysis examines three tokens with clear smart money inflows, backed by onchain data showing what’s being bought, who’s buying, and the clues behind their moves.

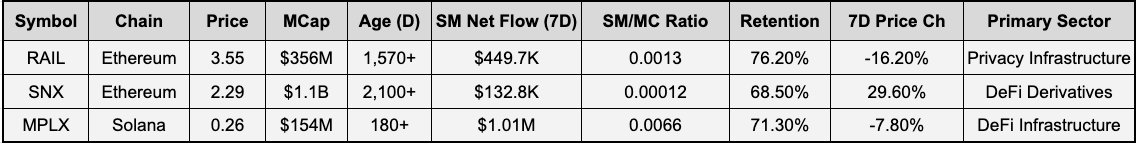

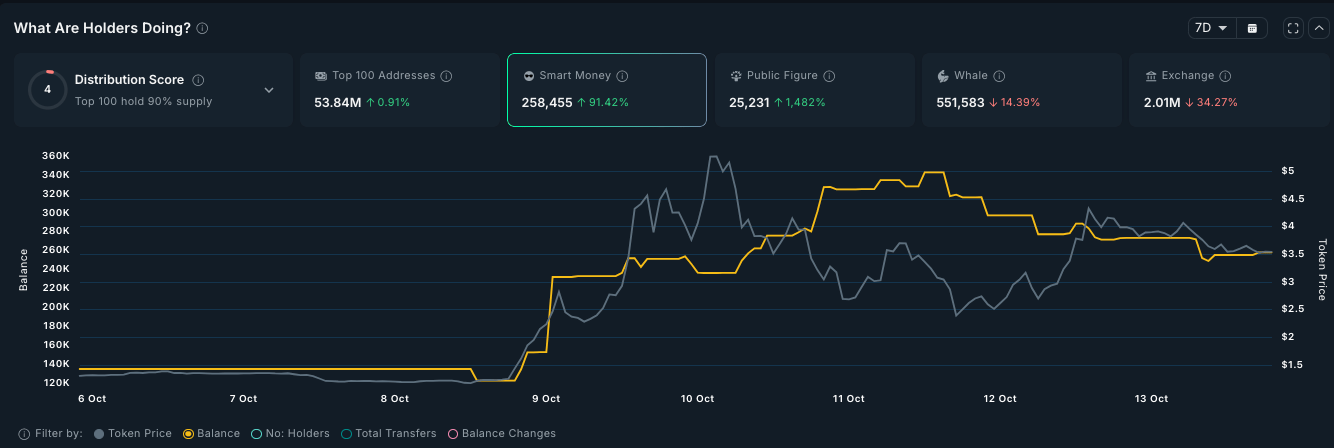

Railgun ($RAIL, Ethereum): Privacy Infrastructure Drawing Concentrated Smart Money Bets

Railgun operates as a privacy protocol for Ethereum and other EVM chains, enabling private transactions while maintaining compliance features. The project provides zero-knowledge proof technology that allows users to transact privately without breaking from the existing DeFi ecosystem. Unlike mixing services, Railgun integrates directly with existing DeFi protocols, allowing private interactions with Uniswap, lending platforms, and other applications.

The Smart Money Story

Smart money's interest in RAIL demonstrates an accumulation pattern that began intensifying approximately 30D ago. The onchain data reveals that smart money wallets have maintained between 11 and 17 active positions throughout the past week, with the cohort adding $449,700 in net inflows over the 7D period. This represents approximately 0.13% of the token's total market cap, flowing from smart money wallets alone in just one week.

Analysis of the top 50 PnL leaders shows that 38 addresses maintain "still holding" percentages above 70%, with several major accumulators like address 0xee6c08 controlling 440k tokens valued at $1.6M while maintaining 76.2% of their peak holdings. This wallet alone has achieved a 217% total return on investment while continuing to hold the majority of their position.

While RAIL experienced a 16.2% price decline over the past 24H, smart money wallets actually increased their positions, suggesting they view current levels as accumulation opportunities rather than exit points. The average smart money position size has grown from 135k tokens to over 255k tokens during the tracking period, representing an 89% increase in average position size.

The broader holder landscape reinforces the smart money accumulation thesis. While smart traders added $449k, fresh wallets contributed $1.7M in new capital, suggesting the smart money move is attracting follow-on retail interest. Exchange flows show net outflows of $756k over 7D. This combination of smart money accumulation, fresh wallet interest, and exchange outflows creates a technically bullish setup even as short-term price action remains volatile.

Market Data:

Price: $3.55 | MCap: $356M | FDV: $356M | Volume: $108M

Strong correlation here between Smart Money balance increase and price

Smart Money Data Callout:

Smart Money: 11-17 wallets, $449.7K 7D net flow, average position $85K, 76% average retention

Whales: -$361K 7D net flow, distribution phase

Fresh Wallets: +$1.7M 7D net flow

Exchange Flow: -$756K 7D net withdrawal (bullish)

Top Holder: 0xee6c08 with 440.8K tokens ($1.6M), labeled smart money

Why This Matters

The accumulation pattern in RAIL suggests smart money is positioning ahead of growing demand for compliant privacy solutions in DeFi. With regulatory scrutiny increasing on fully anonymous protocols, RAIL's approach to balanced privacy could capture significant market share from users who need confidentiality without regulatory risk. The protocol's recent integrations with major DeFi protocols and the upcoming v3 upgrade focusing on cross-chain privacy could serve as catalysts. However, it's important to note that the project's attention is also related to the privacy narrative that started with ZCASH.

Synthetix ($SNX, Ethereum): An Update

Synthetix provides infrastructure for derivatives trading in DeFi, enabling the creation of synthetic assets that track real-world prices without requiring the underlying asset. The protocol serves as the backbone for multiple derivatives platforms including Kwenta and Derive, generating fees from trading activity across the ecosystem. Synthetix pioneered the debt pool model where stakers provide collateral for all synthetic assets, earning fees but also sharing systemic risk.

The Smart Money Story

Smart money accumulation in SNX presents a more complex narrative than simple accumulation, with wallet behavior suggesting strategic positioning around the protocol's v3 upgrade and expanding perpetuals market share. Over the past 7D, smart money wallets have added $132.8k in net inflows, while the 30D period shows $465.9k in accumulation. The acceleration of accumulation from monthly to weekly timeframes indicates increasing conviction as smart money wallets expand positions.

The wallet distribution reveals sophisticated accumulation strategies. 28 to 35 distinct smart money addresses maintain active positions, suggesting broader institutional interest rather than concentrated whale accumulation. The average position size among smart money holders has increased by 42% over the tracking period, with wallets strategically adding during price dips rather than chasing momentum.

Price action context makes the accumulation more significant. SNX has gained 31% over the past 24H, yet smart money began accumulating before this price surge, as we reported before. More importantly, smart money Apollo Capital have not sold any of its holdings.

Exchange flow dynamics support the accumulation thesis. The pattern of smart money accumulation, exchange outflow combined with price appreciation on stable volume suggests supply is being absorbed by strong hands rather than speculative traders.

Market Data:

Price: $2.29 | MCap: $788M | FDV: $788M | Volume: $1B

Smart Money Data Callout:

Smart Money: 28-35 wallets, $132.8K 7D net flow, $465.9K 30D flow, 68.5% average retention

Price Performance: +29.6% 24H, accumulation preceded rally

Volume Profile: $1.1B market cap with growing derivatives volume

Accumulation Zone: $1.80-2.10 (20-30% below current price)

Why This Matters

Smart money accumulation in SNX appears tied to the protocol's dominant position in DeFi derivatives infrastructure as an OG player. SNX benefits from the recent perp narrative and might capture market share when launched on Ethereum or it might turn into a sell the news event, as the narrative may die off. Time will tell.

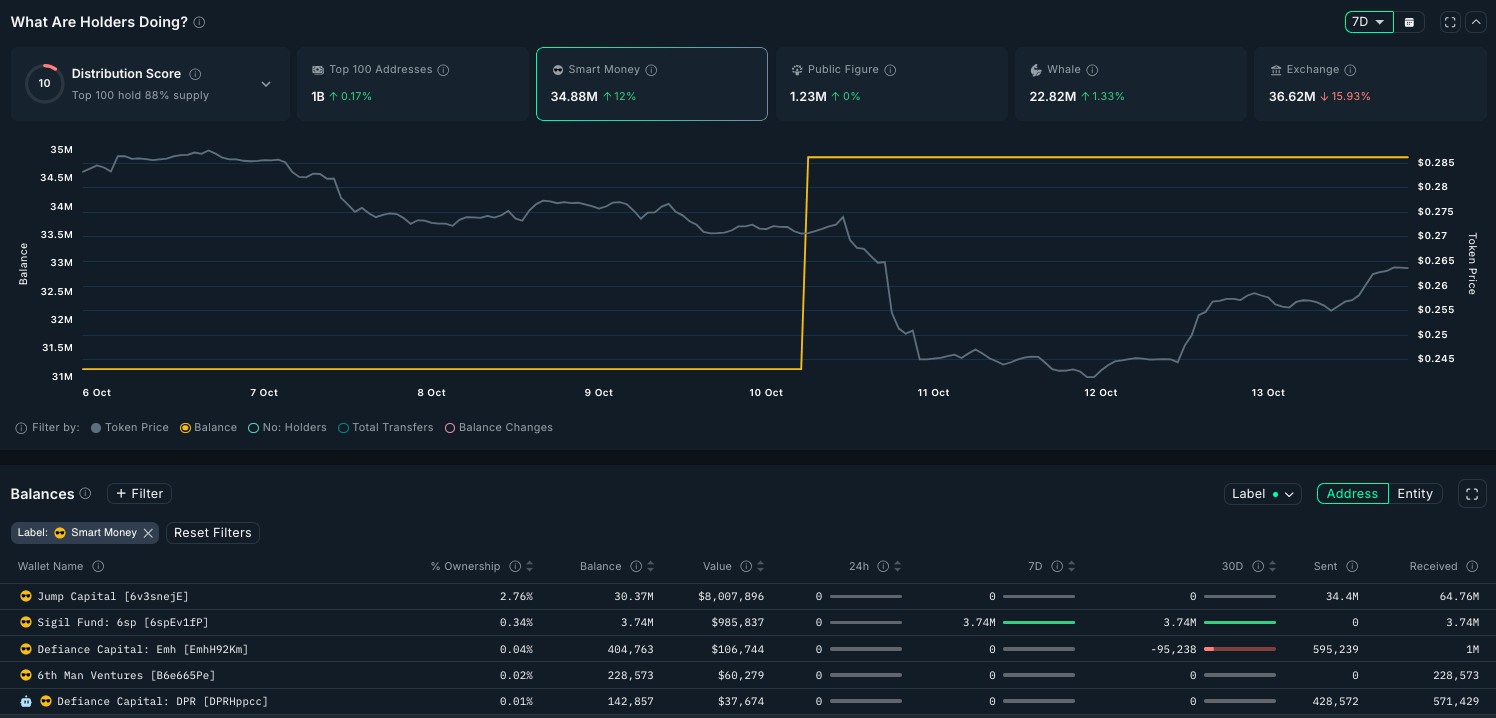

Metaplex ($MPLX, Solana): Sigil Fund Loaded $1M

Metaplex provides essential infrastructure for NFTs and digital assets on Solana. The protocol handles metadata standards, royalty enforcement, and compression technology that enables efficient storage of large NFT collections. While NFT volumes have declined from peak levels, Metaplex's positioning as core infrastructure means it captures value from any NFT activity on Solana regardless of which marketplace or collection trades.

The protocol recently expanded beyond NFTs into broader digital asset infrastructure, including fungible token standards and DeFi integrations. This evolution positions MPLX as a broader play on Solana ecosystem growth rather than pure NFT speculation.

The Smart Money Story

The smart money accumulation pattern in MPLX stands out for both its size relative to market cap and the concentrated nature of positions. Over the past 7D, smart money wallets have accumulated $1M, representing 0.66% of the total market capitalization. This makes MPLX the highest smart money concentration relative to market cap among our analyzed tokens. It also suggests outsized conviction by one of the more sophisticated liquid funds in the space, Sigil Fund.

Position retention metrics demonstrate exceptional holding discipline. Smart money wallets maintain 71.3% average position retention, with several major holders above 90% retention despite recent price volatility. This holding pattern suggests smart money views current accumulation as early-stage positioning rather than trading opportunities. The lack of profit-taking even after periodic price spikes indicates longer-term investment horizons, which is usually the case for liquid funds.

The correlation with Solana ecosystem activity provides context for the accumulation. As Solana has gained momentum with new token launches and increased DeFi activity, infrastructure plays like Metaplex capture value from overall ecosystem growth. Smart money appears to be betting that NFT activity will return to Solana and that Metaplex's expanded scope into broader digital assets will multiply revenue opportunities beyond just NFT trading fees.

Market Data:

Price: $0.26 | MCap: $154M | FDV: $264M | Volume: $7.5M

Smart Money Data Callout:

Smart Money: 4 active wallets, $1M 7D net flow by Sigil Fund, 71.3% retention

Market Cap Ratio: 0.66% of MC from smart money in one week (highest concentration)

Accumulation Start: Approximately $0.20-0.22 range

Wallet Concentration: Sigil Fund larger positions indicate high conviction

Ecosystem Correlation: Beneficiary of broader Solana ecosystem growth

Why This Matters

The exceptional smart money concentration by Sigil Fund in MPLX relative to its market cap suggests they see asymmetric opportunity in this Solana infrastructure play. The protocol's expansion beyond NFTs into fungible tokens and DeFi integrations multiplies potential revenue streams. The compressed NFT technology that enables million-item collections at a fraction of normal cost could also unlock new use cases beyond traditional NFT applications.

Synthesis: The Infrastructure Thesis

Examining patterns across these three tokens reveals a clear meta-trend: smart money is accumulating infrastructure plays rather than application tokens. RAIL provides privacy infrastructure, SNX enables derivatives infrastructure, and MPLX powers digital asset infrastructure. This suggests sophisticated investors are positioning for the next phase of crypto adoption, where infrastructure providers capture value from ecosystem growth rather than betting on individual applications.

The holding patterns across all three tokens, with retention rates between 68% and 76% despite price volatility, indicate these are strategic positions rather than short-term trades. Smart money appears to be accumulating during market uncertainty, viewing current conditions as opportunities to build positions in essential infrastructure at attractive valuations.

These flow patterns suggest smart money is positioning in infrastructure protocols ahead of retail recognition, but as always, onchain data shows what's happening, not why. Each of these projects deserves deeper research into their fundamentals, tokenomics, token unlocks and development roadmaps before making allocation decisions.

Remember: This analysis tracks where sophisticated capital is flowing, not investment advice. Smart money earned that label through consistent outperformance, but they're not infallible. Use this as a starting point for your own research, not an ending point for your investment decisions.

All of the Smart Money information in this article can be obtained via Nansen’s “Pioneer Plan” - If you’d like to use this yourself you can get 10% off a Subscription with our referral link: https://nsn.ai/EDGE