Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

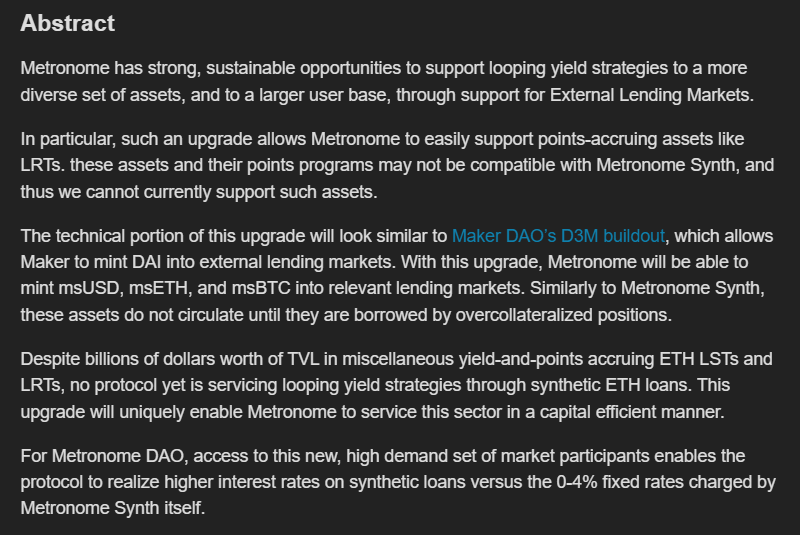

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

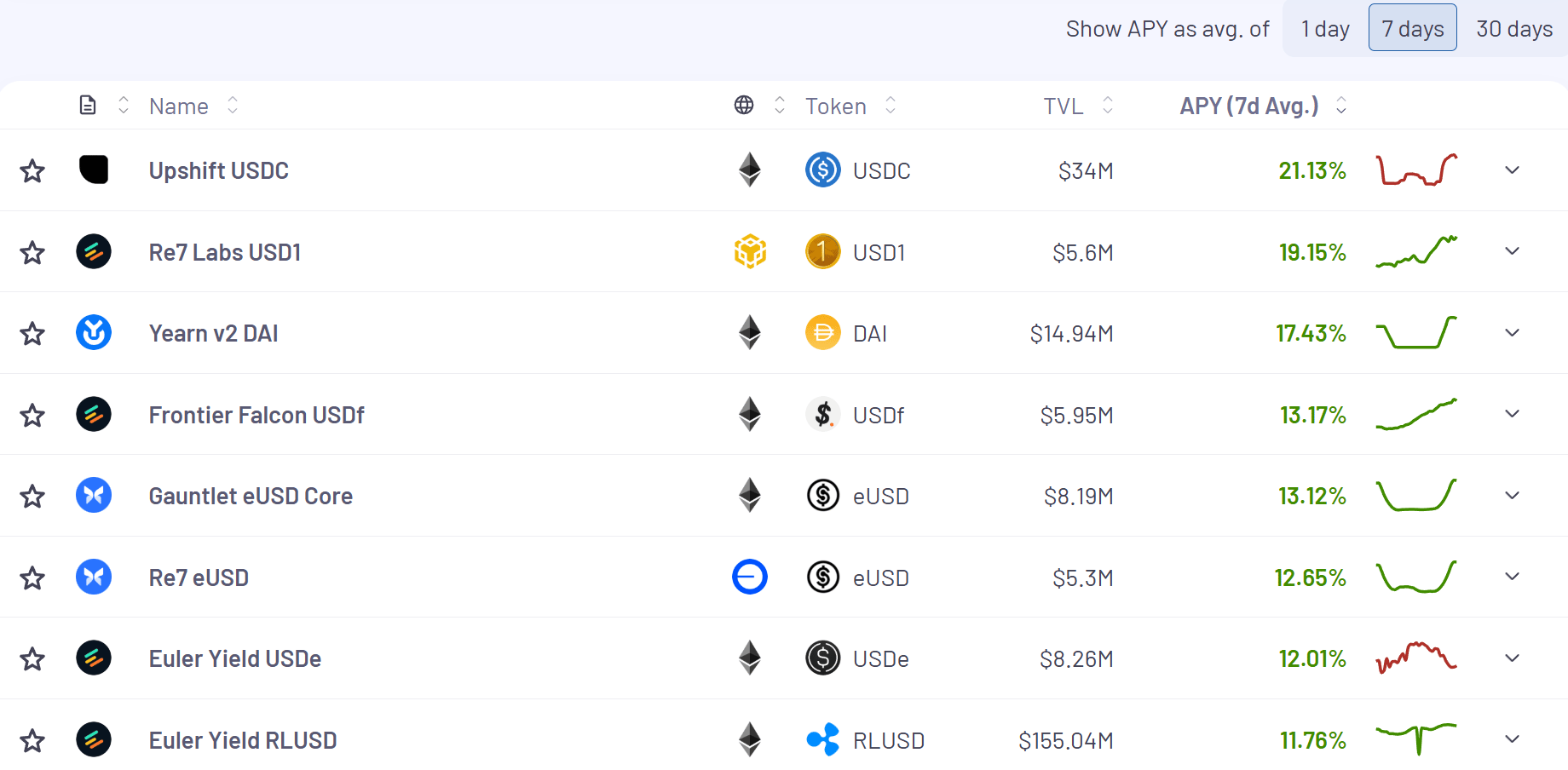

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

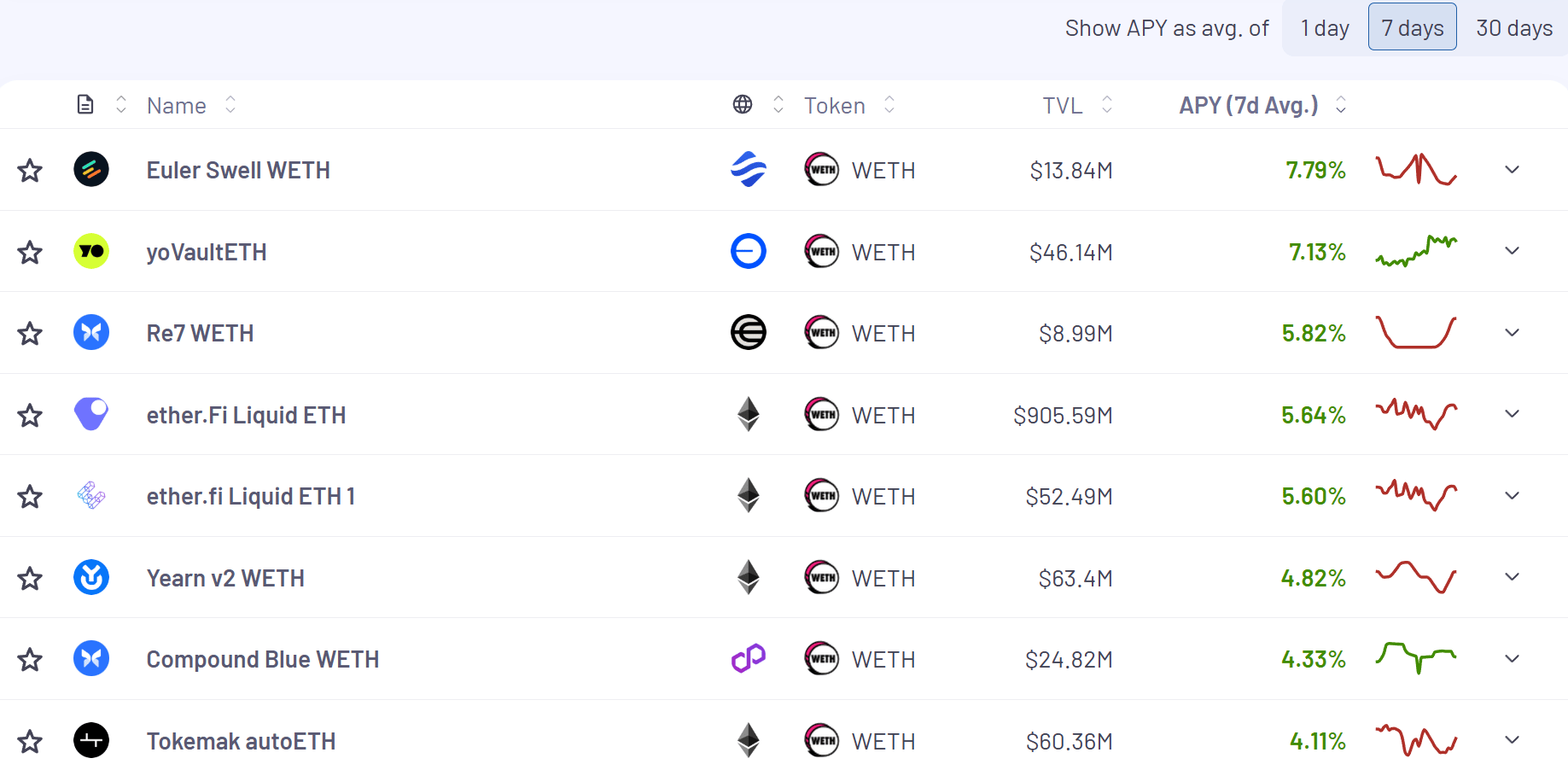

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

ETH Strategy Introduces its Perpetual Note - ESPN

I really think ETH Strategy is building one of the coolest new protocols in all of DeFi (incredibly biased here as a STRAT holder, but still).

The more I learn about their plans the more bullish I get.

If you read the article in the quoted tweet above you’ll see that they are introducing a new Perpetual Note called ESPN.

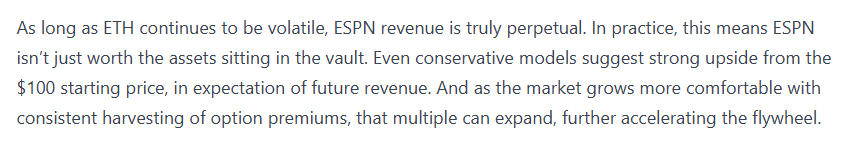

In talking to the team, yield on ESPN will start out very high but likely settle between 20% - 30% yield.

If it can actually achieve 20% - 30% this will have major ramifications for DeFi.

But what is it? Is ESPN pegged to another asset? No it’s not.

Will it be stable? No, it will most likely appreciate in price.

Check this out:

ESPN will essentially harvest the volatility potential of ETH.

You should really read their full blog post right here:

This post from Econ Degen is also excellent and breaks down some of the bond math behind ESPN:

Deposits for ESPN have officially just gone live and here’s everything you need to know to participate:

I’m always bullish on innovation, but innovation isn’t without its risks. Read up on some of the main risks for ETH Strategy - here.

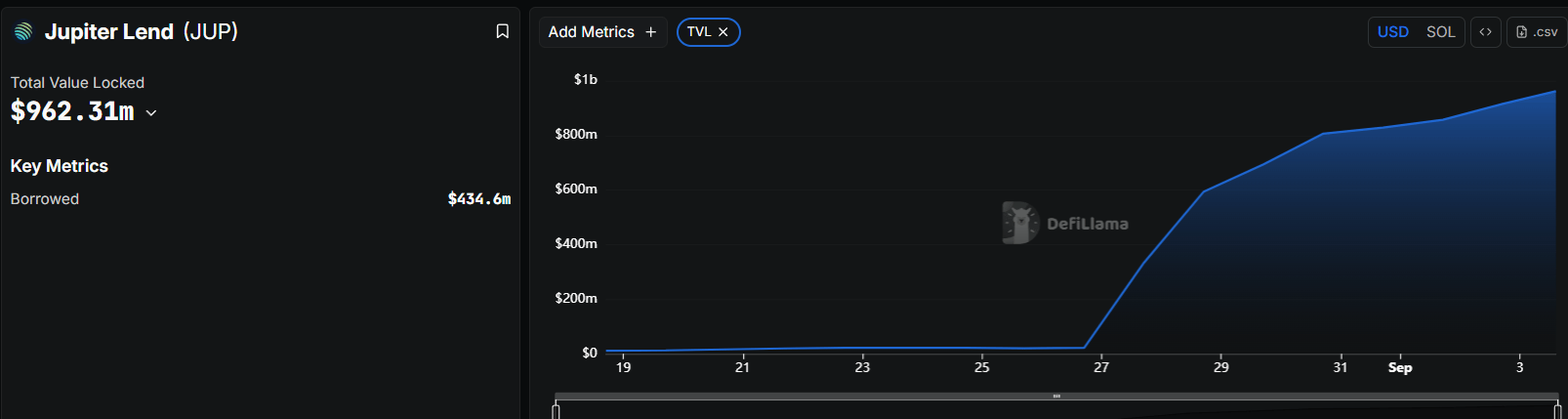

Jupiter Lend went live last week and the growth they’ve experienced so far is incredible:

Already approaching $1B in TVL

We did a full pod on Jupiter Lend here.

The main interface for Jupiter Lend has the familiar tabs of: Earn, Borrow, Multiply and a Statistics page.

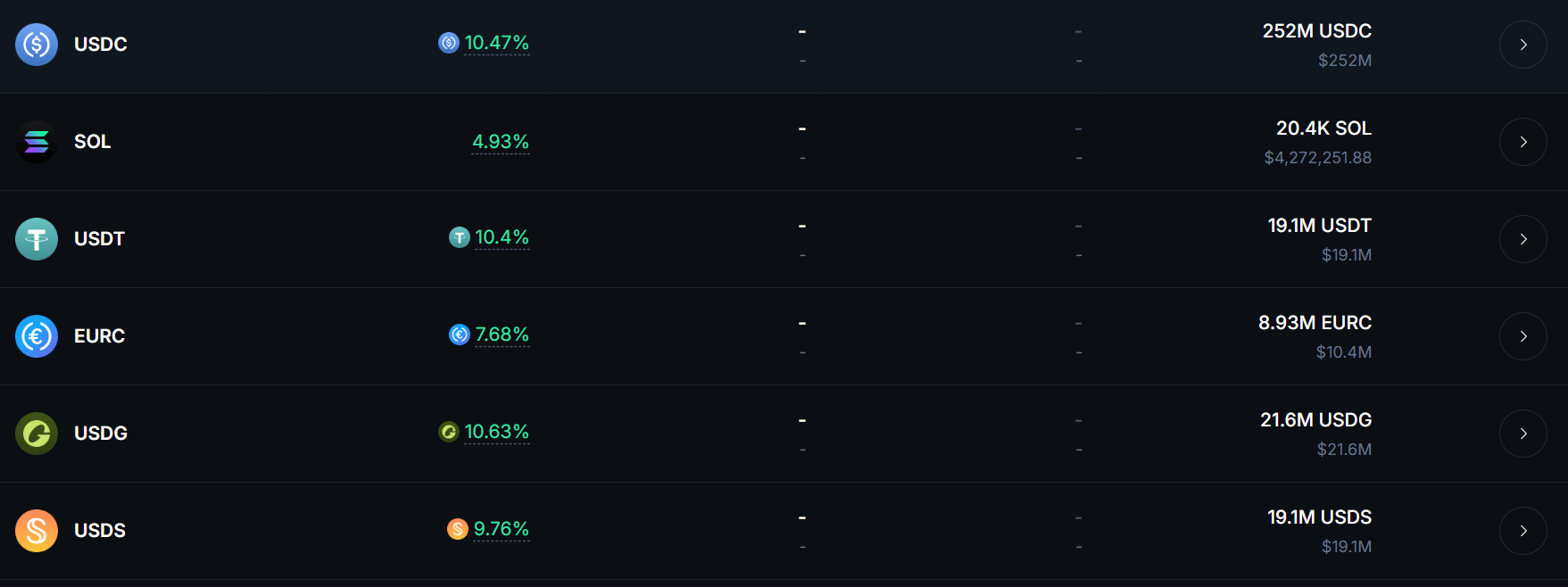

The yields were extremely high out of the gate and even with a bit of a dip they’re still some of the highest yields on Solana:

Earn Tab (no leverage)

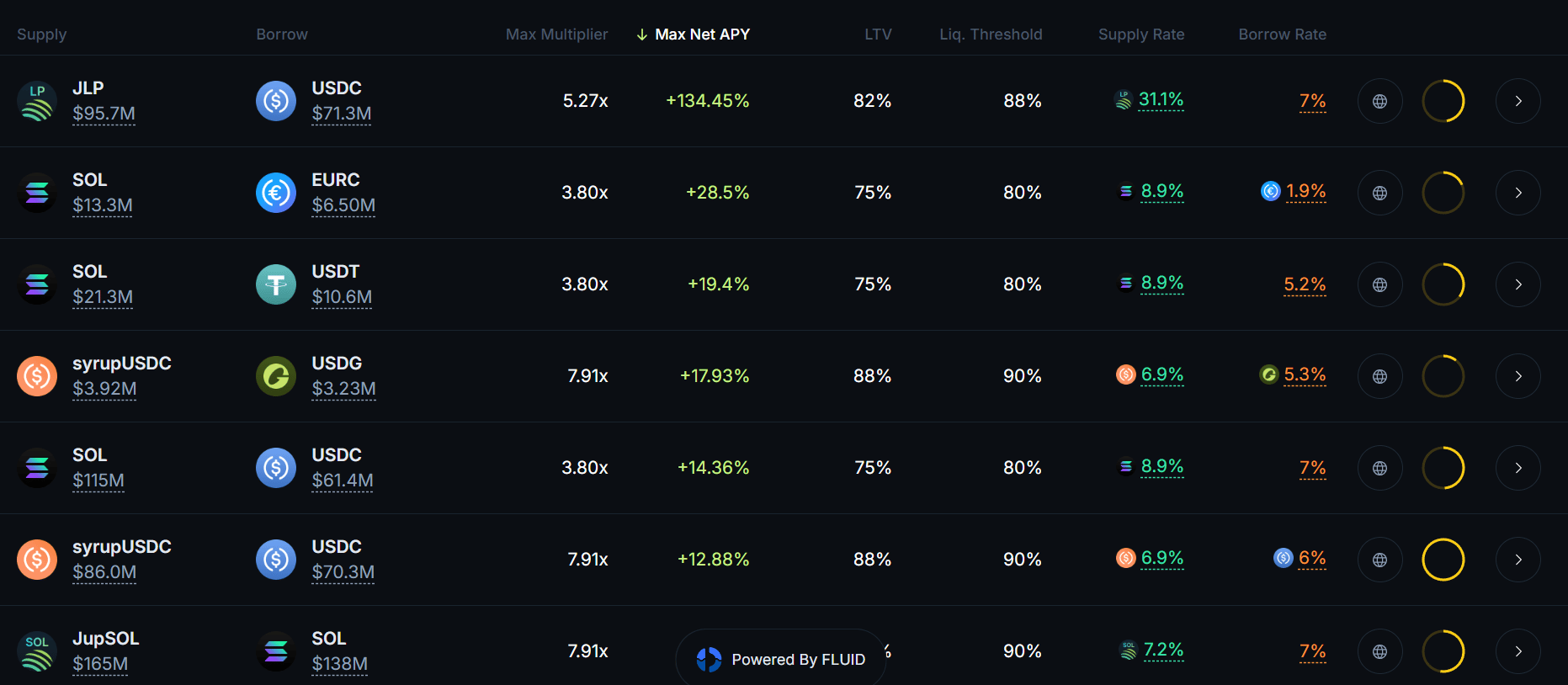

Multiply Tab

It will be interesting to see how they continue to roll this out and add to the product features.

One takeaway for me is that Solana DeFi now has another major addition to their DeFi hub. I think it’s really going to start pushing app developers to prioritize deploying to Solana.

I really think Jupiter Lend will mark a resurgence for Solana DeFi.

The Solana network effect is growing.

Yield Trading

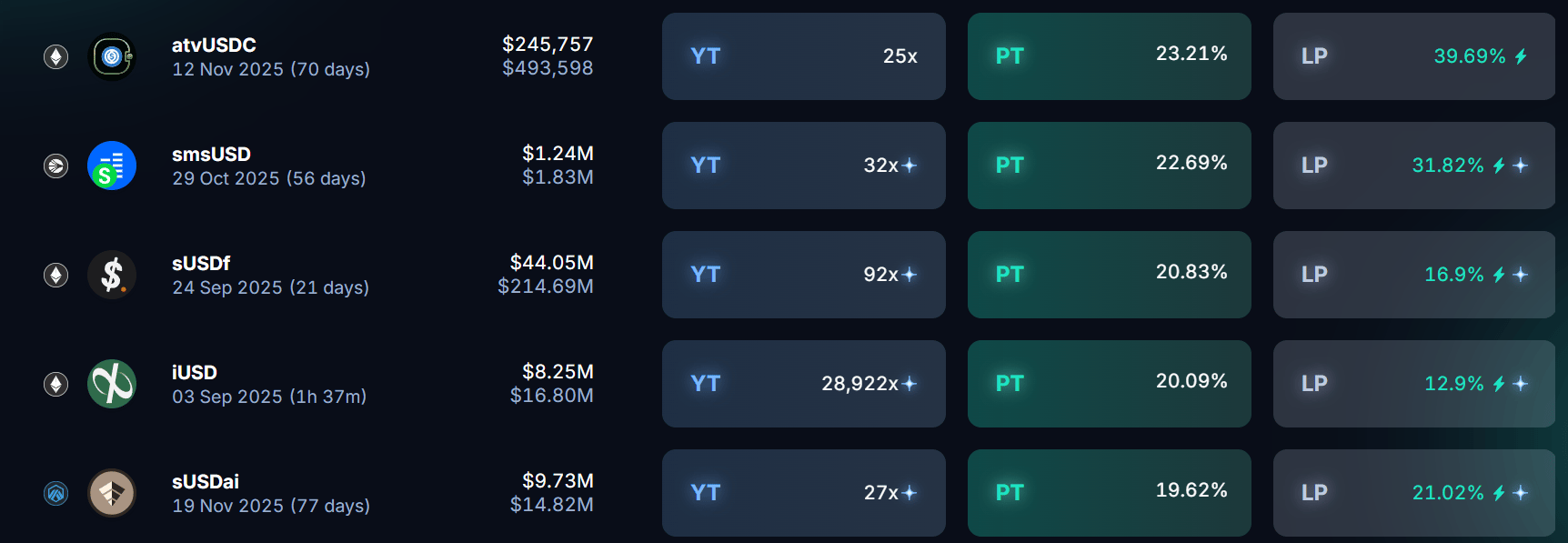

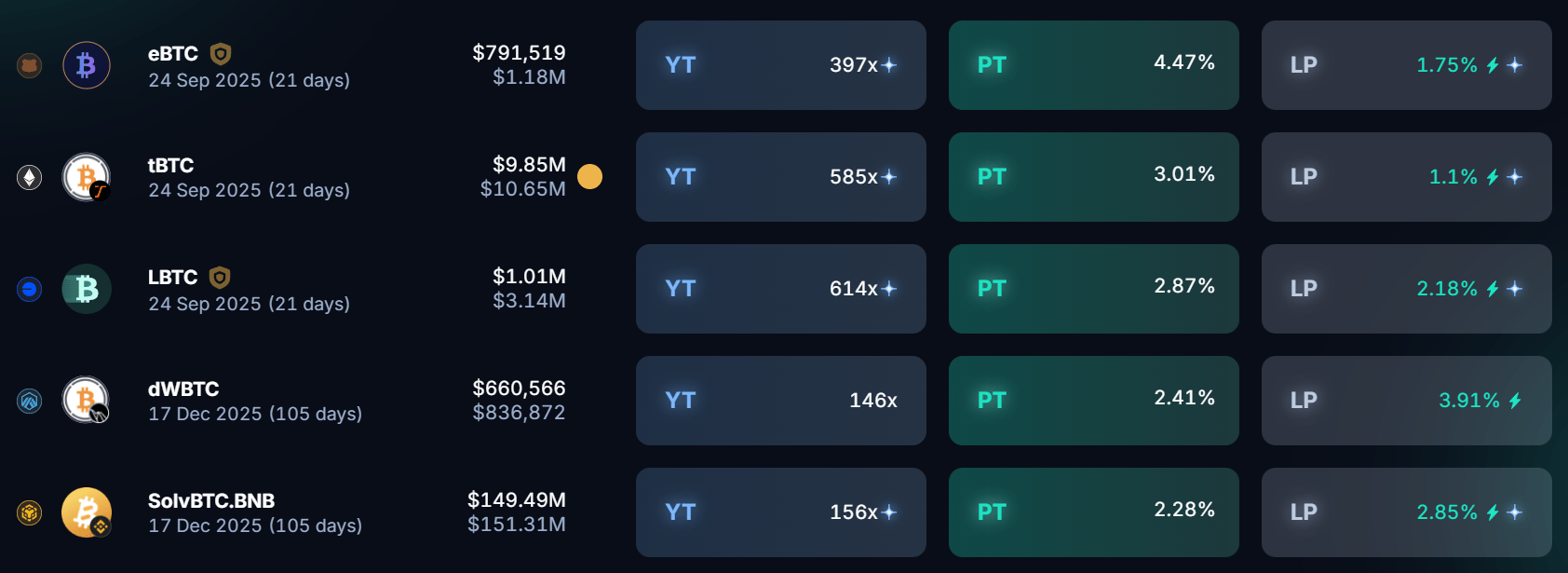

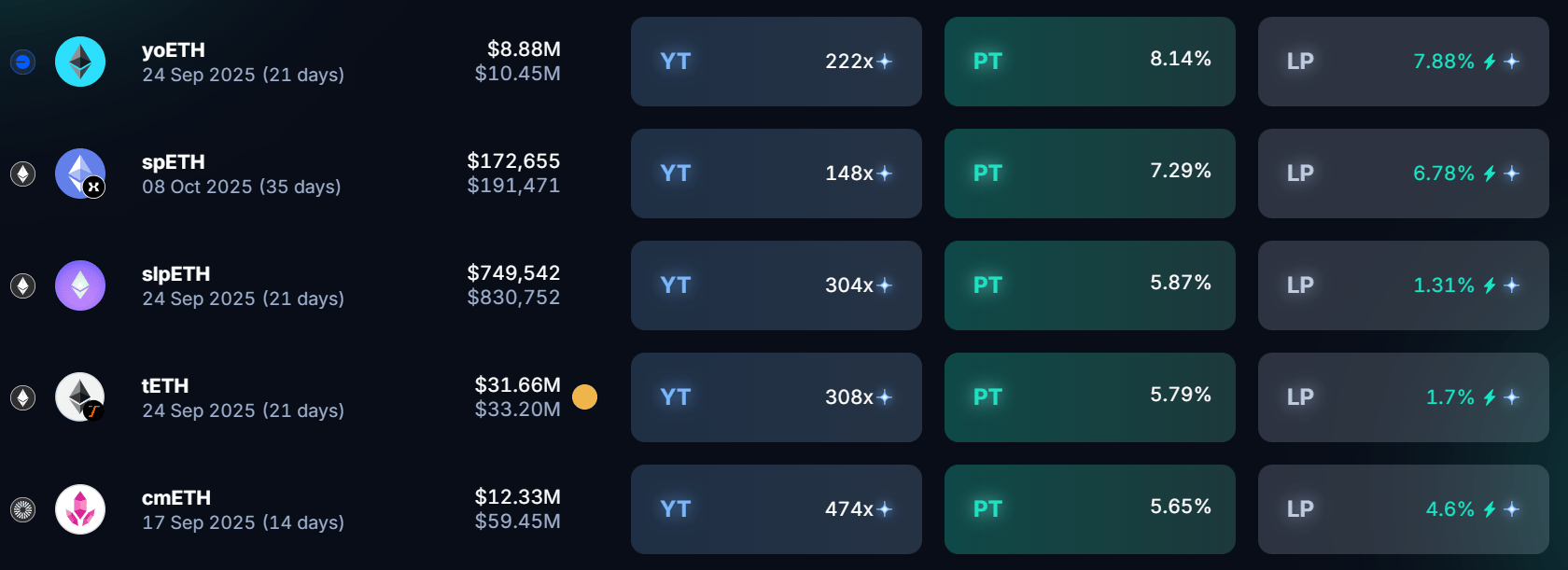

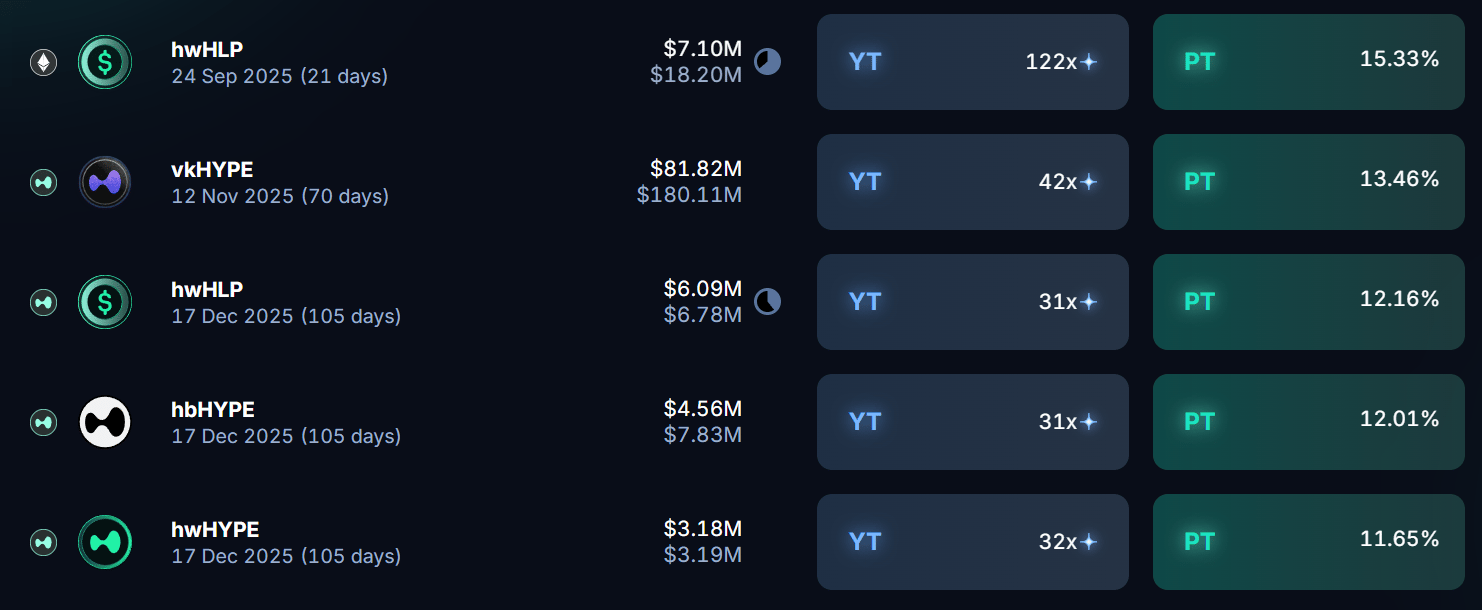

Here’s what the top yield markets on Pendle look like across Stables, BTC, ETH and HYPE:

Stables

19.62% - 23.21%

BTC

2.28% - 4.47%

ETH

5.65% - 8.14%

HYPE

11.65% - 15.33%

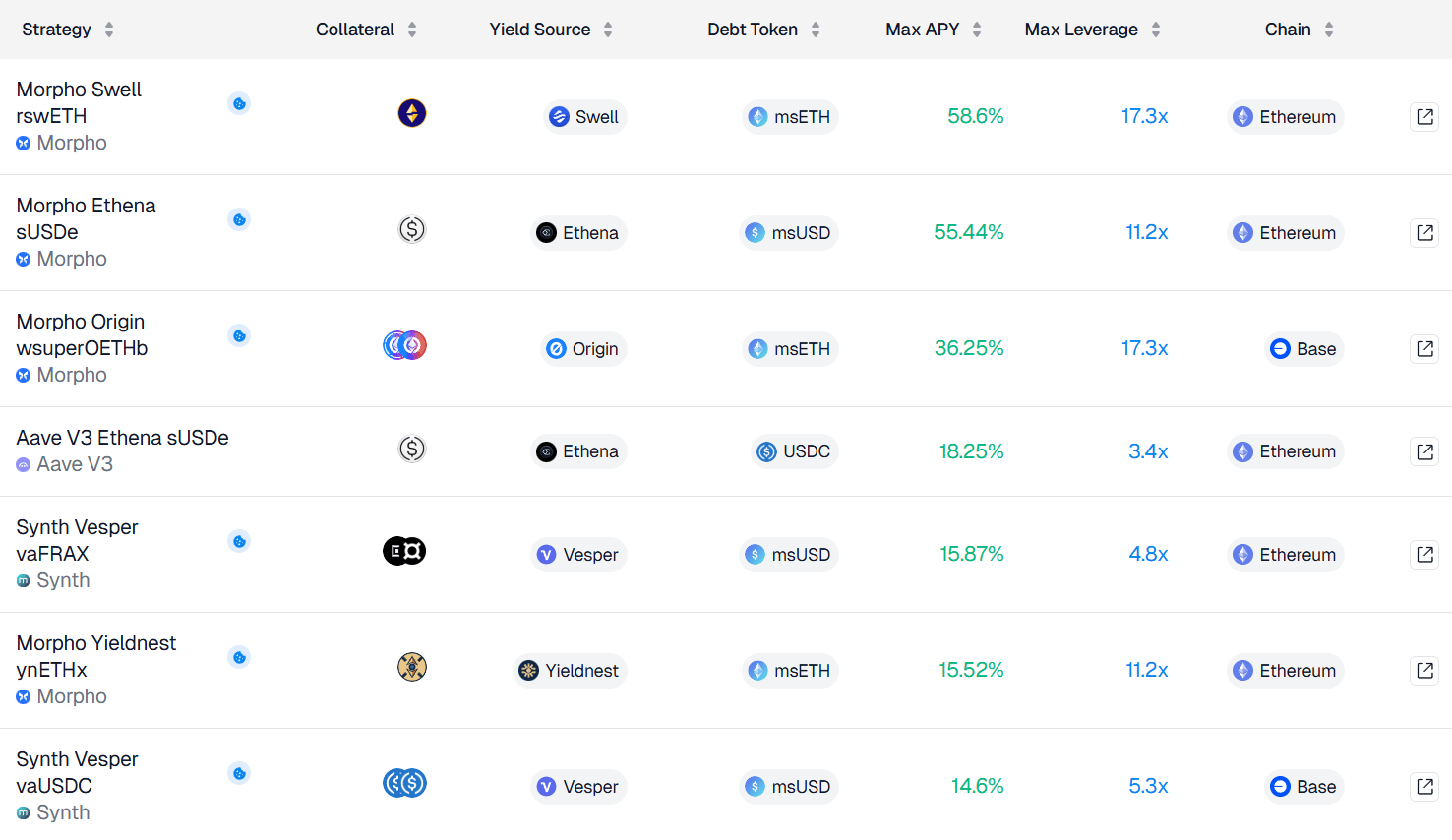

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Odyssey Finance (← check out the beta)

Up to 58% yield on Looped ETH

There’s a new protocol beta that went live recently called Odyssey Finance and they label themselves as:

A DeFi super app with leverage yield, curated vaults, and advanced trading.

One area of interest is their Loopr tab that is showcasing some incredible looping yields:

Normally when I see looping yields this high I discount anything close to the Max APY threshold, but in this case there’s a mechanism that allows higher leverage on strategies that are paired with a msAsset “Debt Token” (msETH, msUSD).

These msAssets are from Metronome and they refer to them as Synths.

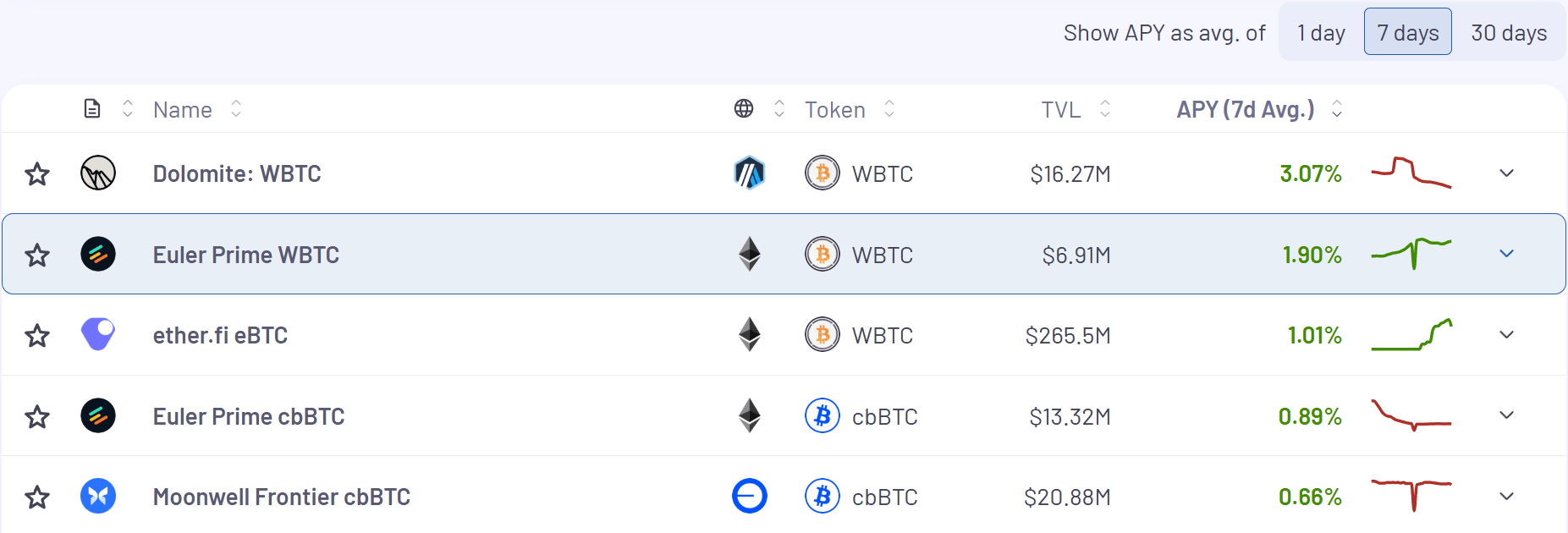

For a bit more on the relationship between Metronome Synths and Odyssey Finanace check out this post from the Metronome DAO introducing the idea:

One of the ways these loops can be kept so high is that Metronome has control over the Synth supply which keeps the borrow rates for msETH and msUSD low - thus maintaining high looping APY.

One of their team described this operation as follows:

The Synths are AMO minted into Morpho and if utilization spikes and they have capacity they can add more to keep the rates lower.

I’m still digging into some things and might start testing a position out with a small amount of capital to see how it plays out, but I think its very interesting and the team has a lot more coming (Morpho PTs 👀).

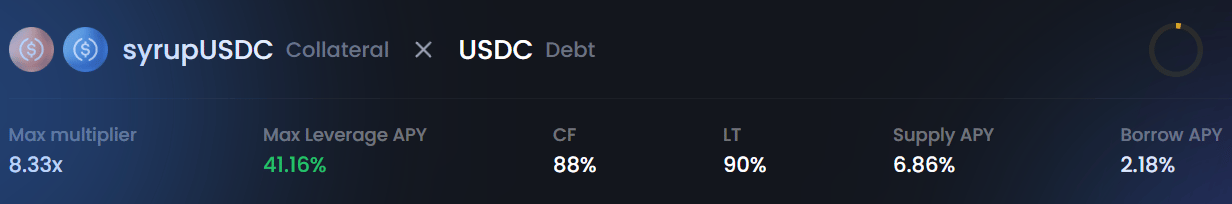

Maple is going everywhere and just yesterday they announced a big expansion to Arbitrum via Fluid, Morpho and Euler - all backed with extra incentives from Arbitrum’s DRIP campaign.

Read this thread below for more info and a link to the Maple blog:

This opens up lots of new looping opportunities including this one on Fluid that’s netting a 41.16% Max APY:

That’s all for now, thanks for checking it out!

.jpg)