Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

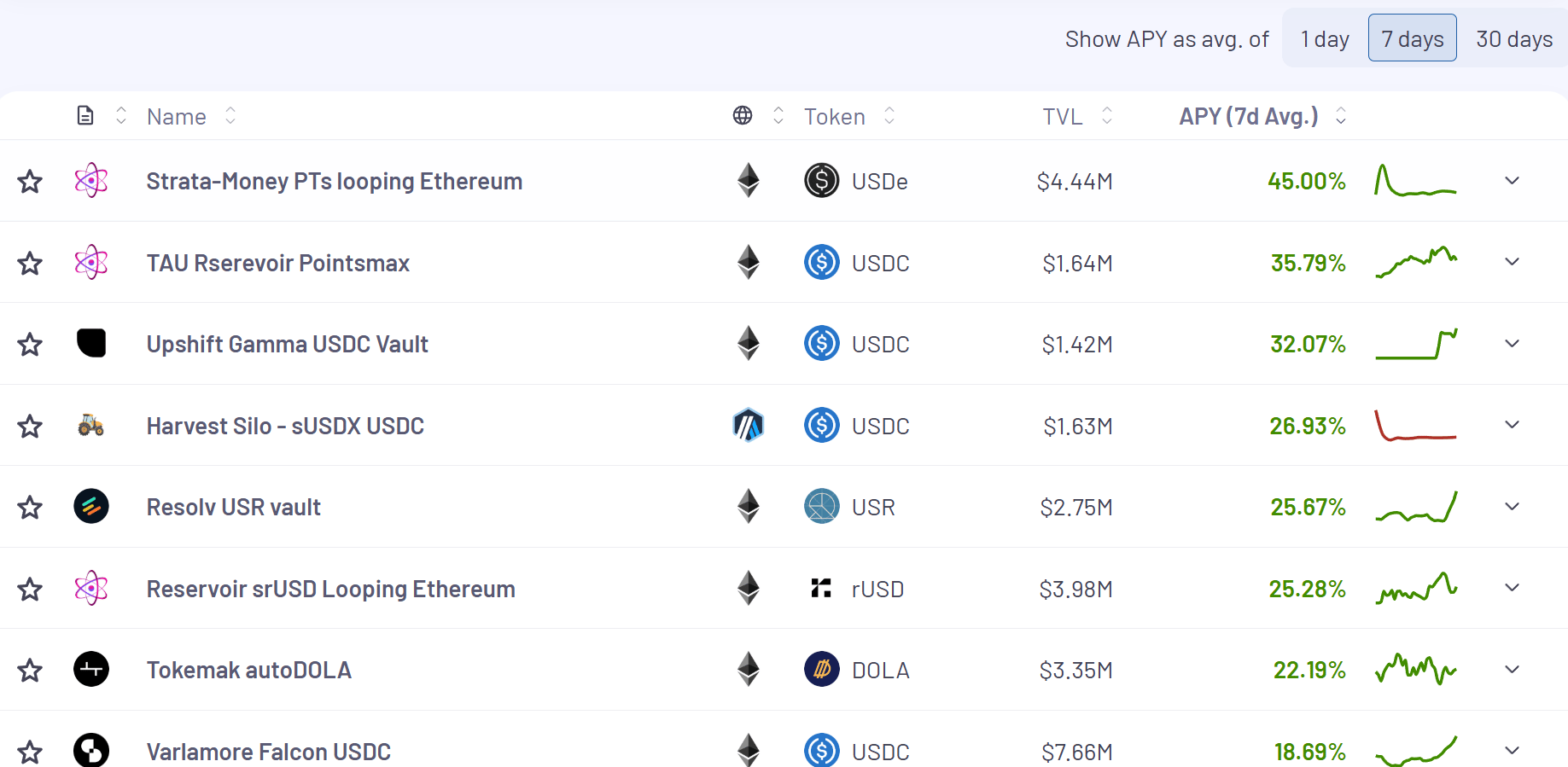

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Normally, I’ve been putting min TVL at $5M, but I saw some interesting new vaults that have high yields and are looking promising this week that are sub $5M and didn’t want to leave them out. While these may not have deep enough liquidity for some at the moment, there’s a few on here that could be promising to track as TVL increases.

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

Neutrl (In Beta, but going live soon)

$51M in their beta right now.

I was quite skeptical about Neutrl when I first heard about it, yet I hadn’t done any research of my own.

In fact, check out one of my first messages to the team when we started chatting a few weeks back:

- Nomatic (Telegram)

The reason I included this is because I think it represents a theme I've seen on Crypto Twitter. There seems to be a hivemind of opinion that develops in this space (I am guilty of it at times too). Sometimes there’s only a few people doing primary research and coming to their own conclusions while thousands of others just amplify these findings without thinking for themselves.

What that sometimes leads to is loud voices making statements and then everyone just sort of agreeing.

I was in this camp on Neutrl. I really didn’t know anything about it other than, I didn’t see how OTC deals could translate safely to synthetic dollar yields.

Finally we had a few calls with the team and realized we had to cover them on the podcast (coming 🔜).

Don’t get me wrong, with any new sources of yields in DeFi there’s always risk, but the team are very sharp and seem to be very buttoned up on the risk side.

So Where Does The Yield Come From?

My main misconception with Neturl was thinking all of the yield came from OTC deals, but that is far from the truth. My other one was thinking that these OTC deals would be typical 1 year lock and 3 year vesting terms (also wrong, most are 3 month deals with major protocol foundations themselves).

In reality only 10% of the the entire portfolio is in the OTC strategy as things currently stand. Here’s an example of how things could look once they’re out of beta:

As you can see from the image above there’s 3 main buckets that make up their overall portfolio:

Delta-Neutral strategies (in talking to the team these are highly liquid Blue Chip tokens)

Liquid reserves (Yield bearing Stablecoins)

Hedged OTC positions

Looking forward to seeing Neutrl go live!

What is Cap? (read this)

Cap is a really interesting new design space for a yield bearing stablecoin. If you’re curious on how it all works, we went in depth with the founder Benjamin on our podcast:

If you prefer to read, they have some excellent docs here.

The base yield for stcUSD (staked cUSD) is currently around 14.87% APY:

Also, if speculating on where the yield could go from here, I think this is a great clip from Dave the Growth Maestro at Cap Labs (clip from The Rollup):

We highlight a Cap looping strategy down below in our looping section 👀

Yield Trading

Plasma is coming to Pendle.

I think this will be a major farming opportunity. Plasma goes live 09.25.2025 🔜

Internet dropping some alpha on these Ethena YTs:

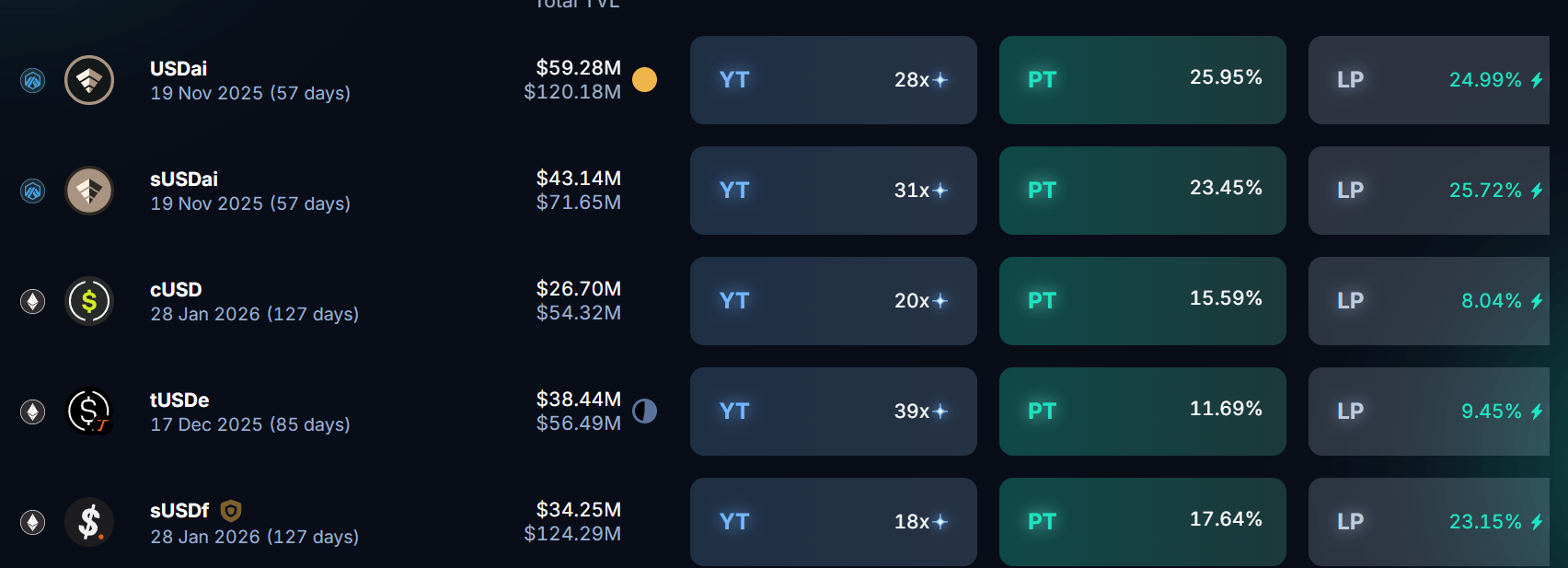

Here’s what the top yield markets on Pendle look like across Stables, BTC, ETH and HYPE (keep an eye on the maturity dates, pools with only a few days left typically show elevated yields):

Stables

17.64% - 25.95%

BTC

2.53% - 6.03%

ETH

7.61% - 9.38%

HYPE

12.76% - 25.27%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

We already talked a bit about Cap above, and as we mentioned, the base yield for stcUSD is currently 14.87% APY.

The team recently put out an excellent guide that walks you through step by step how to loop their PT asset on Morpho:

The breakdown they share in their walkthrough yields 53.9% APY on this loop 👀:

BTW current Morpho borrow rates are only around ~8% so actual looping yield at 10x is around ~78%

I recommend giving their full article a read right here.

That’s all for now, thanks for checking it out!

.jpg)