Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

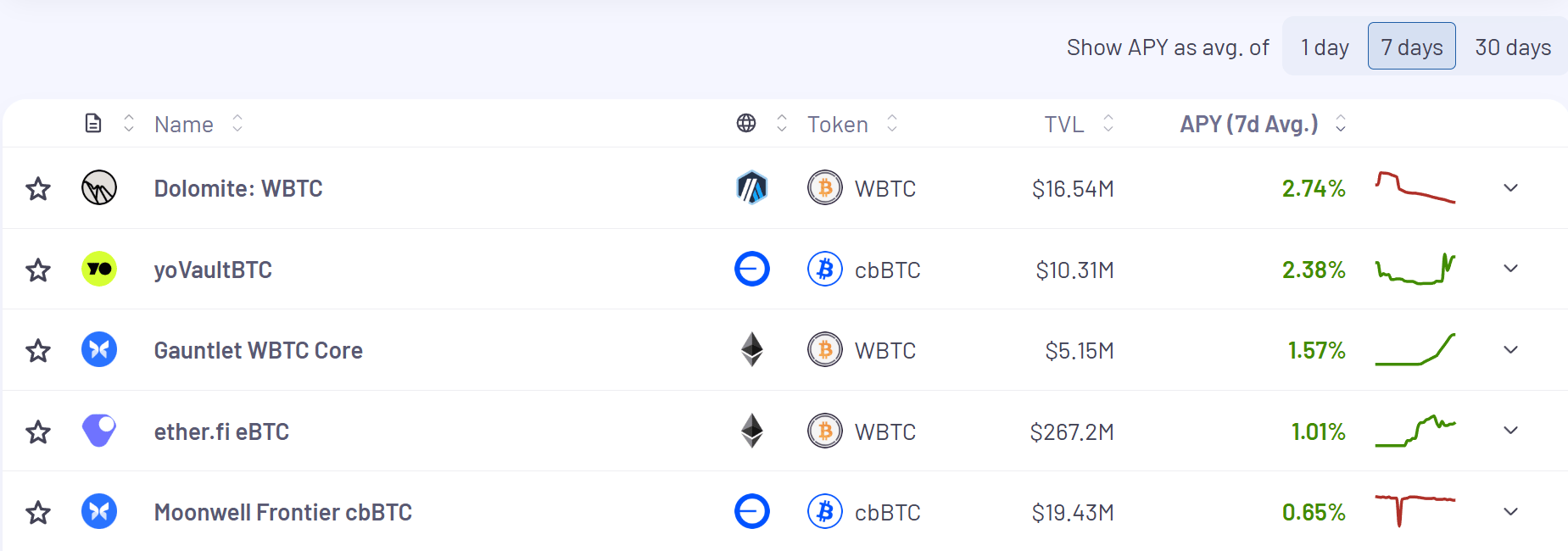

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

Avant continues to have some of the highest non-looping yield I can find in DeFi.

I keep checking up on Avant to see if the yield finally drops, but its been very consistently in the low 20% range for their senior tranche and around ~45% for their junior tranche:

This is not financial advice, but there seems to be a fairly telegraphed play that’s happening before our eyes, much like what we saw with ETH Digital Asset Treasuries (DATs):

A fair amount of this buying will be locked tokens from what I’m reading and not move the market, but some of it will be purchasing open market SOL.

I’ve personally considered putting on a small trade in advance of some of this, but I’m admittedly a very average trader (meaning bad).

Toros’ leveraged tokens are interesting because they eliminate liquidation risk and automatically adjust leverage, something you don’t typically see on perp DEXs. There’s a great thread on this from the team here:

So if you’re bullish SOL you can actually express this using a leveraged SOLBULL3X position:

Not advocating for taking on leverage, but if you do typically leverage trade on perps, this is another venue for that.

Yield Trading

I saw a few individual pieces of research that stood out to me this week that are underpinned by Pendle.

The first is this piece from GLC Research on a syrupUSDC YT strategy. It’s making the case for ~170% APY on syrupUSDC. Give it a read:

The second research piece that caught my eye was this incredible breakdown on HyperEVM points strategy. This is a very long read, but it was so good. Give it a read.

TLDR, the author makes a case for $20 per point with Kinetiq’s kHYPE points:

Here’s what the top yield markets on Pendle look like across Stables, BTC, ETH and HYPE:

Stables

20.79% - 29.95%

BTC

2.32% - 4.57%

ETH

5.74% - 13.06%

HYPE

13.3% - 23%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Rumpel consistently has some of the best looping yields on the market. They’re able to do this because they give you access to your point yield up front (weekly) so you don’t have to wait months for it at the end of a season or epoch.

The top yielding vault on Rumpel right now (Fluid under the hood), is yielding 90.62% APY 👀 :

That’s all for now, thanks for checking it out!

.jpg)