Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 30 day boosted yields this week!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

Btw look how much Midas is cooking 👀

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

Here’s the top yielding BTC vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

“I’m kinda addicted to mystery yield”

I write this article every week where I try to point out competitive risk-adjusted yields that I think are somewhat sustainable.

I think this is great if you’re sitting on a large amount of stables, but what if you’re sitting on a smaller amount and want to put those to work while still giving yourself a shot at upside?

Grant from Blocmates articulates this well:

I will endeavor to sprinkle in more of these opportunities into this section as opposed to just straight forward vanilla yields.

For a bit more context on this thinking (and yes this is nothing new), give this a read by Rami - he’s one of my favorite smaller accounts who shares some incredible insights from his onchain strategies (I couldn’t say it any better than this):

The thing Rami nails here is that our industry consistently serves us up opportunities where we can take 3 - 6 month duration bets (or less) and achieve outsized returns.

The problem is this takes patience, a bit of upfront due diligence and comes with more uncertainty.

Also, because none of us have infinite capital there’s always opportunity cost, so you want to be honing in on high conviction opportunities.

The man who chases two rabbits, catches neither

My personal rule of thumb is just to believe in what I’m using at the very least. Then if I don’t get the outcomes I want it’s a bit easier to swallow and I likely just need to look at my own internal process more. If you spend time on things you don't believe in and they turn out to be wrong, you'll feel even worse for wasting your time.

My Strategy

Its really nothing novel and probably DeFi 101 for many reading this but maybe worth sharing.

I have a home base (Fluid + Felix) of core assets I believe in:

BTC, ETH (Fluid) and HYPE (Felix)

I borrow stables against these collaterals and use those stables to try to find low risk high upside protocols to use that are pre-TGE.

The biggest part of my portfolio is angel investing, but not relevant here (however, if I miss on an angel investment but still really want to get involved, the below strategy is what I use)

I’m actually trying to limit how many protocols I’m trying this with to maybe 3 - 6 per year - focusing on quality teams (sometimes I’m totally wrong)

I try to find great entries on protocols that also have Pendle YTs

I like things that I think are overlooked early on (EtherFi season 1 when few people knew how Pendle YTs worked)

For example, this year I’ve mainly played around with Resolv, Spark and Kinetiq

Results on these haven’t been as good as I’d hoped:

Resolv - I almost lost money, but by participating in S2 as well I will likely be up around 25% (by crypto standards that’s bad ROI for what will be almost a year worth of activity - albeit very passive)

Spark - I was in great position but sold my Pendle YTs near the bottom (I almost never do this, not sure why I did here) and people who held did incredible. I still achieved around 50% ROI for around 3 months (left a lot on the table though as some did 300% - 500% on their money here)

Kinetiq - I believe I’ll find out soon as the KNTQ token might go live on October 16th. I’ve managed to get into the top 300 “Diamond” tier on their kPoints campaign by essentially holding an asset I’m already bullish on + some decent YT activity. KNTQ is one I intend to hold as I’m quite bullish on this team going forward especially if it launches in a bit of a down market.

+ A few other smaller positions of HyperEVM teams I’m bullish on (Felix and Liminal)

A few other notable examples:

2023 EtherFi - Around 840% ROI - heavy YTs + spot

2023 Eigenlayer - Around 500% - heavy YTs + spot (both Eigenlayer and Etherfi were sort of linked)

2024 Usual - 1400% ROI - all via YTs (great entry, but did not go nearly big enough

2024 Hyperliquid - I’m not even sure what this ROI was but I did a bit of trading and hit the biggest airdrop of my life

2025 Plasma - I didn’t get involved here, but even pre-deposit people did really well here with a relatively short lockup on their funds.

The point of this isn’t to brag (because honestly many have massively outperformed me anyways). But more to show how there’s other ways of attaining “yield”.

If you’ve got a decent capital base in some strong majors you can leverage that further by taking some calculated bets on up and coming projects.

I typically buy YTs, but those aren’t for the faint of heart. However, if you don’t do YTs and are just using stables, your only downside is smart contract risk/exploits + the opportunity cost of not clipping 10% - 20% DeFi yield with that capital elsewhere. But as I’ve shown above, it’s fairly easy to beat that in many cases with some level of curation and due diligence.

What Am I Looking At Now?

Something that fits a lot of the criteria I’m looking for is the Neutrl pre-deposit vault. If you’re reading this, it just launched today October 15th and you can find details here.

What we know:

$50M deposit cap - USDT (no directional exposure)

2.5 month lockup

Earn yield (likely 20% - 30% based on Neutrl beta track record)

Earn Neutrl Points

450,000 XPL incentives

IMO, the team is high caliber - check our interview with founder Behrin here

(We may be biased as we’re now working with the Neutrl team)

Like I said this is the sort of criteria I’m looking for to deploy stables as the underlying yield should be very solid and the cherry on top is if Neutrl really takes off, the points will be nice as well and the XPL incentives are just another added bonus.

Again, this is just another way to get upside over and above vanilla yield.

Some others I’m looking at:

Currently I’ve just started Solstice, but apparently they will be launching on Exponent (Pendle of Solana) soon and I think that could be interesting.

Curious what others are looking at! DM me or post in the comments below!

Yield Trading

Here’s what the front page of DeFi yield looks like on Pendle this week across: Stables, BTC, ETH and HYPE markets:

Stables

28.4% - 41.95%

BTC

1.33% - 3.67%

ETH

4.83% - 13.55%

HYPE

12.02% - 18.95%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

(use our referral code “edge” for extra flares on Solstice)

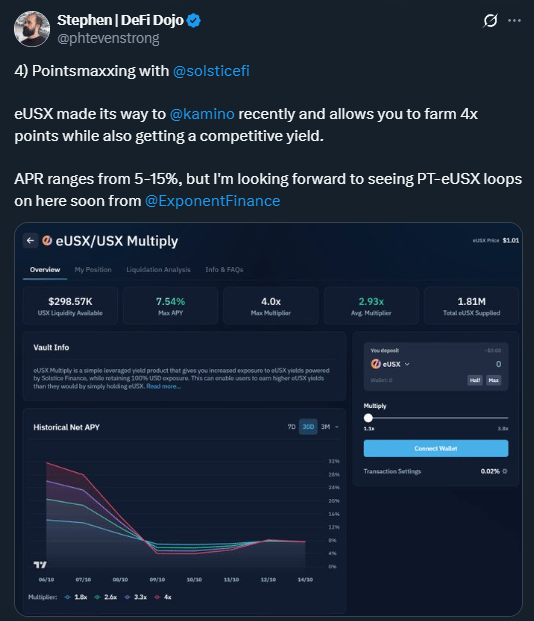

If you’re bullish Solstice you can take your eUSX and earn solid underlying yield while getting leveraged points.

Stephen from DeFi Dojo explains this opportunity well:

That’s all for now, thanks for checking it out!