Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 7 day boosted yields this week!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M In TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M In TVL

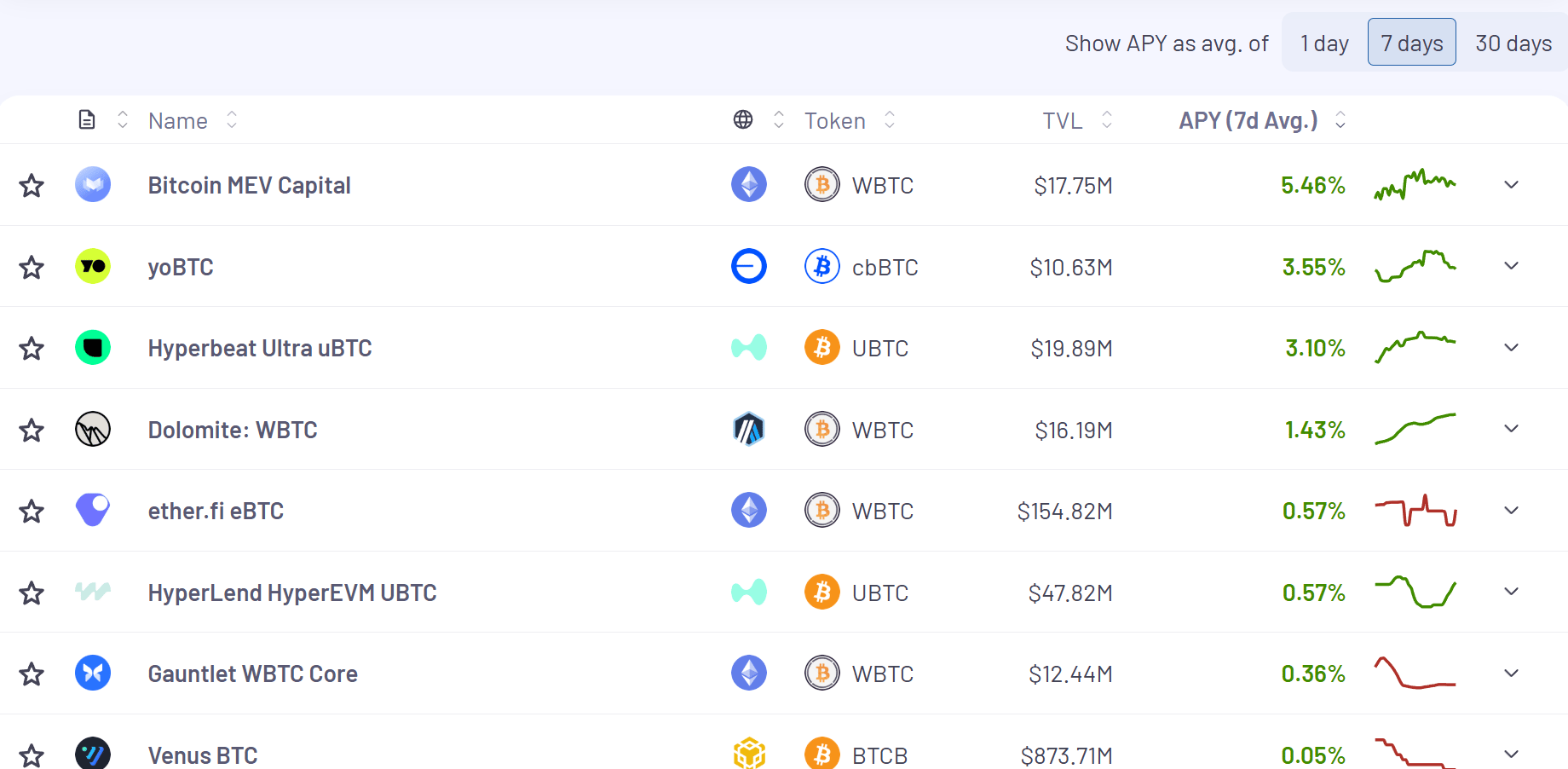

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M In TVL

Stream Finance

In case you haven’t heard, there’s been systemic capital flight from Stream Finance as more of their opaque practices have come under scrutiny.

Last I checked, there still hadn’t been any public communication from the Stream team addressing what’s going on.

I’m glad we never once posted about Stream Finance on X or featured it in YOTW.

About four months ago, someone whose DeFi knowledge I trust warned me to stay cautious. Then, about two months ago, a protocol whose risk council I sit on discussed tapping into Stream yields. The group quickly poked holes in the proposal, and I’m glad it didn’t pass the council’s due diligence review (for context, the protocol was InfiniFi).

There could still be some possible contagion risks elsewhere in DeFi.

Btw, no affiliation whatsoever to this team, but I’ve followed them on X for a while and finally went to their website. It’s a great resource for anyone that’s looking into to stablecoin based yields, risks and growth metrics - check it out here.

This is a nice passive one for ETH if you’re bullish on the future KAT token.

DeFi Dad breaks down all the important components here:

Yield Trading

CBB has become a bit of a polarizing figure on the timeline lately. Their delivery might not always be the most tactful when explaining points or critiquing parts of the industry, but overall, they’ve been sharing solid advice and are directionally right on many things.

This post for example holds a lot of truth and is pretty much my preferred way to get yield:

And if you want to take the above strategy to the next level, you can try to get all the multipliers to make the most of your dollars. Many protocols add in their own multipliers and if you don’t do it you’re leaving money on the table.

Here’s what that looks like:

The drawdown to the YT strategy is that when you miss you can take a loss on your principle, which is less likely to happen with pure stablecoin yield farming.

As I mentioned in a YOTW a few weeks back, I probably only do about 6 - 8 serious YT farms per year.

I’m currently not in any YT positions right now.

I just feel like there’s not enough high quality teams that are worth it to spray and pray more and really, you’re taking a massive bet on the team and their execution when entering a YT position on Pendle.

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

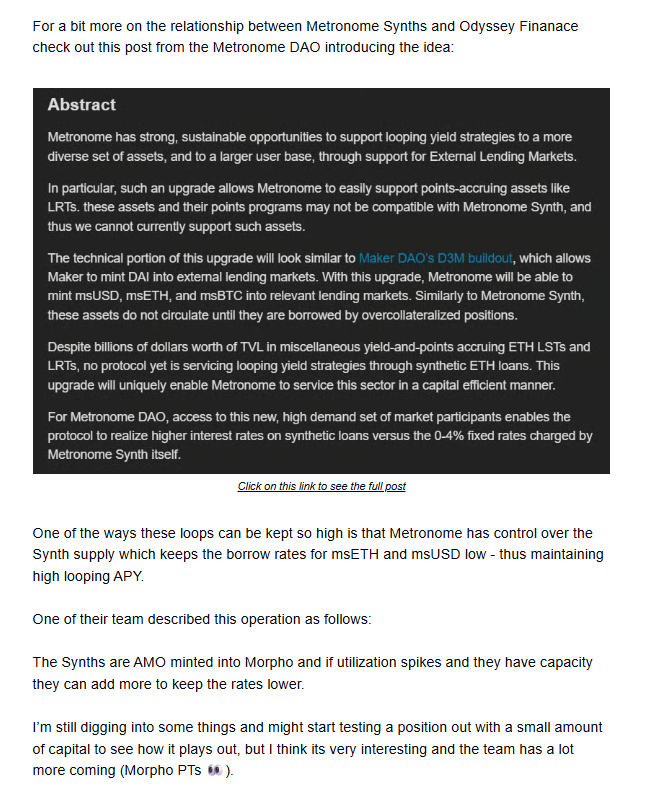

We’ve written about Odyssey a few times as we’ve known a few members of their core team for many years and they have some of the best looping yields in DeFi.

Two of their markets look interesting to us (but as always please do your own risk analysis):

Synth Vesper vaFRAX - 106.7% Max APY

and

Euler v2 K3 Capital sUSDai - 80.83% Max APY (also entitles you to leveraged points 👀)

A few things we should call out is that the Frax loop has a synth msUSD debt token which is a big driver in why this loop can be done very close to max. We wrote about synths below in a previous Yields of the Week:

As for the sUSDai yield source on the second position, there’s a an incredible writeup on the risks for their USD.ai pool right here 🚨

That’s all for now, thanks for checking it out!