Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

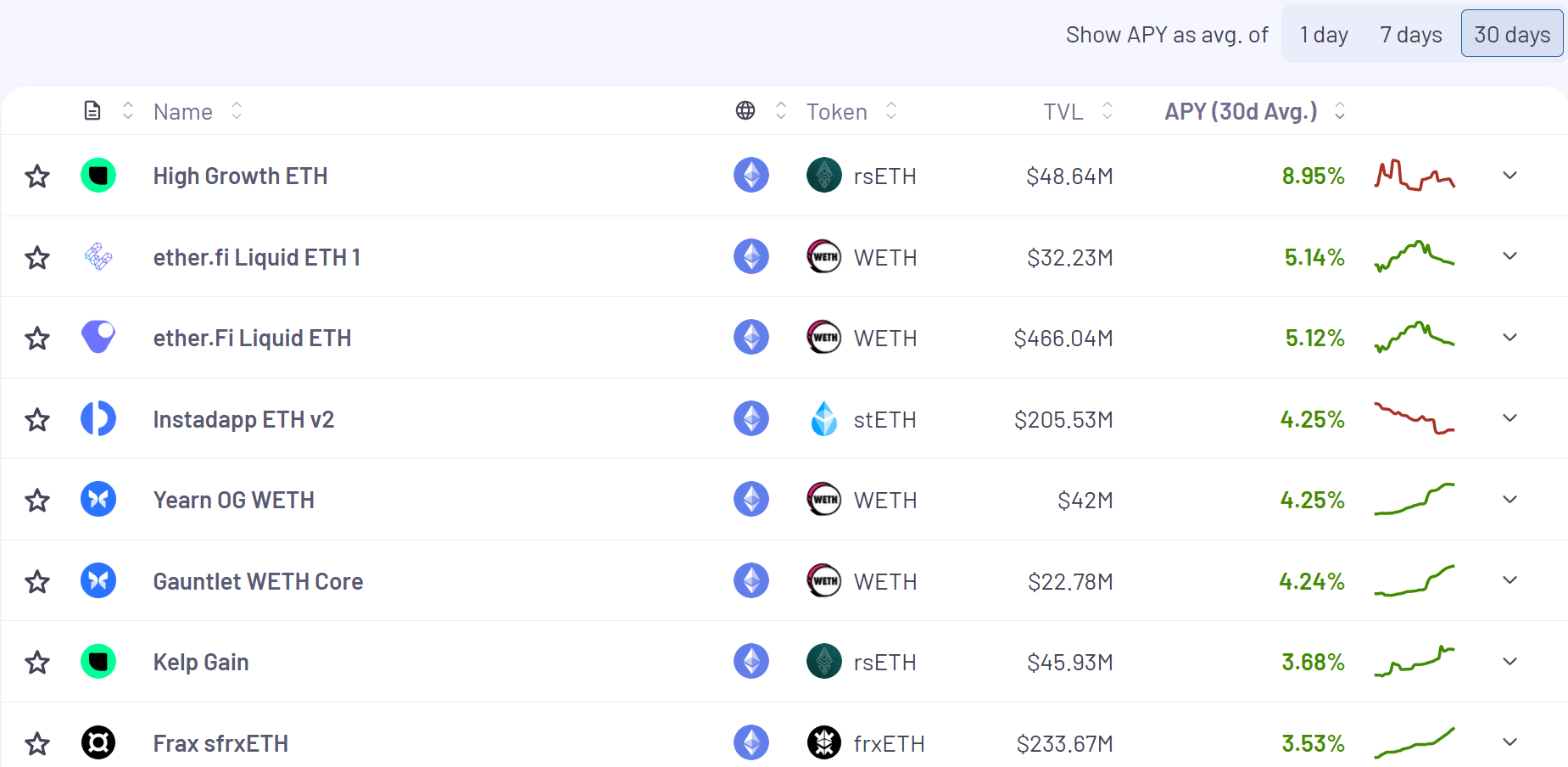

ETH & BTC Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

Here’s the top yielding BTC vaults (real yields) for the past 30 days according to Vaults.fyi:

Min $20M TVL

The BTC yield has really vanished

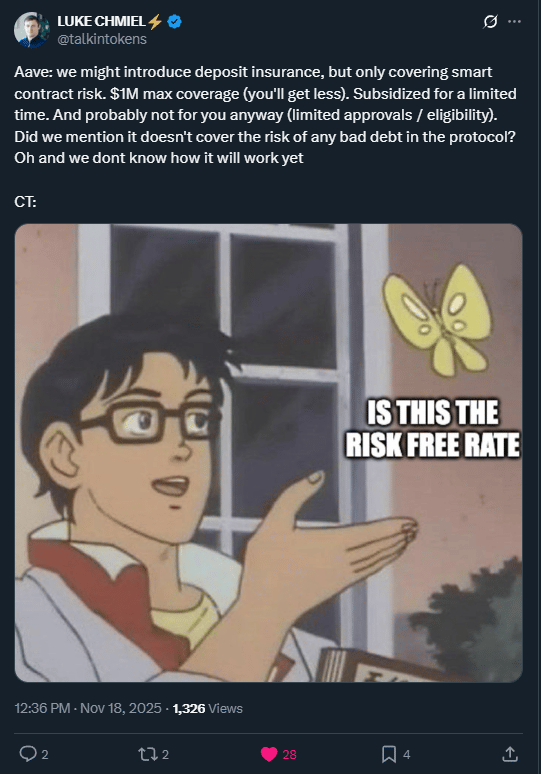

Some of the coolest news out of DeFi this week is Aave’s new app that just launched on IOS.

Aave seems to be coming straight for the banks with this endeavor by offering up to 6.5% yield on stablecoins.

One of the main components that people really latched onto was the balance protection up to $1M. This number dwarfs what many FDIC insured offerings provide.

Meaning, many thought this is all “too good to be true” (and it may turn out to be as we learn more, but so far so good). However, here’s what Marc Zeller had to say:

Hopefully more details emerge around this “regulated subsidiary” and what exactly is covered.

And here’s a spicier take:

You can join the waitlist for the new app here

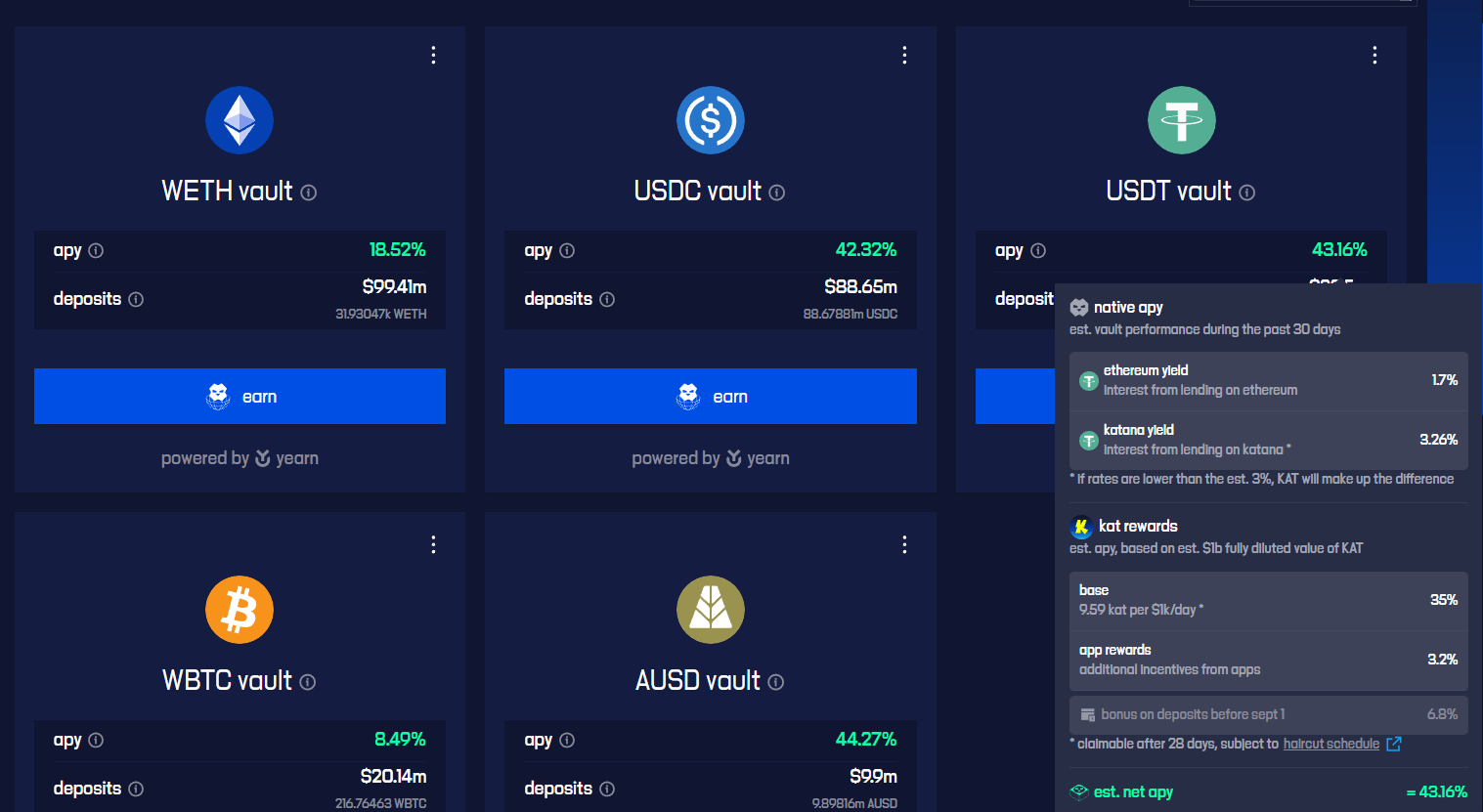

We’ve been highlighting Katana more lately, and recently broke down how their vaultbridge mechanics were incentivizing the borrow side on Morpho, effectively letting you get paid to borrow.

This new epoch will incentivize lenders and borrowers:

Additionally, their passive “earn” vaults are great if looking for yield + upside (especially if you’re bullish on KAT longer term):

Thanks to our sponsors for making it possible to share this content for FREE!

I wrote a piece recently called DeFi 101: Back to Basics. It was inspired by some of the recklessness we were seeing in DeFi and subsequent blow ups (Stream Finance).

One thing I called out in the piece was that: proper documentation, transparency dashboards and audits are mandatory minimum requirements before anyone should deposit $1 into a DeFi protocol.

Cap checks the box on all of these and delivers them all at a high level. For instance check out Stephen’s post on their audits:

Nothing is ever a guarantee in DeFi. Let me repeat that. Nothing is ever a guarantee in DeFi. There is always inherent risks.

The point is, you can look to certain attributes/industry standard practices that at least make you feel a little more at ease.

Cap to me, is one of the better risk adjusted yields in DeFi (if wondering what the “risks” are they go over them in their docs here).

Even as yields have compressed across DeFi, they are maintaining ~10% yield on stcUSD:

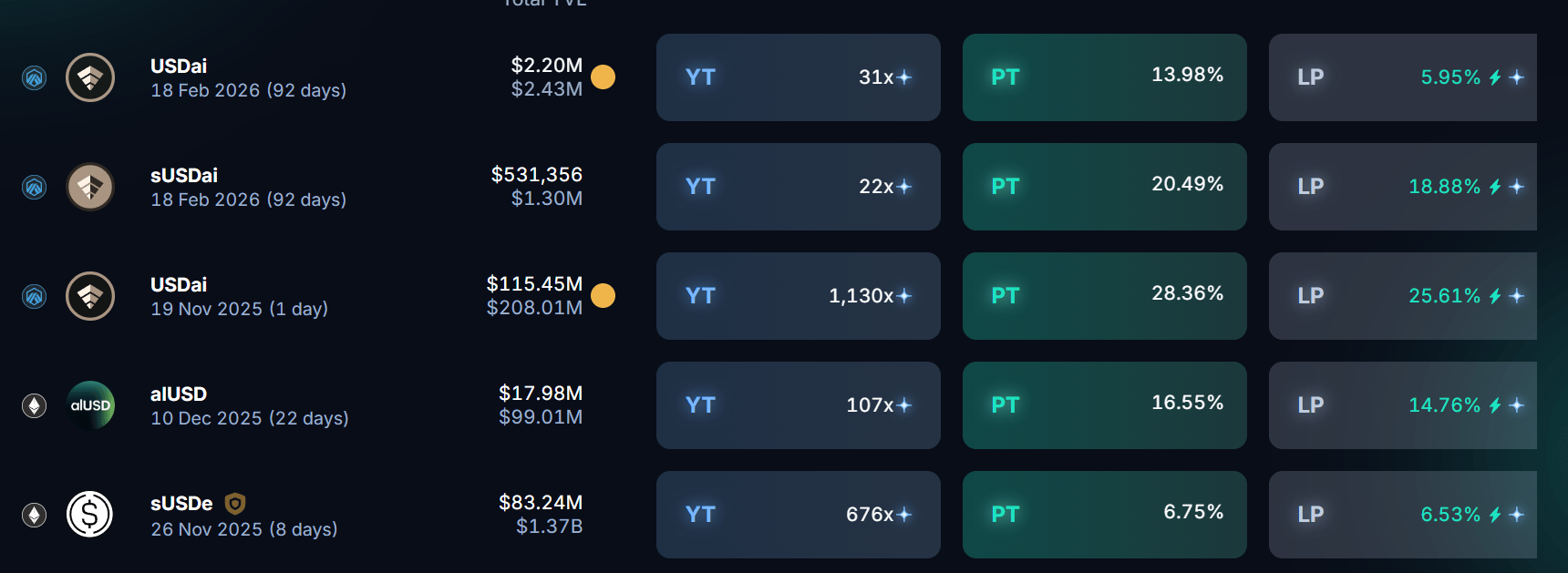

Yield Trading

Here’s what the front page of yield on Pendle looks like this week:

Stables

6.75% - 28.36%

(sorted by deepest liquidity)

BTC

1.14% - 2.17%

(sorted by deepest liquidity)

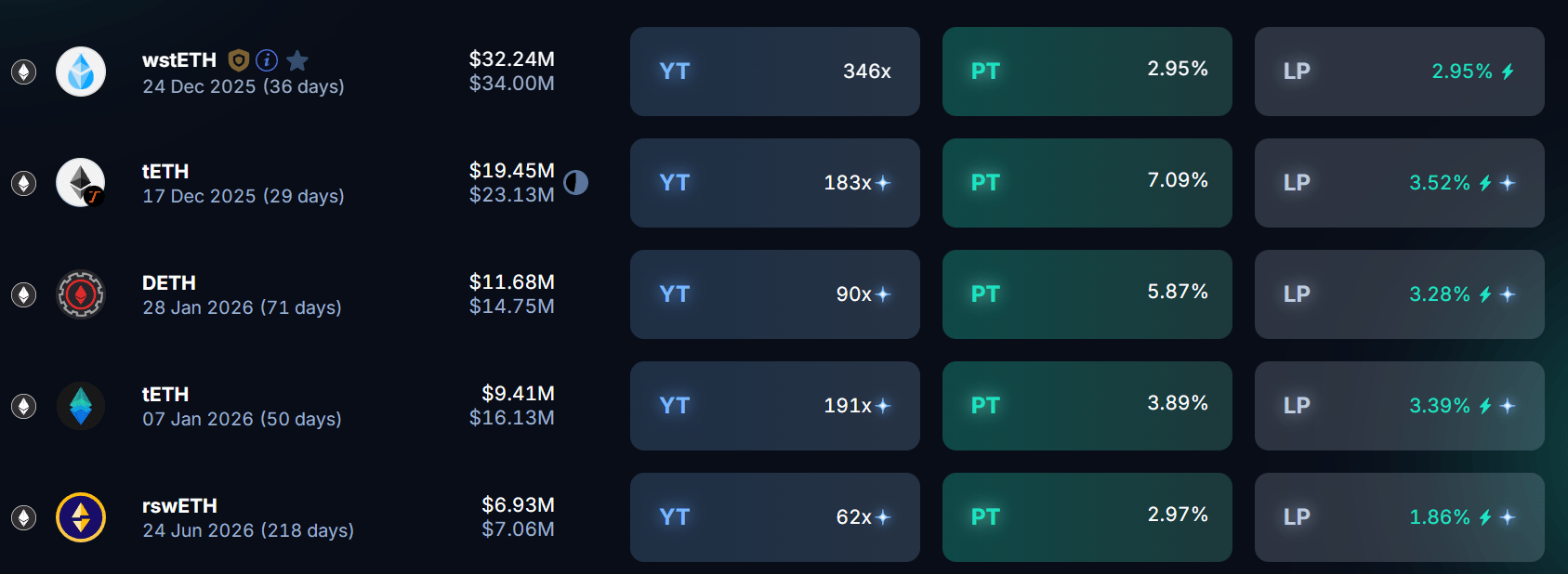

ETH

2.95% - 7.09%

(sorted by deepest liquidity)

HYPE

2.98% - 7.13%

(sorted by deepest liquidity)

Air Drop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

My farm of the week has to be Glider Fi. It launched recently on mainnet and it’s still early to farm.

It’s backed by strong names like Coinbase, A16z, and GSR, and the founder Brian is genuinely brilliant. He’s built an automated, multichain, auto rebalancing portfolio protocol.

They use AI with auto rebalancing to help increase profits for more advanced trading strategies. It also abstracts fees and gas, keeping things simple for the user. I love it.

How to farm it?

> Create a portfolio (in the Glider app - you can use my referral here)

> Choose an asset to add to portfolio (I choose ETH or stables, but can get funky)

> Select it, and deposit the chosen assets

> Earn 1 point per $1 deposited per 24hrs that it's held in the portfolio.

(You might also get a 2-1 as this could qualify you for Base airdrop from having TVL on chain - but just speculation)

I would recommend all interested to watch this podcast with the founder - here

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!