Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable, unique and risk-adjusted. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s report.

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Back To Basics

We’re trying something a bit different this week. In light of the Stream Finance situation, we wanted to take the opportunity to revisit a few crypto 101 risk principles that everyone should know and actually practice.

This may sound obvious and even elementary, but the number of “sharp” people who got caught up in the Stream fiasco suggests otherwise, or maybe they knew the risks and ignored them in pursuit of shiny yields anyway.

With that in mind, here are a few simple things to look for as a starting point when deciding if a protocol is worth considering further:

Documentation

Transparency Dashboard (where is the yield coming from)

Audits

IMO the bar is much higher than these three things, but these are the mandatory minimums. If a project doesn’t have all three, it’s a total red flag for me and I usually move on.

Let’s walk through what this looks like in practice. We’ll use Maple as an example throughout.

Documentation

What constitutes “good” documentation (docs)?

To me, there should be no mystery functions within a protocol. You should be able to visit the docs page and have every question answered clearly.

For example, when I was looking through Maple’s transparency dashboard, I realized I wasn’t sure how they handle liquidations. So I went over to the docs, and as expected, they have a clear procedure that explains exactly how it works:

You should be able to tell good docs from bad docs almost immediately. There should be an abundance of information and nothing should feel hidden or vague.

Another thing I personally like to see is a section on “Risks.” It’s great when a protocol explains how things should work under optimal conditions, but what about the edge cases? What keeps the founders up at night?

It’s reassuring when a team has clearly identified potential risks and outlined how they plan to mitigate them.

Transparency Dashboard

Vaults and onchain hedge funds (some people like to call these yield bearing stablecoins) have taken us to a whole new level of “where does the yield come from?”

This question became a popular mantra during the DeFi Summer era, when food coins and governance token yields were everywhere. Inevitably, it turned out that “you are the yield.” We had to learn the hard lessons of impermanent loss and the fleeting nature of inflationary governance token rewards.

So what has changed?

A lot has changed, but also not a lot has changed.

We’ve gotten better at grift in some ways. The “fake it till you make it” approach has been taken to the extreme, making things look reputable until you start digging deeper. We’ve put a suit on and made everything appear above board.

That said, I’m being a bit pessimistic. The industry has leveled up massively. But we’ve also added layers of complexity under the hood, and that complexity needs to be properly understood and accounted for.

We’ve started to realize the vision of composable money legos, which is incredible, but it also stacks risk and can turn into a house of cards if not managed carefully.

Transparency dashboards are now essential to assess where all sources of yield are coming from. Once again, “don’t trust, verify.” We should always be able to instantly audit and verify both onchain and offchain positions.

So what does a good transparency dashboard look like? Once again, check out Maple’s dashboard for SyrupUSD. They call theirs “Details”:

You can find every active loan and look at which collateral asset is backing it (including links to wallet addresses)

All of the loan collateral is instantly verifiable

Maple’s transparency dashboard is a great example of what I think all DeFi teams should be striving for.

It’s no longer a “nice to have.” After recent events, it’s moved firmly into the category of mandatory. In fact, going above and beyond with radical transparency can now be a real selling point that builds trust and sets a protocol apart.

Audits

Audits are another non-negotiable. You simply need to have them. Are they perfect? Absolutely not, but having multiple audits is far better than having none.

There are a lot of auditors in the space, and deciding who’s the best is highly subjective. Many also specialize in specific areas or types of protocols.

I polled two Telegram chats I’m in that include builders, risk curators, and DeFi power users to get a rough sense of their favorite auditors. Here’s a list of the ones that came up most often, in no particular order (assuming I’ve missed some good ones):

Trail of Bits

OpenZepplin

Spearbit

Code4arena

Dedaub

Hexens

Omniscia

Chainsecurity

This list is by no means exhaustive.

While I don’t put too much weight on auditors alone, seeing some of the names above can give you a bit more peace of mind. In general, it’s essential that fresh eyes review the code beyond just the protocol team, and ideally there should be multiple audits.

I’ll use Maple as an example again. Here’s their audits page within their docs, located under: “Security”:

On top of audits, their security page also shares their bug bounty and other monitoring/security features embedded in the protocol.

If you were counting, Maple has had 14 audits plus a bug bounty program since its inception.

I’m not saying this is perfect, but it’s great to see all of their audit history collected in one convenient place.

If anything, it reinforces their commitment to safety and security. It’s hard to look at this and come away feeling like they aren’t doing enough on the audit and security side, at least that’s my opinion.

End of Session

Once again, I view Docs, Audits, and Transparency Dashboards as non-negotiable mandatory minimums for DeFi. Having these three things isn’t everything you need, but it’s the starting point. This is table stakes for DeFi, and it really shouldn’t be new:

For many of you this has probably been painfully obvious, but I think some people (including myself) needed a reminder of the risks that are inherent in DeFi and some steps to help mitigate them.

How Can we Make This Research Easier?

LlamaAI

I’m not affiliated with the DefiLlama team, but I had a chance to use LlamaAI a bit ahead of its release, and it’s been incredible to see how far it has come. I’ve been giving some casual feedback and helping with bug testing along the way.

When I first started using it, it was pretty clunky and didn’t always produce what I was looking for. Since then, the transformation has been really impressive.

I can easily see myself integrating this into my research process, and I think it could be extremely useful for many of the topics we discussed above.

For example, I asked LlamaAI something fairly vague:

What tokens have had the worst price but have growing revenue numbers over the last few months

The first output gave me a perfect list, but it was sorted by market cap, so I asked it to redo the list sorted by FDV instead.

I then prompted it again to filter out anything below $5M FDV, and the result it produced would have taken me at least a full day to build manually, but it did it in seconds.

If you’re curious what the output looked like, check it out here.

A Few Risk-Adjusted Yields

I think one of the big winners in all of the DeFi wreckage has been Maple.

We’ve kind of gone over this but:

✅ Docs

✅ Transparency Dashboard

✅ Audits

Their risk-adjusted 6.8% yield on syrupUSD now stands out. You can find higher yields in DeFi, but the further out on the risk curve you go, the higher the chance you have of losing your principal (IMO).

The goal is for DeFi to feel less like this:

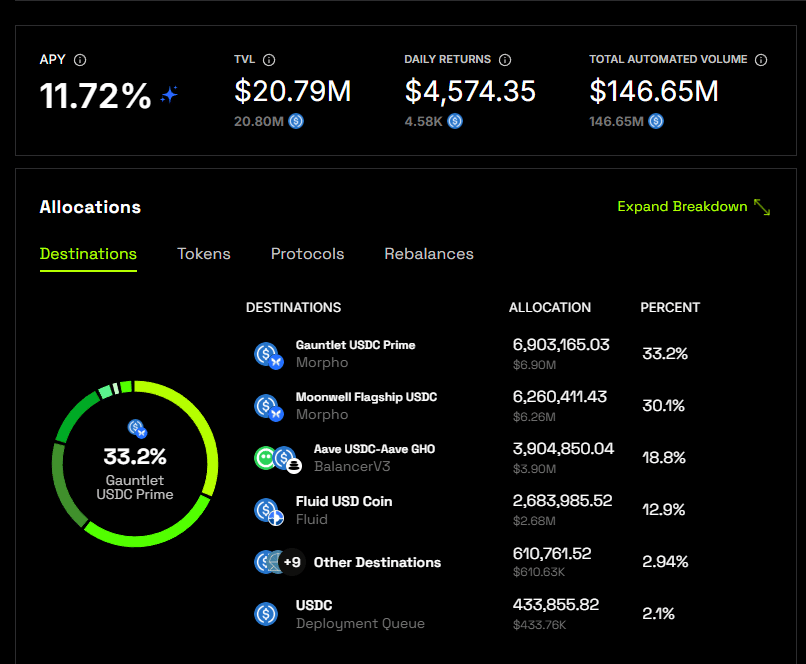

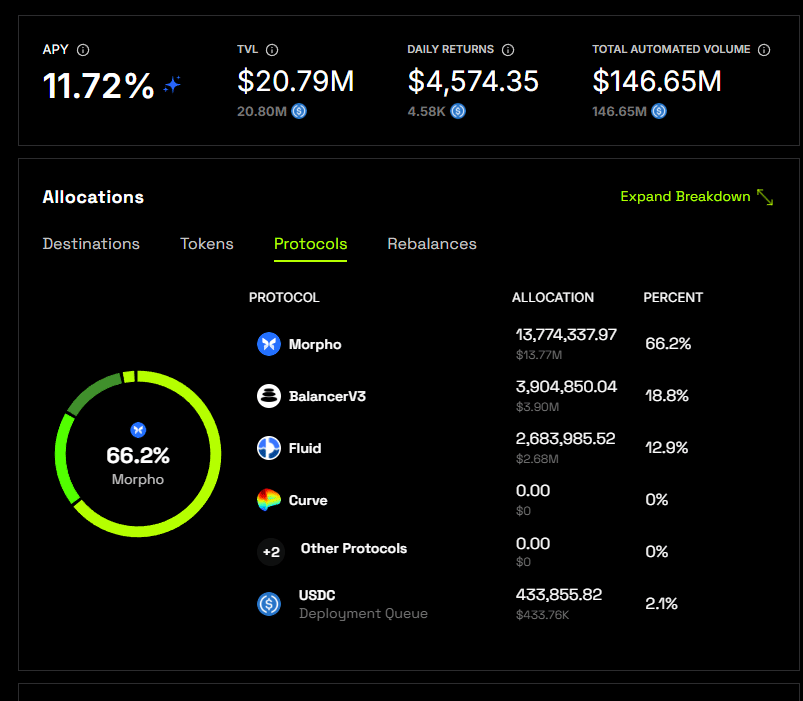

Auto Finance (Formerly Tokemak)

Auto Finance is a protocol I followed closely well before I got into crypto full time. Since then, it has gone through a major iteration.

I have a bit more confidence in Auto partly because I was close to one of their core contributors during its development. I had a front row seat to peek behind the scenes while the new version was being built.

✅ Docs

✅ Transparency Dashboard

✅ Audits

I wanted to include Auto Finance because transparency is built right into the core of the product. It’s fully onchain and you can actually see the rebalances and complete end to end flow of funds in the system:

You can easily see where all the funds are being allocated to

At a glance see all token exposure

You can vet all the protocols you have exposure to

Track every rebalance

I think Auto Finance is a model for what a DeFi protocol should strive to be (I hold no TOKE and have no affiliation to the team other than I like them and the product).

✅ Docs

✅ Transparency Dashboard

✅ Audits

InfiniFi has also held up well during the recent DeFi turmoil (I am an investor, so I’ll let you decide if that affects my opinion).

You can instantly verify where all the TVL and yield are coming from within the protocol. Check out their transparency dashboard under the stats page: https://stats.infinifi.xyz/

They recently added DeBank links as well so you don’t have to be an expert at reading Etherscan.

On top of this transparency the protocol has a risk council where all yield opportunities are heavily vetted. I actually wrote about this in last week’s YOTW:

Then, about two months ago, a protocol whose risk council I sit on discussed tapping into Stream yields. The group quickly poked holes in the proposal, and I’m glad it didn’t pass the council’s due diligence review (for context, the protocol was InfiniFi).

Also some obvious multi-cycle heavyweights that deserve a mention here for standing the test of time are: Sky (Maker), Spark and Aave (and there are more of course).

That’s all for this week!

It felt a bit tone deaf to write my usual Yields of the Week report this week. We always strive to showcase what we believe are the best risk-adjusted yields in the industry, but at times I think even we can focus a little too much on the yield side of the equation, glossing over the risk component that should always be front and center 🫡