Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Before we begin…

This week we’ll be looking at the best 7 day avg non-boosted yields (no incentives).

Yields are back!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

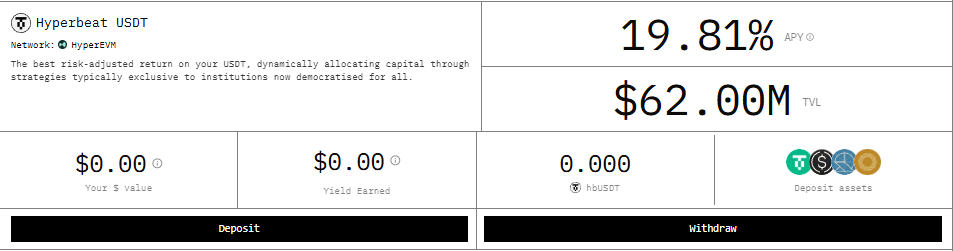

Bonus: I’ve had a chance to meet with the Hyperbeat team and talk about their long term vision and it’s really impressive (more on Hyperbeat later in this piece). They have a really nice yield on their USDT vault. It’s currently yielding ~20% APY:

ETH & BTC Yields

Here’s the top yielding ETH vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

Bonus: Here’s a thread from DeFi Dad from earlier in the week on some risk-adjusted ETH yields (no leverage) he has his eye on:

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (non-boosted)

The link to this filtered table above is here

What I’m Doing On HyperEVM

I wanted to share a few things that I’m finally doing on the HyperEVM.

I’ve only just moved liquidity onto HyperEVM in the last few days so if you think you’re late to the party…well that makes two of us 😂 (I think it’s very early)

I’ve been patiently waiting for Kinetiq’s kHYPE to go live. I should have been deployed into kHYPE last week, but I have an embarrassing admission.

I unstaked from the validators I was supporting, but didn’t realize the 7 day wait time was for transferring HYPE from Staking side back to Spot (not from unstaking from the validators). Basically I had to wait an extra 7 days once I realized my error. However, I’ve told myself this gave me an extra 7 days to monitor for security issues or exploits (thankfully none).

So far I’ve:

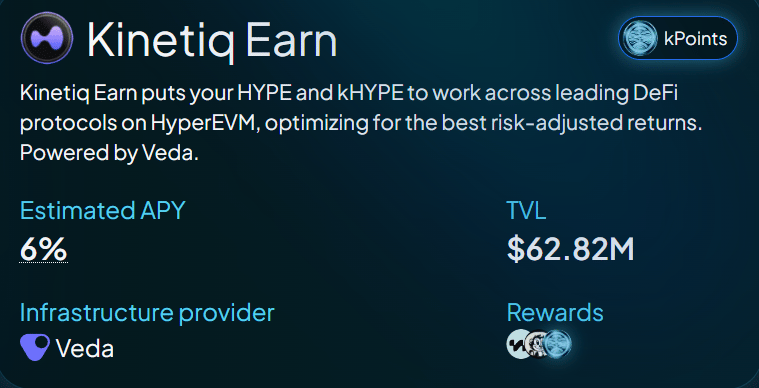

Staked all my HYPE on Kinetiq and converted to kHYPE (usable in DeFi) which yields 2.11%.

Moved all of my kHYPE to Felix where I’ve deposited into the vanilla vault and am borrowing HYPE against my kHYPE collateral (paying a hefty 12% borrow rate).

Taking my borrowed HYPE and staking it again for kHYPE and depositing into the Kinetiq Veda vault that’s farming 6% APY + airdrop rewards from other protocols.

This is the Kinetiq/Veda vault with rewards from: Kinetiq, Felix and Hyperlend

This isn’t +EV from a pure yield perspective by any means, but I’m doing this to try to get exposure to airdrops of the 2 protocols that I see being the major players in the HyperEVM ecosystem in Kinetiq and Felix.

One other thing I’m really looking into is once again from Hyperbeat. They are teaming up in all the best ways with Ether.fi to run a similar style playbook that they ran, but on HyperEVM.

Check out this thread from Stephen from DeFi Dojo on their beHYPE vault:

Right not this vault is about 1/3 full with ~$35M in TVL and I think they are capping it around $100M.

Yield Trading

Due to the way Infinifi adds duration and handles yields, there’s a potential opportunity here 👀

OK so what does this semi cryptic tweet above mean and how do we tie this back to siUSD YT on Pendle?

Infinifi has a partnership with Ethena where they are maintaining 51% exposure to Ethena assets. This is a very symbiotic relationship, but out of the gate the Ethena yields have been lagging a bit because funding rates have been down.

See below the current basket of Ethena PT assets have been between 7.32% APY and 11.28% (~avg 9.6% APY):

You can look all this information up on the Infinifi stats page and these positions are found under “illiquid” section.

However, as animal spirits have come back to crypto, a lot has changed in the last few weeks and sUSDe has shot up from lows of ~5% to 12% while the PT assets have gone up to 15%+

Why does this matter right now?

Infinifi allows you to get exposure to all of these Ethena yields while providing you with auto rollover so you never have to manage PT maturity dates.

There happens to be a lot of Infinifi TVL maturing in the next 6 - 7 days (and more big ones mid August) and then Infinifi will be reallocating to Ethena PTs with much higher APYs (most likely).

Essentially July 30th - August 14th will see a little over half of the Infinifi TVL turn over to new and higher yields ($30M+).

There’s two forms of iUSD on Pendle right now: iUSD and siUSD:

The iUSD YT just offers points (no yield) whereas siUSD YT offers points + yield (shown below):

Note: the iUSD version gets double the points (4.5x) but no yield

At the current siUSD YT pricing, I actually think its pretty fairly priced for value of points + yield.

However, we’ve outlined above a coming change where I think yields are about to jump materially for Infinifi and the siUSD YT will likely lag that coming move.

I wouldn’t be surprised to see the yield on these siUSD YTs jump by 3% which could have a material impact on the YT pricing.

Not financial advice, but one could make the case that siUSD YTs could be a value right now ahead of this major rollover for Infinifi 👀

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

16.33% - 21.15%

BTC

2.35% - 3.65%

ETH

4.42% - 7.66%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

OK this loop below combines two great protocols. It utilizes Fluid under the hood and Rumpel to give an extra boost.

Basically Rumpel takes the extra Ethena points yield and converts it to USDC yield rather than points.

For example, I’ve included an image of a sUSDe x GHO loop on Fluid below that’s yielding an impressive 64.49% Max APY:

The above loop also comes with Ethena points, but these aren’t instantly redeemable unless of course you do all of this through Rumpel.

If you do this same loop via Rumpel you can stream those points into USDC and thus have a more bankable APY. In this instance you get almost 10% more APY at 74.79%:

Here’s what that breakdown looks like

The combination of Rumpel x Fluid is very synergistic and powerful. Especially for those of you that want to bank all your yield sooner rather than waiting many months in some cases.

That’s all for now, thanks for checking it out!

.jpg)