Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL (powered by vaults.fyi)

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $20M TVL

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $20M TVL

ETH yields are incredibly strong right now

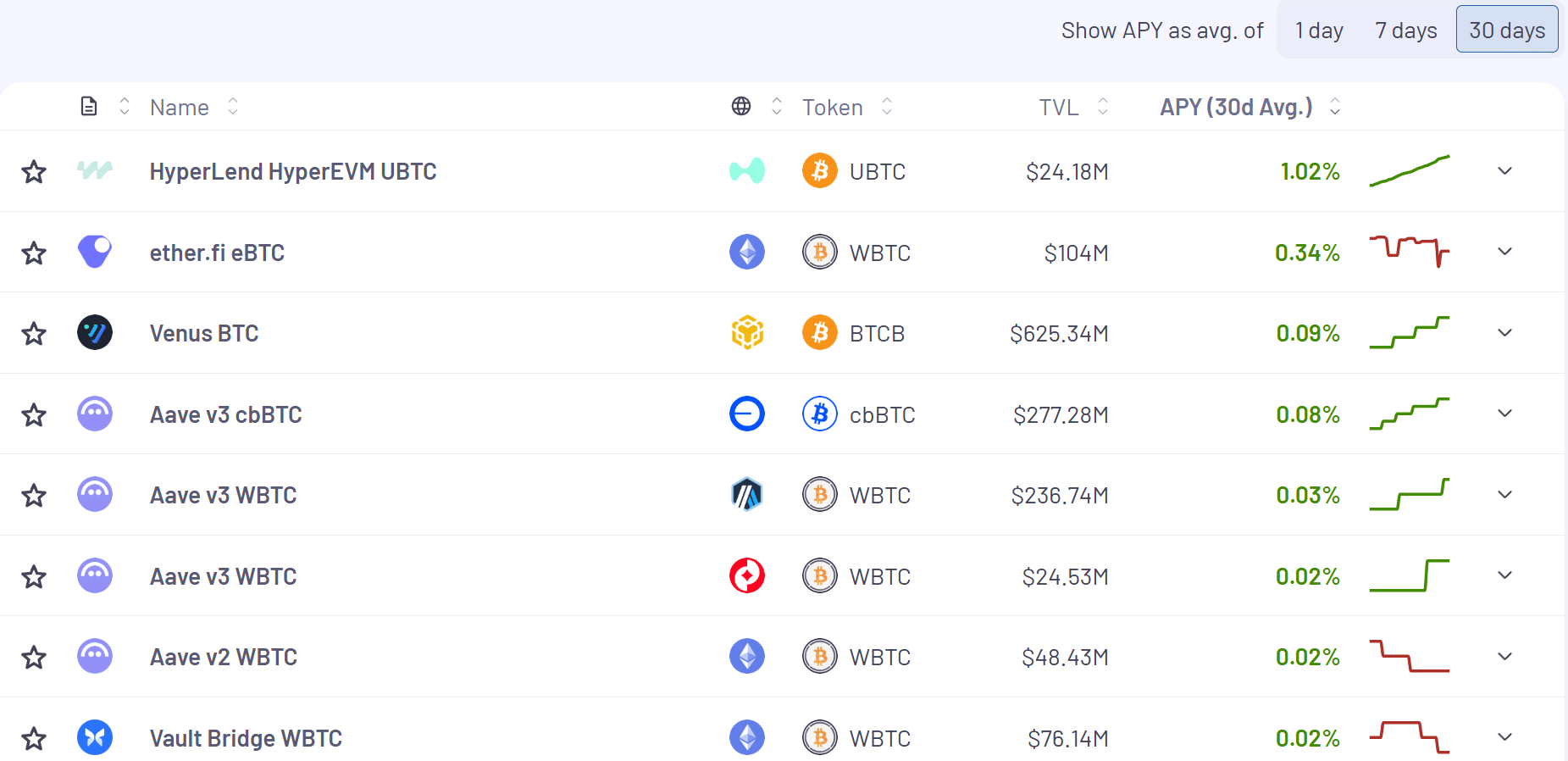

BTC Yields

Here’s the top yielding BTC vaults (real yields) for the past 30 days:

Min $20M TVL

We’ve been trying to highlight teams that are taking strides to move the needle on transparency in DeFi. We recently wrote up Accountable (podcast coming soon) and this week we wanted to emphasize the work that Credora is doing.

Recently their risk ratings went live on the Morpho app:

There’s currently 15 vaults on Morpho that have achieved an “A” risk rating:

While all of the above are currently rated “A,” my understanding is that 90% of the rating process is automated. This means risk ratings can change dynamically and react to live market data, which actually makes them more valuable in my opinion.

In other words, don’t be surprised if some of these change from time to time. This is far better than a static quarterly risk audit, as the system is calculating risk in real time.

We’re hoping this is just the beginning of bringing better risk frameworks to DeFi.

If you’re curious the methodology for how they are arriving at these ratings you can check out the Redstone Docs.

Stablewatch is a site that’s starting to work its way into my rotation. One thing I like to quickly check up on is yield bearing stablecoin TVL changes (I know we’re not supposed to call them stablecoins).

Here’s what that looks like at a glance this week:

We’ve talked about Neutrl before in YOTW and they’re another team using Accountable for proof of solvency.

If you want to see what that looks like head over here to see their live verification and proof of solvency page.

Neutrl is currently yielding ~19.70% for their sNUSD proportionate share of the yield bearing vault:

Gearbox has some nice yields on Monad right now. I’m not entirely sure how they are producing these, but it looks like the borrow side is being compensated in some way to encourage more participation.

The two loops highlighted below look especially interesting right now:

WMON borrow rate is 0% right now.

I’ve reached out to the Gearbox team last minute to get more clarification on why the borrow rates are 0% right now and they didn’t reply before I had to publish this unfortunately. I’m not sure how long these conditions will last.

I don’t actually have much to say about this other than I was scrolling through the timeline, saw it, and still think this future is a very interesting and largely untapped design space. Excited to see how the DeFi + Agents landscape evolves.

Thanks to our sponsors for making it possible to share this content for FREE!

Yield Trading

We typically shine a light on what’s happening on Pendle in this section, but I wanted to share some of the good work Exponent Finance is doing on Solana.

Check out the below post by DeFi Dad where he explains an opportunity to lock in 13.5% fixed yields for the next 55 days:

Airdrop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

TreadFi (Referral in link)

I’ve recently been using TreadFi to generate some volume not only on TreadFi, but also on the perps DEXs they’re partnered with.

So, TreadFi is an algorithmic trading terminal, which is cool to have a points system in its own right.

Farming TreadFi is as easy as doing trades you would normally do, just via the TreadFi terminal. It connects directly to your perp accounts, whether that’s Hyperliquid, Extended, Pacifica, they have a ton of options. You can even connect it to your OKX CEX wallet and farm via that.

This is the way to farm if you don’t want to “burn money for points.” It’s just normal trading, business as usual.

However, they do have some super cool features, like the market making bot and the delta neutral bot. The market making bot should really be renamed to its original name, the Volume bot.

That’s essentially what it is. You set X amount of money to burn on fees, choose which exchange you’re connected to or wish to farm points for, and it generates Y amount of volume, directly farming points.

It’s hard to say if this will be worth it. It’s a bet that TreadFi points plus the perps DEX you’re farming outweigh the amount burned on fees.

That’s all for this week. Tread careful, farmers 🙂

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!