Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

ETH & BTC Yields

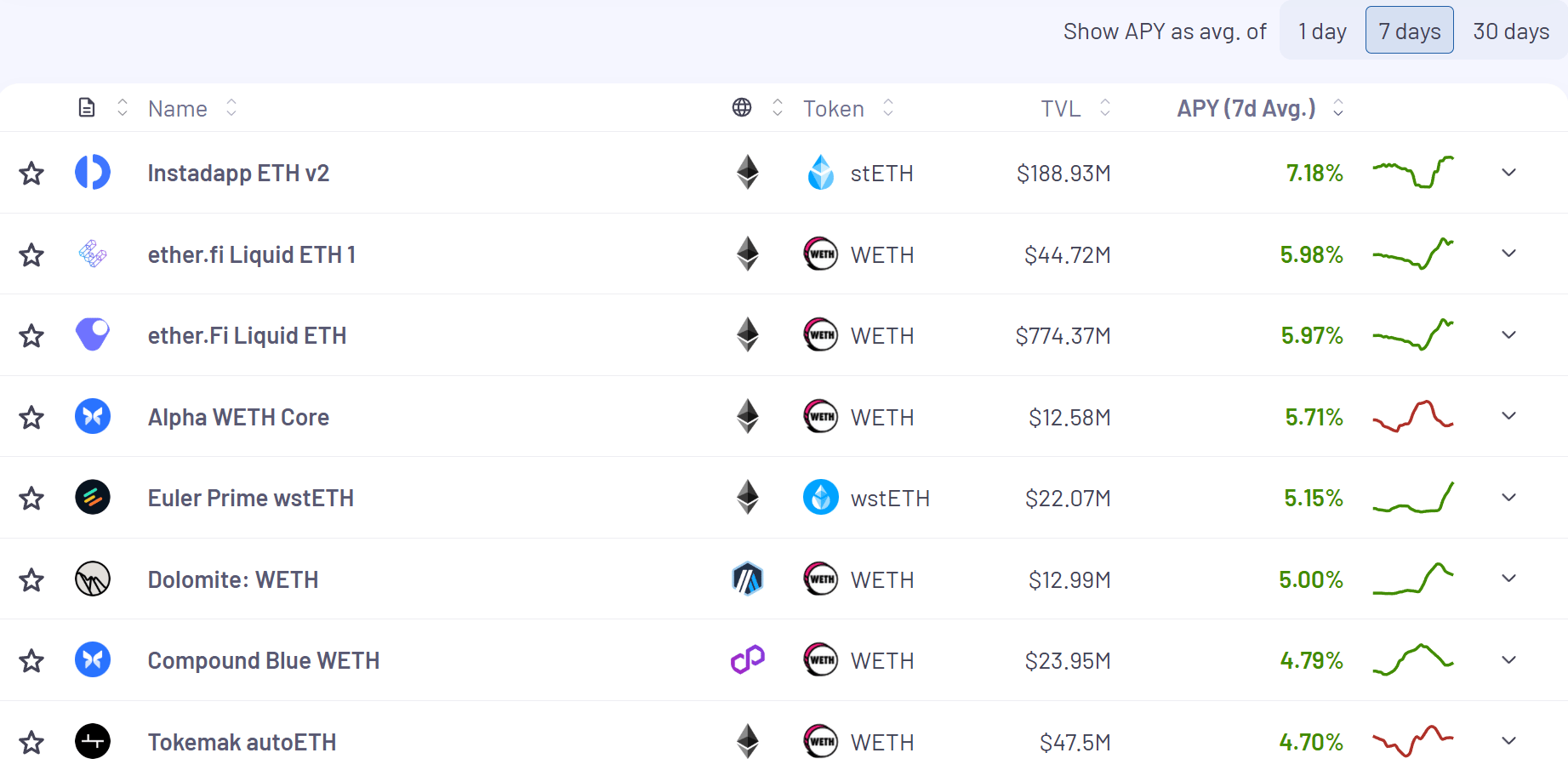

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

What I’m Doing On HyperEVM (Updated)

So far I’ve:

Staked all my HYPE on Kinetiq and converted to kHYPE (usable in DeFi) which yields 2.2%.

Moved all of my kHYPE to Felix where I’ve deposited into the vanilla vault and am borrowing HYPE against my kHYPE collateral (paying a hefty 12% borrow rate).

Taking my borrowed HYPE and staking it again for kHYPE and depositing into the Kinetiq Veda vault that’s farming 6% APY + airdrop rewards from other protocols.

I’ve since deposited a bit of HYPE into Hyperbeat’s beHYPE.

kHYPE YTs on Pendle.

Delta neutral yield on Liminal (checkout below)

I’ve written Liminal up a few times when I was just playing around with it, but I’ve now got a more meaningful amount of funds on the platform to get even more comfortable with it.

I actually find the UI to be a bit confusing to open up a position, but honestly think it’s more of a “me” problem.

I’m currently doing in a 50% ETH and 50% BTC position. The underlying to open this position is all done in USDC (not the assets you’re opening positions in) and currently these are achieving 12.93% - 13.46% 30d APY:

I purposely didn’t go into HYPE as it’s not a Unit asset and I wanted to open myself up to Unit + Liminal airdrop potential here. If curious which assets are supported by Unit, just go to their UI and click the dropdown:

Unit Assets

Lastly, I want to get into the Fartcoin and Pump positions, but they are capped. It could be worth paying attention to when those caps open because these are generating pretty nice 30d APY of 22.46% - 29.04% (on USDC)

The Toros team has carved out a niche in the leveraged token market. While these products don’t technically generate “yield,” they can be highly advantageous in a trending market like the one we're in now.

For example, if you’re bullish on ETH or BTC, you can buy their 3x Leveraged ETH or BTC tokens to get long exposure without worrying about liquidation risk or funding rate fees (Be sure to read about “decay” on their site).

One unique feature is that these tokens continuously rebalance to maintain a constant 3x leverage. This is different from perpetuals, where leverage can drift over time unless manually adjusted.

These are available on a wide variety of networks such as: Arbitrum, Base, Ethereum, Optimism and Polygon

They’re also available to a wide variety of tokens as well:

I’ve written Neutral Trade up many times in the past, but haven’t revisited them as much lately until now. I just think some of the things they are trying are really interesting and sort of trailblazing for DeFi.

Of course with anything new, exercise caution and read thoroughly to understand the risks.

All that said, check this out:

It's fascinating how they're generating the underlying yield. It feels like a traditional hedge fund strategy that's been adapted for crypto investors, taking advantage of the sector's inherent volatility.

Here’s what’s happening under the hood:

Yield Trading

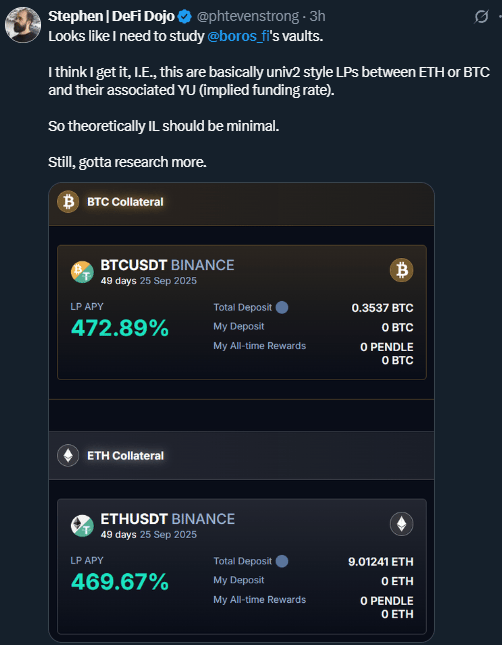

Pendle’s long anticipated new protocol called Boros just went live on August 6th.

Here’s a link to a great breakdown from the Alea Research team to get up to speed:

There’s some very attractive early APYs here, but like Stephen it’s all still so new and I personally still need to do some homework here myself.

Also, for an early primer on how to trade on Boros, Labrin put out a nice writeup here

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

21% - 26.85%

BTC

2.27% - 4.63%

ETH

4.3% - 7.21%

HYPE

9.83% - 13.89%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

When it comes to looping, one combination that has been strong and steady is the Kamino x Maple collab on Solana.

This feels way more like a set it and forget it type of position compared to some of the other loops that require more observation and active management.

These loops have been consistently hitting between ~15% - 30% APY while being quite scalable.

I think Aylo sort of nails it here:

If you’re a Maple user, click this button to get a 50% boost on Drips:

That’s all for now, thanks for checking it out!

.jpg)