Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

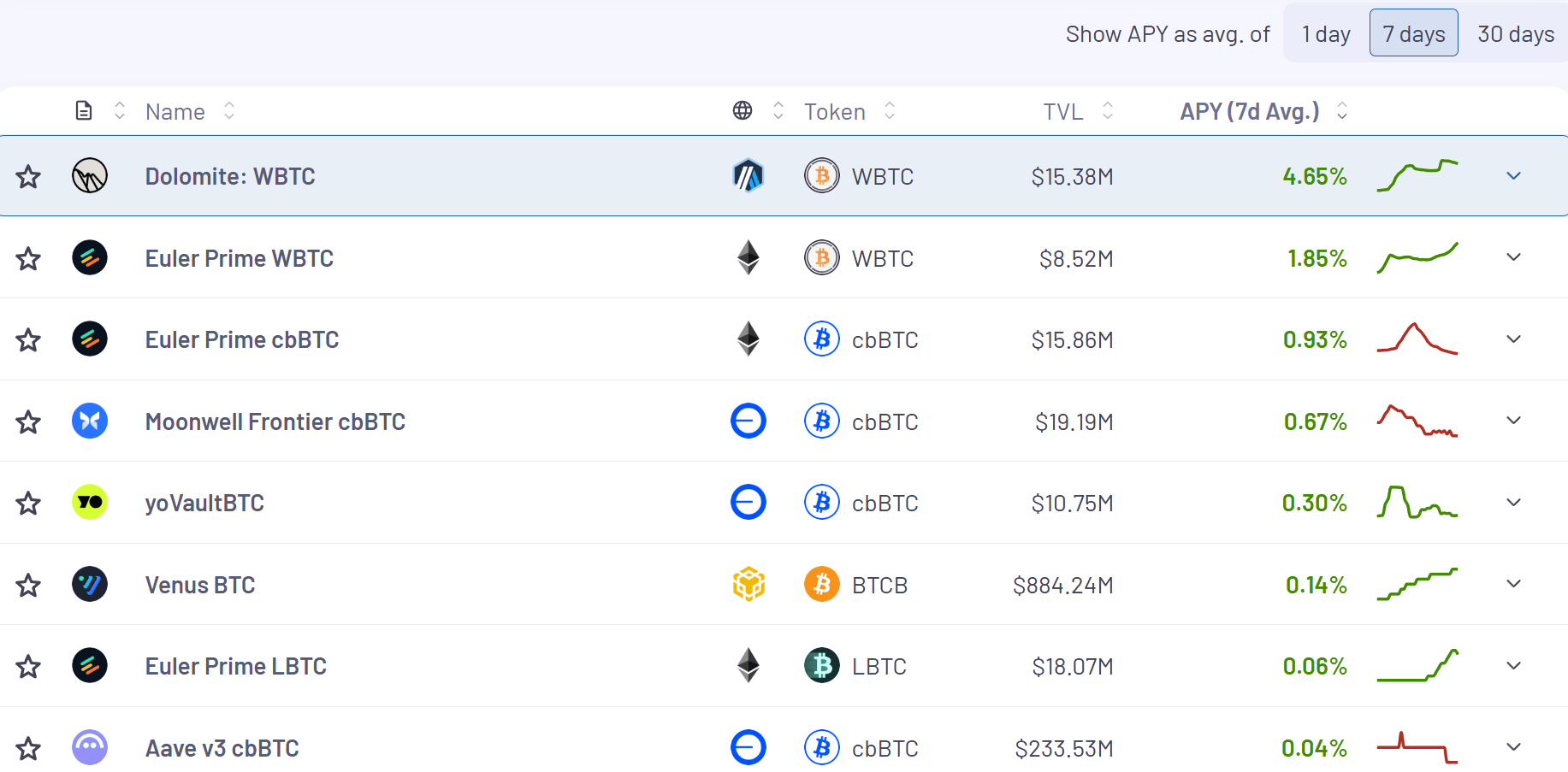

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $5M TVL

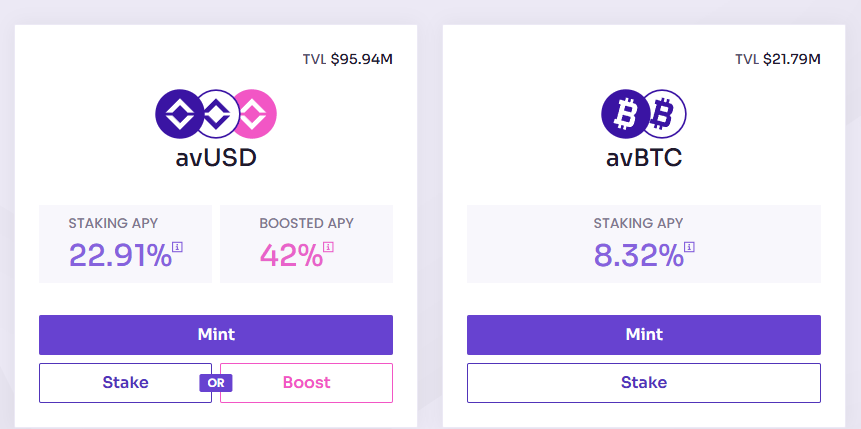

I’ve written Avant up a bunch now, but I feel the need to continually go back to them in YOTW because they legitimately have some of the highest yields in all of DeFi and they’re now up to ~$120M in TVL.

22.91% APY on stables with the option to boost it to 42% APY and then 8.32% APY on BTC is extremely competitive.

If you’re curious (like I was) about what’s happening under the hood with the boosted yield, check this out:

Right now Gearbox is offering 12.07% APY on USDC. This is incentivized with GEAR token and USDf + Falcon miles incentives. Currently the incentives last until September 1st, but wouldn’t be surprised if they extend it for longer.

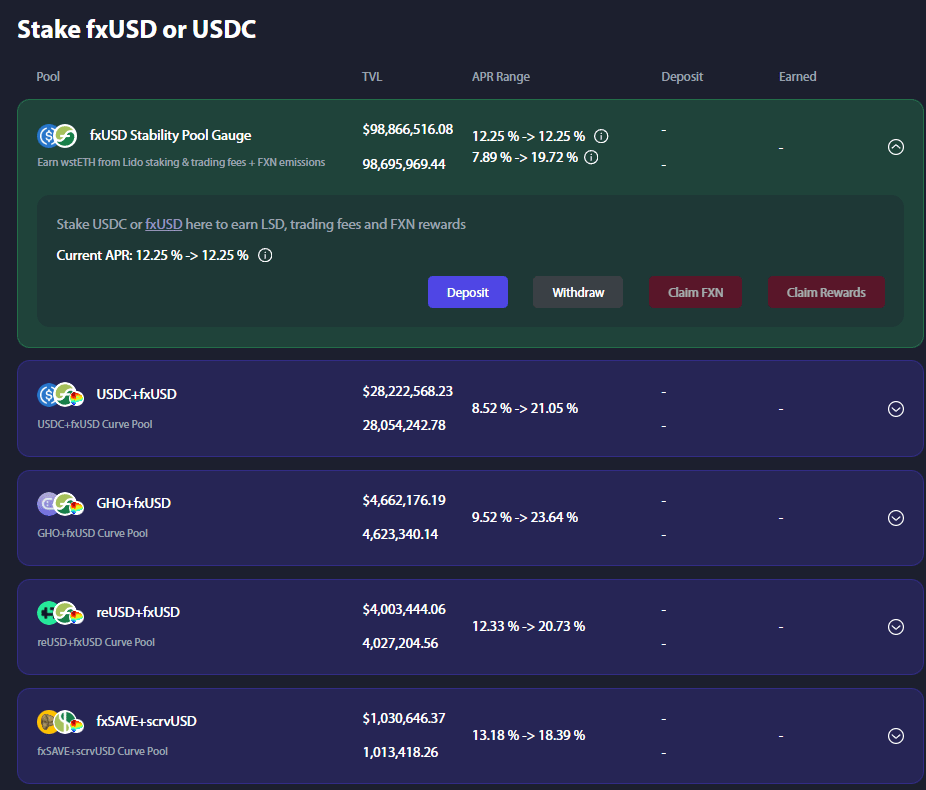

f(x) TVL has been going parabolic lately and recently they crossed $372M 👏

They have an assortment of highly competitive stablecoin yields on their “Earn” tab that range anywhere from 7.89% APR all the way up to 23.64% APR:

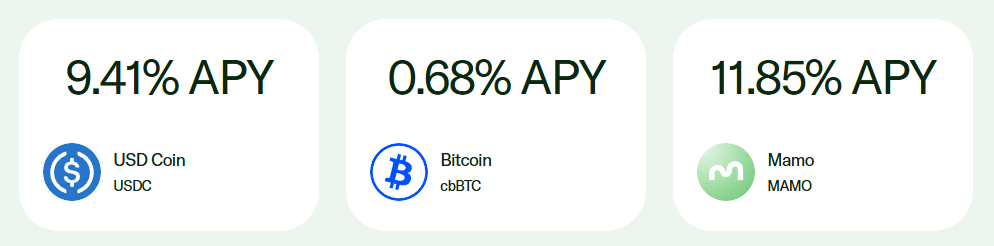

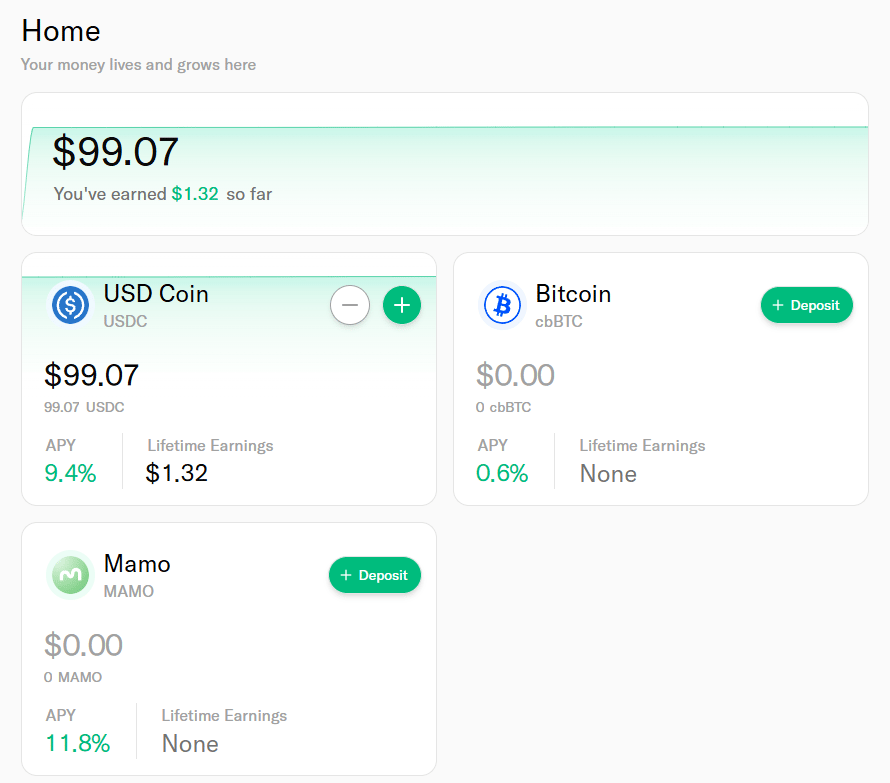

Mamo is an AI assistant that “helps you track, grow, and understand your money – step by step, without the stress”.

Mamo is a great tool for people that want to set and forget their yield generation and it’s constantly compounding your rewards:

I have a little test account going and here’s what the interface looks like (super simple):

Alpha Alert 🚨

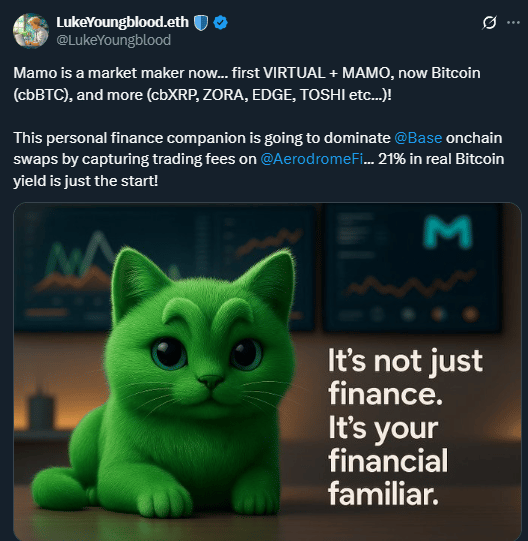

I expect Mamo to generate some very nice real yields in the not so distant future. Not only do they tap into great yields via Moonwell, but Mamo is also becoming a market maker of the future - let me explain. Actually I’ll let Luke Youngblood explain.

A few weeks back if you were paying attention, Mamo created pairings on Aerodrome with all the top tokens on Base:

Now the plan is being fully revealed:

Why does this matter?

They’ve setup all of these pool pairs to stream all the trading fees directly back to MAMO stakers. Meaning, Mamo has become a market maker that is working purely for its token holders.

Furthermore, the timing here is crucial because Coinbase has announced all tokens onchain will be accessible via the Coinbase frontend soon and Aerodrome is the biggest player by far here (ultimate DeFi Mullet). Which means we will likely see an uptick in trading activity between all of these popular pairs and Mamo is at the center of a lot of these trades earning fees.

This strategy isn’t easy to replicate as it takes a lot of TVL to seed these pools, veAERO to attract more TVL via incentives and just a deep understanding of DeFi operations.

IMO they are playing the long game here and it’s a brilliant new way to bring value to an AI Agent.

Yield Trading

One really interesting thing I’m watching on Pendle this week is the points distribution for kHYPE and vkHYPE YTs.

In the first week on Pendle the original kHYPE YT pool seemed to receive a massive kpoints boost. I have a theory we’ll see a similar thing happen for the new vkHYPE YT pool, but we won’t know until this Thursday points distribution.

If that does play out, I wonder what the distribution will be going forward between the two?

Will we just have to guess every week?

Or maybe they will only do a boost in the first week of a pool.

These are things that a degen in the trenches must ponder (need more grass touching).

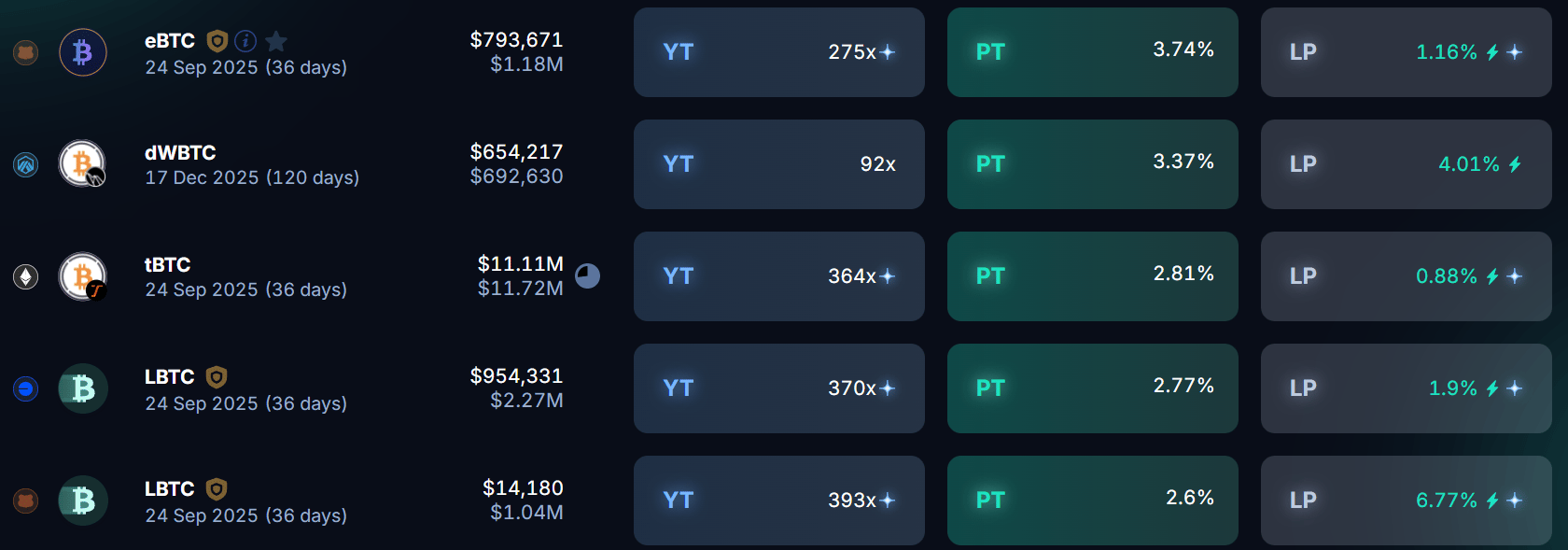

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

16.26% - 22.76%

BTC

2.6% - 3.74%

ETH

5.27% - 7.93%

HYPE

14.53% - 18.08%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

This week I actually want to try something different and share a cool tool for looping I came across from the InfiniFi team. Check out the full X thread here on the tool from Scooter (btw all teams that rely heavily on looping should do this).

Here it is in action:

First I chose the liUSD - 1w and chose an Ethena PT to compare it to.

The out put shows you a chart of expected yield return and number of loops

You get a nice output page with projected earnings and a comparison to whatever strategy you want to compare it to.

That’s all for now, thanks for checking it out!

.jpg)