Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Please read the web version of this post as it will get cut short in email format!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

ETH & BTC Yields

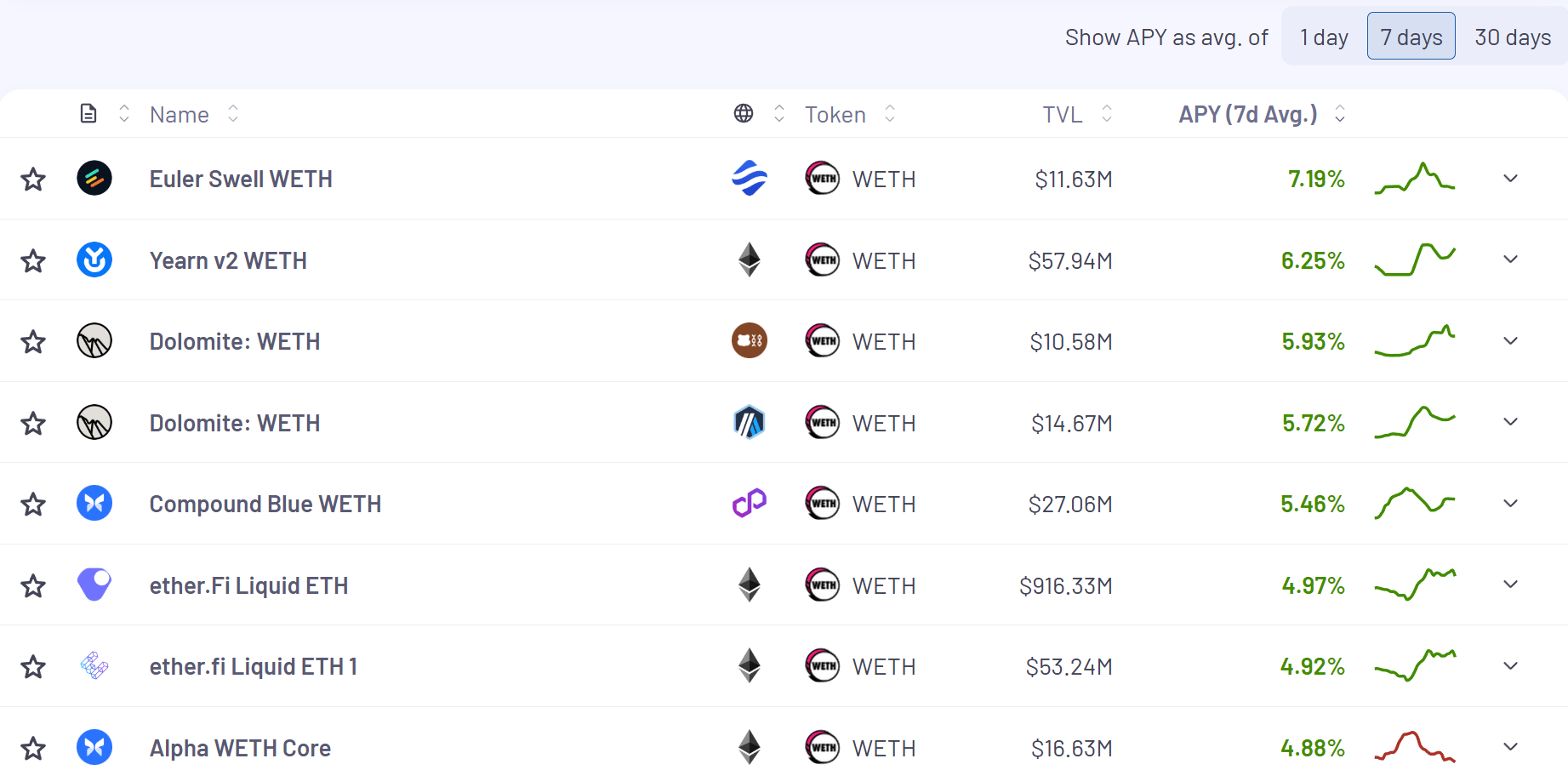

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

The GammaSwap yield tokens have been in development for a long time and I’ve been looking forward to seeing them go live:

The yields out of the gate on these are really impressive and sitting at 26.41% APY as I type this. I’m personally going to monitor these for a while. What I’m looking for is a bit more time to see how they react in different market conditions.

Eventually, due to these positions being tokenized and highly composable, I think these could become very interesting new money legos for DeFi. Imagine borrowing against a tokenized position yielding ~20%+ APY?

I wrote up Liminal last week, but Neutral Trade is another team doing delta neutral strategies on Hyperliquid, but with a different approach.

Here’s an explanation from the team on how they differ from Liminal:

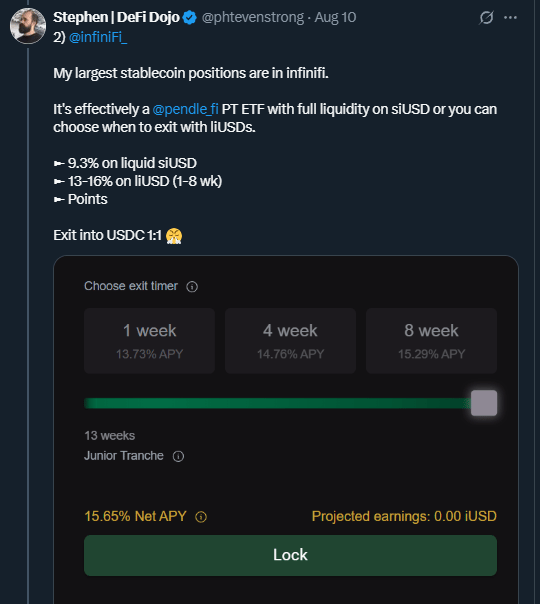

InfiniFi gives you a ton of flexibility on yield and duration with their layered tranche offerings. Depending on what you choose you’re looking at ~9% - 16% yields.

I love the framing Stephen makes by calling InfiniFi a “Pendle PT ETF” - he’s not wrong:

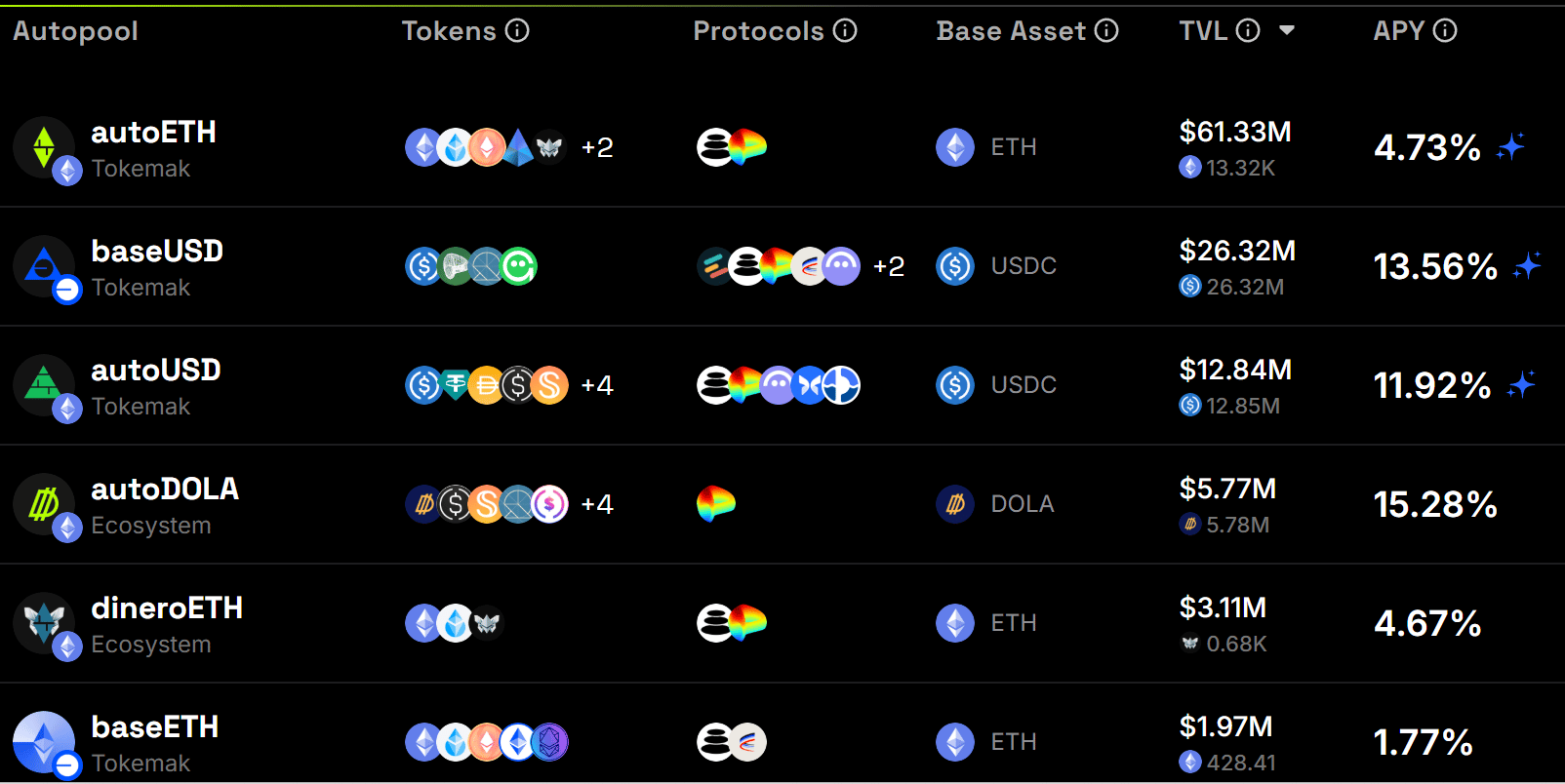

Tokemak’s Autopools have consistently been making it into YOTW again over the last few weeks.

I still think they’re one of the easier “set and forget” strategies for DeFi. Currently they have Autopools for Stables and ETH, but many more are on the way:

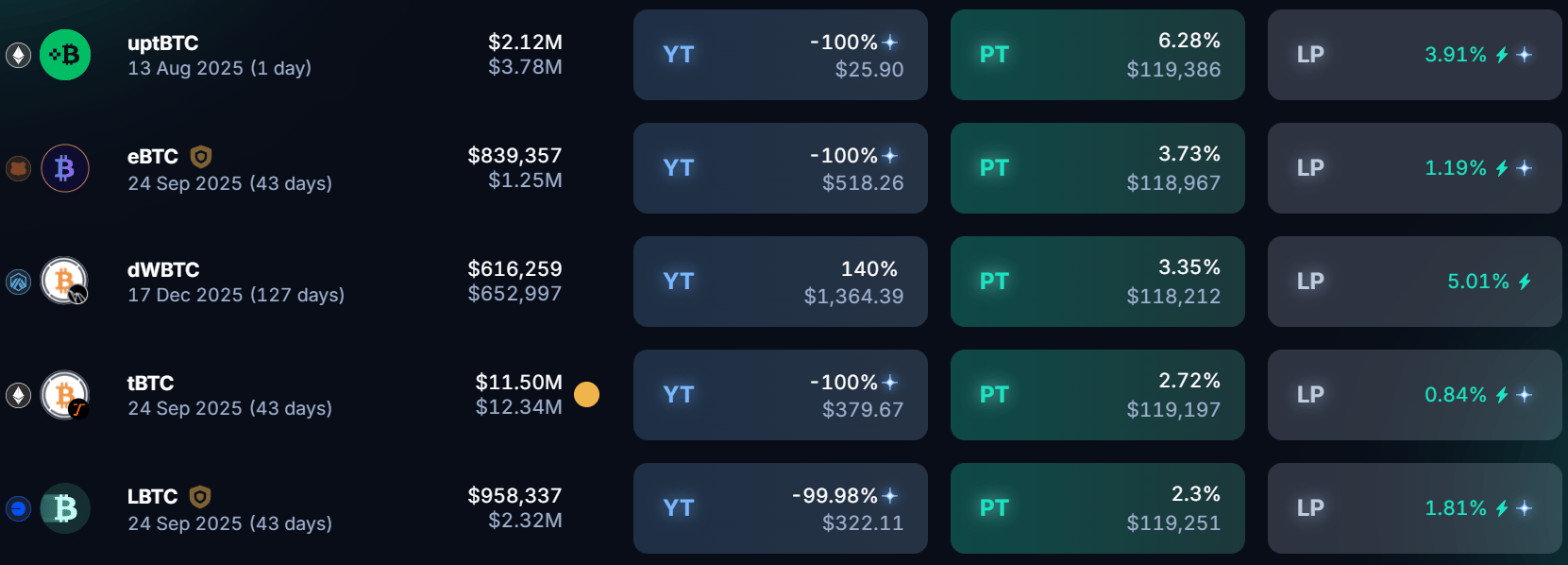

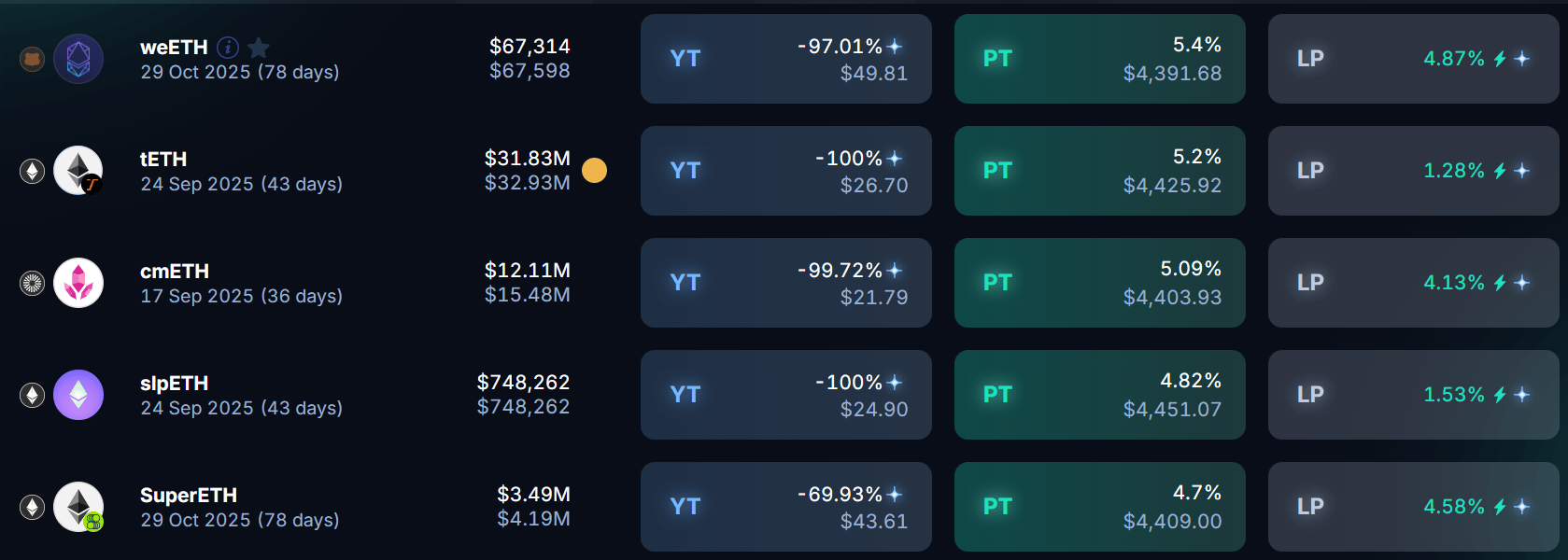

Yield Trading

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

17.65% - 30.37%

BTC

2.3% - 6.28%

ETH

4.7% - 5.4%

HYPE

12.43% - 16.7%

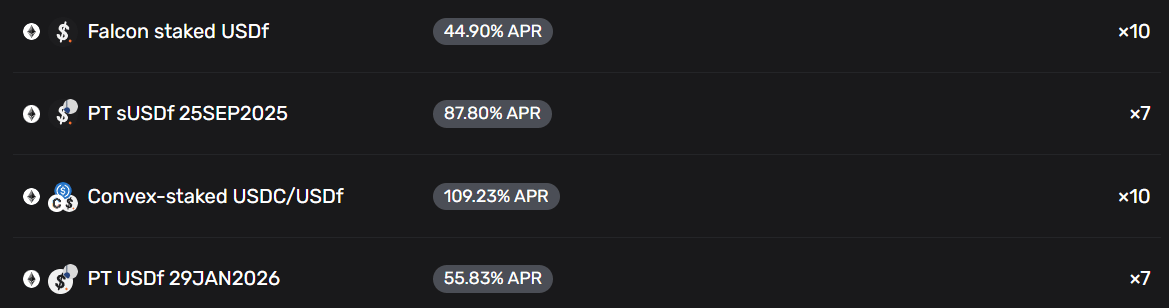

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

The opportunities on Gearbox for looping Falcon’s USDf are hard to ignore. Between these different strategies you can be netting anywhere between 44.9% APR and 109.23% APR:

That’s all for now, thanks for checking it out!

.jpg)