The following is a writeup by inPlanB on what he’s seeing recently with 24HR, 7D and 30D Smart Money flows using Nansen

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base, Arbitrum and BNBchain

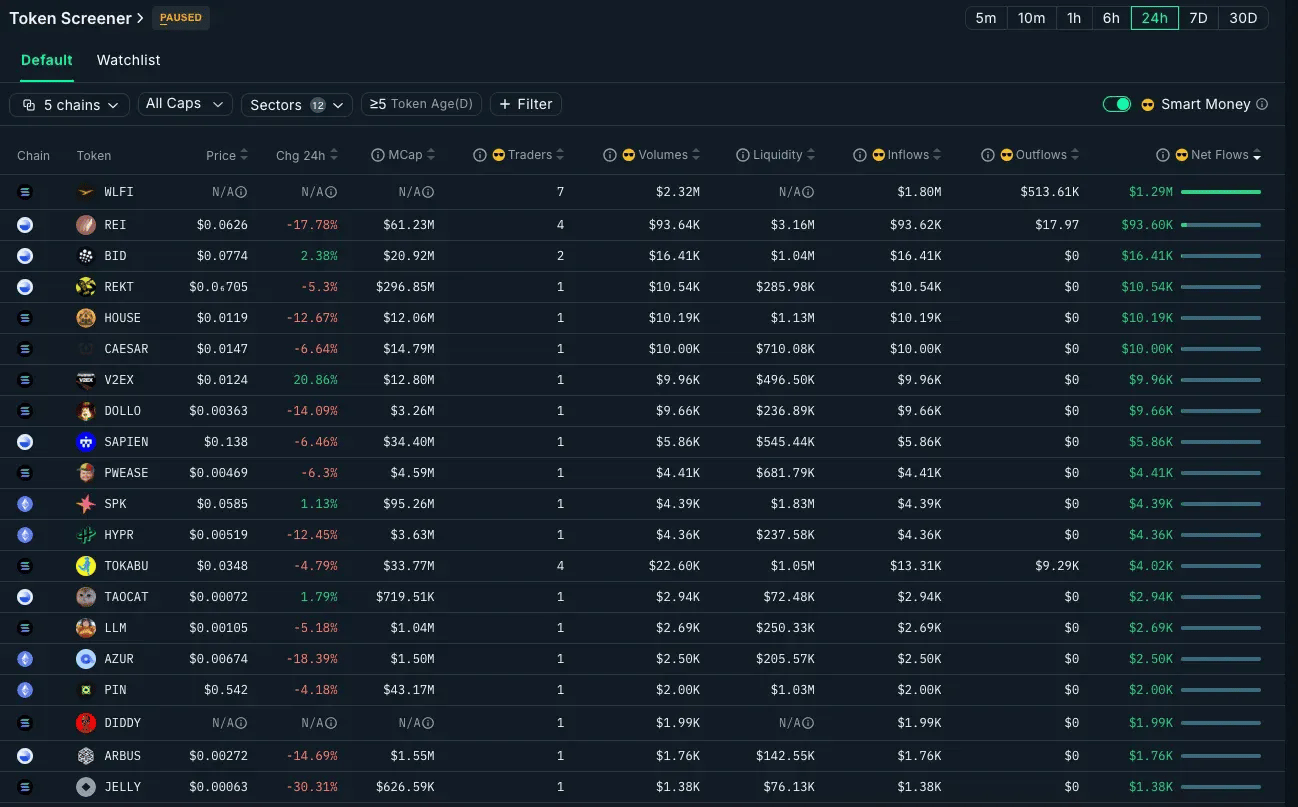

24H Flows

7D Flows

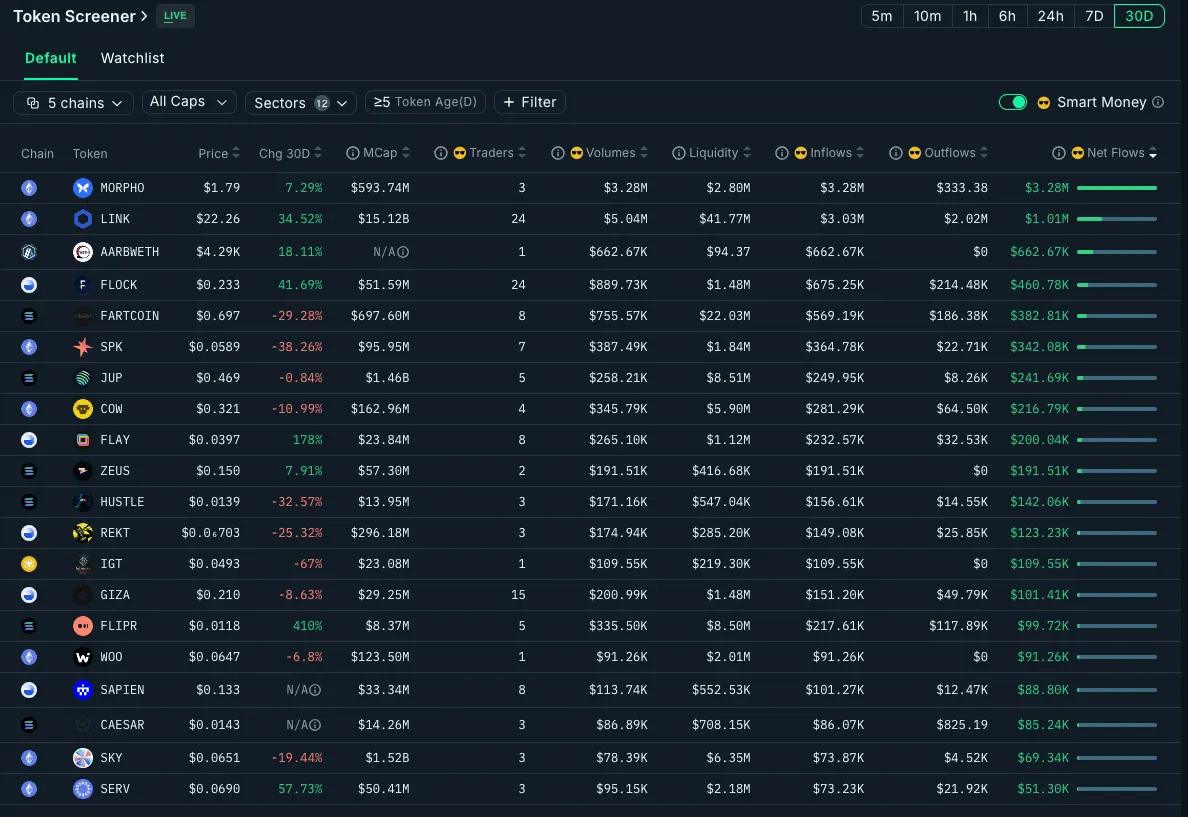

30D Flows

After analyzing the smart money flows across 24H, 7D, and 30D timeframes, one pattern emerges clearly: sophisticated investors are rotating back into fundamental utility tokens that actually generate cash flow. The breadcrumbs are there if you know where to look.

Smart Money Spotlight: The Data Tells the Story

1. Breaking: WLFI (World Liberty Financial) - The Trump Family's DeFi Play

Looking at the 24H data, there's a fascinating new entry that deserves attention - WLFI sitting at the very top of the list with $1.29M in net flows from 7 smart money traders, despite launching just today.

The Pattern:

24H: $1.29M net flows, 7 smart traders, $2.32M total volume

Launch Day Activity: $1.80M inflows vs $513.61K outflows (72% net buying)

Market Cap: $6.7B | FDV: $24.7B | Price: $0.24

Here's what makes this particularly intriguing from a smart money perspective: 7 different sophisticated traders immediately allocated significant capital ($1.29M in net flows) to a token that launched today. This suggests either exceptional due diligence was done pre-launch, or these traders have conviction in the underlying narrative.

The Political-Financial Context:

World Liberty Financial represents something we've never seen before in crypto - a DeFi protocol directly associated with a sitting U.S. President's family. Donald Trump Jr. and Eric Trump are reportedly involved in the project, which aims to create a decentralized finance ecosystem.

From a smart money analysis perspective, this creates a unique risk-reward profile. The political backing could provide regulatory protection and mainstream adoption that most DeFi protocols can only dream of. However, it also introduces political risk that traditional DeFi investments don't face.

Why Smart Money Moved Fast:

The immediate $1.29M in net flows from just 7 traders (averaging $184K per trader) suggests institutional-sized positions rather than retail speculation. These traders likely understand that political-adjacent crypto plays can experience extreme volatility in both directions, making timing crucial.

Risk Level: Extreme - Political crypto can swing 50%+ in either direction on single news items. The smart money flows suggest conviction, but this remains the most speculative play on the entire list.

2. Morpho (MORPHO) - The Lending Protocol of Base

The Pattern:

24H: Not in top flows (recent profit-taking)

7D: $991.70K net flows, -27.4% balance change, 2 smart traders (profit-taking after gains)

30D: $3.28M net flows, +7.29% balance change, 3 smart traders (sustained accumulation)

This is the classic smart money accumulation-then-profit-taking pattern. Heavy buying over 30D, then recent profit-taking as price hit $2.80 two weeks ago. The relatively small number of traders (2-3) suggests institutional-size positions rather than retail activity.

The Fundamental Data: TVL: $7.41B (8th largest DeFi protocol) | Fees: $220.84M annualized | Revenue: $0 (protocol takes no cut) | Market Cap: $609.91M | FDV: $1.8B | Price: $1.84 | 24h Volume: $20.22M.

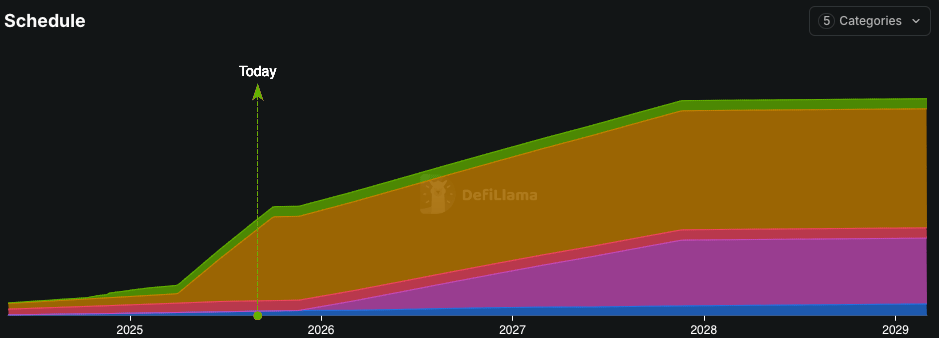

Morpho has created a 12x TVL-to-market-cap ratio - which seems undervalued based on Market Cap. However, it's important to take the FDV into consideration, as the MORPHO token is used for incentives to attract TVL. The lending protocol offers tailored risk-reward profiles through curated vaults and has been steadily gaining market share.

Risk Factor: Daily unlocks, threatening major price action.

Steady token emissions on the horizon

3. Chainlink (LINK) - The Oracle King With Institutional Backing

The Pattern:

24H: No significant flows

7D: No significant flows

30D: $1.01M net flows, +34.52% balance change, 24 smart traders (broad institutional accumulation)

As reported last week, the 30D data is still looking interesting - 24 different smart money addresses accumulated LINK, showing broad institutional conviction rather than a single whale move. The +34.52% balance change indicates sustained buying pressure over the 30D.

The Fundamental Data: Essential DeFi infrastructure | Revenue: Oracle service fees | Market Cap: $16.06B | Price: $23.68 | 24h Volume: $1.15B | Ranked #11 by market cap,

Possible Reasons For Smart Money Accumulation: Bitwise just filed for a spot LINK ETF, SBI Group (Japan's $200B financial giant) announced a partnership for tokenized assets, Chainlink to Bring US Economic Data On-Chain, and Chainlink dominates the oracle space with 10x more partnerships than competitors combined.

Risk Level: Low-Medium - Blue-chip infrastructure play with defensive moat. Large market cap limits explosive upside but reduces volatility risk.

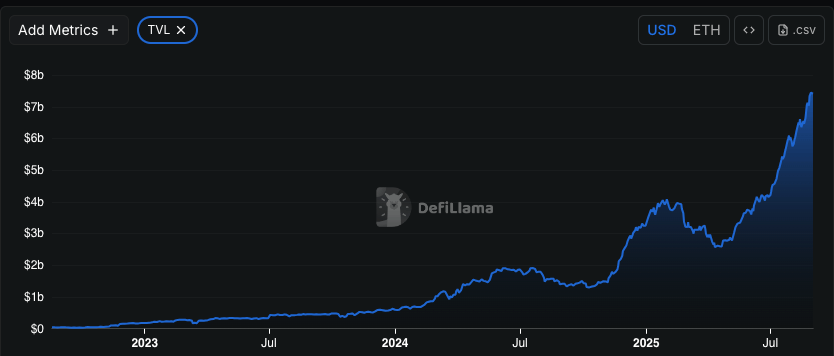

4. Ethena (ENA) - The Synthetic Dollar Protocol With $12B In TVL

The Pattern:

24H: No significant flows

7D: $1.02M net flows, -5.45% balance change, 5 smart traders (massive inflows but profit-taking)

30D: Not in top flows

The 7D pattern shows huge smart money inflows ($1.02M) but with negative balance changes, indicating profit-taking after recent protocol milestones. Smart money bought the growth story, then took profits on the news, it seems.

The Fundamental Data: TVL: $12.57B (doubled from $5.5B in July) | Revenue: $500M in cumulative gross interest revenue | sUSDe APY: ~9% | Market Cap: $4.4B | FDV: $9.4B | Price: $0.64 | 24h Volume: $400M+

Why the Mixed Signals: USDe stablecoin supply exploded to $12B through leveraged yield loops on Pendle and Aave. The protocol generates real revenue from delta-neutral strategies, but one of the fee switch parameters (sUSDe vs sUSDS APY Spread & Fee Switch Target (7D MA), has been oscillating (check Entropy_Advisors's Dune dashboard to monitor all the parameters). Additionally, the September 2nd $25.68m ENA unlock (tokenomist).

Risk Level: Medium - Rapid growth but in general concerns about sustainability of yield strategies. However, the team keeps expanding, not only with a whole ecosystem around USDe, but adding new collateral into its asset framework for perpetual futures. Recently, approving BNB as first new eligible asset with XRP and HYPE meeting onboarding thresholds.

5. FLock.io (FLOCK) - The AI Training Protocol Smart Money Discovered

The Pattern:

24H: No significant flows

7D: No significant flows

30D: $460.78K net flows, +41.69% balance change, 24 smart traders (broad accumulation)

Similar to LINK, the 24 different smart money addresses show broad interest rather than whale manipulation. The +41.69% balance change over 30 days indicates sustained accumulation, despite the recent price drop from $0.47.

The Fundamental Data: Market Cap: $52M | FDV: $235M | Price: $0.23 | Circulating Supply: 214.92M FLOCK | Max Supply: 1B | 24h Volume: $29M+

The Sleeper Play: FLock.io is a decentralized AI model training network that makes AI development composable. Backed by DCG, Lightspeed, and OKX Ventures, it's the only Web3 AI project presented at the Royal Society. It seems that while AI agent tokens crashed, smart money quietly accumulated the infrastructure play for AI training - the picks-and-shovels approach to the AI boom.

Risk Level: Medium-High - Small market cap with high upside potential but early-stage protocol and high FDV. AI narrative could be volatile.

The Sentiment Reality Check

Current market sentiment shows a clear rotation happening:

Building Momentum (Not Peaked):

Infrastructure protocols showing steady development (LINK, MORPHO)

Revenue-generating tokens with sustainable economics (ENA growth metrics)

AI infrastructure vs speculation (FLOCK vs crashed AI agents)

Declining Hype (-67% to -87% over 90 days):

AI agents in DeFi without utility

Speculative "DeFAI" narratives

Synthetic assets without real revenue streams

For the time being, the data shows smart money following fundamentals, while retail chases narratives (except for WLFI, I guess).

The breadcrumbs are there. The choice is yours.

Please comment below if this is something you’d like us to include in The Edge Newsletter more often 👇

.jpg)