We haven’t done an update on flows in a while and to say a lot has happened, would be an understatement.

The ETH Treasury meta didn’t even really exist when we published this piece last on June 6th.

For those of you needing to get up to speed on the ETH Treasury meta, I wrote about it in this piece entitled: SBET: The Most Novel Stock On The NASDAQ? Inside Joe Lubin's Most Recent Ethereum Chess Move.

If you prefer learning via podcasts, we just did a great one with Milk Road Co-Founder, Kyle Reidhead:

The flows we’re seeing into ETH ETFs and ETH Treasury Companies is at levels I couldn’t have ever imagined.

Read on below!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

July 29th Update

ETH Treasury Flows

We’re focusing more on the ETH treasury side rather than BTC this week because it’s a new variable in the flow dynamics.

There seems to be a new player introduced every day and many have only been active for a few weeks.

Even in this short timeframe, Tom Lee’s Bitmine Imersion Tech $BMNR ( ▼ 1.97% ) has managed to acquire over $2B in ETH.

Additionally, Tom should get a lot of credit for not only realizing the opportunity, but for finally finding a way to speak about Ethereum in easy to understand ways. Watch this clip of him linking Ethereum’s value to the growing demand for stablecoins.

Here’s what the current leaderboard looks like (again many of these have only been live for a few weeks):

We’ve essentially introduced 10+ serious players (and more coming) who’s sole goal is to acquire as much ETH as possible.

As one could imagine it’s having a material impact on ETH price:

ETH is up over 50% in the last month

This post by Anthony Sassano really paints a picture of what’s happening:

For added context here, The Merge from Proof of Work to Proof of Stake happened on September 15, 2022. Meaning, Sharplink alone has has bought almost all of the ETH that’s been issued over the past ~3 years…And they did it in a few weeks. One company.

It’s already quite ridiculous, but there appears to be no signs of slowing down as shareholders passed Joe Lubin’s $SBET ( ▼ 1.67% ) stock sale plans to buy up to $6B in ETH.

They’ve likely already started executing these buys 👀

Lastly, one thing to watch for (and we talk about this in our Kyle Reidhead podcast) is share dilution with these new Treasury Companies. There’s a lot of fog of war and information asymmetry when these new acquisition vehicles go live.

My friend Stablescarab has built a site to address this exact problem. The site is called Crypto Treasuries and just recently launched. It dives deep into all the data and insights you’d normally have to scour the internet for, but conveniently packages everything in one place.

Here’s a peak:

Recent Ethereum ETF Flows

OK so the ETH Treasury Companies have been going bananas but what about the ETFs?

See the data below from Farside:

As I write this, Ethereum has had 16 days of consecutive positive net flows into the ETFs. Just from the chart above in 13 days (July 28th wasn’t in at time of writing), these ETFs have brought in $4.82B in positive flows.

Absolutely wild numbers.

Here’s what it looks like since ETF inception:

How does this compare to BTC?

What does this look like vs ETH network inflation (ETH Issuance):

Recent Bitcoin ETF Flows

See the data below from Farside:

Bitcoin flows have maintained their strength as they’ve pulled in $4.8B in positive net flows (July 28th wasn’t in at time of writing).

What’s wild is this is almost the exact same number of positive flows that ETH had over this same 13 day period.

When you factor that Bitcoin is a 5X larger asset than ETH, you can understand why ETH has been moving the way it has over this period.

You can view the full life cycle of the BTC ETF below and as you can see it has been mostly green of late:

Some Relevant News

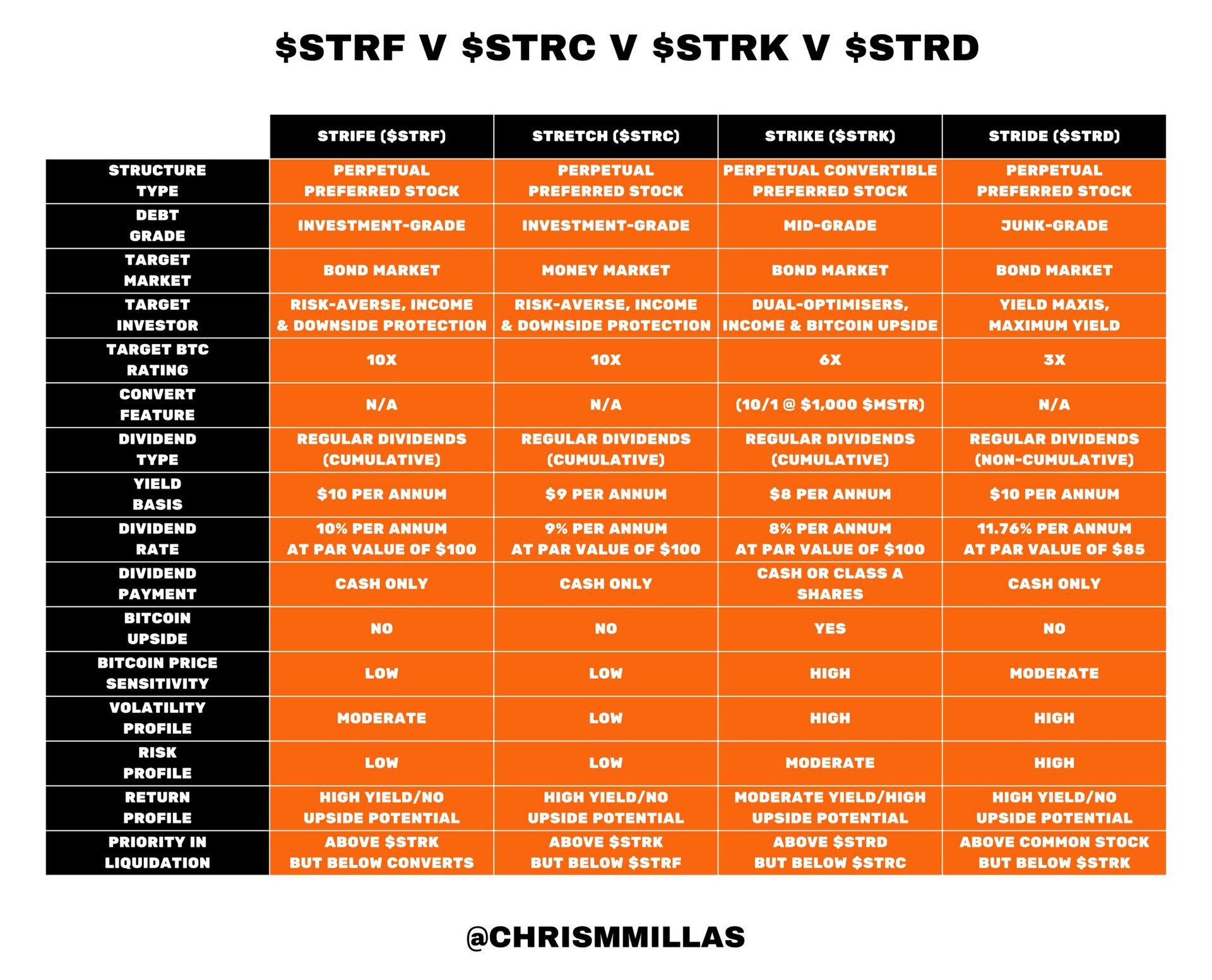

One of the most relevant developments affecting BTC flows is Saylor’s Strategy team continuing to find creative new ways to reinvent financial alchemy. His latest preferred equity product is called Stretch (STRC).

I’m going to tag in my chief quant Mr. GPT to explain it at a 10th Grader level (terms I can understand):

Now, to convert this into a DeFi degen terms:

Saylor has just created a yield bearing stablecoin that will aim to yield a perpetual 9% per year while keeping your underlying stable.

I think this has massive impacts and potential for TradFi. For example, if this product can prove itself as relatively low risk, then why keep funds in treasuries earning 4 - 5%?

Is Strategy slowly becoming some sort of new age Bitcoin bank?

Here’s a chart of all the preferred equity products if you really want to nerd out

Conclusion

Just to reiterate:

ETH 13 day positive net flows: $4.28B

BTC 13 day positive net flows: $4.8B

These numbers are wildly close for two assets that are very different in size. The ETH strength we’ve witnessed is impressive.

I’m still trying to figure out what to make of the Treasury meta. I think it’s obviously a strong force in a bull market and highly reflexive, but I worry what happens in another bear market.

That said, it’s had a strong effect on BTC for years and now ETH has its own group of Saylor-like figures, and based on how they’re talking, I don’t see the momentum slowing down anytime soon. For instance, Tom Lee has stated he wants to hold 5% of the entire ETH supply. It becomes really hard to fade that.

I’m generally bullish on a select few of these Treasury Companies, but the more obvious high conviction play is the asset they’re all scrambling to acquire.

The ticker is ETH 🚀

Share your thoughts below!

.jpg)