Thanks to DeFi Dad, StableScarab and Clouted who helped me write/edit sections of this piece!

Summary

My Timeline of Thoughts on SBET

What Is A Bitcoin Treasury Company?

SharpLink Before And After The PIPE

Why Did SBET Price Drop So Drastically?

What Makes SBET Special Vs Strategy (The SBET Epiphany)

A Few Examples of SBET Powered By DeFi

That’s All Great, But Do You Think SBET Will Actually Use DeFi?

What If SBET Was Fully Onchain? Enter ETH Strategy

My Timeline Of Thoughts On SBET

In late May, SharpLink Gaming (SBET) announced a $425 million PIPE to launch an Ether treasury and appointed Ethereum co-founder Joseph Lubin as board chairman.

Since this announcement a few weeks ago, my thoughts on SBET have been all over the place. Here’s a rough idea of the progression of thoughts I’ve had:

That’s interesting, it will probably be good for exposure/marketing for Ethereum, but not something I’m interested in

What am I missing? This thing looks way overvalued at low to mid $30s

Wow what happened, the stock crashed ~70% what is Lubin doing here?

Oh wait a minute, I think I get it now, this could be a very unique stock and opportunity for DeFi

And finally:

OK so I buy a stock and then write a piece to pump my own bags? Classic “fill then shill” right?

No not at all, I only had ~$1400 of dry powder sitting in my brokerage account on Friday afternoon with 10 minutes until market close when I had this epiphany on SBET (will explain epiphany later). In that time, I just barely managed to get to my computer and make a purchase with the minimal funds I had sitting idle in my account (in hindsight, I should have sold some things to make a bigger buy, but had very little time).

I’m happy I managed to buy shares at ~$9.25, but didn’t manage to get anywhere near the size I wanted.

Since markets were closed over the weekend (June 13 - 16th), I moved more money into my brokerage account with the plan of buying more on market open Monday (June 16th). My conviction on SBET only grew over the weekend.

It turns out, a lot of people had the same idea as me to buy this on market open 😂 :

SBET gapped up 45.60% on market open after the weekend

(Update: In the time it’s taken to write this piece I’ve since added more to my position around $9.86 for transparency)

OK, before we go any further we need to take a step back to understand some of the core fundamentals at play.

SBET is a continuation of a trend started by Bitcoin treasury companies like Strategy (formerly MicroStrategy), Metaplanet, Twenty One Capital etc. However, unlike these Bitcoin treasury companies, SBET has a lot of opportunity to be highly differentiated and standout in comparison (we will get to this I promise).

The initial rise of these Bitcoin treasury companies caught me by surprise. I remember shrugging off Strategy before fully appreciating the complexity of what they were actually doing (and Saylor is only going deeper).

I think to understand this piece you have to have a bit of an idea of the game at play here. The Bitcoin treasury companies have started a trend and more are popping up each day.

Thanks to our sponsors for making it possible to share this content for FREE!

| CONTINUE BELOW FOR REST OF ARTICLE |

What Is A Bitcoin Treasury Company?

A Bitcoin treasury company is a public company that primarily exists to accumulate and hold Bitcoin on its balance sheet, often using financial engineering like issuing debt or equity to buy more BTC. While some (Strategy) started with an operating business, others have shifted focus entirely, effectively becoming Bitcoin-holding vehicles for public market investors.

These companies:

Raise capital (via convertible notes, equity offerings, etc.)

Use that capital to buy Bitcoin

Often minimize or abandon their original business operations

Offer traditional investors indirect exposure to Bitcoin through publicly traded shares

I’ve heard some offer the opinion that these treasury companies are like ETFs in disguise, but with less regulation and some leverage. I guess that’s partially true. However, someone like Saylor would probably argue that these treasury companies specifically differ from ETFs and holdcos since they have the key objective to increase BPS (bitcoin per share). In that sense they're an operating co which is why they can trade at a premium where holdcos do not. There’s a lot more nuance here and I think many are starting to bring their own flavor to the mix, but this is the broad strokes.

Prior to this recent move, SBET was a Nasdaq-listed affiliate-marketing company focused on U.S. sports betting and global iGaming.

Up until the PIPE, SBET had recently undergone a stock split as it needed to defend itself from delisting on the NASDAQ. Essentially, SBET was a floundering company in need of some sort of lifeline.

Here it is visualized:

Aspect | Pre‑PIPE | PIPE / Acquisition Terms |

|---|---|---|

Share price | ~$0.30‑$0.35 | $6.15 per share ($6.72 for insiders) |

Reverse split | 1-for-12, effective May 6 | n/a |

Share count (outstanding) | ~8 million | +69.1M new shares via PIPE |

Market cap before PIPE | ≈$2–3M | Post-deal implied equity value of ~$425M |

Lead investor | N/A | ConsenSys led, backed by major crypto investors |

Use of proceeds | N/A | Major ETH acquisition, working capital, treasury strengthening |

Wait You Keep Saying PIPE What Is That?:

A PIPE is when a public company (one traded on the stock market) sells new shares directly to private investors, usually big ones like hedge funds, venture capital firms, or crypto funds, instead of selling them to the general public.

Terms Of The PIPE:

Announced May 27, 2025 and closed around June 2, 2025.

69.1M new shares were issued at $6.15 per share, raising $425M (I’ve seen this reported as $450M)

Lead investor: ConsenSys (Joe Lubin), with participation from Galaxy Digital, Pantera, ParaFi, Electric Capital, and others.

At-the-Market (ATM) Equity Program

Initiated around May 30, 2025, allowing SBET to sell up to $1 billion in stock on the open market

Through this facility, they raised approximately $79M, most of which was used to buy more ETH.

The table below summarizes all this nicely:

Instrument | Details |

|---|---|

Pre-restructure MCAP | $2 M (May 1) → ~$38 M (June 2) |

PIPE | 69.1M shares @ $6.15 → $425M |

ATM | Up to $1B potential; raised $79M so far |

Use of Funds | Majority deployed to ETH acquisition |

Why Did SBET Price Drop So Drastically?

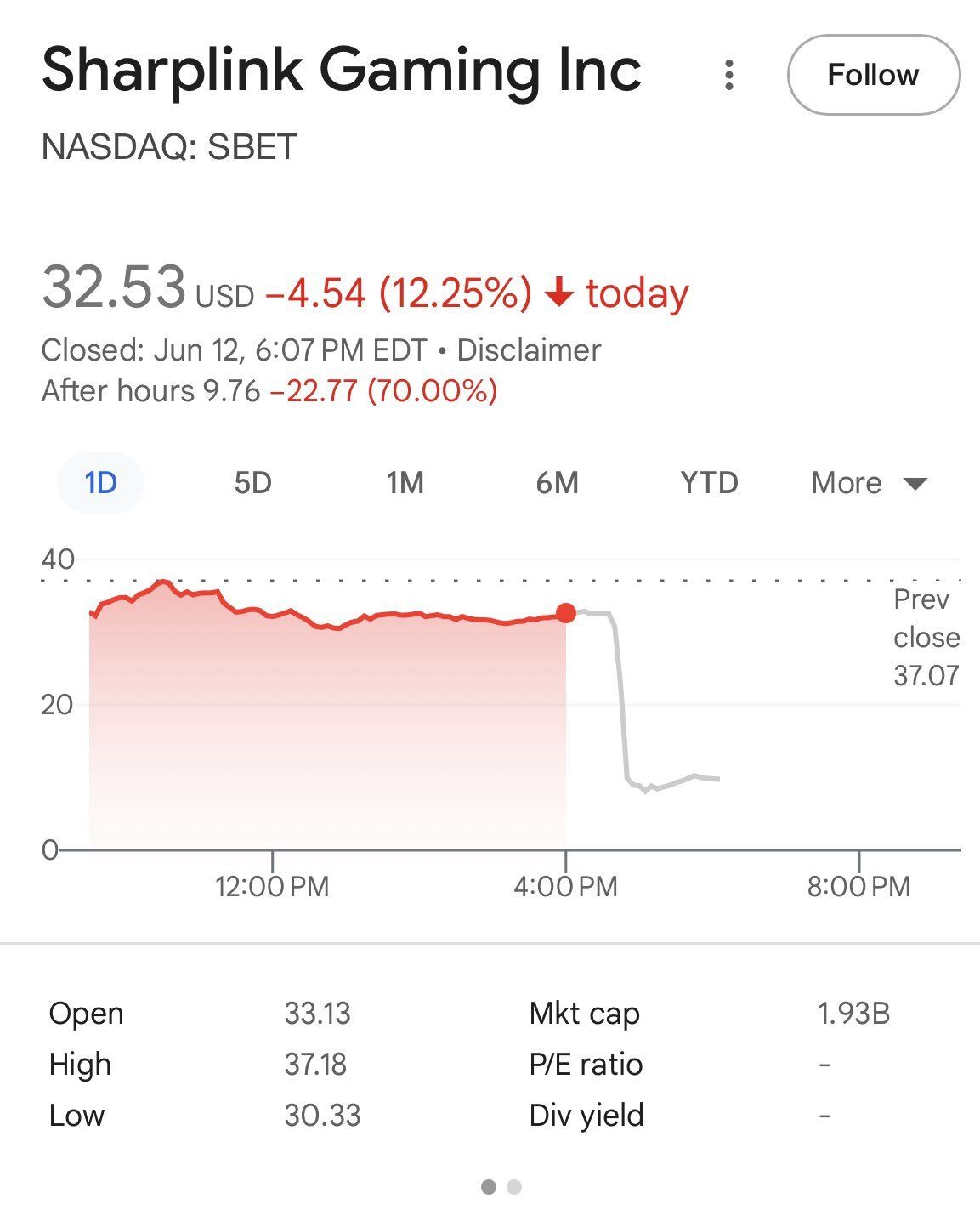

Shortly after market close on June 12th a lot of people were sharing this image on X:

The stock dropped from mid $30s to ~$8 in afterhours trading

There was a bit of a lag before the financial information sites started reporting the full share amounts that included the newly issued PIPE shares (even though total share counts were publicly stated in press briefings). Therefore, there was a leadup to June 12th where it looked like SBET had ~$450M of ETH on their balance sheet with a market cap of only ~$150M (it looked undervalued). I specifically saw this with my own eyes when I looked up SBET on google. This could be why people were still market buying SBET and running it up into the $30’s.

Once the full and accurate share counts were reflected everywhere, the true market cap became clearer. This revealed that the stock had been bid up to $2.5B despite only $450M worth of ETH on the balance sheet (mNAV 5.5x).

Another factor that added to the situation was FUD that started circulating around insider selling (more on that below).

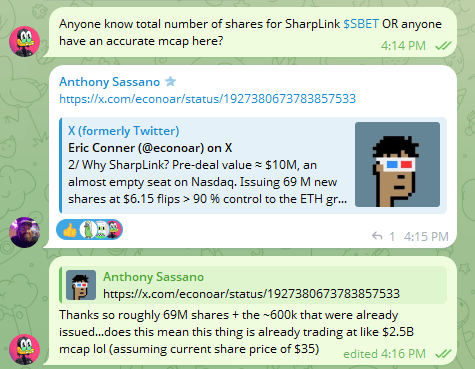

This was me asking these exact questions on May 27th and thankfully some helpful telegram friends pointed me to a tweet by Eric Conner that gave me a better picture of the full share amounts that weren’t immediately shown on some of the financial sites. I still didn’t have the fully accurate picture, but was close enough.

In classic CT fashion, many rushed to comment on something while not having all the facts (it’s what we do):

Many others were quick to judge and fan the flames. People seemed to particularly latch on to this tweet below that all insiders were dumping their shares:

Lubin himself had to clear the air, even though he’s still bound by things he can and can’t say publicly:

This tweet from Kyle Reidhead is what really made things click for me. While I don’t agree with all of his explanations, this was very helpful in validating some of my own assumptions (click “Show more” to see full tweet):

What Makes SBET Special Vs Strategy (The SBET Epiphany)

(I’ve seen different numbers reported between $425M and $450M, so to keep it easy we’ll use the round number of $450M for this section.)

To understand what makes SBET interesting, it helps to start with the company that defined the category: Strategy (formerly MicroStrategy).

Under Michael Saylor, Strategy built the largest corporate Bitcoin treasury in the world of over $60B+ by issuing a mix of debt and equity. The goal was simple: accumulate as much BTC as possible using capital markets. Over time, this included instruments like STRK, STRF, and STRD, offering yields near 10% with different risk profiles to suit different investors. It’s a smart system, and it works well as long as Bitcoin continues to outpace the cost of capital.

But there’s a structural limitation here. Bitcoin doesn’t generate yield. If the company needs to pay expenses or service debt, it can’t draw from cash flow. There isn’t any besides their comparatively small software business. That leaves two choices: sell Bitcoin, or raise new money. In a bull market, that’s fine. When Bitcoin stalls or drops, the system gets strained.

SBET is doing something that, at first glance, looks similar. Raise money, buy crypto, in this case ETH. But there are two major differences:

ETH has native staking yield

ETH has DeFi

SBET didn’t waste any time in putting its ETH to work. According to their recent filing, over 95% of their ETH is already staked. The current staking APR on Lido stETH is 2.7%. On $450M worth of ETH (I believe some but not all the other $79M was used to buy ETH so this number could end up being higher), that becomes ~$12M in income per year. The company can use that income to handle expenses, service debt, or just accumulate more ETH over time.

For context, look at valuation. One way to compare treasury companies is by mNAV: market cap divided by crypto holdings. Strategy sits at 1.84x, however, the industry average of these treasury companies is around ~4.5x. SBET has been fluctuating between 1.3x - 1.5x ( I think you could make a case that it’s undervalued).

Earnings paint a different picture. Strategy has a negative P/E, with over $5 billion in net losses. SBET, on the other hand, is already earning on its holdings. At today’s staking rates, that’s a $12M run rate, putting its forward P/E near 50 - 55. These numbers don’t tell the whole story, of course. Crypto asset price is the main driver, but it’s a useful snapshot.

Staking is just the tip of the iceberg for SBET to leverage Ethereum’s DeFi ecosystem. When ready, SBET can plug into lending protocols like Aave, yield-trading markets like Pendle, and restaking platforms like Eigenlayer without needing permission or custom infrastructure. ETH held in smart contracts can generate income across multiple venues. There’s no need to exit the position or convert to dollars.

This means SBET could issue its own fixed debt instruments in ETH terms, or variable debt instruments in USD terms, backed by income from ETH staking. In contrast with Strategy’s financial engineering, SBET’s ETH produces returns that can cover the cost of debt. Treasury management could eventually be automated with smart contracts that execute based on transparent conditions. That’s not something BTC-native structures are currently equipped to do.

I recently asked Mike Silagadze the Founder and CEO of Ether.fi his thoughts on ETH treasury companies and their potential with DeFi:

We’re incredibly excited at the potential of ETH treasury companies participating in DeFi and we hope to play a big role in that

A Few Examples Of SBET Powered By DeFi

We mentioned some ideas above about SBET tapping into DeFi, but how would they actually do it?

There’s some protocols that come to mind that have been around for many years and have earned the reputation of being battle-tested.

These are just simple examples with some foundational strategies that could be ratcheted up or down depending on risk appetite. I happened to pick a few protocols I’m familiar with that have good reputations.

Here’s four variations that could be employed utilizing Aave, Fluid and Gearbox (none of which have suffered from hacks or exploits):

Long ETH - Aave

One fairly simple way SBET could go long ETH is to use Aave to create a leveraged long position on ETH:

Supply wstETH or something like weETH as collateral

Borrow USDC against that wstETH/weETH

Use that USDC to buy more wstETH/weETH

If you keep you leverage conservative around 1.5x your USDC borrow cost (4.78%) could be somewhat marginal when factoring your larger collateral position APY of ~2.7%.

The USDC borrow rates can get a bit out of hand at times, but they’ve averaged 6.59% over the last year. They would be paying a small premium to create their leveraged long on Aave.

A percentage of the SBET treasury could be used to create a small ETH long position in Aave if they are truly bullish on ETH long term.

Lending - Fluid

wstETH could be lent on Fluid.

This yield consistently hovers around 3.5% - 4% and has deep liquidity with $174M deployed here.

This could add another 1% of yield on top of the staking base rate and is fairly risk adjusted yield.

Vault - EtherFi

Ether.fi have their “Liquid” vaults that would be ideal vehicles to source extra yield.

Their Liquid ETH Yield product has a 7.2% APY and deep TVL of $524.7M

Looping - Gearbox

Gearbox has recently opened an institutional looping instance for Lido’s wstETH that is very scalable and has large borrow capacity. Currently there is around $80M supplied and about ~$51M being borrowed.

They can do bespoke instances with institutional players based on certain needs and requirements:

Whether or not these are workable strategies for SBET, it shows the financial engineering power of DeFi that can allow you to do more with your assets. Once again, this is not available to Bitcoin treasury companies.

That’s All Great, But Do You Think SBET Will Actually Use DeFi?

Yes I do.

I think Lubin is already foreshadowing some of the creativity he is planning with SBET.

And I never even talked about tokenizing it so it can trade onchain.

There are many others doing this strategy with a number of different assets like: ETH, SOL, HYPE and XRP (probably even Fartcoin soon 🤣). There will be tons of treasury companies for many digital assets. For instance, Charles Allen the CEO of BTCS is also early to exploring the use of DeFi with ETH treasury companies:

You can see which one I voted for 👀

What If SBET Was Fully Onchain? Enter ETH Strategy

I’m very excited about SBET and it’s potential to expose TradFi to DeFi. However, if looking a bit further into the future, there is a fully onchain tokenized version of SBET waiting in the wings.

This emerging model called ETH Strategy (launching soon 👀) imagines exactly that: an onchain version of the SBET playbook with no bankers, board approvals, or opaque filings. Instead of infrequent note issuances, it uses continuous “bonding” directly from smart contracts, with real-time treasury transparency and algorithmic pricing. Anyone can mint debt or buy STRAT (the equity token), while a built-in borrow against NAV mechanism helps maintain price floors and liquidity. It’s a decentralized treasury structure that replaces TradFi gatekeeping with programmable incentives, all while remaining fully composable with the rest of DeFi. This approach gives users access to volatility yield, active treasury utility, and governance-aligned ownership.

If you’re interested, we did a podcast on ETH Strategy and you can find it here:

Closing Thoughts

Bitcoin may have an edge on the store of value game, but Ethereum has always been better at programmable money.

When it comes to corporate crypto treasuries which rely on financial engineering, Ethereum DeFi is the perfect foundation. That’s the potential here. SBET is not just another Strategy copy. It is a flywheel that can invest in the native productivity of Ethereum DeFi. The first public company to act like an onchain financial protocol, transparently showing the world what Ethereum is capable of.

So yes, I think SBET could end up being one of the most groundbreaking stocks on the NASDAQ. It’s not just another ticker. It’s a real fusion of TradFi and DeFi, something entirely new. This kind of financial engineering is only possible because of DeFi infrastructure, and analysts are going to be paying close attention.

The DeFi community has been asking the Ethereum Foundation to invest in DeFi for years. Joe Lubin is about to lead by example with SBET.

Follow @Nomaticcap on X (Twitter)

Follow @DeFi_Dad on X (Twitter)

Follow @StableScarab on X (Twitter)

Follow @Clouted on X (Twitter)

Subscribe to The Edge Podcast via Linktree

Watch The Edge Podcast on YouTube

%202.png)