Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 30 day boosted yields this week!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

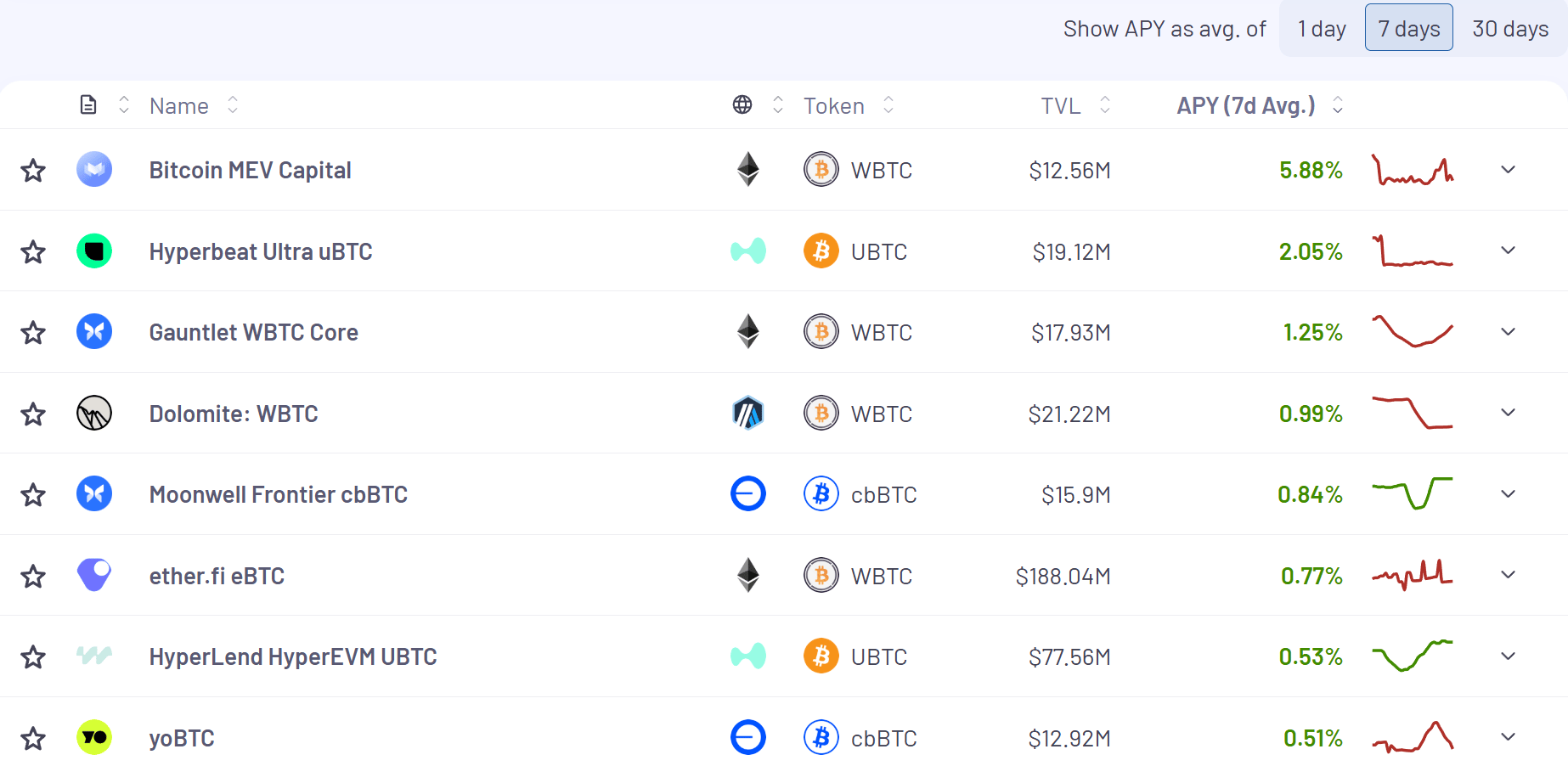

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

Use our referral code: “edge” to get 1000 extra flares

Partner codes: “raydium” or “orca” also get you extra flares

We wrote about Solstice a few times in their leadup to this launch. As quick refresher, they are attempting to become the “Ethena of Solana”.

Last week they officially went live.

As a user you’re faced with the option of clipping solid delta neutral yield, or further utilizing your USX throughout the Solana DeFi ecosystem.

On launch day, DeFi Dad wrote up a really nice explainer that takes you through everything that’s going on here. Click below to see his full break down:

This team has some lofty goals and it will be exciting to watch them execute:

Coming out of the gate with ~$200M in TVL is impressive

Katana launched a few months back out of stealth with no announcements of announcements and no VC funding.

They are an L2 that’s trying to cater purely to DeFi power users.

It’s actually refreshing to see a chain launch without many months of hype and mindshare farming.

These last few weeks I’ve watched TVL continue to tick up and wanted to take a closer look at what’s driving some of this.

Katana TVL has been up and to the right.

I ended up connecting with the Katana team who pointed me to their Morpho markets which creates very strong incentives to borrow on Katana.

As of right now, most of their primary collateral markets are paying you to borrow stables against them. Yes, you read that right, not only is borrowing free, you’re getting paid to do it. As you can see below this is ranging from -1.92% to -4.57%:

Here’s a bit more info on what some of these yields look like under the hood.

This one has a lot going on, but some are just KAT and MORPHO - all depends which vault you’re interested in. Also, the KAT yield is calculated at $1B FDV I believe, which actually seems somewhat reasonable considering their trajectory.

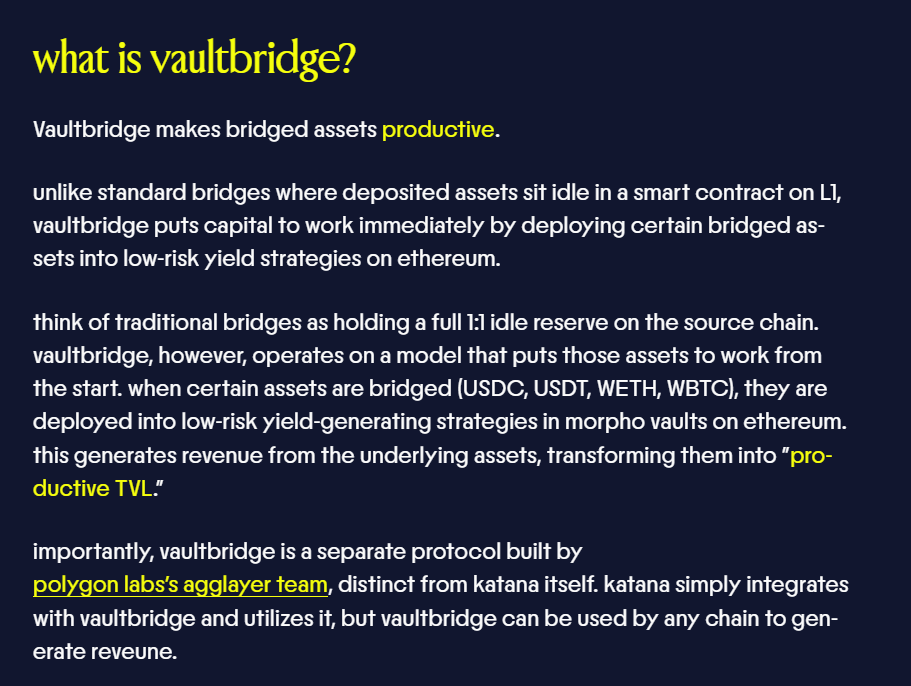

If you’re asking yourself what is vbETH? That’s a good question and its essentially their vaultbridge ETH that is being put to use in DeFi rather than sitting idle. Check this out from their blog:

Lastly, in talking to the team, there is a lot of interest in keeping these rates very enticing for borrowers on an ongoing basis 👀

246 launched their Plasma instance last week and its already quietly risen to ~$2M in TVL.

246 is built as a powerful extension of Aave. Their aUSDT0 re-lend yield is consistently fluctuating between 30% - 60% APY.

The cool thing is, this is without any leverage whatsoever:

If you’re curious about the main innovation here, check out DeFi Dad’s recent post:

As mentioned above, the yields on this particular vault are excellent and at the time of writing this they are still at 50.73% APY:

Here’s the breakdown of the yield:

A few things to note:

- Base APY is just the Aave base rate

- Re-Lend APY is paid out in aUSDT0 (real yield)

- WXPL is obviously XPL rewards that can be claimed on Merkl

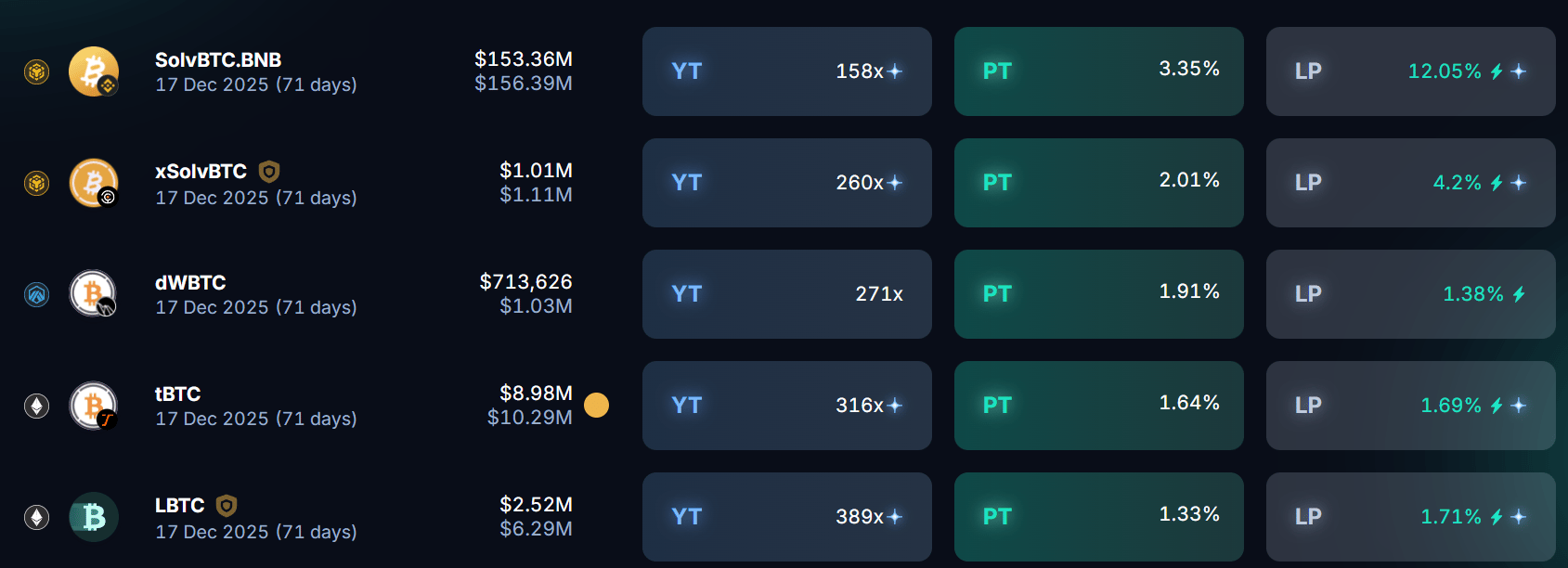

Yield Trading

Stables

29.18% - 36.5%

GPU backed synthetic dollar tokens still on top in a clean sweep of the top 5

BTC

1.33% - 3.35%

ETH

4.63% - 18.24% (*spETH close to maturity)

HYPE

11.4% - 17.2%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

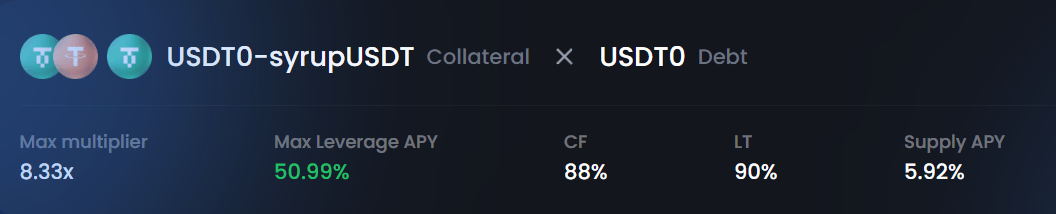

Fluid + Maple have a nice opportunity on Fluid’s Plasma instance. This loop is under their “Multiply” tab and is currently generating 50.99% APY (on Max Leverage):

This one was very close to full when I looked at it, but keep an eye on when caps raise for these.

Gearbox recently announced their support for Pendle PTs on Plasma (see announcement here)

OK, check out these USD.ai PT loops below. I didn’t even know they had March 19 2026 PTs up, but this is wild - they are showing up to 224.81% APR (I actually need to ping the team and make sure this is right 😂) :

Obviously these are showing max leverage and its always advised that if you do leverage up that you’re comfortable with all the risks.

That’s all for now, thanks for checking it out!