Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 7 day boosted yields this week!

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL

The River team recently wrote a guest post for us analyzing the success of their TGE and their novel mechanism they call Dynamic Airdrop Conversion (read it here).

Reading the above post will give you more context, but if looking for the TLDR version, this is a short excerpt from that piece:

Knowing a bit of the above will put DeFi Dad’s post into a bit better context. This is also part of a broader trend in this piece where we try to find opportunities with solid base yield + upside:

Here’s the APRs DeFi Dad was referring to in the piece above

What To Do?

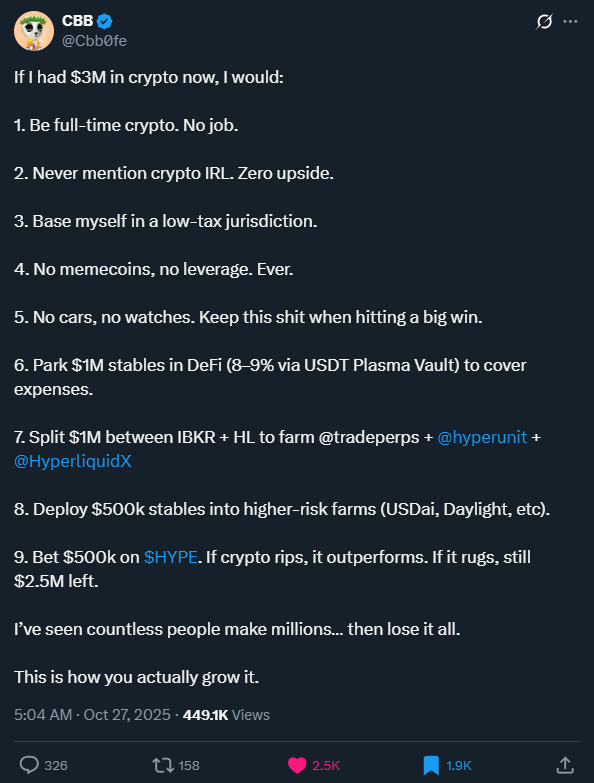

I’ve been liking some of these posts on strategy that CBB has been posting on X. They’ve been sharing perspectives on all different sizes of crypto portfolios.

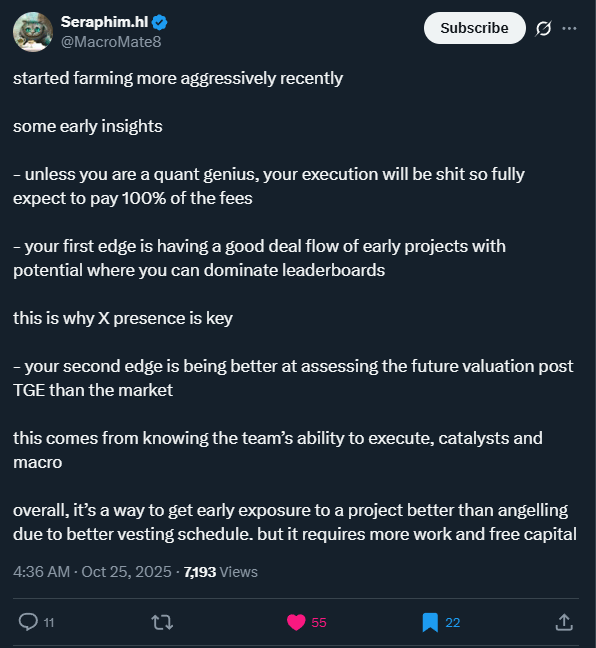

Seraphim also drops a few nuggets of wisdom here.

This is especially on point:

your second edge is being better at assessing the future valuation post TGE than the market

this comes from knowing the team’s ability to execute, catalysts and macro

On the quote above, I might be biased, but I don’t think there’s a better way to assess a project than by hearing the founders talk in long form about what they’re building. I’m lucky to have the chance to hop on calls with many founding teams behind these protocols, but even before that, my favorite format was always podcasts.

In fact, DeFi Dad and I often invite founders onto our podcast as part of our own due diligence process. What better way to decide if we’re bullish on someone than to just talk with them and ask all our burning questions?

Some of the things I’m always listening for are: are they passionate, driven, excited, and deeply focused on what they’re building? Do they have clarity of vision and a concrete plan for how they’ll execute it? In other words, are they highly opinionated about their idea (I actually like it when they are).

Overall, do they seem competent? Do they have strong ethics and sound judgment?

People can be great actors and still fool you, but nothing quite replaces a real, long-form conversation.

As an example, one of my favorite recent episodes on The Edge Podcast was with Sid, the founder of Maple. I left that conversation convinced there’s no one better suited to build what he’s building—and with a high degree of confidence that he and his team will pull it off and be immensely successful. Here it is:

Yield Trading

Solstice just launched eUSX on Exponent Finance. Why is this interesting? Well, there’s fairly low liquidity, but there could be a nice opportunity to lock in some nice yields right now as PT APYs are jumping all over the place.

If you decide to offer liquidity in the LP its offering 44.48% fixed APY + Points (Flares):

I’m already bullish on Solstice and I think the YT side of this could be interesting as well. I appreciate that Exponent simulates what a $1000 position could look like:

I’m knew to Exponent so getting used to their UI, but the way they break down the eUSX yield is important. There’s 3.2% in underlying USX yield and the other 4.02% is Solstice Flares. I’m still sort of trying to figure it out myself after dealing only with Pendle for years.

I will be watching this and seeing if these YTs drop a bit for an entry.

Stephen from DeFi Dojo put out a great video on Cap, how it works and the potential points upside here. Click on the image below to go right to the video:

This is what the updated math looks like with an estimated 400 Billion total points. With the cUSD points trading at 11.5% APY, I'd say they still look undervalued.

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

So we know that eUSX now has a PT version on Exponent - what do we think comes next?

My sources tell me that Kamino will be supporting looping of eUSX PTs very soon (possibly even this week) 👀

This will not come with any Flares (points), but I expect the APY to be quite high.

Once PT looping is live, we’ll really start to see the push and pull dynamic between the PT and YTs.

That’s all for now, thanks for checking it out!