Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

This is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

We’re looking at 30 day boosted yields this week!

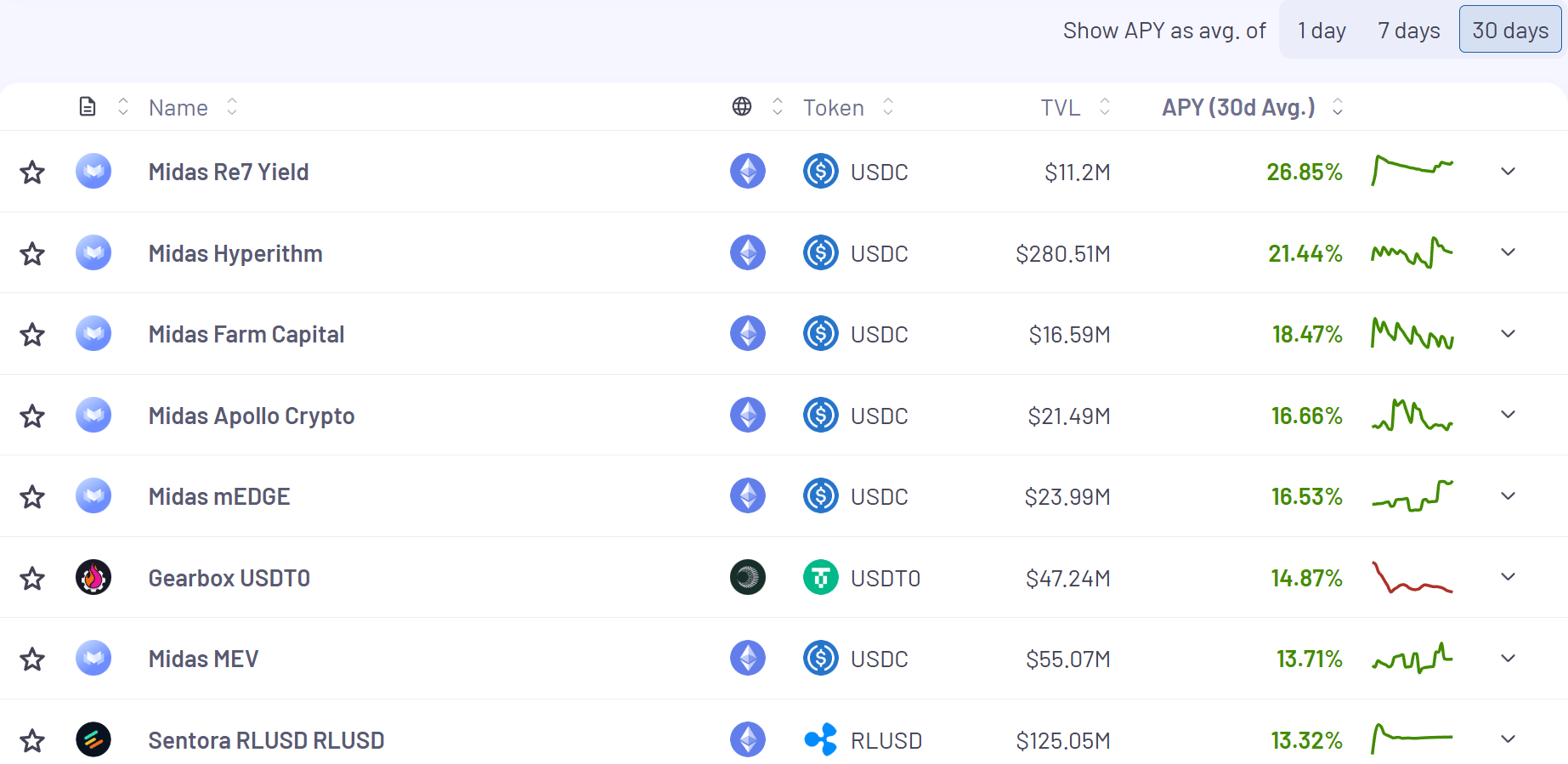

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

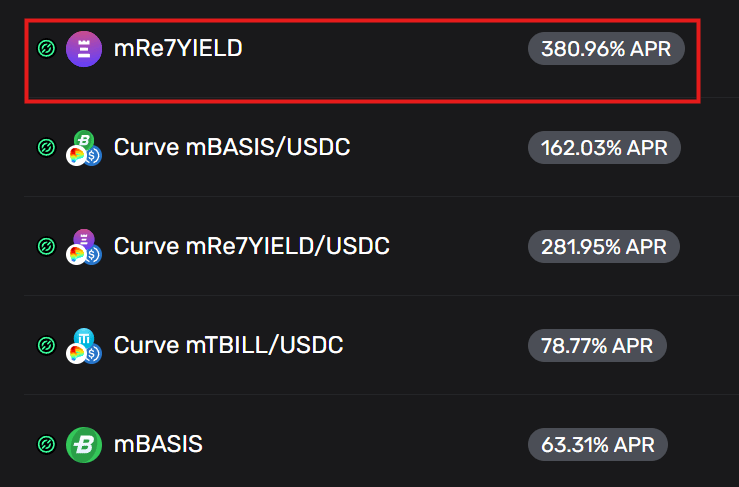

Midas absolutely dominating on yields 🔥

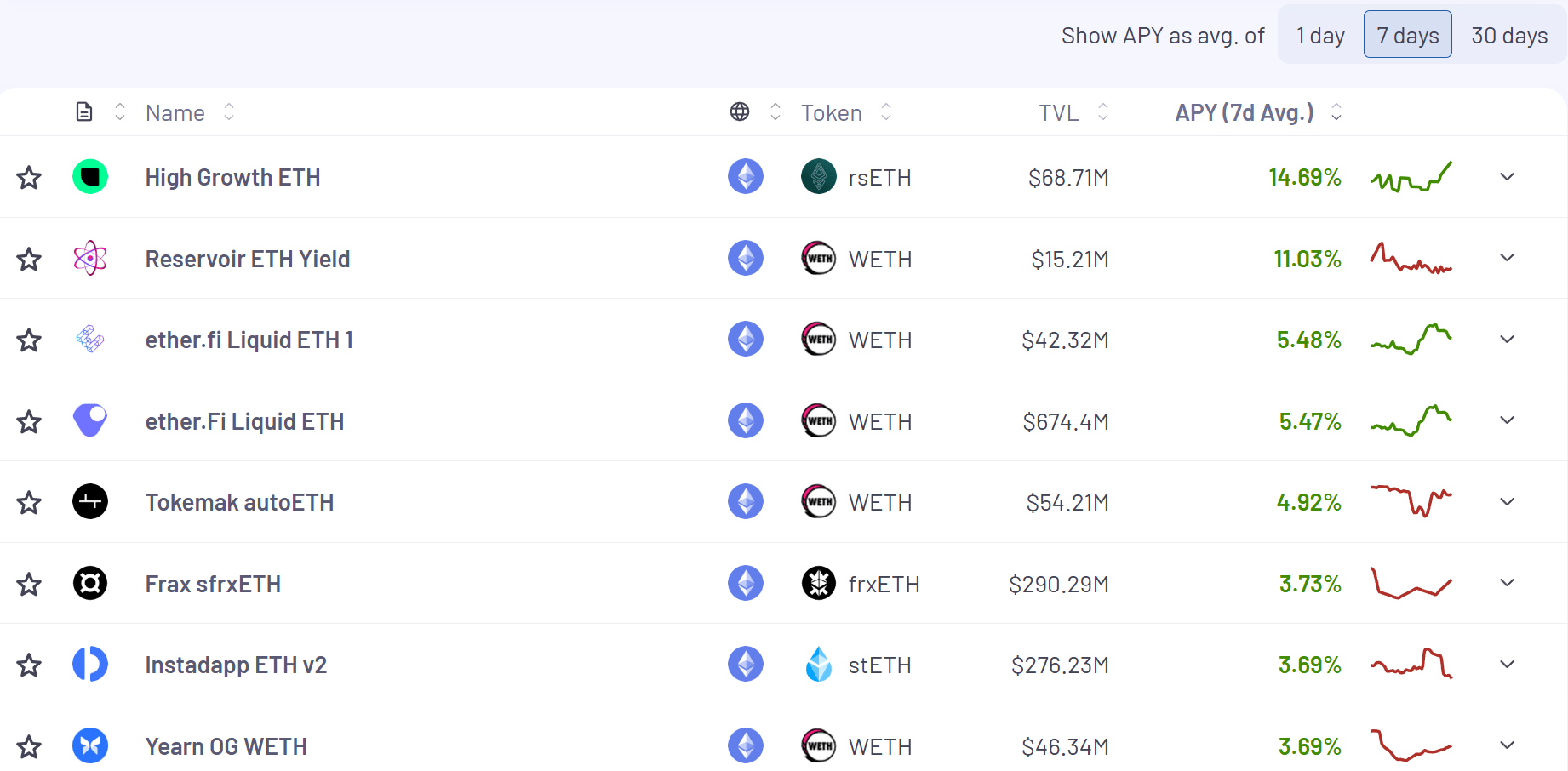

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

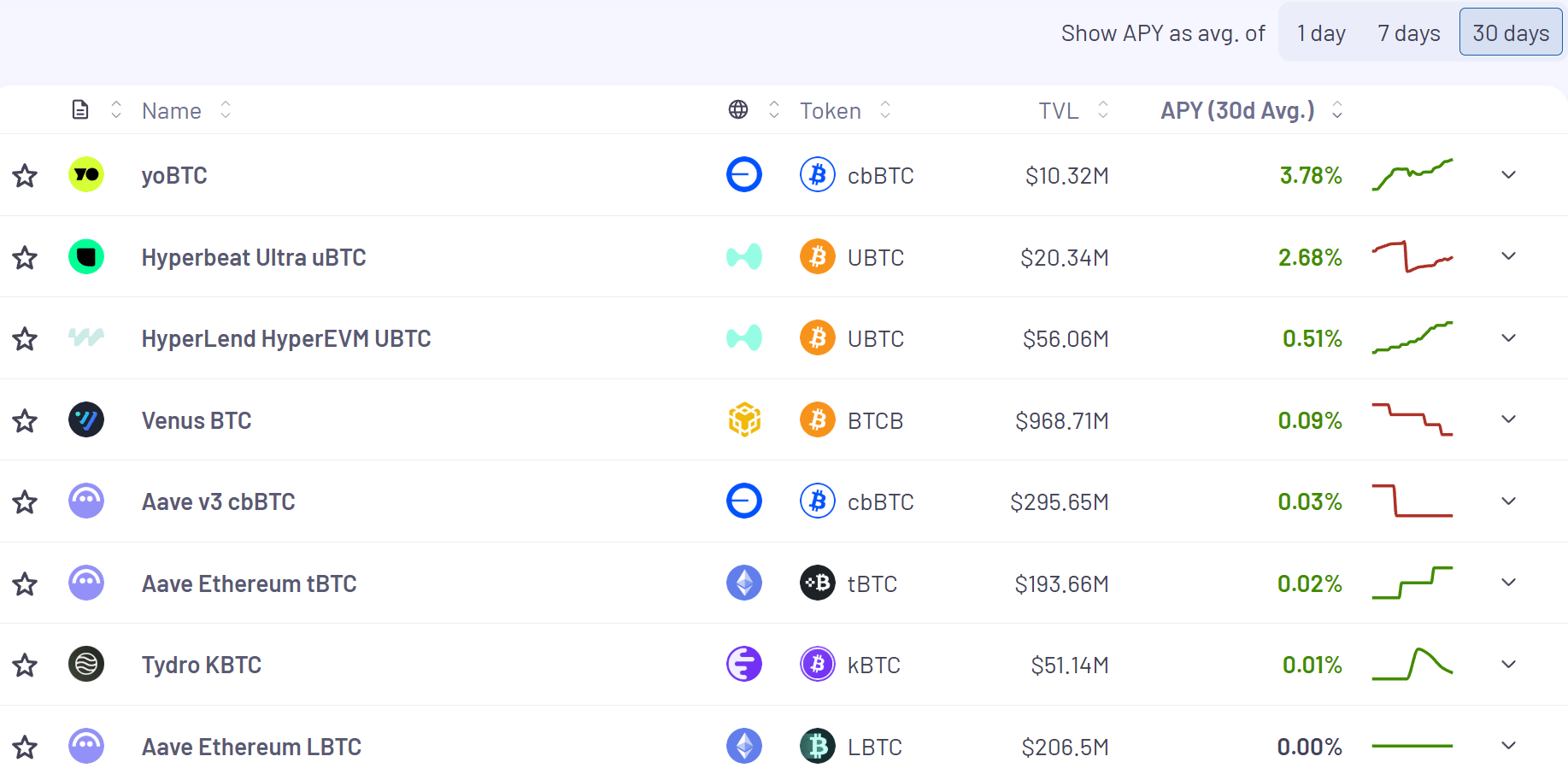

Here’s the top yielding BTC vaults (boosted) for the past 30 days according to Vaults.fyi:

Min $10M TVL

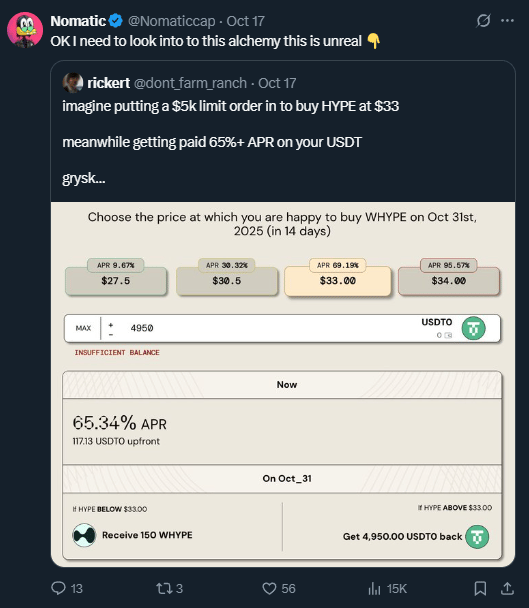

I’d heard of Rysk Finance, but admittedly had no idea what they did until this weekend when I saw a post on X that made a lot of sense:

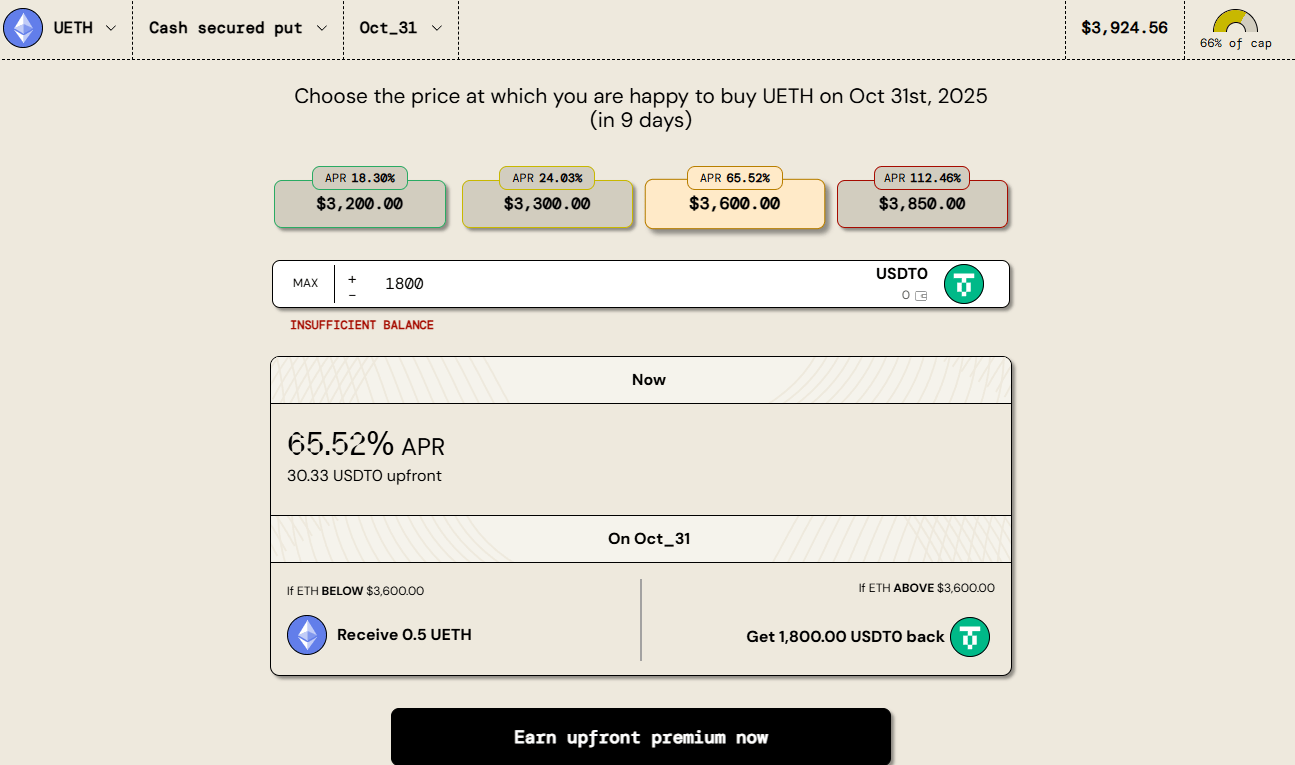

The strategy above is called a “Cash Secured Put” and you actually get your yield upfront.

In the example above, if you put up $4950 you would immediately get 65.34% APR or $117.13 (for 14 days)

Then,

If HYPE is below $33 at expiry (Oct 31st) you get 150 HYPE and if its above $33 at expiry (Oct 31st), you get your initial $4950 back (+ the initial $117.13 that you get immediately regardless of outcome).

I was thinking through how I would use this and I think it’s a really unique way to buy dips while also stacking yield if your prices aren’t hit. If you’re bullish the underlying asset and want to accumulate its a bit of a win win scenario.

It’s also available for other majors like ETH and BTC. Here’s ETH below:

This is a pretty novel way to clip high APR or set yourself up for nice discounts on assets you’re bullish on!

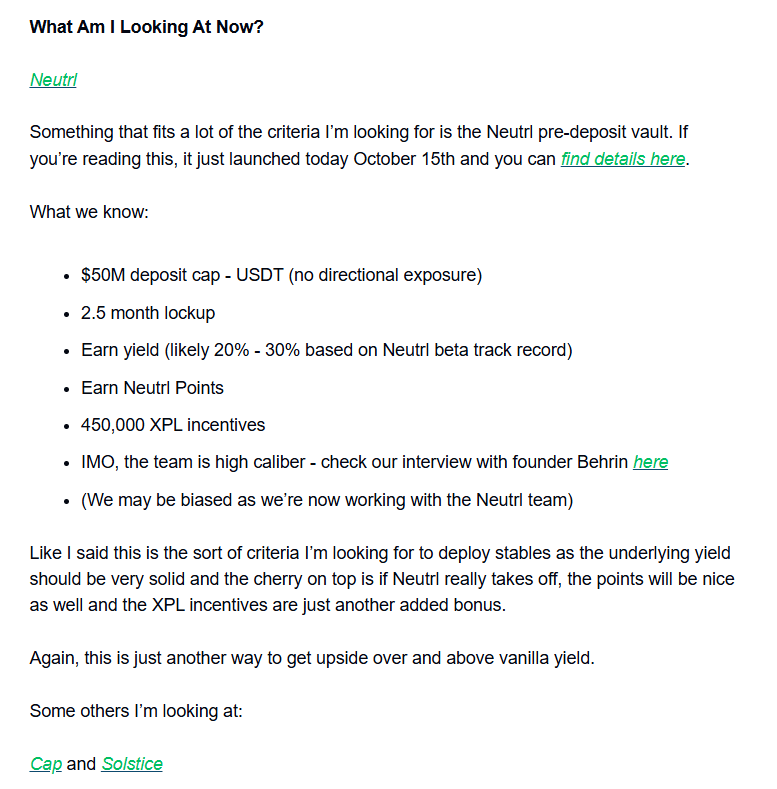

Last week (Oct 15th) we wrote something in this section called “I’m addicted to mystery yield” where we talked about opportunities for yield + upside. One of these opportunities we looked at was Neutrl’s pre-deposit vault. Here’s what we wrote up:

Since we writing this, Neutrl’s first $50M tranch sold out in under 20 minutes. Neutrl opened up an additional $25M tranche on October 20th that also sold out almost immediately (even during the massive AWS outage). This brings the pre-deposit total up to $75M.

Clearly there was a lot of interest in this (as we expected) and we’ll be on the lookout for more of these yield + upside opportunities going forward.

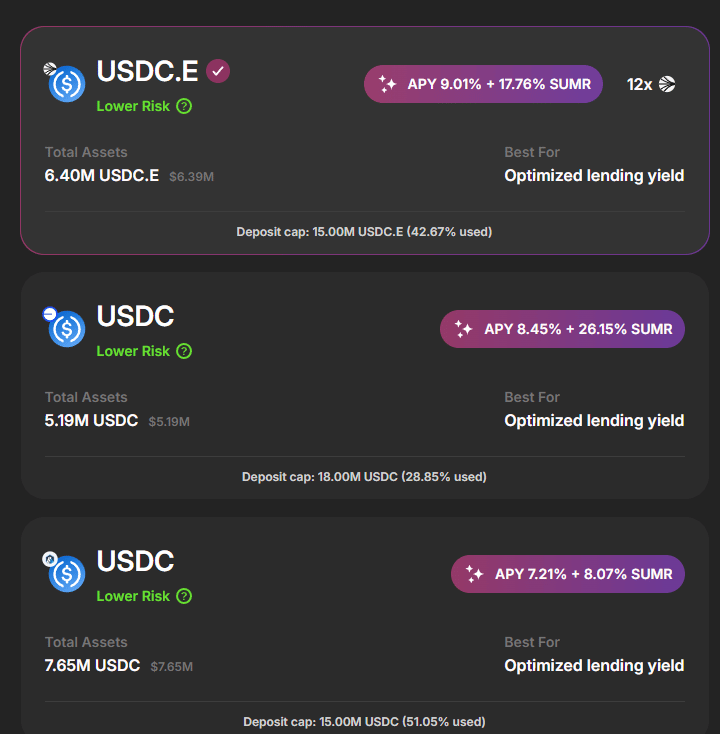

The Lazy Summer Protocol by the Summer.Fi team are another example of yield + upside.

In the lead up to their SUMR token they are offering yields + token incentives. DeFi Dad wrote up a great thread on these vaults right here.

Here’s some of the stablecoin yields on the platform right now and the token upside:

One important component that DeFi Dad calls out in the X post above is that the SUMR yield is based on a $250M FDV for the future token. If you think this is high or low you can lower it or raise it in the UI and yields will reflect these changes.

There’s just a lot you can do with your time to put yourself in position for some great opportunities.

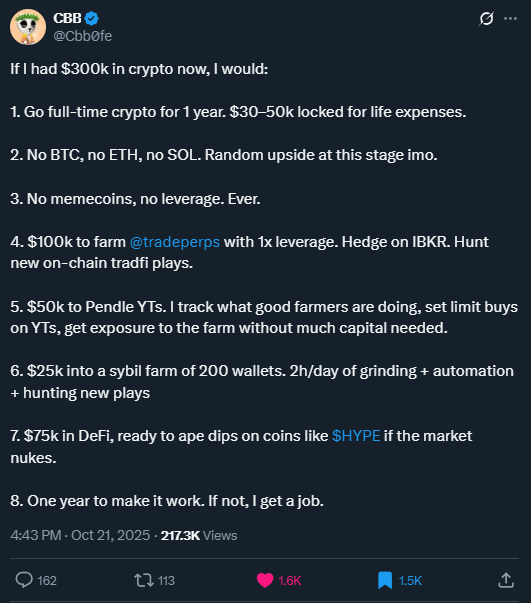

I saw this on X and thought it was worth sharing. I don’t agree with absolutely every step, but I think its directionally right:

Yield Trading

🚨 IMPORTANT 🚨

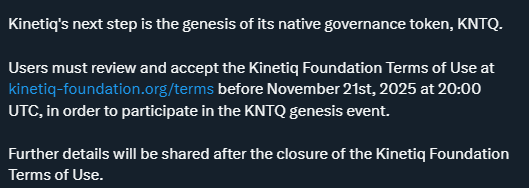

I’ve written up Kinetiq YTs a lot in this section over the past few months and they just announced a step that all users need to do if they want to be eligible to claim their airdrop.

If you have ANY kPoints you can click on the image below that will take you to the Kinetiq Foundation Terms of Service where you’ll have to sign with any wallets that hold kPoints 👇

Failure to do this will disqualify you from getting an airdrop.

There’s strong speculation the KNTQ token will launch on Nov 27th the day before the anniversary of the HYPE TGE.

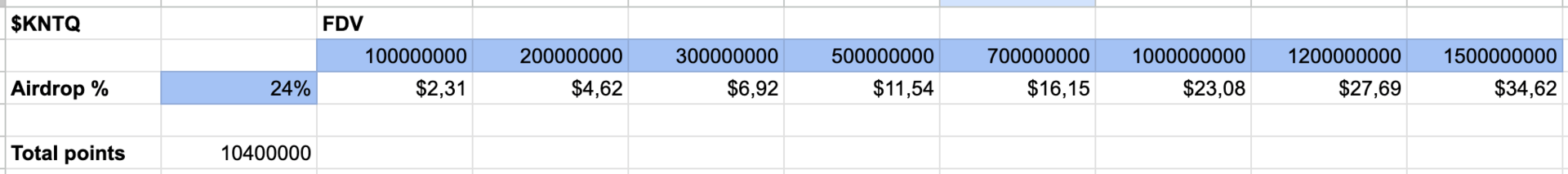

As far as speculation on $/pt prices have come down a lot and the $6 - $12 range is looking plausible unless we get major rally:

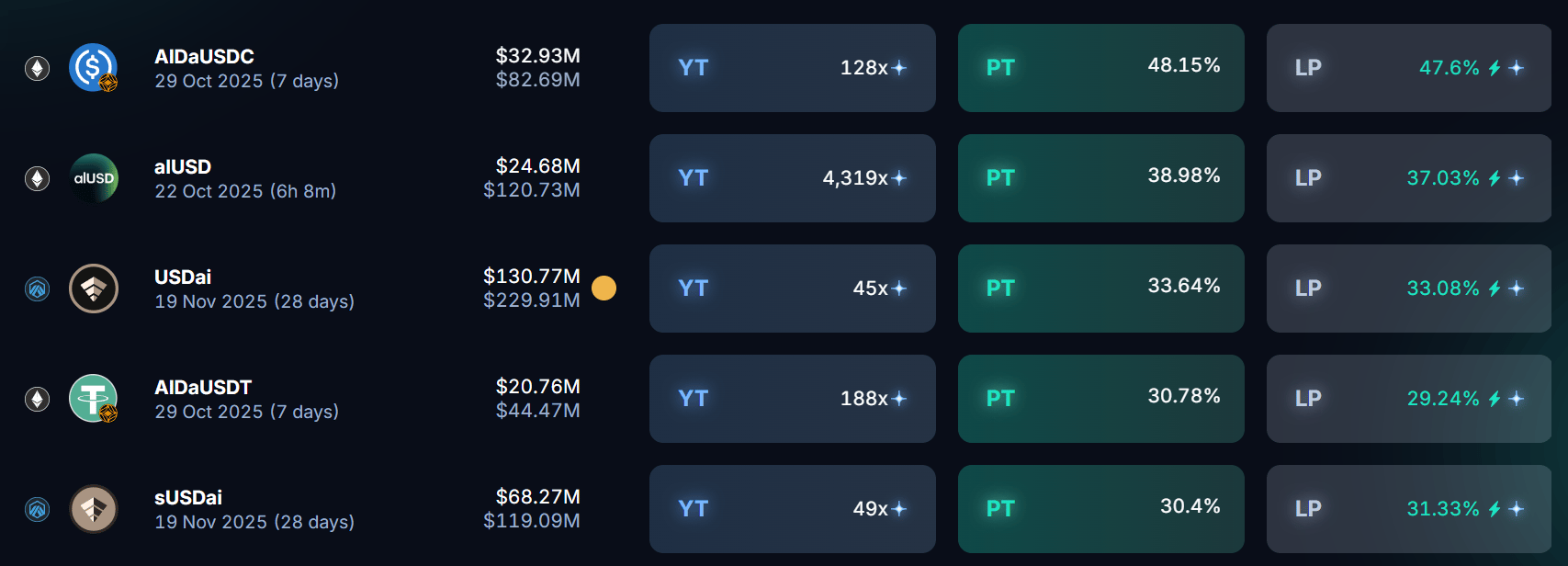

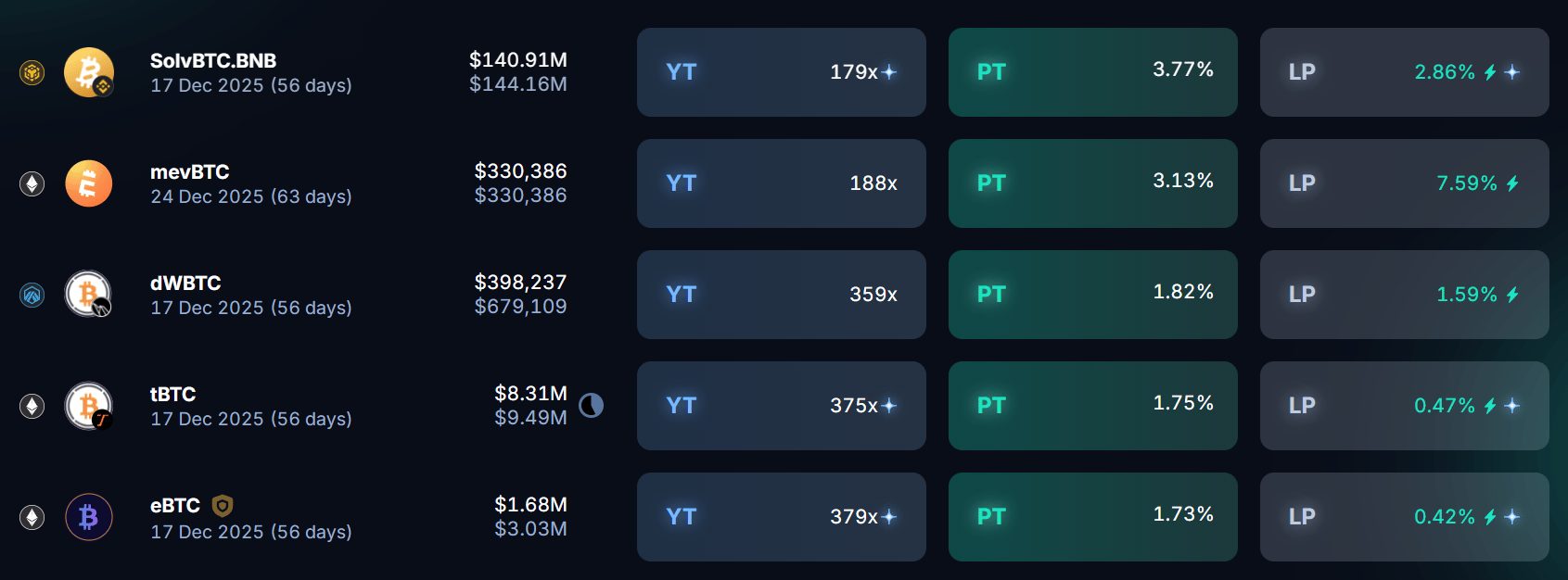

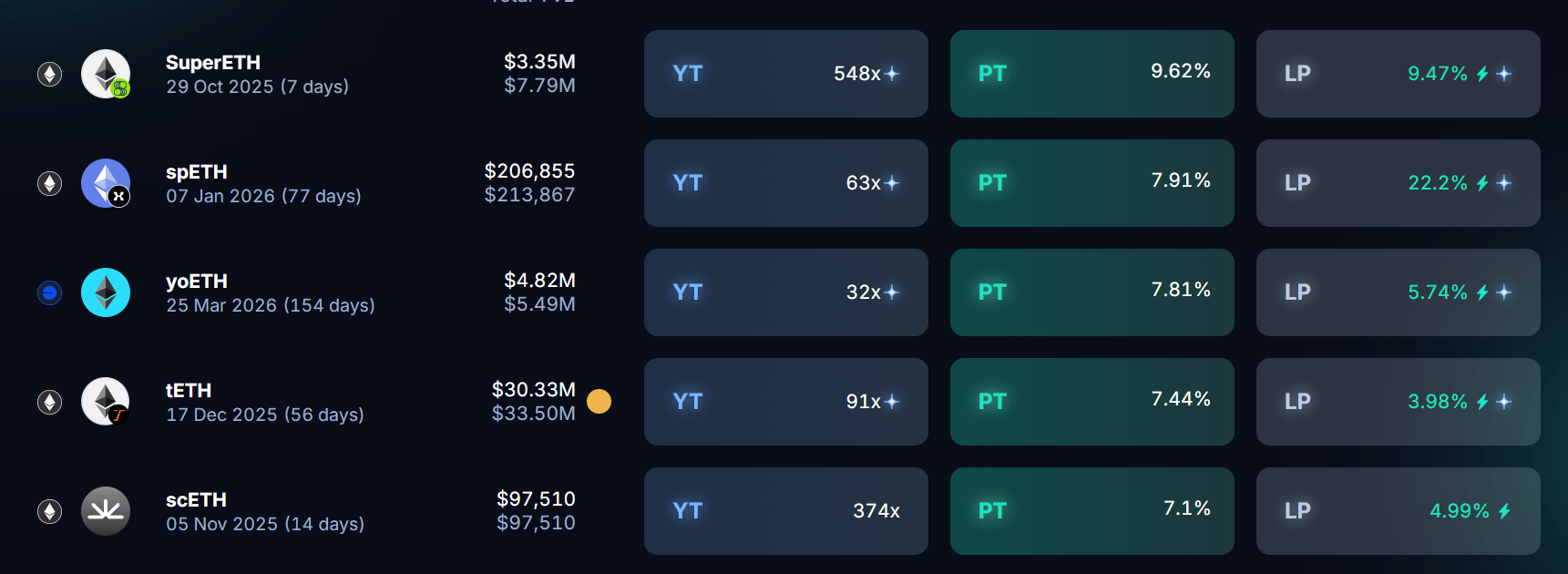

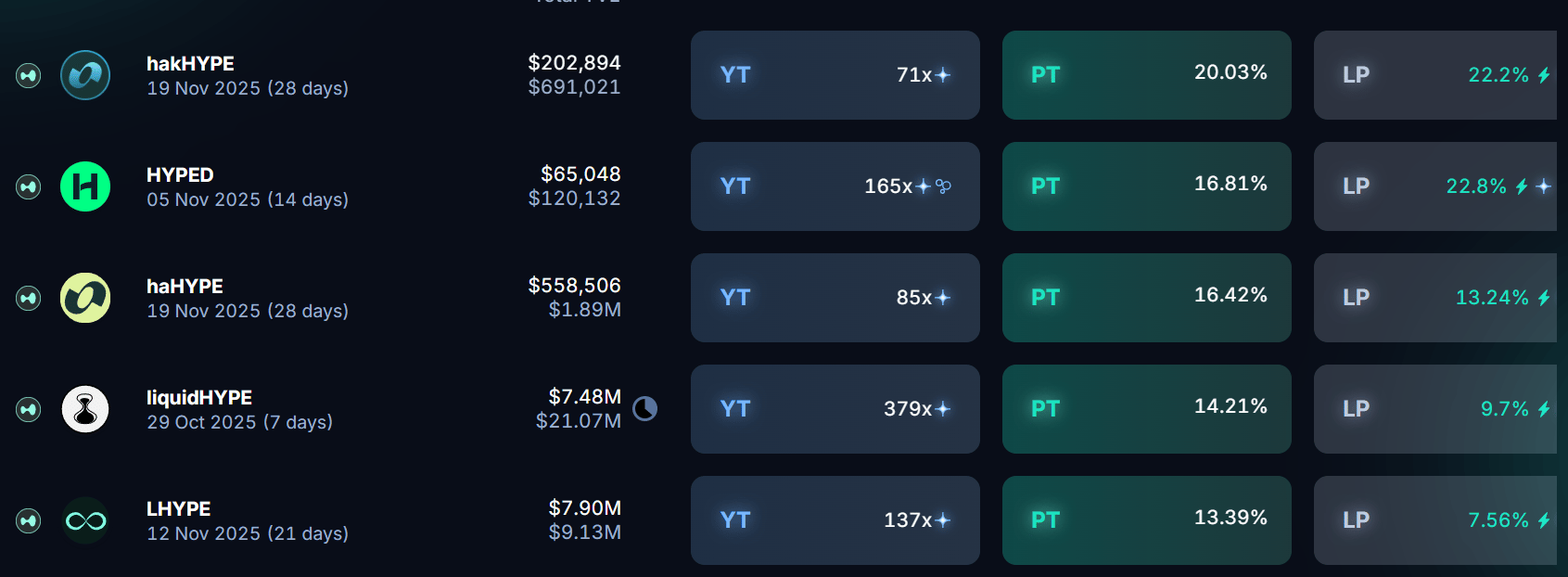

Here’s what the front page of DeFi yield looks like on Pendle this week across: Stables, BTC, ETH and HYPE markets:

Stables

30.4% - 48.15%

(note - a lot of these are expiring or close to as I type this)

BTC

1.73% - 3.77%

ETH

7.1% - 9.62%

HYPE

13.29% - 20.03%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

mStable has released a new product that has automated the Aavethena loop:

I had the opportunity to test this product out while it was in beta and it was very smooth to use and takes out a number of steps you’d need to take to do this manually.

I was in it for about 29 days (again to test it out) and netted around 40% APR.

When I exited I had a bit of slippage, but since then they’ve:

Adjusted the oracle for better withdrawal pricing

Aave has whitelisted the token for free flashloans

I’m told these steps will make pricing even tighter so you retain more of your yield.

Click here to see their full announcement post for more information.

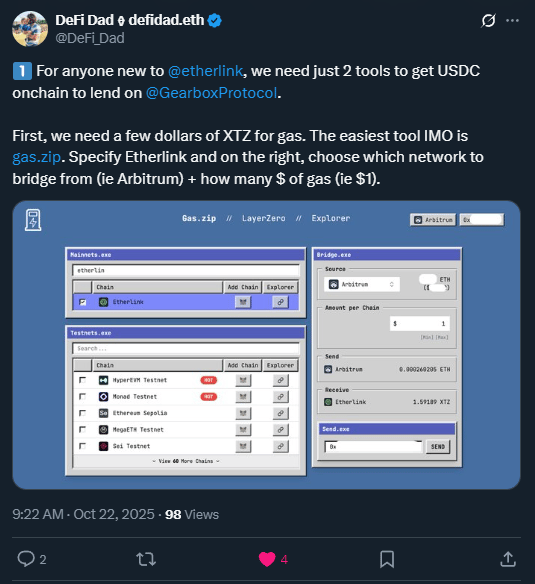

If you’re new to Etherlink, DeFi Dad has an incredible onboarding post that walks you through getting funds over to the chain (he’s personally in some of these Etherlink loops via Gearbox):

We’ve written up a few Etherlink + Gearbox strategies already the past few weeks, but this is probably one of the more outlier yields we’ve found to date.

I don’t expect this mRE7YIELD to stay this high, but at the time of writing this its 380.96% APR:

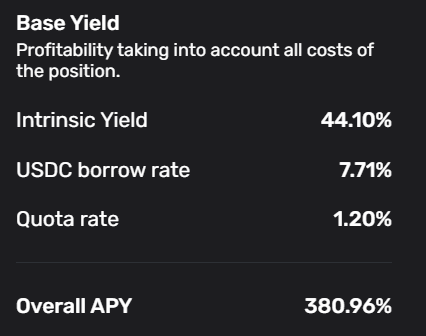

If you hover over the yield you can see the breakdown below. Extremely high intrinsic yield coupled with a low borrow rate:

That’s all for now, thanks for checking it out!