Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

🧪 MANTLE | START YOUR RESTAKING JOURNEY TODAY WITH CMETH

🐡 PUFFER FINANCE | LIQUID RESTAKING FOR THE LITTLE FISH

🌔 MOONWELL | THE LEADING LENDING AND BORROWING APP ON BASE

⚙️ GEARBOX PROTOCOL | ONCHAIN LENDING REIMAGINED

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Stablecoin Yields

Here’s the top yielding stablecoin vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Bonus: There are some nice lending APYs on Euler right now particularly for sDAI on Mainnet yielding 20.57% APY:

Bonus: Another product we’re a big fan of is Fluid’s Smart Lending. Right now, this USDC/RLP pair is earning 13.94% APR:

These yields above can be achieved because RLP is paired with a core lending asset (USDC/USDT). Since USDC is a core lending asset, this pair can tap into some extremely strong yields:

Here’s a breakdown on where the yield is coming from.

As you can see the trading APR alone is adding 9.99% yield on top for this arrangement. Therefore, be on the lookout for assets that have strong yields that are paired with one of the core lending assets.

ETH & BTC Yields

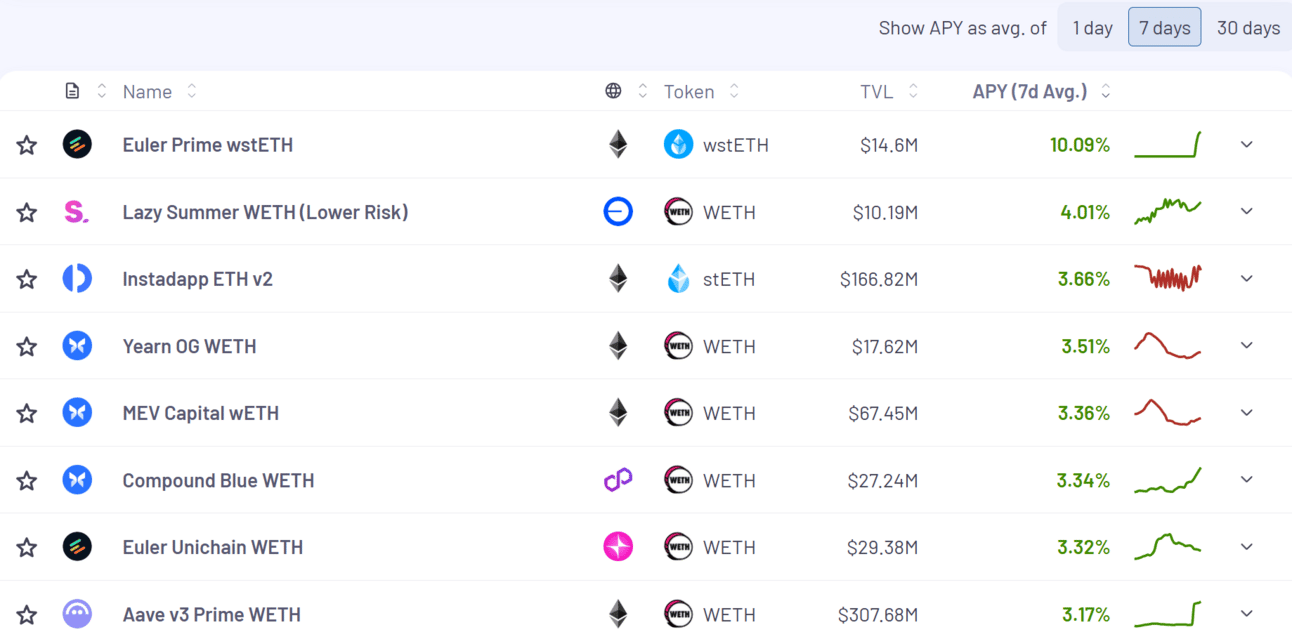

Here’s the top yielding ETH vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Here’s the top yielding BTC vaults (non-boosted) for the past 7 days according to Vaults.fyi:

Min $10M TVL (7 day avg, non-boosted yield)

The link to this filtered table above is here

Bonus: The Gearbox team have a new opportunity for tBTC lending right now. This started out quite high, but has since come down to a solid 4.19% APY

DeFi Dad explains a bit about what his happening here (yields have come down since this post obviously):

Yield Trading

First up, if you missed this, Pendle Intern has started to dig into InfiniFi. This is a YT play that I personally have my eye on but have not yet entered. I will be watching their TVL growth over the coming few weeks:

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

11.25% - 14.93%

BTC

1.97% - 4.3%

ETH

3.96% - 5.01%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

Myself and DeFi Dad are early investors in 246 Club. They’ve been in an exclusive mainnet phase for a while, but recently opened up to Sonic.

To bring you up to speed, this is one of my favorite posts about 246 from Rightside:

Here is one of their premier looping yields right now that has a max ROE of 50.8% (real yield):

One limitation right now is available liquidity as the protocol is still early days of ramping up.

Here’s a breakdown of the math and where the yields are coming from (non-inclusive of points):

The ability to tap into cross-protocol loans can turn 246 into a standout for looping yields going forward. It allows them to source some of the best collateral yields and pair them with the best borrow yields on the market.

That’s all for now, thanks for checking it out!