Welcome to Yields of the Week! Every Friday, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable and unique opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Before we get started, this is never a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

Before we begin…

This week we’re going to showcase yields from minimum TVL of $1M (While still curated with more trusted names). We typically don’t show boosted yields as much, but we’re going to show those this week just to mix it up.

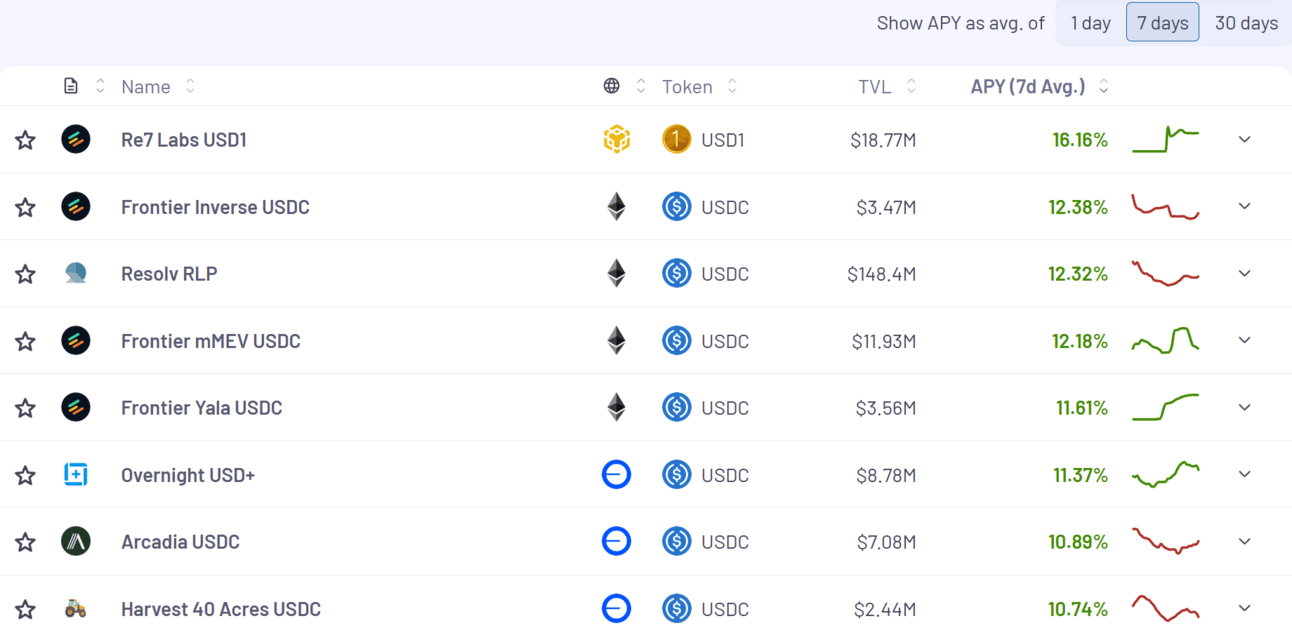

Stablecoin Yields

Here’s the top yielding stablecoin vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $1M in TVL (7 day avg, boosted)

The link to this filtered table above is here

Bonus: If you’ve been reading this for a long period of time, its no secret I’m a fan of Tokemak’s Autopools.

This autoDOLA pool has no incentives and is achieving a base rate yield of 11.40% APY. Pretty impressive:

I love the transparency of where all the funds are deployed and then under the rebalances tab you can see how often funds are being optimized.

ETH & BTC Yields

Here’s the top yielding ETH vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $1M in TVL (7 day avg, boosted)

The link to this filtered table above is here

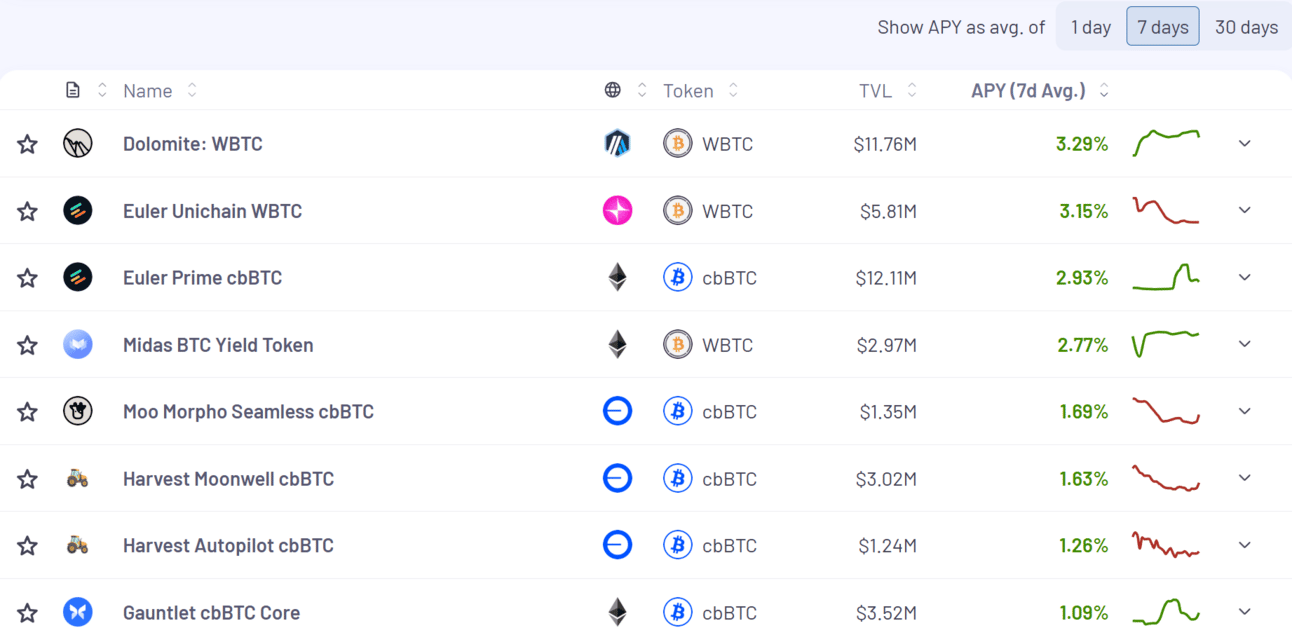

Here’s the top yielding BTC vaults (boosted) for the past 7 days according to Vaults.fyi:

Min $1M in TVL (7 day avg, boosted)

The link to this filtered table above is here

Bonus: We’ve known the founder of Avant (Rhett Shipp) for many years now and Avant’s new BTC product is quite interesting as yield on BTC is hard to find. Right now avBTC is yielding a very impressive 5.21% APY:

Want to learn more? We did a Yield Talks session recently with their founder Rhett Shipp:

Bonus: OK one more BTC yield for you and its a bit of a hidden gem IMO.

I know the Goat team very well, we’ve had many calls over the past year as they were an early supporter of the The Edge. The grand vision of what they’ve been building towards is finally coming together (if you need a refresher this is a great resource)

All that to say, sometimes when I see high yields advertised, I’m a bit skeptical but in this case I know where the yield is coming from. This particular opportunity is on Artemis Finance and yielding 117.39% APR:

Here’s a breakdown of the yield and as you can see 29.48% in real yield (BTC)

So of course, the GOATED portion is highly contingent on the value of the future airdrop, but I consider that sort of a really nice bonus. Even if you throw that out (which you shouldn’t), 29.48% real yield (in Bitcoin) is absurdly high.

Here’s more details from the team:

Bonus: (btw, I’m leaving this in from last week)

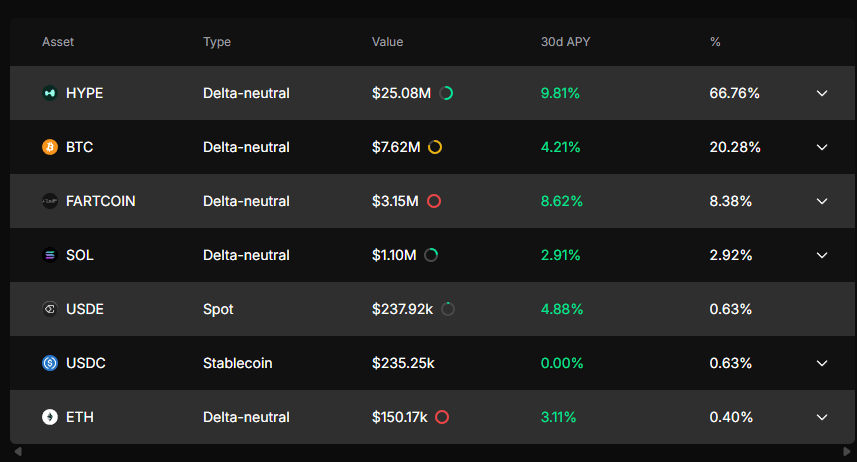

I think one of the coolest DeFi product ideas I’ve read about recently is Liminal. It allows you to get delta neutral yield on a number of blue chip assets with ease.

Here’s an idea of assets and yields:

Again, this is real yield, no incentives.

The ones that obviously standout are the HYPE and BTC yields.

This is the excellent thread that finally got me up to speed on Liminal. It’s very much worth your time:

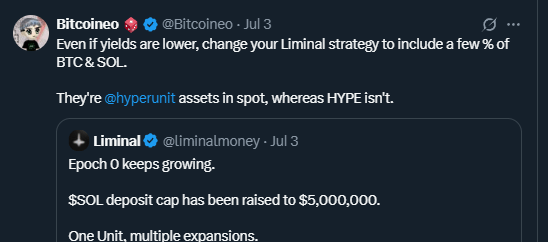

OK, want to take it one step further?

I’ve been looking for ways to get creative exposure to Hyperunit airdrop. This strategy makes a lot of sense to me:

Pretty sharp idea here by Bitcoineo

OK and lastly check this out:

Yield Trading

Here’s what the top yield markets on Pendle look like across Stables, BTC and ETH:

Stables

12.9% - 15.49%

BTC

1.52% - 3.47%

ETH

3.98% - 5.91%

Leverage Looping Yields

Looping can be a very effective leverage strategy to earn more yield, but one must be cautious to monitor borrowing rates, and liquidations which are a necessary cost to generate such leveraged yields (we don’t recommend max leverage). It’s also important to know if you’re going after points or real yield when looping.

We have a nice one for you today from Rumpel!

Why is Rumpel a new Superpower for points/yield farmers?

Stephen from DeFi Dojo explains it better than anyone in under one minute:

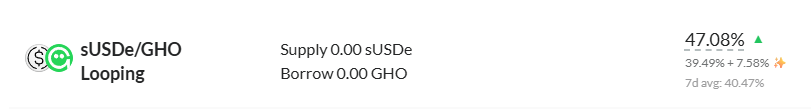

Check this out, 47% APY on a stable position of sUSDe/GHO.

How is this possible?

It’s partly the financial alchemy from the giga brains at Fluid coupled with the ability to immediately stream points into yield via Rumpel.

Look at this:

Rumpel is converting all of these Ethena points to real yields, but in ~real-time. This is pretty much a farmers dream and I still think this goes a bit under the radar.

No more waiting 3 - 6 months to convert points to yield. Rumpel does this on the fly!

We’re going to leave you with a bit of a tip on slippage and how much it can effect looping. Give this post from Gearbox below a read through. This may seem like a small thing, but it can have major impacts on your bottom line and Gearbox is improving this experience:

That’s all for now, thanks for checking it out!

.jpg)