Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

Huge thanks to our Yields of the Week lead sponsor: Summer.fi

Built by the team behind the Sky Ecosystem (aka MakerDAO) and Oasis, Summer.fi provides automated access to high-quality DeFi yield through curated vaults for assets like ETH, USDT, and USDC.

Earn above benchmark yields + SUMR tokens on top!

Learn more about Toros Finance and their novel leverage tokens

We’re looking at 30 day real yields this week with minimum of $10M in TVL (powered by vaults.fyi)

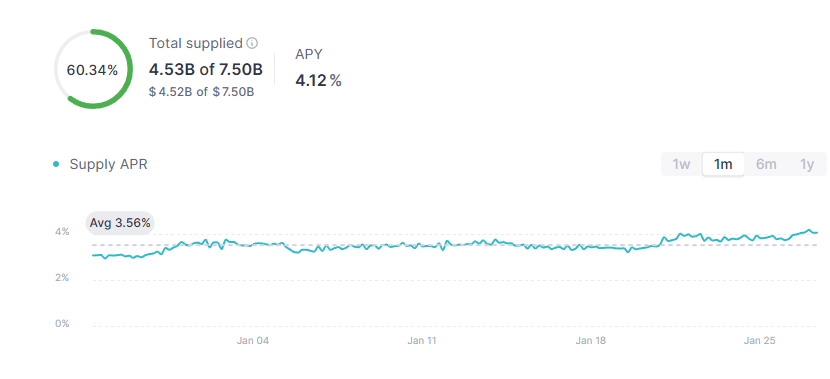

Stablecoin Yields

USDC 30 day benchmark rate on Aave: 3.56%

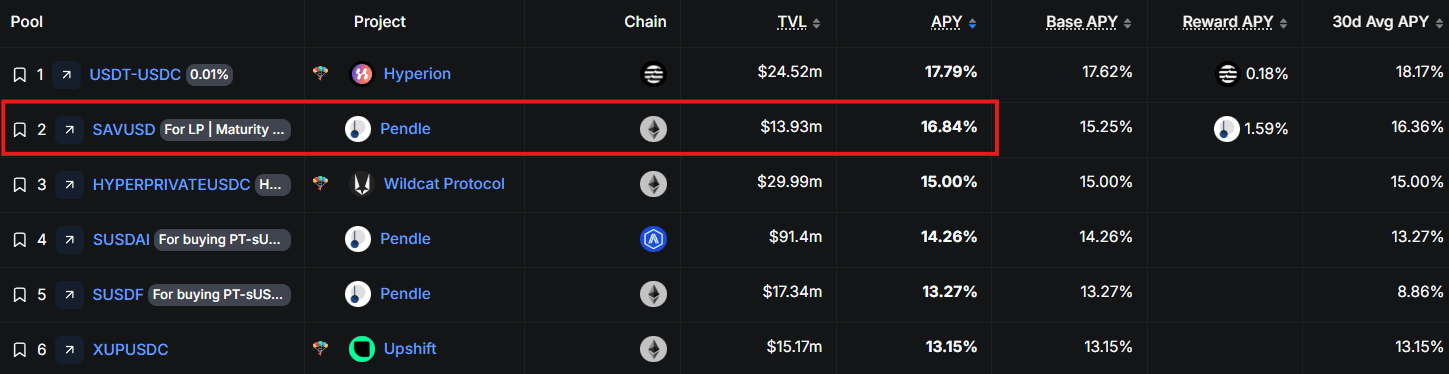

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $10M TVL

Btw, I love that you can see how many holders that are in each of these vaults. It really gives you a rough idea of user type.

Checking in on Stablewatch to see the 7-day TVL changes.

This week the top movers were Yuzu +77.0% (once again - last week it was syzUSD and this week its yzPP) , Unitas +70.7% and Frax +17%.

It’s impressive to see Hashnote’s growth of 12.3% on such a large TVL base of $1.66B.

Nothing conclusive here, just things I’m watching:

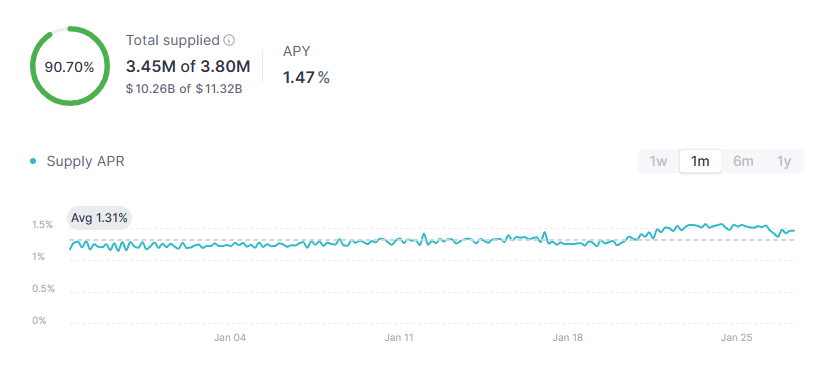

ETH Yields

ETH 30 day benchmark rate on Aave: 1.31%

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $10M TVL

Rapid Fire Yields

I had this earmarked to go in this week, but the caps already filled in less than 12 hours 😂

The good thing is, caps are being raised 🔜

Aegis is on my radar mainly because they’re working with Accountable. They recently introduced a tokenized JLP product called jUSD. It looks interesting at first glance, and I’ll be jumping on a call with the team soon to dig into this and a few of their other products.

We’ve written about Avant a lot over the past several months. They consistently offer some of the most competitive yields in DeFi and have been making real progress on their transparency dashboard. We’re still waiting on full transparency for avBTC and avETH, but the direction has been encouraging.

On top of that, their savUSD Pendle LP has been one of the top 30 day yields on DeFiLlama, currently sitting at 16.84%.

We’ve been intentionally highlighting Accountable vaults because of their strong alignment with transparency. It’s no surprise that many of them are already capped or nearing their limits.

Yuzu is essentially full. Hyperithm still has some room, and sUSN from Noon Capital has plenty of capacity. Both are among the higher base yielding vaults on the platform, offering roughly 12% base yield for Hyperithm and 9.54% for the Noon vault, respectively:

DeFi Best Practices

These two posts caught my eye this week because I’m always curious what smart people are saying about risk and transparency in DeFi. Not all vaults are created equal.

Here’s the first post from definikola at Blockanalitica:

The second is by Sebastien from Steakhouse:

Thanks to our lead sponsors for making it possible to share this content for FREE!

Yield Trading

I have this weird mental block where I struggle to differentiate certain definitions. It honestly feels a bit like a form of dyslexia. For example, it wasn’t until the later stages of high school that I could reliably differentiate AM and PM. I don’t really know why I’m like this. Maybe the simplest explanation is just a low IQ 🤷♂️

How does this relate to DeFi? It shows up in other areas of my life too. One of those is differentiating “implied yield” versus “expected yield” on Pendle. I’ve always had a hard time keeping straight which is which in my head.

Which is why I really needed this lesson from DeFi Dad this week:

Taking a look at the front page of DeFi yields on Pendle:

Stablecoins

15.09% - 24.31%

PT yields have started to creep back over the past many weeks in the wake of Stream Finance.

BTC

0.98% - 5.32%

BTC yields continue to be fairly anemic across the board in DeFi

ETH

4.76% - 7.7%

HYPE

4.45% - 9.07%

Airdrop Radar

Gladiator is an avid airdrop hunter I follow on X. I asked if he’d write the odd post on airdrops that are high priority for him.

Hylo ← Gladiator’s Referral

Hylo is a platform offering yield bearing leveraged tokens for assets like SOL and stables.

You can farm exposure via YTs or PTs from RateX, or simply hold the yield bearing assets themselves, depending on your risk tolerance and conviction in the project.

Solana needs strong DeFi. I’m a fan of anyone building real primitives there, and when leverage enters the conversation, I’m even more interested.

That’s all for now, thanks for checking it out!

DISCLAIMER: Nothing written in The Edge Newsletter or said on The Edge Podcast is a recommendation to buy or sell tokens or securities. This content is for educational and entertainment purposes only. Nothing shared here is financial advice. Any views expressed in our content are solely the opinion of that writer, host, or guest. Always do your own research. DeFi Dad, Nomatic, and guests may have positions in the assets or other matters discussed in this content.