Welcome to Yields of the Week! Every week, we spotlight the top DeFi yields across the crypto landscape, focusing on opportunities that are not just the highest APYs but also sustainable risk-adjusted opportunities. Whether you're new to DeFi or a seasoned degen, our goal is to help you navigate the yield farming space with confidence. Let’s dive into this week’s picks!

We’re looking at 30 day real yields this week with minimum of $20M in TVL (powered by vaults.fyi)

Stablecoin Yields

Here’s the top yielding stablecoin vaults (real yields) for the past 30 days:

Min $20M TVL

ETH Yields

Here’s the top yielding ETH vaults (real yields) for the past 30 days:

Min $20M TVL

One thing I’m noticing is that some of these vault yield providers are starting to offer consistently better yields than Pendle fixed rates. This hasn’t normally been the case, but a trend that has started a little bit more recently.

BTC Yields

Here’s the top yielding BTC vaults (real yields) for the past 30 days:

Min $20M TVL

I’ve written about ETH Strategy a few times in this section, but I want to once again highlight their ESPN (ETH Strategy Perpetual Note).

What first caught my eye was that it offered real yield by harvesting ETH volatility. This is something TradFi has long mastered, but it still hasn’t gained meaningful traction in DeFi.

It’s currently offering ESPN holders a weekly 19% yield.

ESPN had a few UI/UX bumps at launch, but the team listened to feedback and rebuilt it into something DeFi users will feel more comfortable using (ERC 4626 vault).

Here’s a few of the main changes:

This is all very novel and I suggest giving this full blog a read to get a better understanding of what ESPN is. The blog is a bit out date, but Ceazor made an excellent (and timely) video explaining how all this works:

The “ESPN Info” tab directly on the app is also super helpful. Here’s a look at that below:

If you want to get started, all you have to do is mint ESPN from USDS and you can start earning from ETH volatility (via options).

(I hold STRAT, but up until this point I haven’t minted ESPN just yet)

This is pretty huge news for Maple.

A deployment on Aave ETH Mainnet is the biggest show in town for DeFi. The Aave distribution is second to none.

Back in July I wrote a bit about what it could mean for Maple and the SYRUP token if this ever went through (click on the image to read the full post):

When Ethena rates were high, we saw the Aavethena partnership garner a ton of interest. I think at its peak Ethena added around $7B in TVL through Aave alone.

With Ethena rates low and looping not making as much sense, I think there’s probably a large void to be serviced by Maple with syrupUSDT.

Last I checked, $100M in caps had already been immediately hit. My sense is this will get pretty big.

(I actually bought SYRUP for the first time on the news of this partnership, but I’m writing a longer piece on this that should drop 🔜 )

Thanks to our sponsors for making it possible to share this content for FREE!

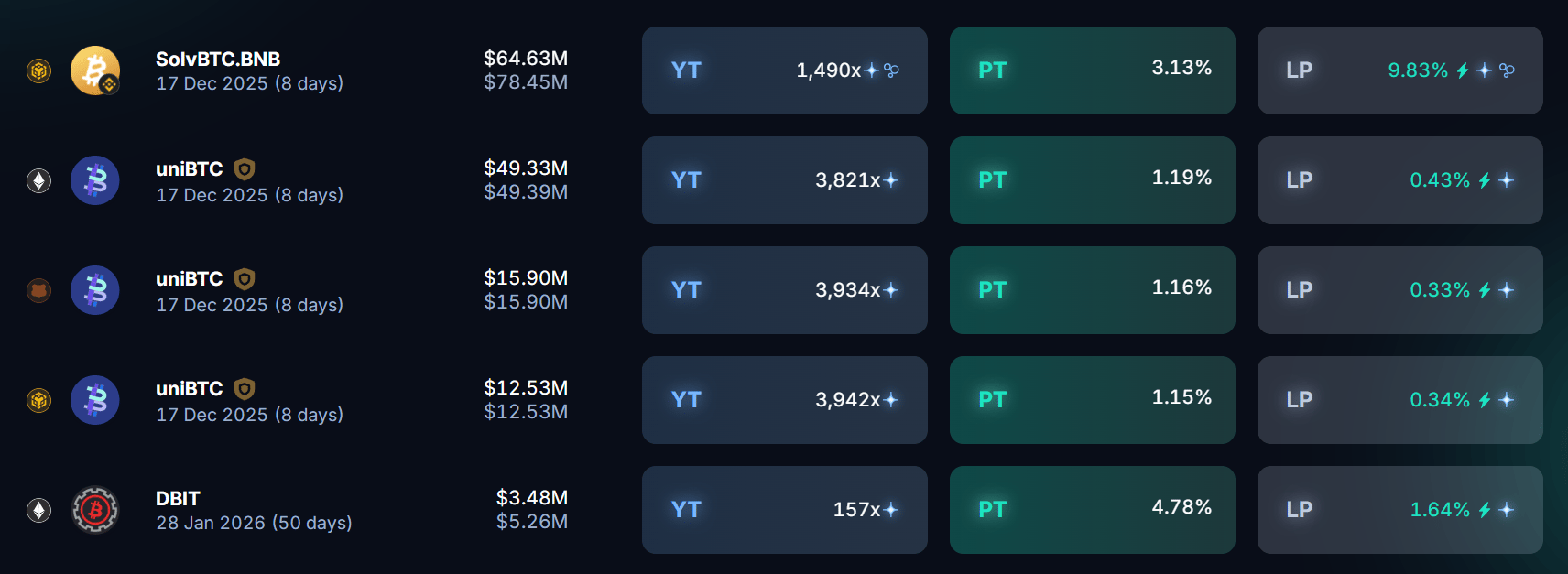

Yield Trading

Here’s what the front page of yield on Pendle looks like this week:

Stables

5.59% - 19.53%

(note - alUSD is expiring in 1 day so its inflated, but sNUSD by Neutrl still has one of the highest yields with long duration at 16.34%)

BTC

1.15% - 4.78%

ETH

2.89% - 5.79%

HYPE

As a reminder none of this is a recommendation or endorsement to buy any token(s) mentioned, and here’s a few risks to consider:

Smart contract risk in any underlying protocols

Pool size and liquidity depth

Front-end spoof attack on an app frontend

An economic design exploit

Colluding signers on any multisig

Systemic risk across DeFi, including stablecoin depegs

That’s all for now, thanks for checking it out!