The following is a writeup by inPlanB on what he’s seeing across 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

How Is Smart Money Defined?

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Nansen’s definition of Smart Money

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base and BNBchain

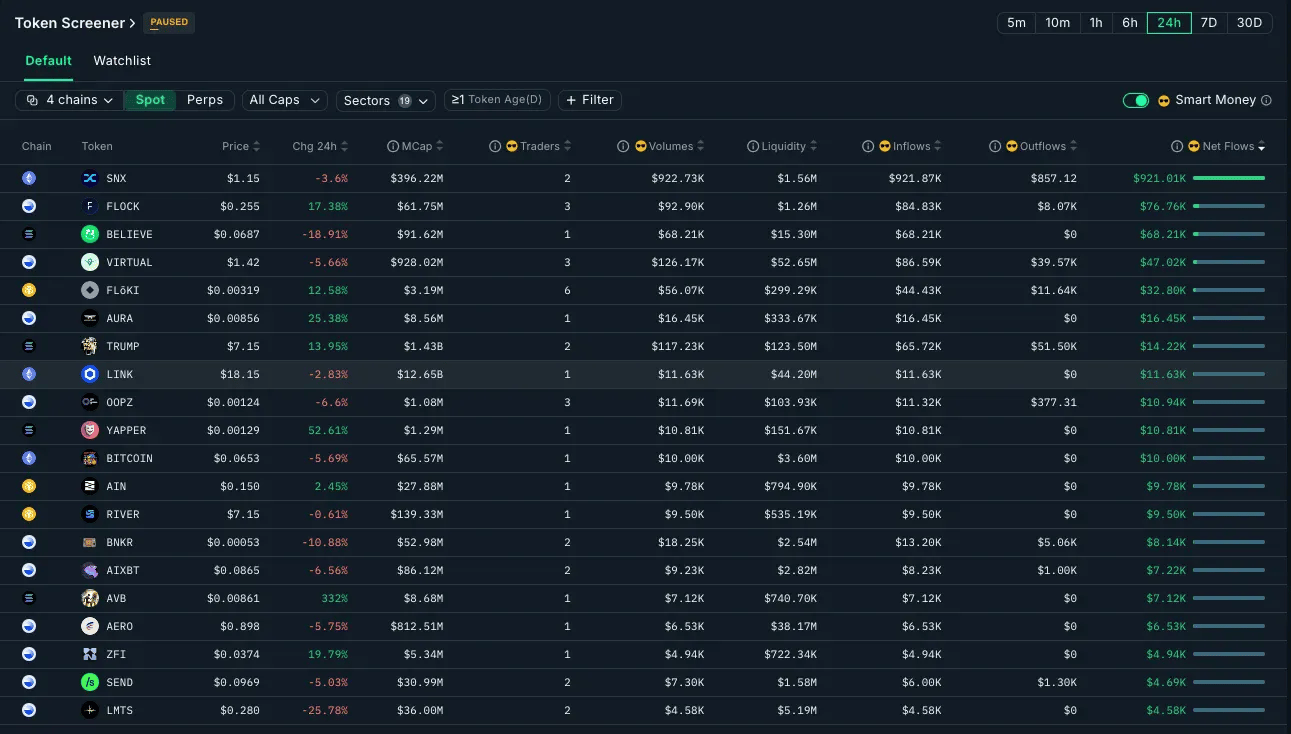

24H Smart Money Flows

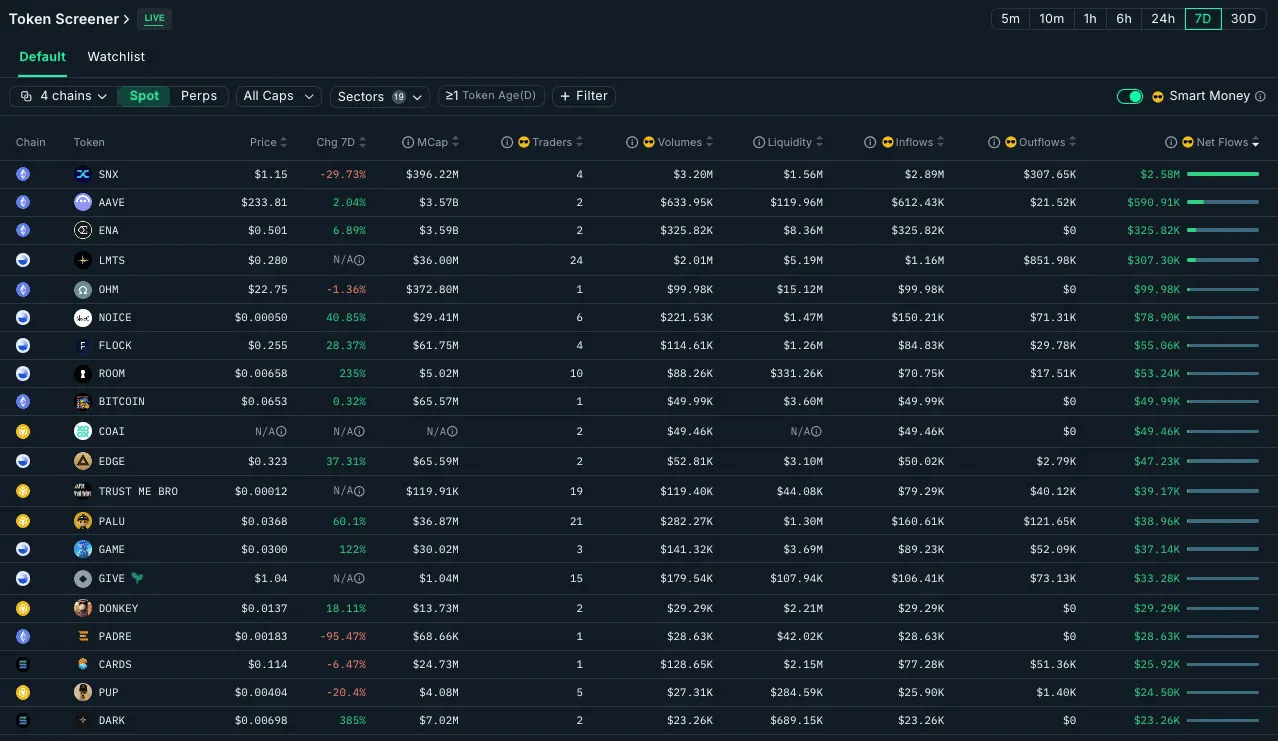

7D Smart Money Flows

30D Smart Money Flows

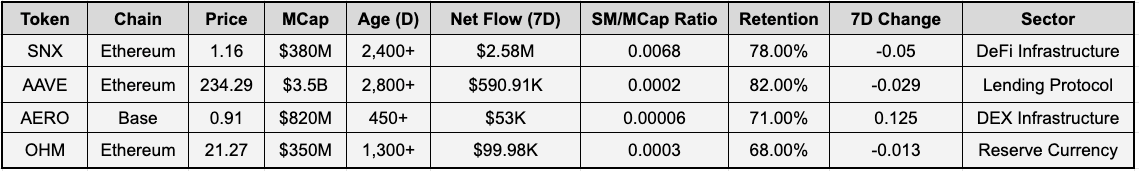

This Week’s Spotlight: SNX, AAVE, AERO and OHM

Smart money addresses have been methodically accumulating specific DeFi tokens we have covered in the previous reports, the kind of consistency that typically precedes significant price movements: SNX, AAVE, AERO and OHM. The fact that we're covering these tokens again is a signal that you should be paying close attention.

The Nansen data shows smart money wallets have accumulated $2.58 million in SNX over the past 7 days, with consistent buying across multiple timeframes, from 24 hours to 30 days. There’s a clear divergence in behavior, as retail sends tokens to exchanges while smart wallets pull them into self custody for long term holding.

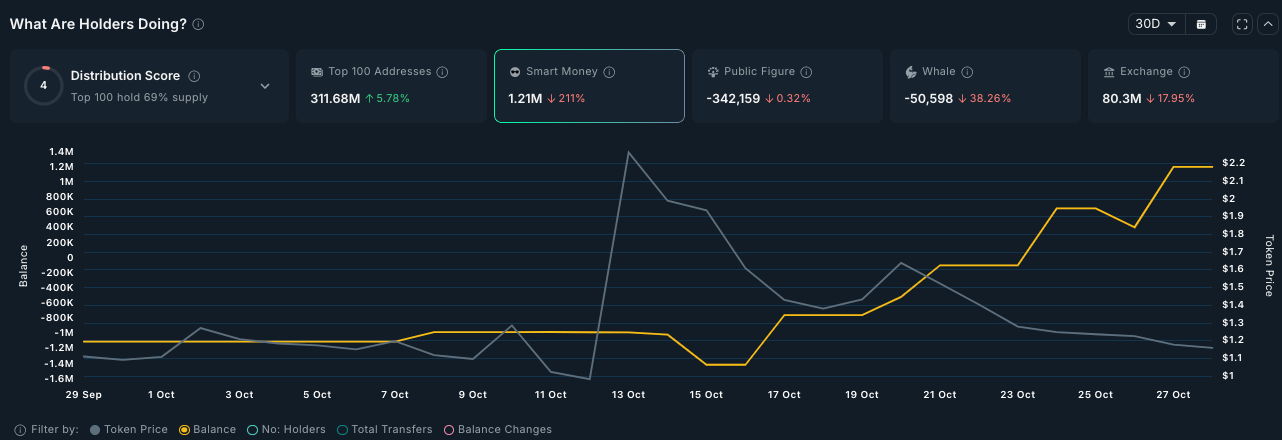

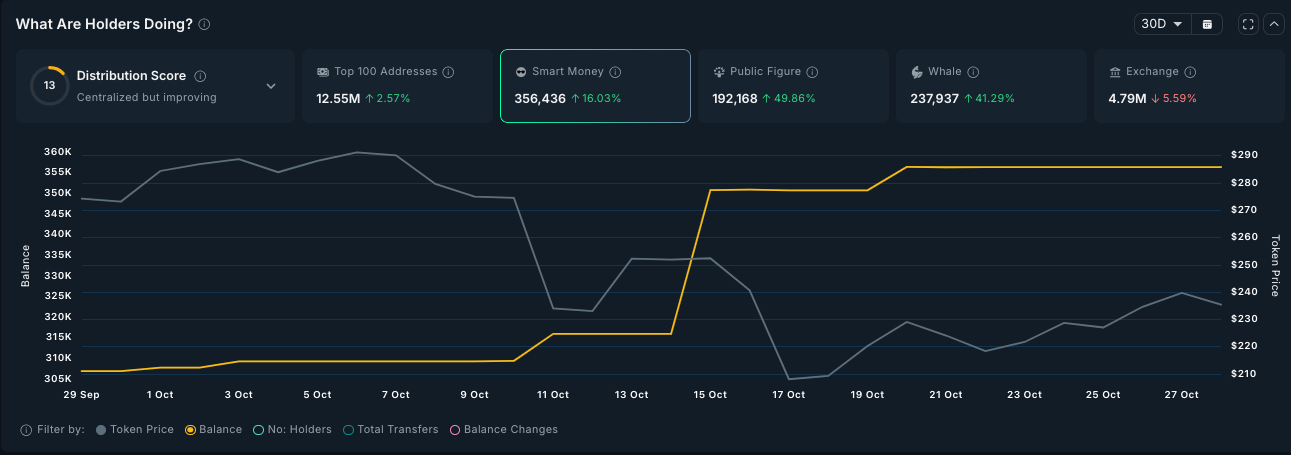

1. Synthetix ($SNX, Ethereum): A Quick Follow Up

We covered SNX two weeks ago, and we're covering it again as it continues to attract strong smart money interest. Over the past 30 days, smart money wallets have added $3.67 million in SNX positions, with the pace accelerating sharply in the last week to $2.58 million. What stands out is the concentration pattern: wallet counts are decreasing while dollar values are rising, suggesting accumulation among the most convicted buyers. And that kind of concentration deserves close attention.

Smart Money Balance (Yellow) Price (Grey)

Flow Intelligence Breakdown:

Smart Money: 47 wallets, $2.58M net inflow (7D), average position $54k, 78% retention

Whales: Mixed signals with slight net inflows of $180k

Fresh Wallets: $420k in new capital entering

Exchange Flow: Net outflows of $890k (tokens leaving exchanges)

Top Holder: $1.2M position, labeled as "Fund" by Nansen

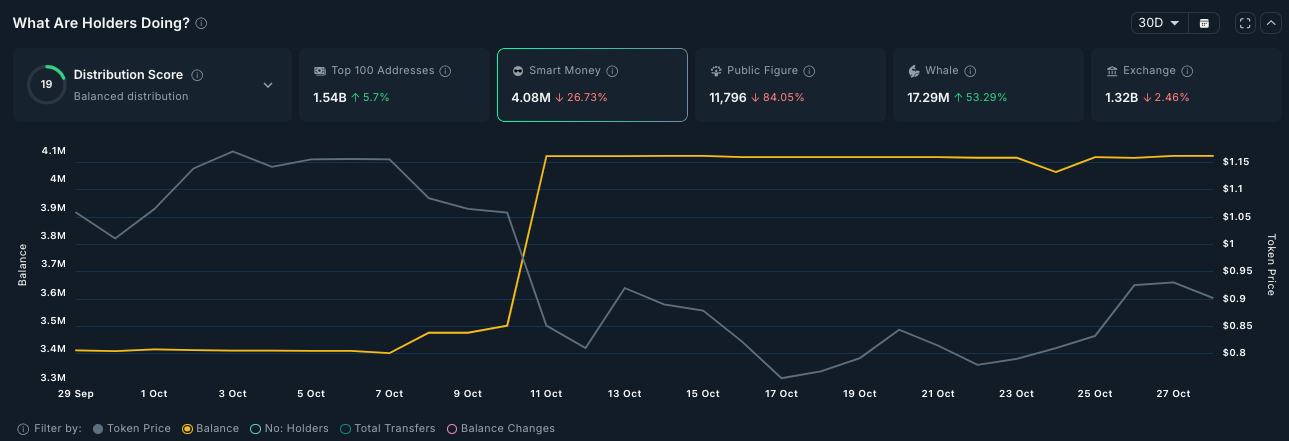

2. Aave ($AAVE, Ethereum): Attracting $10.62M in Sustained Accumulation… Follow Up

The 30-day accumulation pattern for AAVE is impressive, with $10.62 million in net smart money inflows, making it the second largest accumulation target after SNX. The 7-day flows of $590k show steady buying, though the pace has eased compared to earlier in the month. What’s notable is the wallet distribution: 31 distinct smart money addresses are involved, indicating broad institutional interest rather than concentrated whale activity. I’m personally confident in AAVE and have been buying the dips.

Smart money wallets are maintaining an 82% position retention rate, the highest among the tokens we analyzed. This suggests these aren’t opportunistic trades but strategic positions being built for longer term holds. The average position size of $19k might seem modest, but these are often test positions that scale up over time.

Smart Money Balance (Yellow) Price (Grey)

Flow Intelligence Breakdown:

Smart Money: 31 wallets, $590.91K net inflow (7D), average position $19k, 82% retention

Whales: Strong accumulation with $2.1M in net inflows

Fresh Wallets: $880k in new capital

Exchange Flow: outflows of $3.2M (bullish signal)

Top Holder: $4.8M position held by "Paradigm Fund" entity

3. Aerodrome ($AERO, Base): Base's Liquidity Engine

Aerodrome holds approximately $560 million in TVL entirely on Base, with daily trading volumes averaging $610 million. This activity translates into annualized swap revenue of roughly $202 million, ranking Aerodrome among the highest-revenue DEXs in DeFi despite operating on a single chain.

Aerodrome represents a different thesis entirely: a bet on Base ecosystem growth and Coinbase's ability to bring mainstream users on-chain, especially with the upcoming $BASE token and its everything app. Launched in August 2023, it's quickly become the dominant DEX on Base, processing more volume than all other Base DEXs combined.

The Smart Money Story

While Aerodrome’s 7-day smart money flows of $53k may seem modest compared to SNX or AAVE, context matters. The 30-day flows show $672,810 in accumulation, indicating that smart money interest is picking up momentum.

What's particularly interesting is the 71% retention rate combined with relatively small average positions of $1,900. This pattern typically indicates early-stage accumulation, where institutional wallets are building starter positions before larger deployments.

Smart Money Balance (Yellow) Price (Grey)

Flow Intelligence Breakdown:

Smart Money: 28 wallets, $53K net inflow (7D), average position $1,900, 71% retention

Whales: Limited activity, with $41k in net inflows

Fresh Wallets: Strong interest with $290k entering

Exchange Flow: Net outflows of $125k

Top Holder: $890k position, unlabeled address

Why This Matters

The combination of institutional recognition (Grayscale inclusion), Coinbase backing through the Base Ecosystem Fund, and dominant market position on a rapidly growing L2 creates a compelling growth narrative. With Base upcoming token and everything app, Aerodrome is positioned to capture significant value from increased onchain activity.

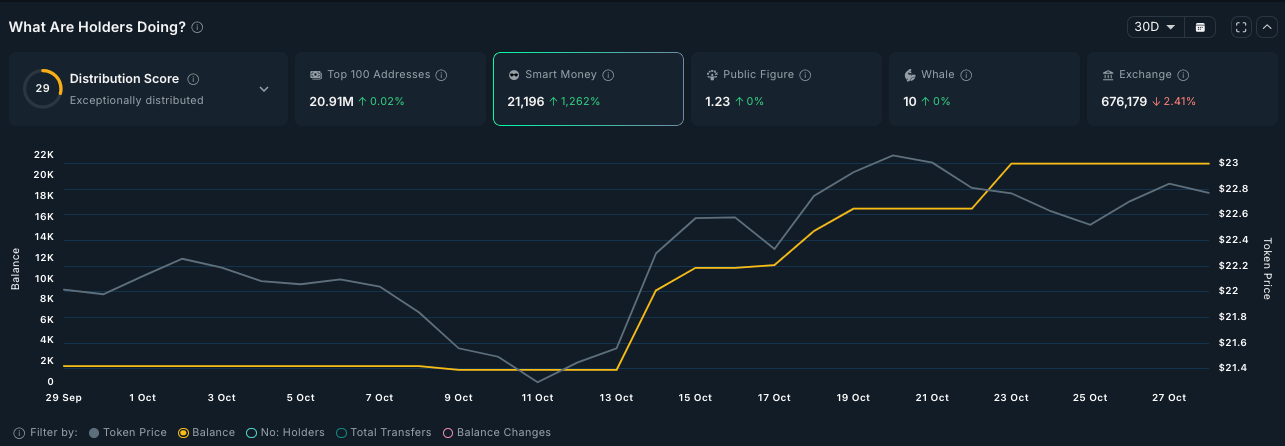

4. OlympusDAO ($OHM, Ethereum): Follow Up

The Smart Money Story

A quick review, as we covered last week: the 7D flows show $99k in smart money accumulation across 15 wallets, with 30D flows reaching $448k. While these aren’t massive numbers, the 68% retention rate and average position size of $6.6k suggest these are deliberate positions rather than short-term speculation.

The concentration in just 15 smart money wallets, compared to 30+ for other tokens, indicates this is a more selective trade. These appear to be DeFi natives who understand Olympus's unique mechanics and are betting on a revival of the protocol's treasury-backed model.

Smart Money Balance (Yellow) Price (Grey)

Flow Intelligence Breakdown:

Smart Money: 15 wallets, $99.98K net inflow (7D), average position $6.6k, 68% retention

Whales: Neutral with minimal flows

Fresh Wallets: $67k in new interest

Exchange Flow: Slight outflows of $44k

Top Holder: $2.1M position held by "DeFi Fund" entity

The Meta-Pattern: Infrastructure Over Applications

Looking across these four tokens, a clear pattern emerges: smart money is favoring DeFi infrastructure over applications. SNX provides derivatives infrastructure, AAVE offers lending rails, Aerodrome delivers DEX liquidity, and Olympus serves as a treasury infrastructure play. This suggests institutional capital sees more value in owning the platforms that power DeFi rather than the end-user applications built on top. The trend continues to grow, with newer examples like Pump, Zora, and Clanker showing the same dynamic.

Exchange flows tell another crucial part of the story. Across all four tokens, we're seeing net outflows from exchanges ranging from $44k (OHM) to $3.2 million (AAVE) over 7D. This exodus from trading venues to cold storage typically precedes supply squeezes that can catalyze significant price movements. So, as the market sentiment improves, those tokens are most likely to move with confidence. I'm particularly confident on AAVE and AERO, adding to my position.

These flow patterns suggest smart money is positioning for a DeFi renaissance, but one led by established protocols with real utility rather than speculative newcomers. As always, onchain data shows what's happening, not why. Each of these projects deserves deeper research into their fundamentals, tokenomics, and development roadmaps before making allocation decisions.

This analysis through Nansen presents onchain data for informational purposes and is not financial advice. Always conduct thorough research before making investment decisions.

All of the Smart Money information in this article can be obtained via Nansen’s “Pro Plan” - If you’d like to use this yourself you can get 10% off a Subscription with our referral link: https://nsn.ai/EDGE