The following is a writeup by inPlanB on what he’s seeing across 24HR, 7D and 30D Smart Money flows using Nansen

Disclaimer - These are merely observations and none of this should be construed as financial advice

How Is Smart Money Defined?

According to Nansen, Smart Money refers to the most successful onchain traders.

But what deems a trader successful?

Smart Money Labels:

30D Smart Trader: Top-ranked wallets by PnL in past 30 days

90D Smart Trader: Top-ranked wallets by PnL in past 90 days

180D Smart Trader: Top-ranked wallets by PnL in past 180 days

Smart Fund: Crypto fund meeting Nansen’s Smart Fund criteria: Venture capital firms; Hedge funds; Liquid crypto funds; Institutional investors

Nansen’s definition of Smart Money

Disclaimer - These are merely observations and none of this should be construed as financial advice

Chains Reviewed: Ethereum, Solana, Base and BNBchain

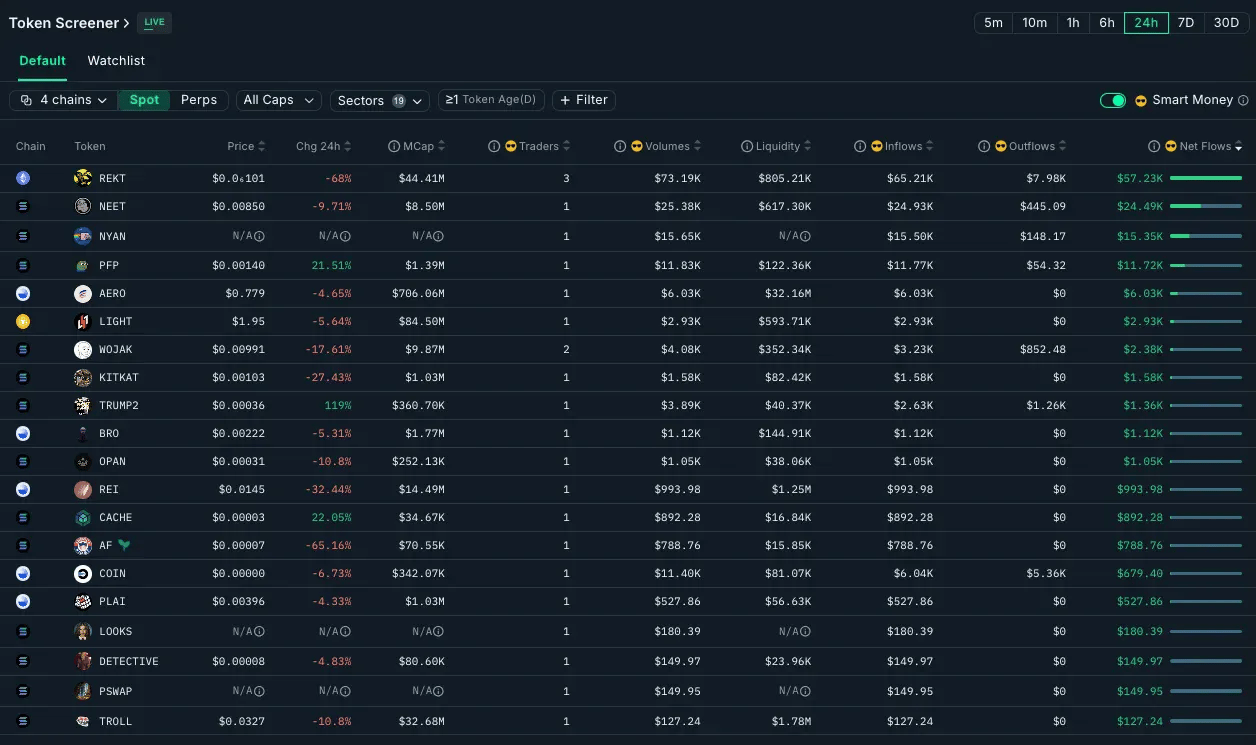

24H Smart Money Flows

7D Smart Money Flows

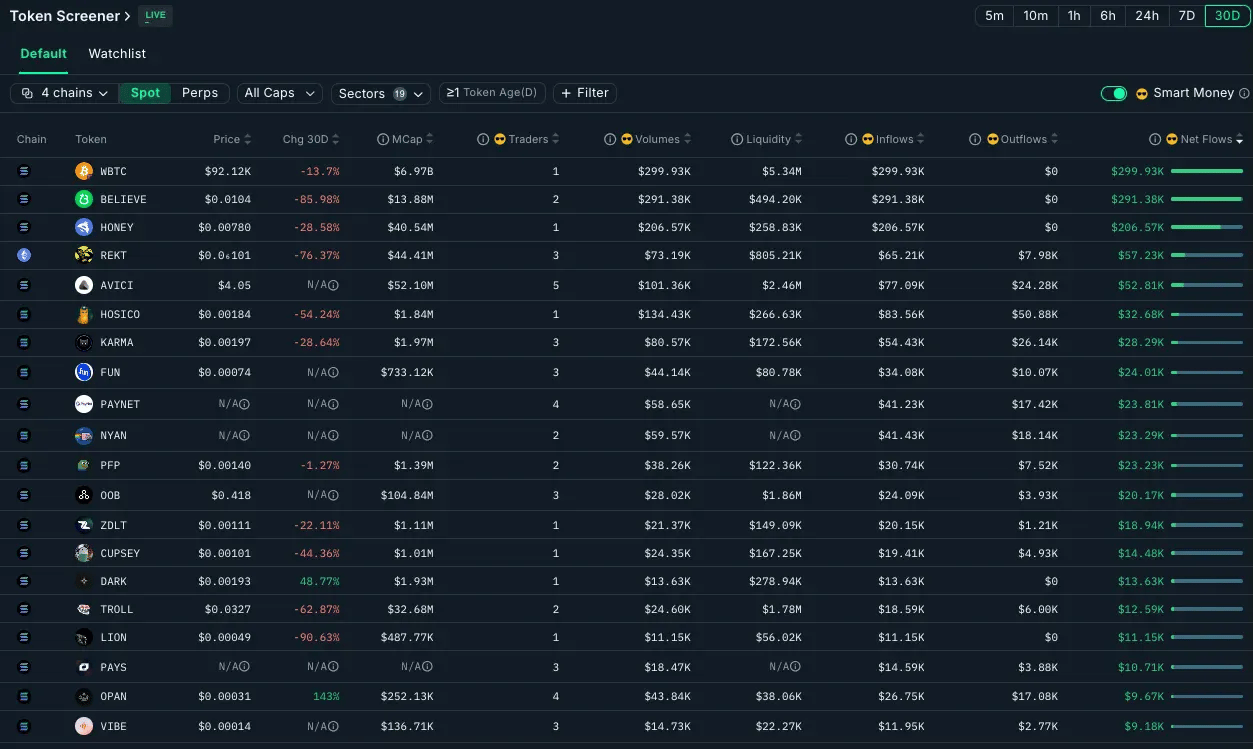

30D Smart Money Flows

Thanks to our sponsors for making it possible to share this content for FREE!

While retail investors panic-sold through Bitcoin's ~29% correction from its October peak, a more telling story emerged in the onchain data: smart money didn't show up to buy the dip.

Bitcoin plummeted from ~$126k to $88k between late October and mid-November 2025, triggering $3.2 billion in liquidations and pushing the Fear & Greed Index into "Extreme Fear" territory, the institutional wallets that typically capitalize on market dislocations remained conspicuously inactive.

This isn't a story about what smart money bought.

It's about what their silence reveals about market structure, cycle timing, and the mechanics of institutional capital deployment during periods of genuine distress. When sophisticated traders who were correctly positioned ahead of previous rallies collectively step back, their absence becomes the signal.

The Data That Wasn't There

Across Ethereum, Solana, Base, and BNB Chain (the four networks where smart money typically concentrates activity) net flows during the November selloff told a stark story. Over the 7D period ending November 17, aggregate smart money flows across hundreds of tokens rarely exceeded $50k per asset. For context, during accumulation periods in Q2 2025, weekly smart money flows into major DeFi protocols routinely exceeded $5M per token.

The largest "positive" flow in the screener data WBTC on Solana showing $299,9k in smart money activity over 30D. But granular wallet analysis revealed the real story: smart money holdings of WBTC dropped from 138.6 BTC to just 41 BTC during the period. The "$299K inflow" figure masked massive position liquidation, not accumulation. Smart traders reduced their WBTC exposure by $9.5 million in dollar terms as Bitcoin crashed through $100k.

Aerodrome Finance on Base, the leading DEX by volume on the network with a $706M market cap, recorded just $6k in 7D smart money inflows from a single wallet. For an established DeFi protocol with proven product-market fit, attracting only one institutional buyer deploying minimal capital signals absence of conviction, not stealth accumulation.

Even more telling: the wallet counts.

During healthy accumulation phases, tokens showing institutional interest typically draw 15-30 distinct smart money wallets building positions over a 7D window. Throughout the November correction, most tokens in the top flow rankings showed 1-3 active smart money wallets, not broad conviction, but isolated traders making marginal bets.

Why Smart Money Stayed Out

The absence of institutional buying during a 29% Bitcoin correction defies the conventional wisdom that "smart money buys when others panic."

Onchain behavior suggests sophisticated capital operates with more nuance than simple contrarianism. Several structural factors explain the institutional hesitation.

First, the velocity of the selloff created genuine uncertainty about near-term support levels. Bitcoin lost 29% in roughly three weeks, with much of the damage concentrated in a few violent trading sessions. When Grayscale's Bitcoin ETF recorded $318M in outflows in a single day it signaled institutional clients were reducing crypto exposure through regulated vehicles. Smart money wallets, which often front-run or mirror institutional flows, had no reason to catch a falling knife when ETF flows indicated the selling wasn't finished.

Second, the macroeconomic backdrop offered no catalyst for a quick reversal. The Federal Reserve's November posture remained hawkish, with rate cut probability for December falling near 50% on the CME FedWatch tool. Bitcoin has historically thrived in low-rate environments where speculative capital seeks asymmetric returns. When the Fed signals higher rates for longer while inflation concerns resurface, institutional allocators reduce risk assets, regardless of how "oversold" technical indicators become.

Third, exchange flow data showed tokens moving TO exchanges rather than withdrawing to cold storage (we typically read this as bearish signal).

Over the 7D period, major tokens showed net deposits to centralized exchanges, the inverse of accumulation patterns. Exchange inflows precede selling because traders must move assets to exchanges before liquidating. When smart money sits out AND retail moves tokens onto exchanges, it creates a structural oversupply that prolongs corrections.

The absence wasn't limited to Bitcoin. Ethereum saw smart money holdings remain flat or decline across tracking periods. Solana, which outperformed during the 2024 cycle, recorded minimal institutional inflows despite dropping from $290 to sub-$210. The broad-based institutional retreat suggests sophisticated traders view November's action as early-stage deleveraging rather than a buyable dip within an intact bull cycle.

What Smart Money is Doing Instead: Building Cash Positions

The absence of accumulation doesn't mean institutional wallets are inactive. Analysis of smart money flows reveals consistent patterns throughout November: tokens moving TO stablecoins rather than FROM stablecoins into risk assets.

This rotation signals defensive positioning. Sophisticated traders exchanged volatile tokens for USDC, USDT, and DAI (preserving capital in dollar-denominated assets while maintaining onchain presence for rapid deployment when opportunity emerges). Stablecoin balances among smart money wallets increased during the November period as risk asset holdings decreased.

This behavior mirrors institutional strategy during uncertain markets: raise cash, reduce risk exposure, preserve optionality. The stablecoin accumulation suggests smart money expects better entry points ahead and wants dry powder ready for deployment, but views current levels as too early for meaningful accumulation.

What Comes Next: Reading the Signals Forward

Smart money's absence during November's correction doesn't predict the future, but it establishes parameters for what institutional re-engagement might look like. Based on historical patterns and current positioning, several signals would indicate genuine accumulation opportunity emerging.

First, stabilization of exchange flows. When net deposits to centralized exchanges reverse and withdrawal activity increases, it indicates buyers moving assets to cold storage for holding rather than positioning for sale. This hasn't occurred yet; exchange balances remain elevated.

Second, smart money wallet count expansion. Currently, most tokens showing any institutional activity draw 1-3 wallets. When accumulation begins in earnest, wallet counts typically expand to 10-15 distinct addresses building positions in quality protocols. This breadth indicates consensus forming among sophisticated traders rather than isolated speculation.

Third, sector rotation back to DeFi fundamentals. When institutional capital returns, it typically flows first into established protocols with proven revenue and product-market fit. A return of smart money flows to major DEXs, lending platforms, and liquid staking derivatives would signal genuine bottom-fishing rather than continued risk reduction.

Fourth, correlation with Bitcoin dominance metrics. If Bitcoin begins consolidating while smart money flows into alternative tokens, it suggests institutions believe altcoin season might emerge. Conversely, if Bitcoin falls further while altcoins hemorrhage against BTC, it confirms continued flight to quality and risk reduction.

None of these signals have emerged yet. Smart money remains in wait-and-see mode, positioned in stablecoins with dry powder ready but no urgency to deploy capital. The patience suggests institutional participants expect either further downside or extended consolidation before attractive entries materialize.

This analysis through Nansen presents onchain data for informational purposes and is not financial advice. Always conduct thorough research before making investment decisions.

All of the Smart Money information in this article can be obtained via Nansen’s “Pro Plan” - If you’d like to use this yourself you can get 10% off a Subscription with our referral link: https://nsn.ai/EDGE