This week is a bit different than normal. I’m actually going with a bit of a theme and it sort of happened by accident.

I read a few great posts/announcements this week and they all had one common denominator: Morpho was in all of them.

Sometimes the dots connect all in one moment and that’s sort of what happened this week. I realized that Morpho has put themselves at the center of not only DeFi, but the collision of TradFi and DeFi.

TLDR

Hard to not be extremely bullish Morpho.

(Disclosure: I currently hold no position in Morpho…yet)

“A New Chapter For Institutional DeFi”

What Is It?

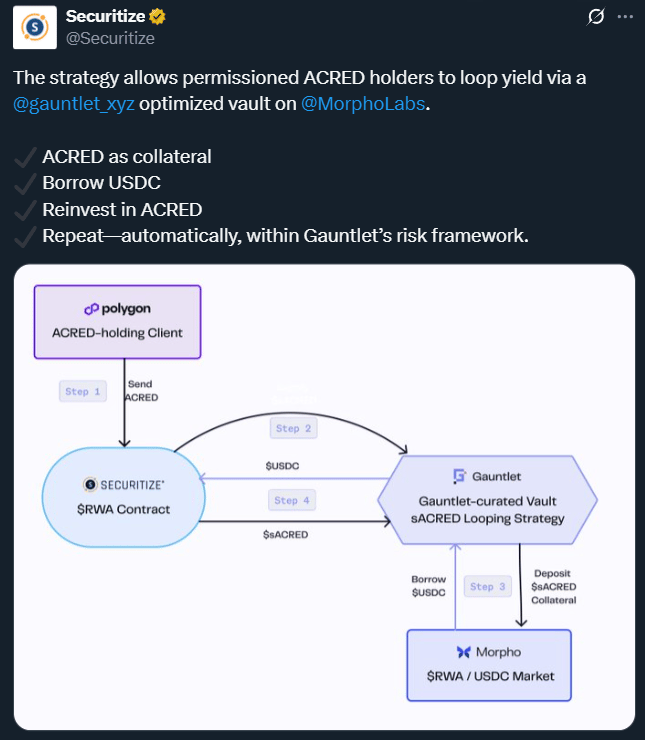

Securitize announced a new tokenized credit fund from Apollo that is powered under the hood by: Morpho, Polygon and Gauntlet

Why We Liked It?

This is the first instance I’ve seen where one of these tokenized funds is being accepted as a collateral (on Morpho). This allows holders of the fund to borrow against it or even loop it up for more yield. While looping sometimes sounds like a silly DeFi primitive, I believe there’s going to be a ton of appetite for this one-click leverage from TradFi.

My gut tells me the tokenization narrative is very real and this isn’t just a one-off. I think this is the beginning of a massive wave of others bringing more of their workflows onchain. Morpho, and many other DeFi teams/blue chips, are in an incredible position to capitalize.

Here’s an image below of what the looping looks like:

This is among the first institutional deployments of Securitize’s sToken standard—bringing RWAs into permissionless DeFi while preserving compliance, risk management, and investor protections.

The first deployment is on @0xPolygon via Compound Blue (powered by @MorphoLabs )

Click on the post below to read the full article:

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

“Bitcoin-backed loans are now fully rolled out to all US users”

What Is It?

Around 2 - 3 months back, Coinbase rolled out Bitcoin-backed loans in their exchange UI powered by Morpho under the hood. I personally felt like it went a bit under the radar, yet it was a smaller scale rollout. Now, all US users (ex. NY), can take out loans against Bitcoin (up to $1M)

Why We Liked It?

To me, its cool to see a long cherished DeFi primitive like this move up the distribution funnel and garner exposure to all of Coinbase’s US users. It’s always been a niche group of people borrowing USDC against their WBTC or ETH onchain, but now Coinbase’s ~40M US users can partake as well.

This move also showcases the long game Coinbase has played with Base. Base is the connective tissue that allows Coinbase to reach into DeFi and tap into all of the onchain innovations.

Once again, this is all made possible with the modular design of Morpho. More on this in our third and final article this week down below.

Bitcoin-backed loans are powered by @MorphoLabs on @base . Coinbase in the front, DeFi in the back. This is the future of finance.

Click on the tweet below to read the full article:

“Morpho: The On Chain Credit Operating System for Bitcoin”

What Is It?

John Lilic wrote a great piece covering the transformational power Morpho is having on DeFi.

Why We Liked It?

This piece by John articulates so well how Morpho makes Bitcoin an even more useable asset for credit creation in DeFi.

I can’t say it any better than John, just read this passge:

Because each lending market on Morpho is isolated and permissionless, it is possible to design Bitcoin specific markets with tailored liquidation ratios, oracles, and interest models. That is exactly what Coinbase has done. Users deposit native Bitcoin on Coinbase, borrow USDC, and manage their position using a familiar interface. Behind the scenes, everything is settled and secured through Morpho’s smart contracts.

This model allows Bitcoin to access liquidity without being sold, while maintaining user custody and on chain guarantees. It makes Bitcoin capital efficient and puts it to work in programmable, transparent lending systems.

Compare this to the current trend of public companies accumulating Bitcoin on their balance sheets. That may signal long term conviction, but it does not activate the asset. Bitcoin held in treasuries cannot be rehypothecated, lent, or used to build financial products.

Morpho, by contrast, gives Bitcoin new functionality. It makes BTC usable in structured credit markets. It allows institutions and sovereigns to build collateral backed lending systems that run on math, not trust. And it does all of this without wrapping, bridging, or relying on third party custodians.

Click on the post below to read the full article:

That’s all for now, thanks for checking it out!