Before we begin, please note that this is not financial advice. This framework is intended solely as a guide, offering data-based insights to help inform your decisions. Also, thanks to Bitcoin Magazine for providing all of this great data!

If you read my cheeky thumbnail and are expecting a precise answer to that question, well I’m sorry.

Nobody can do that, not even Gandalf The Grey (possibly Gandalf The White).

Best we can do is use a multitude of different signals to try to get into the right zone with our decision making.

The last update I made to this series was on May 30th so I wanted to do a quick check-in to see how things were looking as we’ve just entered Q3.

In that last piece I wrote about all the pre-emptive bear calls I was seeing all over my timeline. I think I was fairly sympathetic to the bear view despite maintaining my bullish bias all year long.

Here’s an excerpt from my last update:

I’m empathetic to people that want to be cautious and call tops, because I know the downsides of being too greedy and not taking profits.

Everyone is different and has their own financial situations to consider. For example, people who live in more strict tax jurisdictions need to be very diligent and have enough money set aside to pay taxes vs the person yapping on X who’s in Dubai, Portugal or Puerto Rico (extremely relaxed tax jurisdictions). Furthermore, you never know when someone has hit their own internal profit targets and decides to take chips off the table. So even though data is powerful, you don’t have insight into the underlying motivations for why someone is formulating a certain view. It’s also very possible they are projecting what they want the market to do.

All that said, calling early tops can be equally as damaging if it prevents you from catching material upside. We aren’t getting exposure to a highly volatile asset class so we can slightly outperform the S&P 500.

I think there’s something deeper to this though. It feels like being a bull is becoming more and more unpopular over the years. Maybe people are just becoming more cynical/negative?

Being a bear seems to have gained some sort of prestige and often becomes consensus on Crypto Twitter (CT).

It’s true that bears often sound the smartest because they use industry jargon and sharp analysis that makes them seem highly intelligent, and in many cases, they are.

But you always have to ask yourself:

Do you wanna make money or do you wanna be right?

Even over the last few years I’ve heard a number of these intelligent “doomer” theses that sound compelling.

Why do we idolize the bear?

For example:

Michael Burry has been immortalized in cinema history with The Big Short because he was right in a very big way one time back in 2008. Don’t get me wrong, it was an incredible call, but I think we put this sort of thing way up on a pedestal.

Michael Saylor has been chastised for the last ~5 years for his bitcoin strategy and being one of the biggest bulls in recent memory (and being incredibly right). Yet, I can’t even count how many stupid “Saylor is about to get liquidated” calls I’ve seen on CT over the years (when in many cases that was not even possible or at least extremely low probability).

Do people just not like to see others win?

Anyways, I could ramble on, but let’s just look at some data and see if it makes sense to be bullish or bearish here 😉

Thanks to our sponsors for making it possible to share this content for FREE!

| NEWSLETTER CONTINUES BELOW |

Let’s take a fresh look at what all the indicators are telling us right now.

Bitcoin Dominance

What Is This Indicator?

Bitcoin Dominance (BTC.D) is an indicator used to understand Bitcoin's market share relative to other cryptocurrencies and is shown as a %.

How Do We Use it?

Rising Dominance:

This can signal that capital is flowing into Bitcoin from other cryptocurrencies, possibly due to Bitcoin's perceived stability or market events favoring Bitcoin. It might precede or accompany bearish conditions for altcoins.

Falling Dominance:

Suggests capital might be moving from Bitcoin into altcoins, which could indicate a bullish trend for altcoins or a lack of confidence in Bitcoin's near-term performance.

Our Current Interpretation

BTC.D has climbed back to 65.4%

We have a very small sample but BTC.D has bottomed around ~35% to 40% range previously and topped around the ~70% - 73% range last cycle.

Last cycle, after BTC.D topped, we had a ~10 month alt season until BTC.D bottomed (fwiw, I don’t think we have alt seasons like we’ve had in the past going forward)

Interpretation: As Bitcoin is becoming a globally accepted asset, it’s possible that BTC.D will become less of a useful indicator over time. I don’t think BTC.D has ever been something that could be used in isolation, instead its part of a basket of things you can look at to get a rough picture of the market. BTC.D is not my favorite indicator but worth looking at.

I haven’t had much of a view on BTC.D for a while, but starting to feel more confident it’s closer to a top, but wouldn’t be surprised to see continuation to 68-69% range. I say that as I see real movement in ETH and think its likely that it will outperform Bitcoin over the next 6 - 12 months. I’m basing this on strong ETF flows and renewed institutional interest in ETH with ETH treasury companies coming online $SBET ( ▲ 0.92% ) , $BMNR ( ▲ 1.15% )

When ETH moves, I actually think its highly net beneficial to the rest of the market now (DeFi) and will pull a lot of other assets out of their slumber.

This may sound like an “alt szn” call, but it is not. I still think only quality names will be part of the rising tide with ETH.

Lastly, I’m not married to this idea and its definitely not a strong stance.

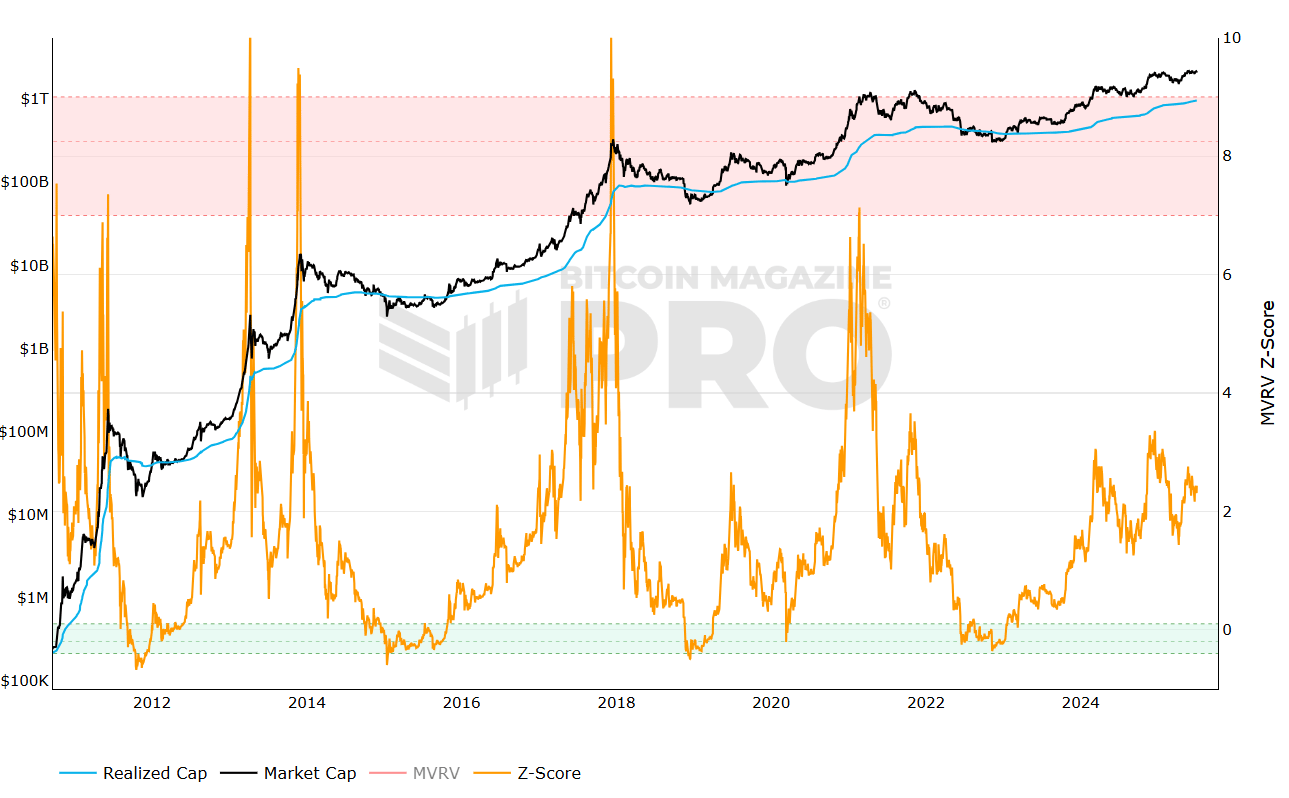

MVRV Z-Score

Historically, it has identified major price peaks within two weeks.

MVRV Z-Score for July 4th = 2.43 (zoomed out)

What Is This Indicator?

The MVRV Z-Score chart helps identify when Bitcoin is highly over or undervalued compared to its 'fair value' using three metrics:

1. Market Value (black line): The current Bitcoin price multiplied by the total coins in circulation, similar to market cap in traditional finance.

2. Realised Value (blue line): Calculates the average price of each Bitcoin based on its last movement between wallets, providing a long-term valuation by filtering out short-term market sentiment.

3. Z-Score (orange line): A standard deviation measure highlighting extreme differences between Market Value and Realized Value.

How Do We Use it?

The MVRV Z-score effectively highlights periods when Bitcoin’s market value significantly exceeds its realised value, marked by the Z-score (orange line) entering the pink zone, which often indicates market cycle tops—accurately identifying cycle highs within two weeks.

It also signals when market value is well below realised value, shown by the Z-score entering the green zone. Historically, buying during these times has yielded substantial returns.

Attempting To Predict Bitcoin Price Using MVRV Z-Score

The MVRV Z-Score chart helps predict Bitcoin price extremes, signaling potential pullbacks when the Z-score reaches the upper red band and possible rallies after time in the lower green band. Historically, it has identified major price peaks within two weeks.

MVRV Z-Score for July 4th = 2.43 (zoomed in)

Our Current Interpretation

The orange line (z-score) is currently at 2.43 (This was 2.56 when I wrote this in May)

In every other bull market, the orange line (z-score) has breached 7

Interpretation: By this metric, Bitcoin is still nowhere near what would be considered frothy overvalued territory and if this metric remains accurate, it’s likely that this cycle has a lot more room to run.

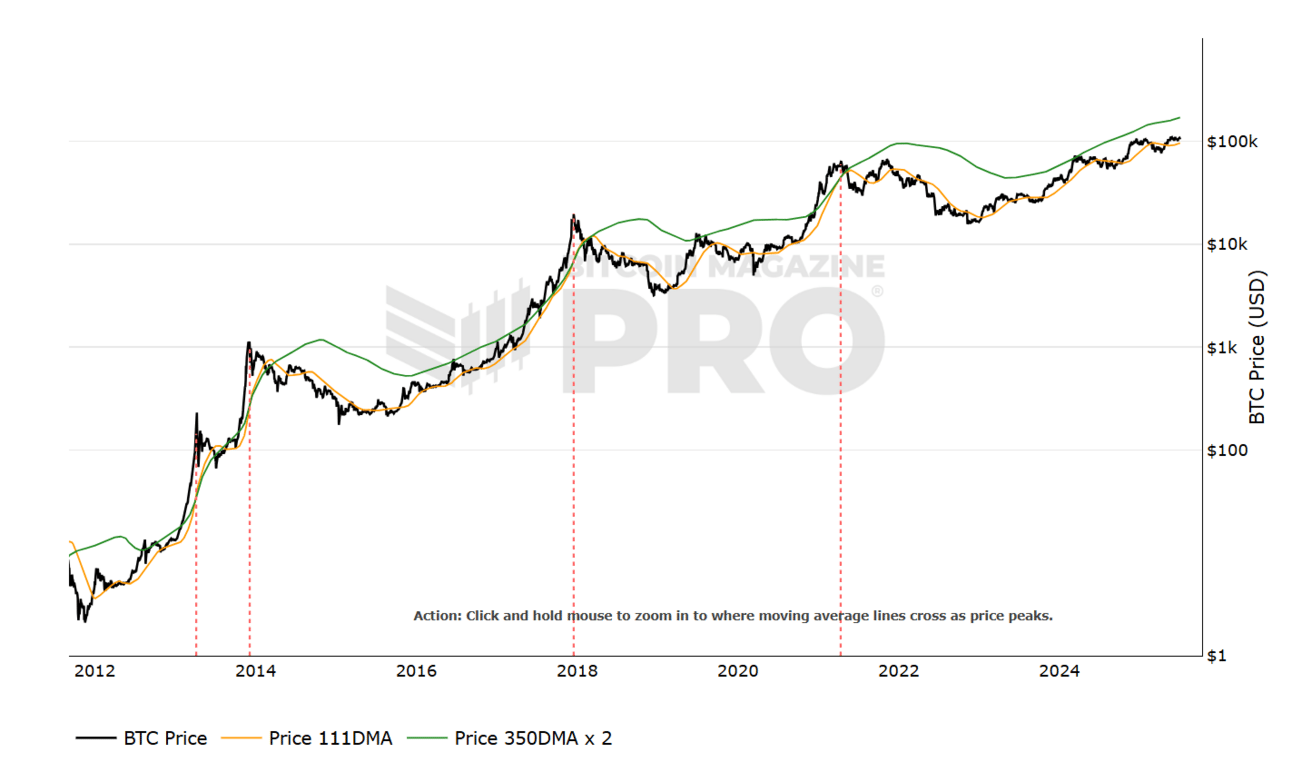

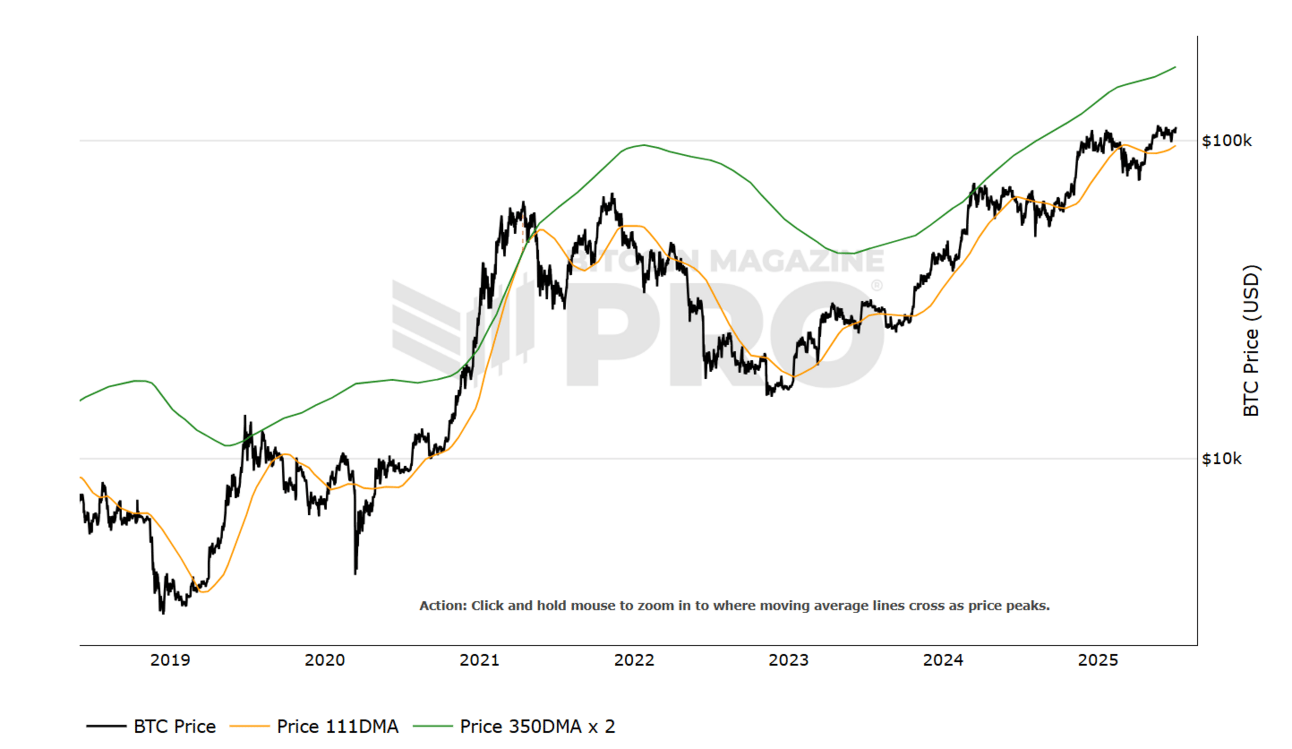

Pi Cycle Top Indicator

The Pi Cycle Top Indicator has been highly accurate in identifying Bitcoin market cycle highs within three days.

Pi Cycle Top (zoomed out)

What Is This Indicator?

The Pi Cycle Top Indicator has been highly accurate in identifying Bitcoin market cycle highs within three days. It combines the 111-day moving average (111DMA) with a 2x multiple of the 350-day moving average (350DMA x 2).

For the last three cycles, Bitcoin’s price peaked when the 111DMA crossed above the 350DMA x 2, illustrating Bitcoin's cyclical price behavior. Interestingly, dividing 350 by 111 yields 3.153, very close to Pi (3.142), highlighting a unique mathematical pattern.

How Do We Use It?

The Pi Cycle Top Indicator forecasts Bitcoin’s market cycle peaks, predicting when the price will reach a top before declining. It operates on high time frames and has accurately identified the absolute tops of Bitcoin’s major price movements throughout its history.

Attempting to Predict An Overheated Market Using Pi Cycle Top Indicator

The Pi Cycle Top Indicator signals when the market is extremely overheated—when the 111-day moving average reaches a 2x multiple of the 350-day moving average. Historically, this has been a beneficial time to sell during Bitcoin’s price cycles.

However, since this indicator has been effective primarily during Bitcoin’s early adoption phase, it may become less relevant as Bitcoin ETFs launch and Bitcoin integrates further into the global financial system.

Pi Cycle Top (zoomed in)

Our Current Interpretation

The 111DMA and 350DMA x 2 are relatively far apart

In previous bull markets, this indicator has shown a high degree of accuracy at calling potential tops when these two lines meet.

Interpretation: Currently these two lines are widely separated and we will be monitoring them closely going forward. If this indicator remains accurate, it would appear as though the market is still not in overheated territory.

Everything Indicator

What Is This Indicator?

The Bitcoin Everything Indicator consolidates multiple metrics into one score to provide a comprehensive market overview. The result is a reactive, historically reliable oscillator that identifies market peaks and bottoms for Bitcoin.

It combines the following critical inputs:

Market Profitability: MVRV Z-Score

External Macro Supply: Global M2 Money Supply

Miner Profitability: Puell Multiple

Onchain Profit Taking: Spent Output Profit Ratio (SOPR)

Volatility Trends: Crosby Ratio

Relative Network Growth: Active Address Sentiment Indicator (AASI)

Our Current Interpretation

This indicator is sitting at 44.85 (This was 49.84 when I wrote this in February when Bitcoin was at ~$95k)

You want to think of taking profits at or before the red band (85) and consider buying at or below the green band (15)

We’re currently somewhere in the middle

Interpretation: Nothing appears to be overheated and this indicator would suggest we’re not close to a market peak.

Some Other Great Reads

One section of data I think this piece lacks is something that encapsulates the macro trend we’re in. I could take a stab at this but there’s many people that do this better than me.

One of the best threads I’ve read lately (maybe the best macro thread I’ve ever read) that distills the macro picture down to its most foundational points is this one by Julien Bittel from GMI. He calls it The Everything Code. Is that hyperbolic sounding? Yes, but does it all make a lot of sense? Also yes:

Conclusion

MVRV Z-Score

Current Level: 2.43 (2.56 last update in May)

Area Of Caution: Anything above 5

Highly Overvalued: 7+

Pi Cycle Top Indicator

Current: Widely Separated

Area Of Caution: Lines Becoming Close

Overheated: Lines Touch/Cross

Everything Indicator

Current: 44.85 (49.84 last update in May)

Area Of Caution: 75

Highly Overheated: 85+

What’s crazy is, many of the indicators have actually got better looking since I published this in May (Bitcoin had just hit a fresh ATH of ~$112k).

Maybe I didn’t wait long enough to write this update because I honestly wouldn’t change too much from what I wrote last time in this conclusion:

After analyzing all of these indicators, most of them are at their midway point to neutral. None are suggesting we’re overheated. I personally don’t think we’ve topped out for this cycle.

Are we at the beginning of the cycle? No.

In my opinion, we’re actually in a similar spot as we were when I wrote this piece back in February - a little over ½ of the way through.

This is actually pretty wild to see. After 4 months of price action which included another Bitcoin all-time high, the indicators are telling us we’re still in roughly the same spot.

When putting this all together I see the following possibilities:

- We have not topped and are still waiting for the classic parabolic/blowoff top that has come in every other cycle

- We’re coming into a more mature adoption period of crypto where the trend could be a slower “up-and-to-the-right” trajectory without a blowoff top (this is probably a long way of saying “Supercycle”)

- These indicators are irrelevant in this new regime and we don’t really know where we are

Overall, I’m still bullish. I’m mostly risk on and expecting a continuation of higher crypto prices at some point in 2025. That said, I’m not exposed to any leverage and trying not to put myself in a bad situation if I’m wrong. This also doesn’t mean that we can’t have 20% corrections (or more) at various times throughout the second half of the year. Anything is on the table when dealing with an asset class as volatile as crypto. However, I do think the bull trend is still intact barring any unforeseen world calamities.

One thing that’s happened since I wrote this article is yet another WW III scare with the Israel - Iran conflict. The crypto market more or less shrugged this conflict off. The resiliency has been somewhat surprising.

Another thing is, Trump’s Big Beautiful Bill was just passed while I was writing this. Ray Dalio dropped his thoughts and its funny because it’s exactly what a lot of Bitcoiners have been saying for over a decade.

The spending will never stop.

The denominator will continue to be debased.

Nothing stops this train 🚄

Buy 🌽

That’s all, thanks for reading!

.jpg)